What the Future Holds for the Renewable Energy Industry in Asia

11 November 2021 – by Viktor Tachev

Is the future of energy industry bright or it’s dim? Is the energy industry capable enough to meet the challenges of the future?

The International Energy Agency’s warning in the latest World Energy Outlook 2021 couldn’t be more explicit – even the boldest globally announced CO2 reduction pledges won’t limit temperature rise enough.

Changing the current trajectory in energy sector is paramount, and the world needs unconditional political commitment and a collaborative energy industry. This would ensure the transition away from fossil fuels to renewables at pace. However, there remains one condition: how quickly can Asia transform its energy from dirty to clean and how would energy sector respond to it. The need of the hour is that energy sector should emphasize more on renewable energy sources. It’s a sad thing that energy prices; gas prices, and oil prices are on the rise and more investment is needed to produce energy.

The End of Fossil Fuels is Getting Closer – Great News for Energy Industry

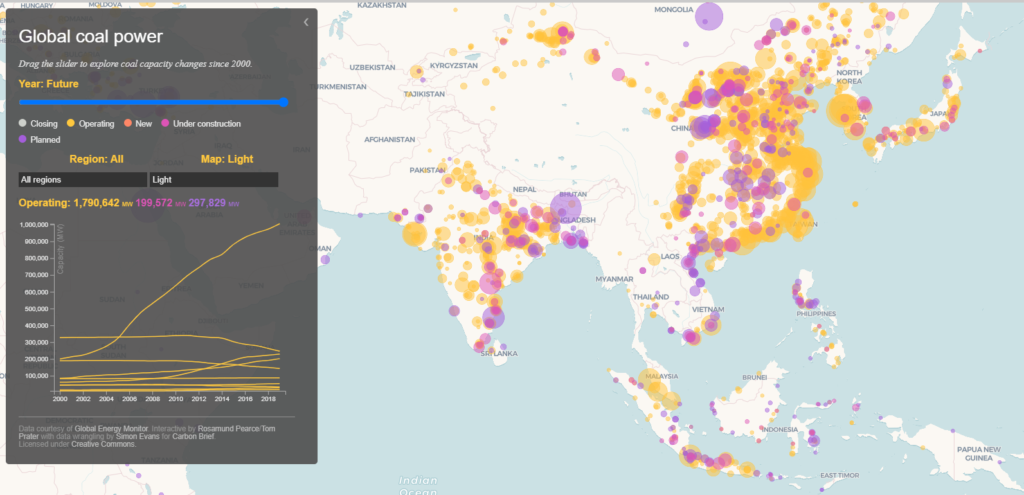

Globally, fossil fuels are still holding out in Asia. The continent is still home to over 80% of the 500 GW of the globe’s coal capacity, with similar figures shared for oil and gas. Indeed, the Asia-Pacific region now accounts for 94% of new coal plants either approved, under construction or proposed.

That doesn’t mean things aren’t changing. In Xi Jinping’s UN announcement, China pledged to end coal financing. Soon after, South Korea and Japan announced net-zero goals by 2050. Other Asian countries are now also following suit.

Financing trends are also evolving across Asia. The Asian Development Bank, a huge regional player, declared to stop coal and oil financing. With their ongoing studies, the bank hopes to accelerate the phaseout of coal power using blended finance to generate more investments in renewables.

Slow Progress of Energy Sector towards Energy Transition

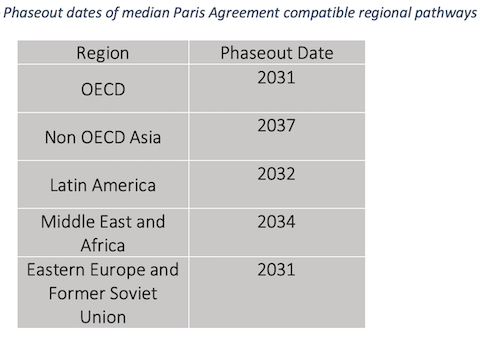

Progress with the energy industry and a clean transition is making headway, albeit slowly. There are a couple of reasons for this. A rapid departure from fossil fuels would cause significant issues like a stranded asset risk. On average, coal-fired power plants are only 13 years old in developing economies across Asia, with average lifespans reaching 46 years. To make matters worse, most of the USD 1 trillion of global capital invested in young coal plants are in Asia.

