Hydrogen Cost: Can We Afford It?

Portion of a electrolyser at a hybrid power plant. Source: Reuters

22 June 2023 – by Eric Koons Comments (0)

Hydrogen has been gaining attention as a potential solution to the world’s energy problems. It is abundant, versatile and emits primarily water when used as fuel. However, the cost of producing hydrogen has been a major obstacle to its widespread use. The price of hydrogen depends on several factors, including the method of production, the type of feedstock used and the efficiency of the process.

Green Hydrogen Production Cost

One promising method of producing hydrogen is through electrolysis powered by renewable energy sources, such as solar or wind. Hydrogen produced from this method is known as green hydrogen. While this method is environmentally friendly, it remains too expensive to be commercially viable at present.

The high cost of electrolysers and the inefficiency of the electrolysis process contribute to the high cost of green hydrogen. Despite this, green hydrogen has the potential to play a significant role in decarbonisation efforts if costs decline.

As renewable energy becomes more affordable and available and technological advancements are made in electrolysis, the cost of green hydrogen and hydrogen fuel will decline. This could make it a valuable tool in reducing carbon dioxide emissions in industries such as transportation and manufacturing. Green hydrogen could become a key player in transitioning to a cleaner, more sustainable energy future.

How Much Does Hydrogen Cost?

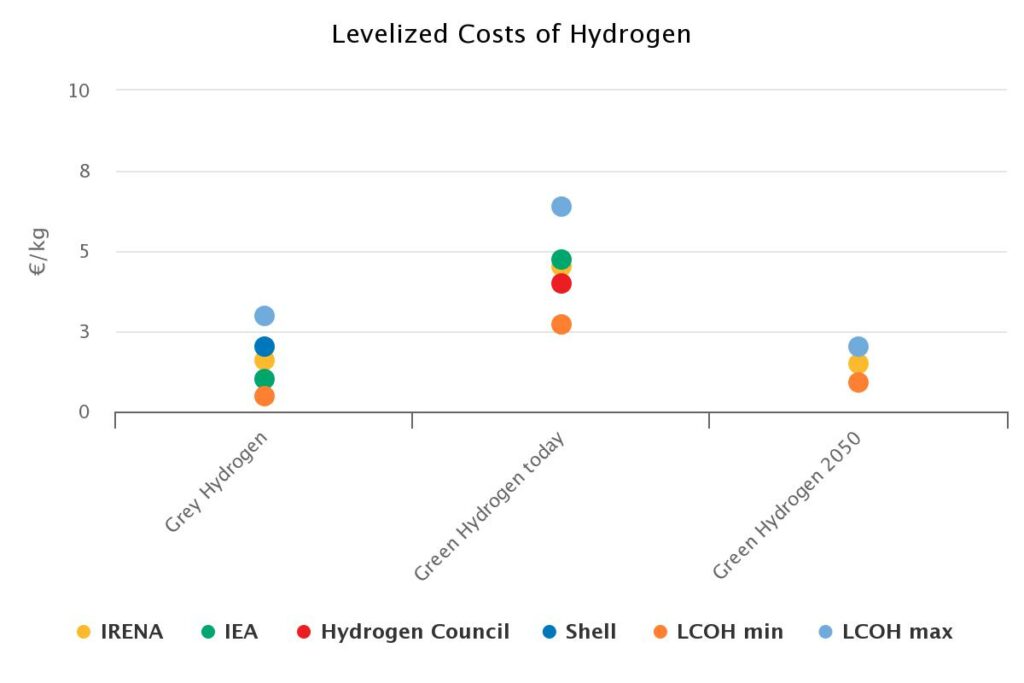

Currently, fossil fuel-based hydrogen costs range from USD 0.5 to USD 1.7 per kg. Meanwhile, green hydrogen ranges from USD 3 to USD 8 per kg. This gap remains significant and is one reason why increasing demand for green hydrogen is challenging.

Why Grey Hydrogen is Cheaper than Green Hydrogen?

The cost of fossil fuel-based hydrogen is lower than green hydrogen due to the high rates of natural gas extraction, existing infrastructure and the low cost of fossil fuels. However, the high carbon emissions associated with fossil fuel-based hydrogen production make it unsustainable in the long term. On the other hand, green hydrogen production is still in its early stages, and the cost is relatively high. Most markets will continue to purchase the cheapest option available unless there is an incentive to do otherwise.

However, trends indicate that green hydrogen will likely become more affordable as renewable energy costs decline and electrolyser manufacturing improves.

