Chinese Banks Risk their Reputation With Investments in Coal

Oil rigs are some of the first fossil fuel related stranded assets due to their significant upkeep costs. Source: Raconteur

18 May 2021 – by Eric Koons

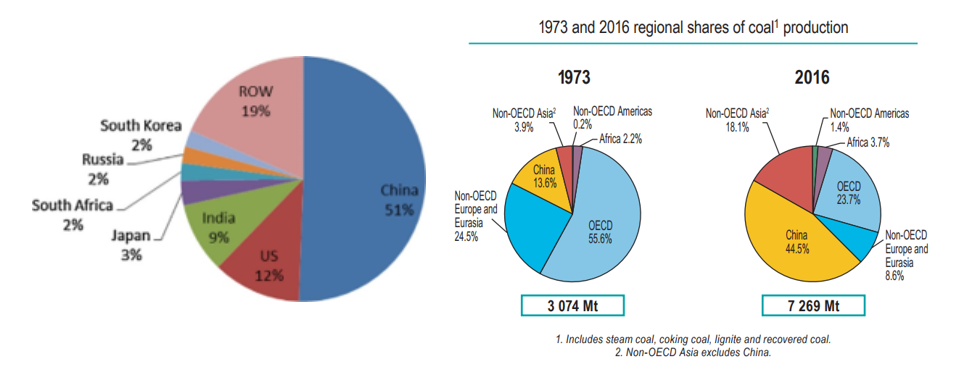

Chinese banks have made investments in coal for decades and this hasn’t changed with China’s recent focus on shifting to renewable energy. China is the world’s largest single producer and user of coal, by a great margin.

China’s investments in coal fired power plants between 2016 – 2019

In terms of financing, between 2016 and 2019, the four largest financiers of coal mining and coal-fired power plants were Chinese banks, with investments totaling over $100 billion.

China’s Plans for Renewable Energy

However, China is taking huge strides to a renewable future. They are the worlds’ largest investor in renewable energy, they have a target to be carbon-neutral by 2060, and the recently released five-year plan has key targets for clean energy. But is this change being reflected in the Chinese banks and their financing policies? As some of the world’s largest financiers, Chinese banks have a key role to play in the renewable future.

China’s 14th Five Year Plan (FYP)

In September 2020, President Xi Jinping announced Chinas’ first long term carbon target to the UN: carbon neutrality by 2060. This bold declaration has been reinforced by China’s recently announced five-year plan, or 14 FYP (the 14th five-year plan). The 14 FYP has some key targets related to renewable energy. These include an 18% cut in CO2 emissions as a percent of GDP by 2025, and an increase in the proportion of non-fossil energy to around 20% by 2025, up from 15.8% in 2020. This percentage is in line with a pledge by Xi in December 2020, to achieve 25% non-fossil energy by 2030.

China is obviously a huge user of energy which means a 10% rise in the share of renewable energy necessitates massive renewable energy investment. The question is, where will this finance come from? China is home to some of the world’s largest banks, but are these banks moving with the times, or are they lagging and risk being left behind?

