China’s Growing LNG Dependence – Is Increasing Imports the Solution?

Source: China Daily

21 March 2022 – by Eric Koons

World’s Largest LNG Market

China is the world’s largest LNG buyer and importer. China’s import capacity represents a significant portion of global fuel consumption, considering natural gas is responsible for 24% of the world’s power generation. Meanwhile, global natural gas consumption increased by 4.6% in 2021, driven by the post-pandemic economic recovery.

As the least polluting fossil fuel, liquefied natural gas (LNG) is extracted as a gas and converted into a liquid. In liquid form, natural gas is much easier to transport over long distances without pipelines. LNG is a clear, colourless, non-toxic liquid that is 600 times smaller than natural gas.

Largest Exporter of LNG

Qatar is the largest exporter of LNG and uses enormous tanker ships to move the LNG supply around the world.

LNG provides power across residential, commercial and industrial sectors for diverse purposes. These include heating, cooking, electricity generation and manufacturing. While it is not used typically for passenger cars, it is used as a fuel for heavy-duty trucks and other vehicles.

Asian Share in Global LNG Imports

Along with other fast-growing Asian economies, China has been a significant driver for the growing global market for natural gas and LNG in the past few years. Collectively, Asian economies are responsible for 70% of the world’s global LNG imports. As a result, they have pushed the rise of LNG prices and caused major fluctuations in its value.

Where Does China Get its LNG?

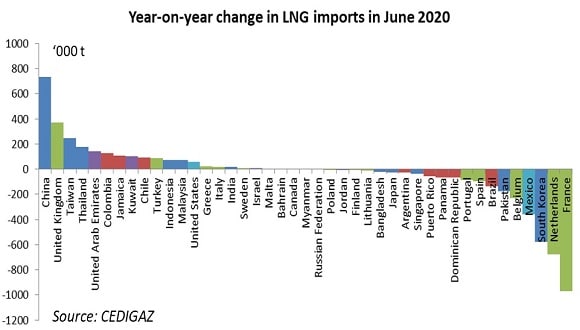

In 2021, China focused on the post-pandemic recovery of its industries. According to S&P Global, China’s total natural gas imports increased by 19.9%, with pipeline gas imports rising more than 22% year on year and LNG imports growing more than 18% between January and December of 2021.

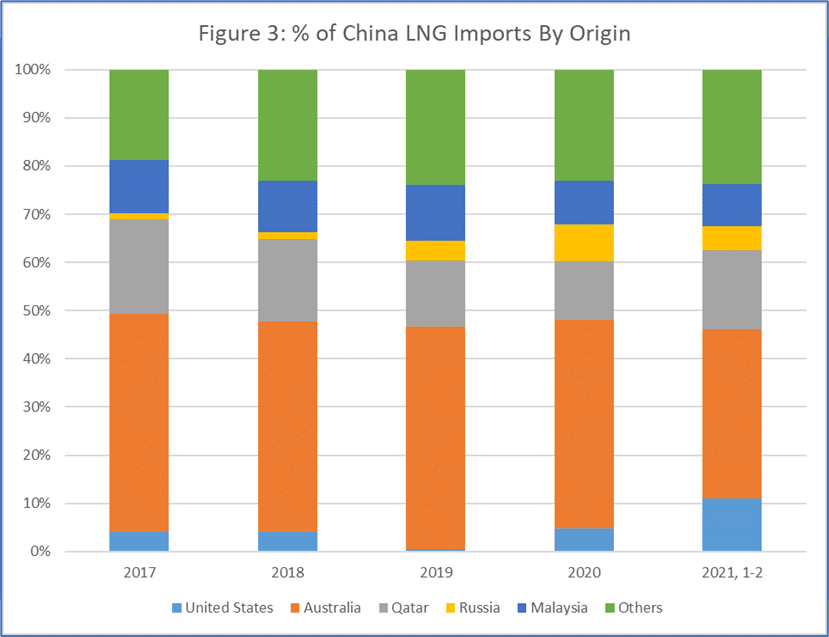

Australia supplied a majority of this natural gas (39.3%), and imports from the United States reached a record level of 11.6%. LNG imports from the United States had the largest increase of any country in 2021, with a year-on-year increase of 187.4%, though China imported this LNG mainly through intermediaries.

Why Is China Buying LNG?

China is heavily dependent on its export-led industries for economic growth. With its push for economic recovery in 2021, the country also experienced peak domestic demand for energy.

Space heating and industrial gas demand are the key reasons for rising LNG demand in China. Rising electricity consumption has been a significant factor since the beginning of 2021, driven by the country’s economic recovery. In fact, the first four months of 2021 witnessed a 14% rise in year-on-year gas-fired power generation. Specifically, strong electricity demand in southern China has led to a dramatic increase in LNG imports, as the gas provides peak supply to the market.

Unfortunately, renewables, such as hydro and solar, have produced less electricity than expected in southwestern China due to lower rainfalls. Furthermore, the fluctuating price of coal has also shifted the focus towards LNG and gas-fired combustion.

Does China Have Its Own LNG?

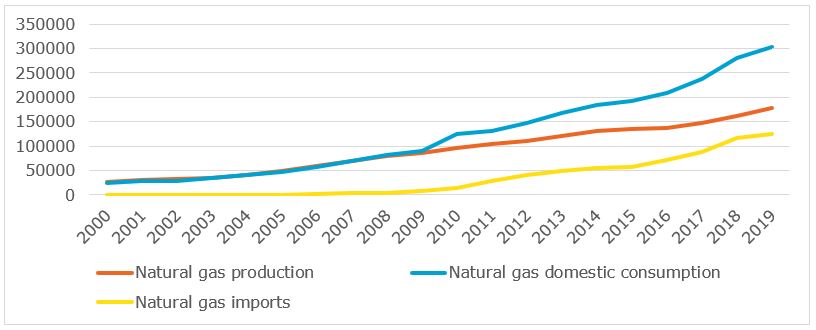

China has a significant dependence on natural gas for its energy transition and economic growth. Due to this, the country is highly motivated to develop its own LNG production and has invested in it. Fluctuating gas prices and volatile global markets have also added to this motivation.

To increase domestic production of natural gas, the Chinese government has introduced incentives, especially for Chinese companies, for several forms of natural gas production. These include tight gas, shale gas and coalbed methane – to a lesser extent. In June 2019, the government introduced a subsidy program that created new incentives for producing natural gas from tight formations and extended the existing subsidies for production from shale and coalbed methane sources. Although this subsidy will be in effect through 2023, the government has already allowed foreign countries to operate independently in China’s oil and natural gas upstream sector.

Liquefied Natural Gas (LNG) in China – What’s the Future?

Due to its post-pandemic economic recovery, China has the highest energy demand in Asia. This demand has pushed the country to call upon LNG to meet its energy needs. Chinese buyers, especially state-owned national oil companies, are engaging in long term contracts to purchase LNG. However, fluctuating gas markets and rising political tensions have put China’s energy future in doubt, holding back its energy transition towards renewables.

Go further with LNG

This article is part of ultimate guide about LNG.

We will discuss more related topics in the following articles, such as LNG prices.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more