Can Green Hydrogen Decarbonise Asia?

Photo: Shutterstock / Scharfsinn

17 June 2024 – by Nithin Coca

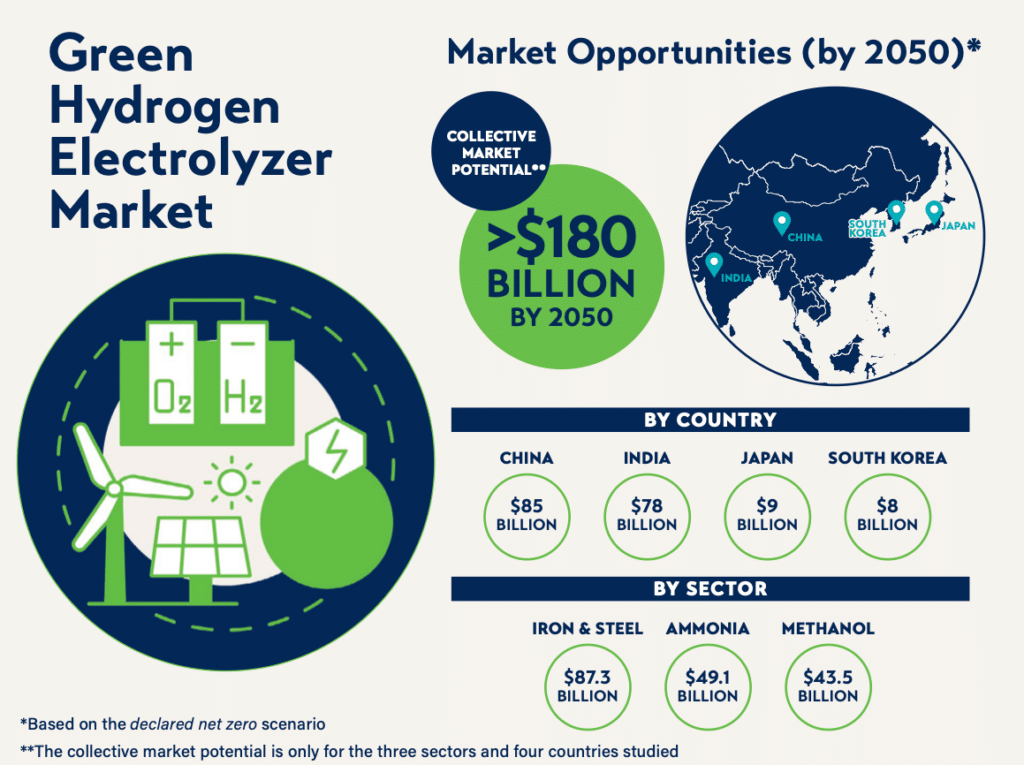

A new report from the High-level Policy Commission on Getting Asia to Net Zero and the Asia Society Policy Institute showcases the potential for green hydrogen to decarbonise hard-to-abate industries in Asia’s four largest economies: China, India, Japan and South Korea. Steel-making, of which these four countries dominate global production, is one area where the emerging fuel could make a difference.

Ali Hasanbeigi, founder, CEO and research director at Global Efficiency Intelligence said using green hydrogen in steel-making “is essential to decarbonise these key sectors”, in a press release. “Our analysis shows there is a massive electrolyser market potential in these major Asian countries, and those who capitalize on it stand to gain substantially.”

What Is Green Hydrogen?

Green hydrogen or renewable hydrogen is a high-density fuel and can, theoretically, replace coal, natural gas or petroleum in industrial applications, such as factories, heavy industry, and steel-making. It is produced from renewable energy sources. These are areas where electricity generated from renewable sources is unlikely to be used in the short or medium term.

Hydrogen has long been promised as a clean fuel source that can play a role in the shift away from fossil fuels. The challenge has been that it’s expensive to produce, difficult to store and challenging to transport safely.

Electrolysers in Japan, India, China and South Korea

Electrolysers are a new technology that is able to produce hydrogen from renewable energy sources, such as wind and solar power. Over time, the cost of electrolysers is falling, making hydrogen a potentially viable future energy source.

The report projects that the electrolyser market in Japan, South Korea, India and China could grow to USD 180 billion by 2050, if proper investments are made.

Source: Asia Society Policy Institute

Notably, steel is an area of concern in these four countries, which are among the largest steel producers in the world. Steel furnaces are mostly powered by coal and natural gas and are a major source of greenhouse gas emissions. Switching to green hydrogen could result in significant emissions reductions.

What About Blue Hydrogen and Natural Gas?

Currently, the vast majority of hydrogen used globally is grey hydrogen or brown hydrogen, made from unabated natural gas or coal. Also of concern is that countries like Japan and South Korea, in their national hydrogen plans, are focusing on expanding the use of blue hydrogen, which is made from natural gas, but with supposedly lower emissions due to the use of untested and unproven carbon capture and sequestration (CCS) technology.

South Korea has plans to build a massive clean hydrogen ecosystem, which relies heavily on blue hydrogen, sometimes called low-carbon hydrogen, to be used in industry, large transportation and more. Meanwhile, Japan’s Green Transformation (GX) relies heavily on hydrogen, and the country is already piloting hydrogen shipments after opening the world’s first liquefied hydrogen receiving terminal in 2020.

Both countries, along with China and India, aren’t doing nearly enough to invest in and promote green hydrogen economy.

Renewable Energy and Green Hydrogen

In order to scale up green hydrogen projects, Asia needs to first rapidly expand the use of renewable energy. At the moment, Asian countries, including Japan, South Korea, India and China, are not adequately supporting renewable energy or electrolysers.

“[Electrolysers] will be essential to decarbonising the region and the world. Asia’s industrial giants could therefore see net-zero pathways as vehicles for driving development, rather than limiting it,” said Kate Logan, associate director of climate at the Asia Society Policy Institute, in a press statement.

Of the four key markets in the report, Japan has the highest electricity generation from solar, at 11%, followed by China, with India, Taiwan and South Korea lagging. When it comes to wind, China is leading, with 9.4% of electricity generation coming from wind. Considering that green hydrogen seeks to replace the use of fossil fuels in industrial use – most of which isn’t electrified – it’s clear that a lot more clean energy is needed, and fast.

“There is no shortage of money worldwide, but it is not finding its way to the countries, sectors and projects where it is most needed,” said Fatih Birol, executive director of the International Energy Agency, in a press statement. “The financial sector can and must play a key role in achieving the goals of the Paris Agreement by mobilizing capital for green and low-carbon investments.”

There are some efforts underway to grow the production of green hydrogen, the term for hydrogen produced with renewable energy. Japan’s Mitsui and Toyo Engineering are launching a feasibility study on producing green ammonia in Chile. Meanwhile, another Japanese company, JERA, recently announced a joint study to produce green hydrogen in the Philippines.

Green Hydrogen Production

Ideally, electrolysers would produce green hydrogen using clean energy within each specific country. That fuel would then be specifically destined for use in heavy industry, steel-making or perhaps aviation and shipping, where electrification still faces challenges.

Building that model, alongside a broader transition away from fossil fuel usage in transportation, electricity generation, home heating and agriculture, would show that Asian countries are serious about the energy transition. Green hydrogen can play a key role, but only if policies and financing are designed properly.

by Nithin Coca

Nithin Coca covers climate, environment, and supply chains across Asia. He has been awarded fellowships from the Solutions Journalism Network, the Pulitzer Center, and the International Center for Journalists. His features have appeared in outlets like the Washington Post, Financial Times, Foreign Policy, The Diplomat, Foreign Affairs and more.

Read more