What Is at Stake at the COP29 Climate Finance Negotiations?

UN Secretary-General Antonio Guterres (source: UN Geneva | flickr)

18 November 2024 – by Walter James Comments (0)

By the time negotiators gathered in Baku, Azerbaijan, for the 2024 United Nations Climate Change Conference, COP29, it was almost certain that this would be the hottest year in history. And despite the unprecedented progress in global renewable energy buildout, there are no clear signs yet that global carbon dioxide (CO2) emissions have peaked.

“The sound you hear is the ticking clock,” said UN Secretary-General António Guterres in his opening speech at the summit. “We are in the final countdown to limit global temperature rise to 1.5°C. And time is not on our side.”

Climate Finance for Developing Countries at COP29 2024

COP29 Azerbaijan has been dubbed the “finance COP” for its focus on addressing the gap in global climate finance. Solving, adapting to and addressing the damages from climate change cost money. A lot of it. While global financial flows to climate solutions have increased significantly in recent years, much more is needed. Climate finance must also be better distributed to developing countries and least-developed countries (LDCs).

Averting climate catastrophe hinges on this year’s COP. As the human and economic costs of delaying climate finance ambitions balloon, the stakes of the COP29 negotiations are high.

Global Climate Finance Has Increased but More Is Needed

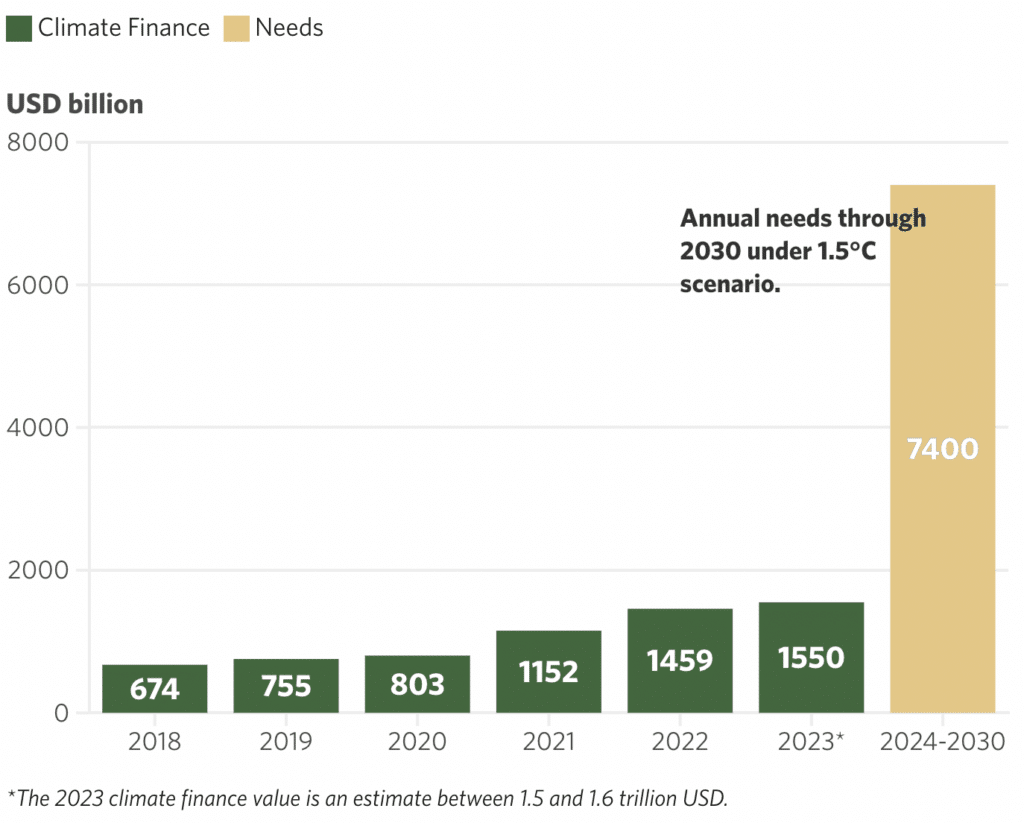

What’s the state of global climate finance today? Between 2018 and 2022, annual climate finance more than doubled globally from USD 674 billion to USD 1.46 trillion, according to the Climate Policy Initiative (CPI). Global climate finance is estimated to have continued growing in 2023 to surpass USD 1.5 trillion, but at a slower pace compared to the preceding five years.