Use of Natural Gas in Asia to meet Energy Demand

It is critical that energy sector should invest more in natural gas to reduce emissions. In Asian energy sector, natural gas is mostly used for electricity generation and industrial purposes. But still use of natural gas to generate electricity or meet the energy demand is on the lower side as compare to coal. World institutions are trying hard to support usage of natural gas as much as possible.

On the Brink of Growth – The Renewable Energy Industry in Asia

The latest commitments to net-zero by Asia’s largest economies in China, South Korea and Japan will inevitably accelerate the renewable energy industry’s growth, which is great for the whole energy sector.

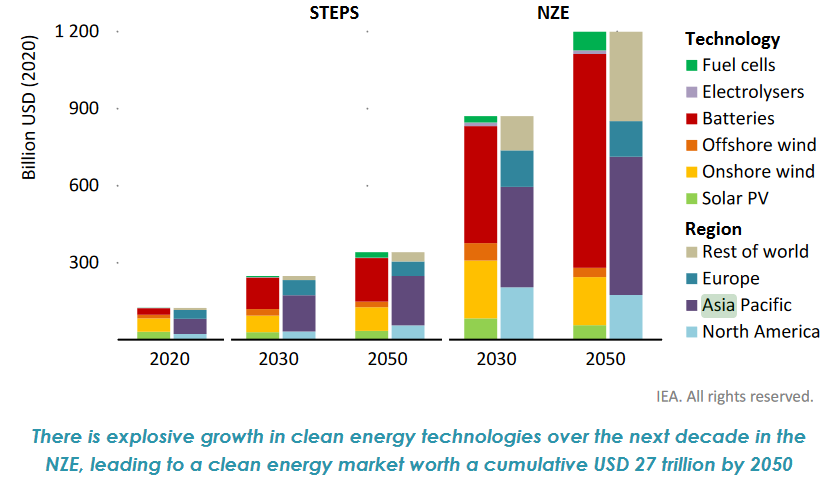

The IEA’s net-zero by 2050 scenario predicts that the market of the Asia-Pacific region for clean energy will balloon by 45% by 2050. This would play along with Southeast Asia’s transition, providing up to USD 1 trillion in annual economic opportunity by 2030.

Energy Companies and their Investments

Nationally, governments have varying targets for renewable energy’s contribution. Japan with 22-24% by 2030, Taiwan with 20% by 2025, and countries in the Association of Southeast Asian Nations, ASEAN, collectively pursuing 23% by 2025. This could lead to renewable energy covering 50% of the electricity for Asia by 2050. It’s a great opportunity for energy companies to invest more.

Renewable Energy Growth Beyond China

China is already establishing itself as one of the largest renewable energy producers globally. It now makes up over 90% of the newly added 55 GW of wind power across the Asia-Pacific. China’s neighbours, however, are catching up.

Other Asian markets like South Korea, Japan and India are all establishing themselves on renewable energy development. Japan and India, for instance, are now amongst the top ten largest renewable energy producers.

Across Asia, the renewable energy industry is on the precipice of tremendous growth. South Korea is planning on developing the world’s largest offshore wind power project, which will see its capacity soar from 125 MW to over 8 GW. Similarly, Taiwan is setting ambitious goals with its 15 GW of planned offshore wind capacity. Despite recent changes in its energy policy, Vietnam was the largest solar market in Southeast Asia for a few months.

Collectively, the Asian market has the potential for over 800 clean energy projects, with a total investment potential of USD 316 billion.

A Collaboration-Driven Future for the Energy Industry in Asia

One issue that affects Asian countries differently is the disparities in the uneven availability of renewable resources. However, proposals like the “Asia Super Grid” could quash these challenges and enhance collaborations and ties between countries.

Linking grids across borders has the potential to integrate large volumes of renewable energy. This would be particularly useful for grid-isolated countries like South Korea and Japan. It would also support small or land-limited markets like Singapore.

As well as integrating electricity supplies, grid-linking would also support countries overcoming supply and demand peaks. In turn, this could help alleviate intermittency issues that would distribute a continuous energy supply for those that need it.

More importantly, a linked grid of energy sharing across Asia would help countries wean themselves off their fossil fuel dependency. This would be especially helpful for emerging nations that still require copious amounts of energy to develop their economies and lift people out of poverty and the like. The promise of renewable energy’s potential in Asia is just getting started and energy companies are watching it.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more