China’s Oil Demand Dropped: Experts See Start of a Trend

01 May 2025 – by Viktor Tachev

Oil markets have long relied on China’s seemingly endless demand growth. However, 2024 data reveals that the tides are turning and not temporarily. Instead, experts believe China is entering an era of structurally weakening oil demand as part of its decarbonisation goals and strategy to promote transport electrification. The country’s progressive move away from oil-based fuels and the production of competitively-priced EVs can inspire Southeast Asian nations to follow the same path, improving their energy security and decarbonisation progress in due course.

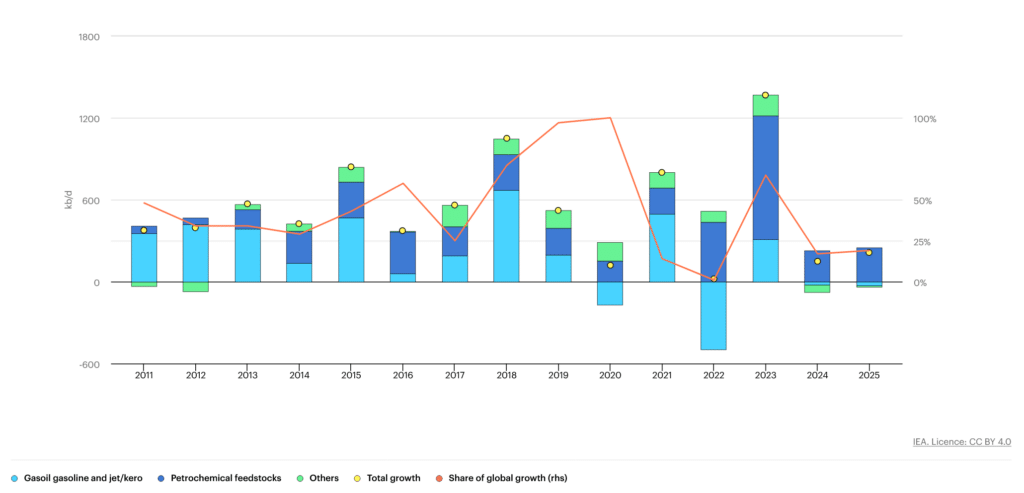

IEA: China’s Oil Demand Growth For Fuels Has Plateaued

China’s total crude oil consumption dropped by 1.2% last year. At 8.1 million barrels per day, its consumption of oil-based fuels, such as gasoline, jet fuel and diesel, in 2024 was 2.5% below 2021 levels. Remarkably, the figures are only narrowly above those in 2019. The IEA considers the developments in China unprecedented. Last year, the country consumed four times less oil-based fuel products than all OECD member countries, which combined, equal China’s population.

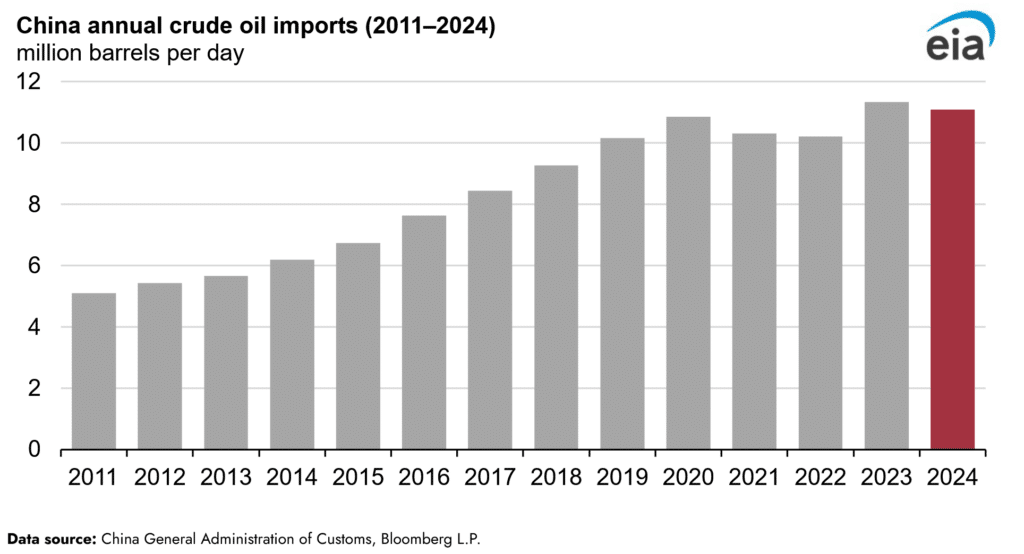

China relies on imports for 73% of its oil consumption, compared with 40% for natural gas and 7% for coal. However, in 2024, the world’s largest importer of crude oil also saw a drop in crude oil imports, according to the US Energy Information Administration.