The growth from 2022-2023 was thanks to an increase in investments in renewable energy, electrified transport and increased financing by multilateral development banks, according to CPI.

The fact that annual climate finance more than doubled between 2018 and 2022 is cause for celebration. But CPI cautions against complacency. Between now and 2030, annual sums must increase by a whopping fivefold to reach the USD 7.4 trillion needed each year for limiting global temperature rise and to stay under 1.5°C above pre-industrial levels.

Not only does global climate finance need to keep growing; but it must also be distributed more equitably. Thus far, this increase has skewed toward developed nations and China. “These are countries with fiscal space to invest in infrastructure related to clean technology, which is very capital-intensive work,” says Baysa Naran, senior manager at CPI, in an interview with Energy Tracker Asia.

By contrast, emerging markets and developing economies (EMDEs) received 15% of total global climate finance and LDCs accessed only 3%. Although climate finance directed toward these countries has also increased in 2018-2022, they still face the challenge of balancing economic development, energy security and access and emissions cuts.

LDCs, in particular, struggle with over-indebtedness from the COVID-19 pandemic and the spike in fuel prices triggered by Russia’s war in Ukraine. “We’re talking about debt distress, high inflation, food security, energy crisis. So, these countries are really thinking about day-to-day issues,” Naran said. “It’s just too much on their plate right now,” she said.

At COP29 Baku, countries are negotiating to set a new global climate finance target to reduce greenhouse gas emissions and limit global warming

What Is at Stake at the COP29 Climate Finance Negotiations?

More and more equitably distributed climate finance is urgently needed to achieve Paris Agreement goals and to support climate action in developing countries.

Recognizing this, negotiators at COP29 2024 are aiming to update the global climate finance goal, as well as establish mechanisms to implement it.

New Collective Quantified Goal

“Low-income and least-developed countries are very much dependent on international public climate finance,” Naran said.

That’s because private investors are jittery about investment risks in EMDEs and LDCs, driving up the cost of capital in those markets.

To overcome this barrier, negotiators at the 2009 UN climate summit in Copenhagen agreed that developed countries would mobilise at least USD 100 billion of climate finance to LDCs and low-income countries by 2020.

Although they delivered on their promise — in 2022 rather than 2020 — developed nations must commit much more capital to stay under the 1.5°C target.

The COP29 Presidency highlighted the need to set a new collective quantified goal (NCQG) for 2025 and beyond. This will be the first time since 2009 that leaders will reevaluate climate finance for developing nations to implement emission mitigation and climate adaptation measures.

Negotiations are now ongoing in Baku to hammer out the NCQG’s size, scope and structure, while making financing mechanisms more transparent, accountable and responsive to developing countries’ needs.

Naran emphasises that the new goal must be bold. “Leaders shouldn’t go for an incremental change like updating the NCQG from USD 100 billion to USD 150 billion,” she told Energy Tracker Asia. “It needs to be substantial to really signal and tell the world that right now, we’re changing our gears. We’re really taking this issue seriously. All countries are going to work together, and we’re going to mobilise finance at scale.”

