How Europe Revived the Economy through Green Spending in 2008

The 2008 financial crisis caused the fall of several sectors in the EU, including the banking system, business investment, plus household demand and output. In response, central banks implemented a major monetary policy stimulus while national governments implemented a series of fiscal packages. Combined, these amounted to about 5% of the bloc’s GDP.

By the end of 2009, the EU unemployment rate had jumped from 6.8% in early 2008 to 9.4%. For under 25s the loss was larger, increasing from 15.2% to 21.1% in the same period. Regions were impacted differently by the crisis, with the degree of impact being heavily influenced by a combination of their pre-crisis situation, their economic strengths and weaknesses, their sectoral structure, as well as how their policymakers responded.

In 2009, GDP across the EU territory fell by 4.5% per capita and industrial production declined by 20%.

Europe’s 2008 and 2009 stimulus package

In November 2008, the European Commission adopted the European Economic Recovery Plan (EERP) in response to the financial crisis and aimed to encourage Member States to promote green technologies through the ‘European energy-efficient buildings’ initiative that granted support of EUR 1 billion, plus the ‘factories of the future’ initiative that granted support of EUR 1.2 billion.

In April 2009, the European Energy Programme for Recovery was also adopted with a dedicated EUR 4 billion to support new energy infrastructure, including offshore wind and carbon capture and storage demonstration.

The green component of European Economic Recovery Plan (EERP)

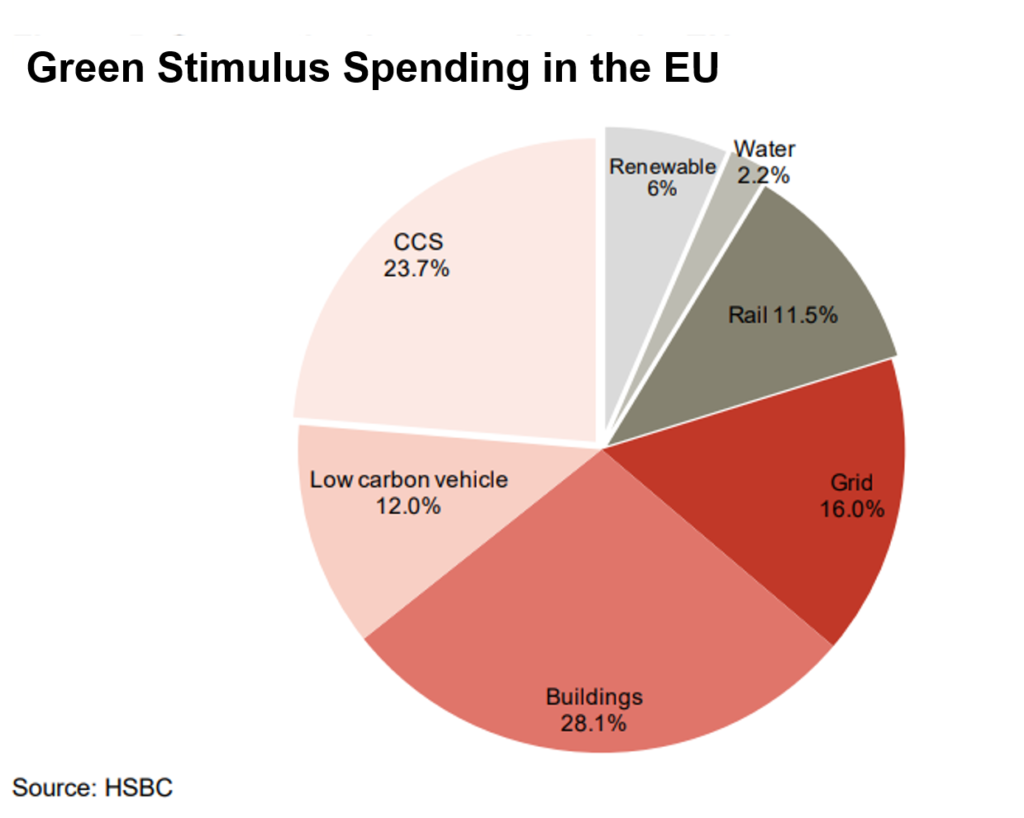

The EU-wide stimulus package was worth EUR 200 billion – about 1.5% of the bloc’s GDP. Across the EU, green investments accounted for 13.2% of the total stimulus and prioritised climate protection and energy efficiency, with the majority of spending on energy efficiency of buildings (75%) and the remainder on rail (20%) and vehicles (5%).

Focus varied by country – for example, Germany encouraged purchases of lower emissions vehicles, while France focused on energy efficiency and public transport. Of the Member States, Germany’s stimulus was the largest fiscal recovery programme in the EU, contributing to over 20% of the entire bloc stimulus. The EUR 81 billion (USD 104.8 billion) plan included tax cuts and investments in infrastructure and climate change.

The EERP resulted in a rise in GDP in many EU countries in 2010 and 2011, but in half of these, GDP fell again in 2012. Unemployment in the EU increased from 9.4% of the population in late 2009 to 9.6% in 2010, peaking at 11% in early 2011.

Assessment of the effectiveness of the EERP was not ultimately straightforward, as soon after the EU was hit by the subsequent sovereign debt crisis. According to a study by the European Central Bank, if implemented as initially enacted, the EERP’s effects would have been sizable but short-lived.

This article is part of the Green Stimulus as Response to COVID-19 Economy Impacts series, consisting of the in-depth introduction of the green stimulus packages and the different views on the effectiveness of the stimulus packages deployed in 2008-2009 in our series of case studies from the USA, China, and South Korea.