China’s Oil Consumption Decline

The IEA projects another decline in total fuel use this year, which is likely to accelerate even further in the medium term. As a result of these developments, the agency sees limited potential for the future growth of petroleum fuel for combustion. China’s top refiner, Sinopec Group, has already said that diesel and gasoline consumption has already peaked. The Chinese government is reportedly pushing refiners to reduce fuel output and focus on products for the petrochemical industry.

While demand for oil-based fuels is declining, the IEA finds that the country’s overall oil demand continues to increase. The reason is the growth in petrochemical feedstocks used for plastic and fibre production.

According to its 2024 Oil Market Report, the past year’s developments in the oil market mark the start of a period of progressively more sluggish gains in oil consumption, underpinned by major technological, behavioural and demographic shifts. As a result, global oil demand is on course to plateau by the end of the decade.

In China, this is likely to happen even sooner. The China National Petroleum Corporation’s Economic and Technological Research Institute (ETRI) projects that the country’s oil demand will peak in 2025, while others believe it has already done so. According to ETRI, the overall fossil fuel demand will peak in 2028, coinciding with the peak in energy-related carbon emissions.

China’s LNG Imports Also Set to Fall

According to BloombergNEF, China’s LNG imports will decrease in 2025 for the first time since 2022.

This can have several consequences for LNG-dependent Southeast Asian nations. First, it means less competition, which might provide buyers with near-term relief. Next, many LNG exporters and traders have relied on the prospect of increasing Chinese demand, which can cause market shifts. Japanese traders, for example, have considered Southeast Asia their primary target market to dump excess LNG, and the developments in China can further strengthen this trend. Last but not least, it indicates that the world’s biggest fossil fuel-consuming economy is actively trying to reduce its dependence on LNG imports.

China’s moves can inspire Southeast Asian countries dependent on LNG imports or with plans to invest in new, expensive and polluting gas infrastructure, often under pressure from Japan, to prioritise cleaner alternatives. Scaling up investments in solar and wind power, as well as other green technologies, as in the case of China, can future-proof their economies against fossil fuel market instabilities, which have cost them dearly in recent years. Due to their import dependence, many South and Southeast Asian nations have had to bear periods of sustained blackouts, drained foreign exchange reserves and an exacerbated cost-of-living crisis. All of this necessitates prioritising renewable energy instead of LNG imports as a means to ensure cheaper and more stable energy for businesses and households across Southeast Asia.

Transport Sector Decarbonisation and the Transformation of China’s Economy: The Main Drivers of Declining Oil-based Fuel Demand

According to the IEA, the reason for the declining oil-based fuel demand is the significant ongoing transformation of the Chinese economy and the transportation sector, in particular. These developments are driven by the government’s policies, which increasingly prioritise energy security and pollution control and aim to shift the economy from manufacturing to a service-based model.

Other major contributing factors include the targets to peak CO2 emissions before 2030 and achieve carbon neutrality before 2060. As part of them, the Chinese government has been continuously breaking records in solar and wind energy deployment as well as rapidly adopting EVs. The latter is a major contributor to the dwindling oil demand. The government has introduced a series of incentives for new electric vehicles, including a trade-in policy from April 2024 that will continue expanding this year. As a result, EVs currently account for about half of all car sales in China, while the demand for petrol and diesel vehicles is nosediving.

To complement the evolution of the country’s transport sector, the government is also actively expanding the provision of public transport, especially high-speed rail. The massive investments are expected to continue this year, further developing the already-biggest high-speed rail infrastructure in the world.

ETRI also considers the rapid adoption of EVs and high-speed rail as key factors accelerating the decline in oil-based fuel use.

Aside from the economy’s transformation, decarbonisation and the shift to electrified transportation, some analysts also point to deflationary pressure and slower economic growth as key contributing factors to the declining oil-based fuel demand.

