How China Revived the Economy through Green Spending in 2008

The spillover effects of the 2008 financial crisis were felt in China. Although the country managed to sustain the economic growth of 9.6% in 2008 and 9.2% in 2009, it was a substantial contraction from the 14.2% growth in 2007. In the last quarter of 2008, 20 million rural migrant workers lost their jobs and many factories closed down, leaving laid-off workers without compensation. A total of 26 million people were out of work by the first quarter of 2009, a figure higher than the population of Australia.

The 2008-2009 China stimulus package

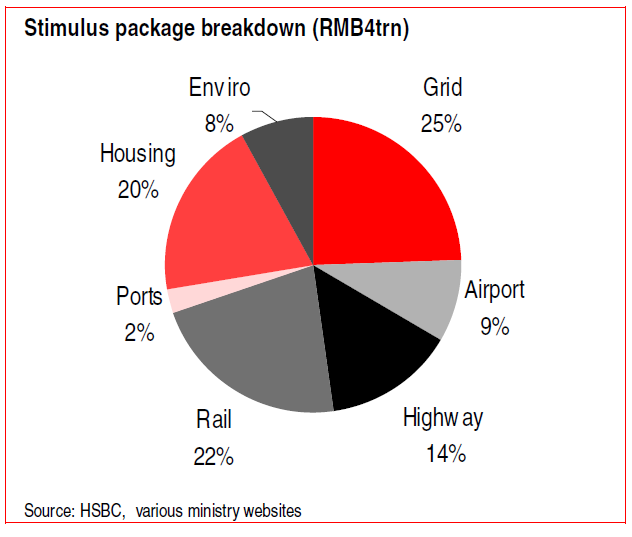

The Chinese government responded with an RMB 4 trillion (USD 586 billion) stimulus package over 2008-2009, equivalent to 12.5% of the country’s GDP in 2008. The ‘green’ component of China’s stimulus plan totalled about USD 221 billion – roughly a third of China’s entire stimulus package. These included energy efficiency, environmental improvements, rail transport and new electricity grid infrastructure.

Of the RMB 4 trillion economic stimulus package, RMB 210 billion (5.25%) was invested in energy savings, pollution control and ecological improvement, and another 9.25% was used for technical and structural upgrades in energy intensive industries.

The stimulus included investments by the central government (about RMB 1.2 trillion) and supporting investments from local governments, state-owned enterprises and banks (nearly RMB 3 trillion). These investments were predominantly financed by loans provided by policy banks and commercial banks.

Green stimulus influence on the development of China’s renewable energy sector

Although the renewable energy sector was not the main recipient of the stimulus programme, it continued to receive generous support through a whole raft of policies aiming to stimulate the development of the sector as part of China’s 12th Five Year Plan.

The wind industry was able to continue its dramatic growth in 2009, with grid-connected wind capacity increasing to 17.6 GW, up 110% year-on-year, according to the Chinese Electricity Council. While the collapse of demand in Europe and the US for domestic solar PV triggered the Chinese government to stimulate its own domestic solar market.

These policies made a significant difference to green jobs – a 2015 study looking at the green economy development in China found that cities located in a province with clean energy policies had 54.3% more green jobs and 61.8% more green businesses, compared with cities located in a province without such policies. Another study found that, in 2010, for every 1% increase in the share of solar PV generation there could be a 0.68% increase in total employment in China – an effect larger than any other power generation technology.

Stimulus package outcomes for China

The World Bank considered China’s 2008-2009 fiscal stimulus largely successful, “about the right size, included a number of appropriate components, and was well timed”, adding that it had significant effects on output at both the national and subnational level, through strong local spending that matched the earmarked funds from the center.

However, the World Bank also noted that local governments’ investments were largely financed from bank borrowing to support investment in property construction and infrastructure, which contributed to a significant rise of local government debt.

The crisis response also led to governance issues. One study described the frenzy, “ready or not, many of these projects were quickly rolled out and brought forward, and new projects were hastily put together to meet the calls for new spending in environmental and green technology areas. Within less than a month […] local governments, in aggregate, had proposed a staggering total of RMB 18 trillion in investment projects. Soon after, the figure rose further to RMB 25 trillion for the first 18 provinces reporting their plans.” The supply side, such as the state-owned bank, also responded with “frenzied enthusiasm”. This led to what was described as “a tsunami of credit expansion”.

By the middle of 2014, China’s total debt had quadrupled from about USD 7 trillion in 2007 to USD 28 trillion and, due to the excess capacity in real estate and heavy industries like steel and cement, it left Chinese banks with a large and rising portfolio of non-performing loans, exposing China to the risk of financial instability, warned the IMF.

The country’s stimulus package contributed to financing the start of China’s green economy transition, but the infrastructure growth actually led to a medium-term sharp increase in coal consumption and emissions. Between 2000 and 2013, China coal consumption increased almost three-fold. This rapid growth saw the country become the largest net importer of coal in 2009, and by the end of 2013 was responsible for half of the global coal consumption.

China’s stimulus investment also expanded its energy-intensive industries, including steel and iron, further increasing energy consumption and emissions. A study looking at China’s emissions pattern from 2005-2012 found that more than 70% of China’s carbon emissions growth from 2007 to 2010 was induced by this capital investment.

This article is part of the Green Stimulus as Response to COVID-19 Economy Impacts series, consisting of the in-depth introduction of the green stimulus packages and the different views on the effectiveness of the stimulus packages deployed in 2008-2009 in our series of case studies from the USA, South Korea and Europe.