How the United States Revived the Economy through Green Spending in 2008

The US economy plunged as a result of the 2008 financial crisis, exacerbated by the economic slowdown that started in 2007. As the economy went through a deep recession, the GDP experienced the sharpest decline since 1958, falling by 5.4% in the last quarter of 2008 and by 6.4% in the first quarter of 2009. 4.6 million jobs were lost between the start of recession and February 2009.

The 2008 US stimulus package

The stimulus package announced during the 2008 global recession aimed at reviving the economy. ‘Green’ spending included three categories: the Emergency Economic Stabilization Act (EESA) passed in October 2008, the American Reinvestment and Recovery Act (ARRA) passed in February 2009, and the 2010 budget. The green component of the stimulus package constituted about one-eighth of the total.

The ESSA, also known as the bank bail-out, was a law passed by US Congress in response to the subprime mortgage crisis, allowing the Treasury Secretary to buy up to USD 700 billion of troubled assets and restore liquidity from banks. This was followed by the ARRA announced by the Obama administration in February 2009, boosting the economy with USD 787 billion which helped the US out of recession in July 2009. This amount was later revised to USD 831 billion.

The green component of Obama’s American Reinvestment and Recovery Act (ARRA)

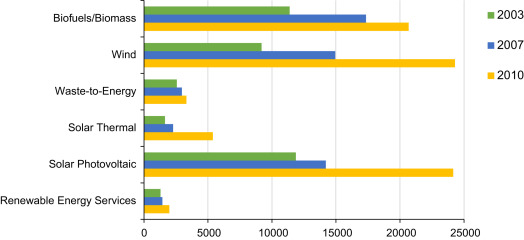

The ARRA bill released USD 92 billion to renewable energy technologies, of which renewables accounted for USD 21 billion. It focused on four categories of energy-related investments: energy efficiency, the electric grid, transportation, and renewable energy, and created about 900,000 jobs in clean industries from 2009 to 2015.

The stimulus package allocated money to state agencies and NGOs to retrain unemployed or incumbent workers in renewable energy. The Act included tax incentives, loan guarantees and subsidies for research and development in clean technologies. And it leveraged more than USD 100 billion in private capital in manufacturing and generation of wind, solar and other low-carbon sources.

Obama’s ARRA is considered “the biggest renewable energy bill in history”, because it strengthened the renewable energy economy in the US. Overall, the US green stimulus response had a positive impact on the renewable energy sector. Since 2008, wind power installations have almost quadrupled and solar power increased more than 50-fold. The cost of utility-scale solar fell by 60% between 2008 and 2016, with solar becoming cost-competitive with fossil fuels in 20 states. 270Mt of CO2 emissions were avoided due to the uptake of renewables between 2008 and 2012.

Further green stimulus in electric vehicle and battery manufacturing

The ARRA stimulus package also jumpstarted the electric vehicle (EV) and battery manufacturing, strategically building a competitive industry. Lithium-ion battery prices went down from USD 1,000/kWh in 2008 to under USD 300/kWh in 2014. The Recovery Act helped the rebirth of EVs in the US, supporting 16 auto manufacturers to offer 28 new EV models and increasing the number of EVs on the road from a few thousand in 2008 to 400,000 in 2015. The US is the third-largest EV market, with 320,000 EVs sold in 2019, according to BNEF.

ARRA green stimulus outcomes for the US

According to the Council of Economic Advisers (CEA), the ARRA increased the country’s GDP about 2 to 3% from late 2009 through mid-2011. In 2015, the Council of Economic Advisors (CBO) estimated the stimulus had created between two million and 10.9 million jobs between 2009 and 2012, with the majority of the increase occurring in 2011.

While the public-private investment in the renewable energy package was unprecedented, the ARRA focused on short-term supply side investments. Regulatory certainty on energy and climate legislation could have driven more investment into renewable energy companies. The loan guarantees programme received negative publicity due to bankruptcies (ie. Solyndra), even though the programme reached its stated objective of reducing the cost of clean technologies.

With this loan programme, the Obama administration aimed to position the US as the global leader in developing and manufacturing renewable energy technologies, yet was undercut by competition from China.

This article is part of the Green Stimulus as Response to COVID-19 Economy Impacts series, consisting of the in-depth introduction of the green stimulus packages and the different views on the effectiveness of the stimulus packages deployed in 2008-2009 in our series of case studies from China, South Korea and Europe.