Chinese Banks Leading the Way in Coal Investments

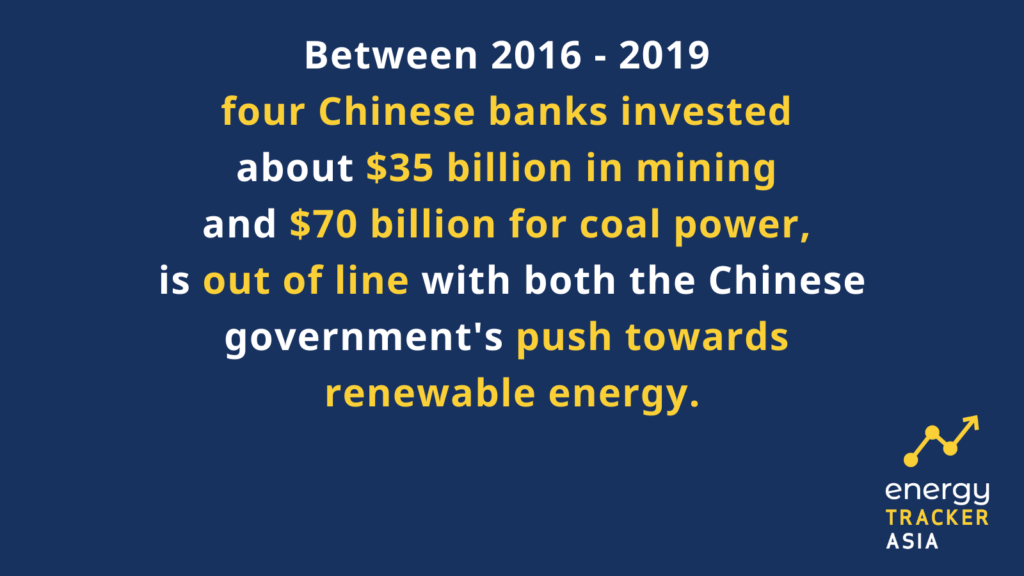

Chinese banks are leading the world in investments in coal. This was led by the ICBC, Bank of China, China Construction Bank, and Agricultural Bank of China. Between 2016 and 2019 these four banks invested about $35 billion in mining and $70 billion for coal power.

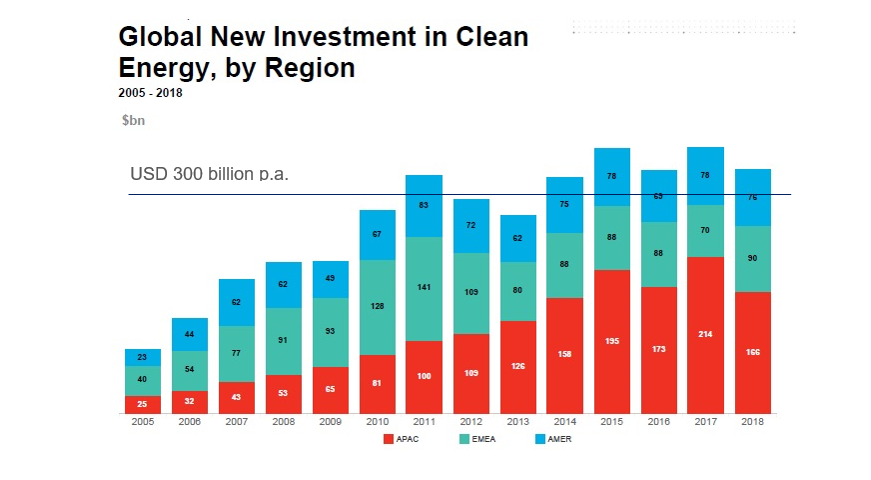

The funny thing is this trend doesn’t seem to be changing, which is out of line with both the Chinese government’s push towards renewables, and worldwide investment in general. Since 2010, worldwide renewable energy investment has consistently been around $300 billion per year. In that time, investment in fossil-fuel energy has dropped to around USD $120 billion.

Renewable energy investment is no longer a minority interest, it has become part of mainstream investment strategy. By continuing to invest in fossil fuels, Chinese banks risk being left behind in this gigantic opportunity. Additionally, there is significant risk that assets may become stranded, especially in coal projects.

Stranded Assets and Damaged Reputations are a Risk for Coal Investors

This is already happening in other countries. In February, Australian energy provider AGL wrote off $2.7 billion of coal power generating assets. They cited continuing lower wholesale prices due to lower cost technologies (i.e., renewable energy) and change in government policy.

By changing their investment strategy to renewables, Chinese banks can avoid this risk. Not only do they stand to make a lot of money, but they will enhance their reputations in a world that is more and more concerned with climate change.

The Influence of Chinese Banks

The shift to renewable energy is well and truly on, and China has become a major driver. Almost inexplicably, Chinese banks and financial institutions don’t seem to be moving with the change.

As some of the largest financing institutions in the world, Chinese banks have great power to drive renewable energy investment. By not doing so, they risk financial harm and damaged reputations, as well as being out of step with the Chinese government and the world at large. Almost all signals point to this being a poor choice by Chinese banks, so it will be interesting to see if this continues.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more