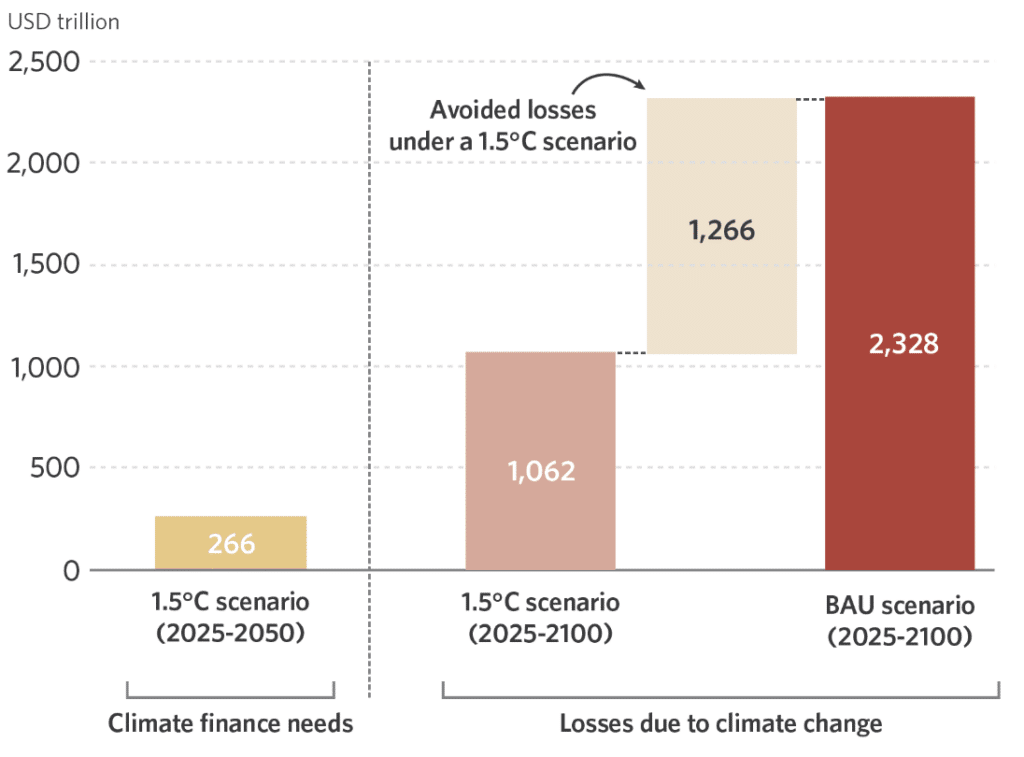

The costs of inaction are immense and growing. CPI estimates that under a business-as-usual scenario — that is, if developed nations fail to level up their climate finance commitments — economic losses will be five times greater than the climate finance needed to stay under 1.5°C warming by 2050.

Baku Initiative for Climate Finance, Investment & Trade (BICFIT)

To help mobilise the funds needed for the expected new goal, the COP29 Presidency has announced several initiatives. The Baku Initiative for Climate Finance, Investment & Trade is one of them.

In the leadup to the climate summit, Azerbaijan announced that it will launch the Baku Initiative for Climate Finance, Investment & Trade (BICFIT). BICFIT will be a multilateral platform that will host regular dialogues and meetings to enhance cooperation on climate finance, investment and trade. It will be a hub for information exchange and peer learning, as well as a body to help implement national climate targets to ensure just transitions.

Loss and Damage Funds for Greenhouse Gas Emissions Reduction and Climate Adaptation

Climate finance is mostly meant to address emissions mitigation and climate adaptation. But today, efforts to mitigate and adapt to the climate crisis are not enough to stem the speed and scale of its impacts.

“Loss and damage” refers to the harms from climate change that go beyond what countries can adapt to. The United Nations Environment Programme (UNEP) estimates that up to USD 580 billion annually will be needed in total loss and damage funding by 2030 and USD 1.7 trillion by 2050.

Loss and damage has been on the COP agenda since 2007, but it wasn’t until COP27 in 2022 that countries agreed to talk about funding for it at the summit. Since COP28 in Dubai, negotiators have been working to operationalise the Fund for Responding to Loss and Damage, commonly called the Loss and Damage Fund.

This work continues at COP29, albeit secondary to the bigger priority of the NCQG. The COP29 Presidency identified fully operationalising the fund as an agenda item and urged states on the Board of the Loss and Damage Fund to pay more and work with donor countries to turn its USD 800 million in pledges into tangible funding.

At the beginning of the summit, Sweden pledged 200 million krona (USD 18.4 million) to the Loss and Damage Fund.

High Hopes for COP29 Azerbaijan Climate Change Conference

“COP29 must tear down the walls to climate finance.” Those were the words of UN Secretary-General Guterres to the summit attendees. “We need a new finance goal that meets the moment.”

A massive increase in climate finance is called for, and that finance must be accessible by developing countries that suffer from climate impacts most acutely. The stakes are high in the negotiations in the remaining days of COP29.

by Walter James

Walter James is the principal consultant at Power Japan Consulting, which offers research, writing, and consulting services related to Japan's climate and energy policies. He also writes about these topics on his Power Japan Substack. He holds a Ph.D. in Political Science from Temple University and is a former research fellow at Waseda University in Tokyo, Japan.

Read more