The Impact on Other Countries: Focus on Southeast Asia

Due to the scale of its economy and oil demand in recent years, China’s developments have far-reaching consequences for the region and the world. While China was responsible for over 60% of the global increase in overall oil demand between 2013 and 2023, it represented less than 20% of the growth in 2024 — a massive drop resulting mainly from the slowdown in fuel use.

According to the IEA, the shifting demand patterns in China create pressure on refiners all around the world, as well as on the underlying crude oil demand.

As the biggest crude oil importer globally, China’s plateau in oil-based fuel demand also impacts its suppliers. Historically, Malaysia has been the second biggest supplier of crude oil to China after Russia. While imports from Malaysia increased significantly last year, the EIA warns that this was due to crude oil cargoes initially shipped from Iran but relabeled or transferred to avoid sanctions. In the long term, China’s declining oil demand could negatively impact Malaysia’s economy, as the country may earn less from oil exports.

China aside, some experts believe that other big markets, such as the US and Europe, are also nearing peak oil demand. As a result, the world is likely well supplied with oil over the coming decade. The competition between oil-producing nations for the remaining demand, paired with the accelerating shift to clean transportation, could potentially lower and stabilise oil prices on global markets. For South and Southeast Asian countries, this would mean less volatility, reduced pressure on foreign exchange reserves and potentially alleviated cost-of-living pressure tormenting the most vulnerable post-COVID.

However, others see a different scenario. According to Wood Mackenzie’s latest Gas & LNG in Asia report, prices will remain volatile in the short term. Despite the wave of new supply expected from 2026, risks to supply growth will persist, keeping prices around the average through 2034.

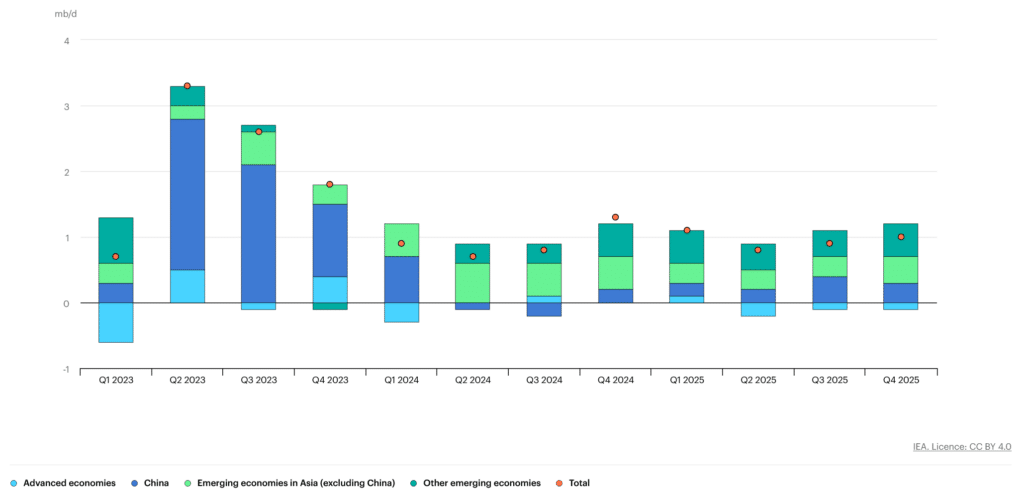

According to the IEA, other Asian economies, particularly India, will likely play a part in replacing China as the engine of global oil demand growth. In the first two months of 2025, India continued going strong with oil imports. Alongside its coal expansion plans, it is taking the opposite trajectory to China.

Still, the IEA considers it unlikely that other Asian nations will fully replicate China’s role over the last two decades due to the smaller roles of manufacturing, construction and petrochemicals in their economies. As a result, the demand for oil from Southeast Asia isn’t likely to experience a major boom.

Southeast Asia Is Well Positioned to Follow China’s Steps

Emerging economies in Asia, excluding China, have already seen a steady decline in oil demand in 2025. The trend can accelerate going forward due to the shift toward clean transportation in the region, driven mainly by Chinese EV models becoming more affordable, as well as the fact that they are locally produced in factories across Southeast Asia.

As a result, the region might well and truly follow China’s steps toward plateauing oil-based fuel demand. The remaining oil supply needs of ASEAN nations can be met by deliveries from big local producers like Malaysia. Paired with the shift toward renewables, this would essentially improve the region’s energy and fuel security and cost-efficiency.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more