Ending Asia’s Love Affair With Oil and Gas

06 October 2021 – by Eric Koons

Despite global demand to tackle climate change and the Levelized Cost of Energy or LCOE of renewable energy steadily falling, Asia will continue to have very close ties to oil and gas for quite some time. The demand for fossil fuels is still high around the world. Furthermore, oil and gas companies in Asia are ready and able to meet the demand.

Natural Gas Production is Steadily Rising in Asia

Though oil continues to see steady demand in almost every industry, natural gas is experiencing a massive resurgence in Asia. Natural gas, seen as a ‘cleaner’ fuel, has helped reduce air pollution and has helped Asian countries move away from coal and oil.

2018 saw the fastest growth in demand for natural gas since 2010, with a 4.6% growth. This is expected to rise by over 10% by 2024.

Oil and Gas in Asia Compared to China’s Consumption

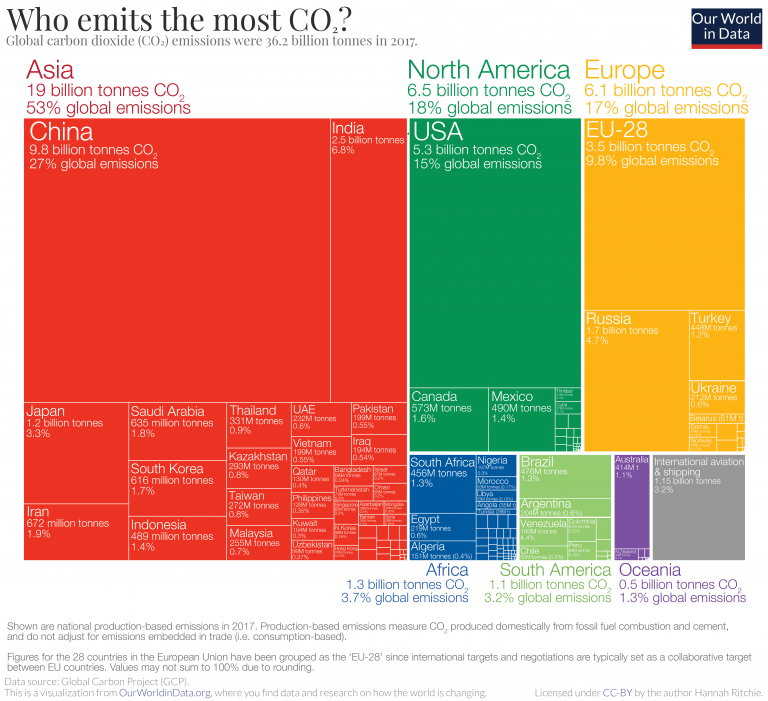

China is the hungriest nation for gas and will account for over 40% of global demand by 2024. Despite the country’s considerable solar and wind power growth, natural gas consumption grew by 18% in 2018. This growth is a result of the government closing old coal-fired plants and replacing them with gas-fired plants.

Other Asian countries are not too far behind. With Bangladesh, India, Pakistan and others looking to increase their share of natural gas.

Despite its ‘clean burning’ status, natural gas is still a fossil fuel contributing to greenhouse gas emissions. Plus, it requires significant infrastructure to extract, refine and deliver as a final product.

Oil Demand Is Still High

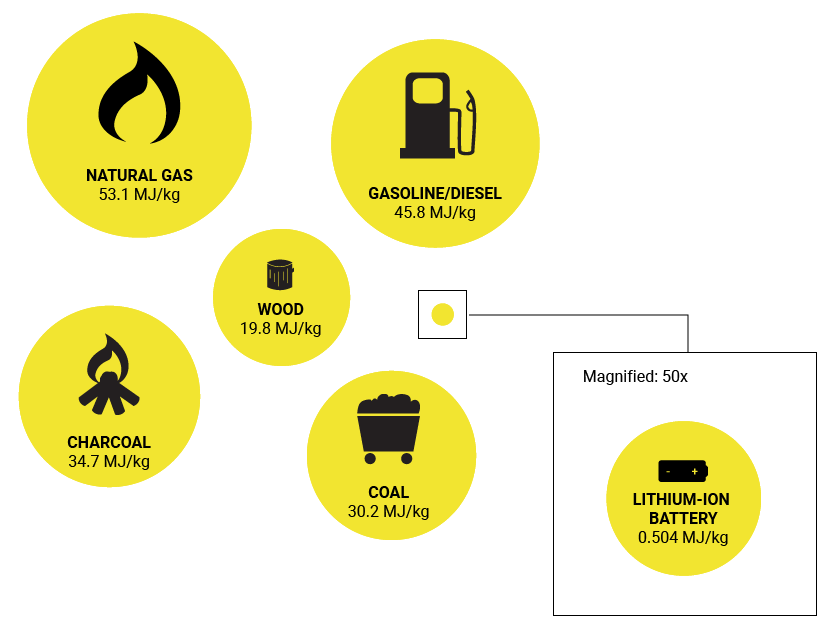

As for oil, despite its climate shortcomings, it is still one of the most energy-dense fuel sources available. By weight, oil is over 90 times more energy-dense per kilogram than a Lithium-ion battery.

With its existing infrastructure to help keep costs low, oil and gas in Asia continue to be in high demand.

On par with the increased demand for oil and gas is the demand from industry bodies and the general public for oil and gas companies to transition away from fossil fuels and into clean energy products.

Oil Companies: Calls To Transition Away from Oil and Gas

In addition to the Paris Climate Agreement, all sides have mounting pressure to move away from oil and gas. The International Energy Agency (IEA) called for no new investments into oil, natural gas and coal for the world to reach net-zero carbon emissions by 2050.

Several governments worldwide (mainly in Europe) have pledged to take significant steps towards being carbon neutral (or even carbon negative).

Even industry incumbents such as BP, Shell and Eni have announced plans to invest in either renewable energy, carbon capture, energy storage, or hydrogen. They are also looking at purchasing electricity from renewable sources only.

Asia Continues to Rely on Oil and Gas

So why does Asia continue to be in love with oil and gas? As with most things, the answer is complicated and multi-layered. Below are some of the driving factors:

Demand – We may be in the middle of an energy transition, but the world is still in love with products made from fossil fuels, and Asia is the world’s factory. Plus, local demand from giants such as China, India and Japan is growing. As their local economies grow, demand from Malaysia, Vietnam and Thailand will continue to grow.

Income – Much like the Middle East, the discovery of oil and gas has made Asian countries incredibly wealthy and has brought them financial security. Next to manufacturing, natural resources are one of Asia’s core industries.

Political Stability – In addition to financial security, discovering natural resources and their subsequent wealth has helped bring political security to the region. Furthermore, governments may fear losing that stability if one of their crucial income streams declines.

Global Influence – In addition to financial power and political stability, oil and gas industries give Asian countries a controlling say on the world stage. Asia is no longer a collection of small nation-states. Multiple Asian countries are global powers, and oil and gas have helped make that happen.

Energy Security – There is currently a healthy supply of fossil fuel energy available in Asia. So Asia can rely on this energy without being dependent on other oil and gas suppliers such as the Middle East and Northern Europe.

What Does This Mean for Asian Countries?

Asia is currently responsible for over 50% of the world’s greenhouse gas emissions. While it is understandable that oil and gas is a crucial energy source, keeping oil and gas as the primary energy sources for the long term will have serious negative consequences.

From economic to political and environmental damage, climate change promises to bring instability to the region.

The International Energy Agency (IEA) has stated that Asia will be the biggest challenge for its proposed pathway to net-zero emissions. If net-zero is to be achieved by 2050, investment in fossil fuels needs to end.

Renewable energy and low carbon solutions could be Asia’s next biggest goldmine. China is already leading the way by becoming the world leader in solar panel and wind turbine manufacturing. Furthermore, in 2020 China installed more wind farms than the rest of the world combined.

If Asia moves away from oil and gas and refocuses on low-cost clean energy, it will remain a global power.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more