Additionally, grey hydrogen prices are volatile, as they are directly dependent on the natural gas market. For example, during 2020 and the COVID-19 disruption, natural gas prices tripled in Europe, leading to higher grey and blue hydrogen prices.

Challenges to Reducing the Cost of Green Hydrogen

Green hydrogen costs remain high, yet estimates show it may become cost-competitive within the decade. However, several factors must be overcome to reach this price parity.

First, the existing hydrogen production process electrolysis technology is relatively inefficient compared to the alternatives. Converting renewable energy into hydrogen and back into power has a round-trip efficiency of 18-46%. Other energy storage solutions like pumped-storage hydropower and lithium-ion batteries are above 70%.

This means more renewable energy is required to store the same amount of energy as alternatives, driving up input energy costs and leading to the second cost factor of green hydrogen: the lack of infrastructure such as hydrogen gas pipelines.

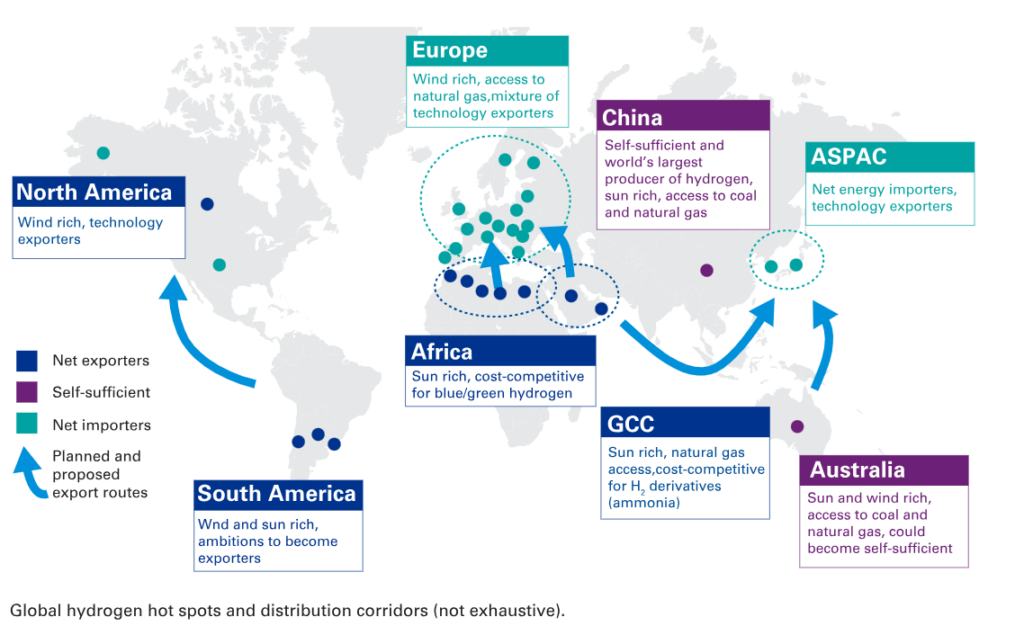

Renewable energy generation and access are inherently variable depending on the region. Some regions, like Scandinavia, are rich in renewable energy opportunities, while others, like Malaysia, have a significantly lower potential. This will ultimately create an import and export network for green hydrogen. However, the infrastructure to support this system is not in place. It is time-consuming and expensive to build. For example, building a hydrogen pipeline takes seven to 12 years.

Furthermore, renewable hydrogen electrolyser infrastructure is minimal, even in renewable energy-rich regions. Most green hydrogen production facilities have electrolyser capacities of less than 50 MW, significantly below that of blue and grey hydrogen and nowhere near commercial scale.

Developing technology and production capacity for commercial-scale electrolysers is an expensive process. Additionally, the small quantities of green hydrogen currently available on the market drive up prices.

Steps To Reduce Green Hydrogen Costs and Increase Adoption

Bringing down green hydrogen costs and increasing adoption go hand in hand. First and foremost, technology must improve to create more efficient and commercial-scale electrolysers. Infrastructure must also be built to transport hydrogen from production facilities to shipping or manufacturing hubs.

Increasing production capacity and investing in infrastructure development will enable economies of scale, leading to lower production costs.

This relies on investment from both the public and private sectors and government incentives to facilitate the investment. Subsidies, tax incentives and direct government funding can all shift the economies of projects in the near term.

Commercial-scale pilot projects must be implemented within the next several years. They will play a crucial role in developing the needed experience and technology to facilitate ongoing production growth and drive down costs, creating a robust green hydrogen market.

Future Cost of Green Hydrogen

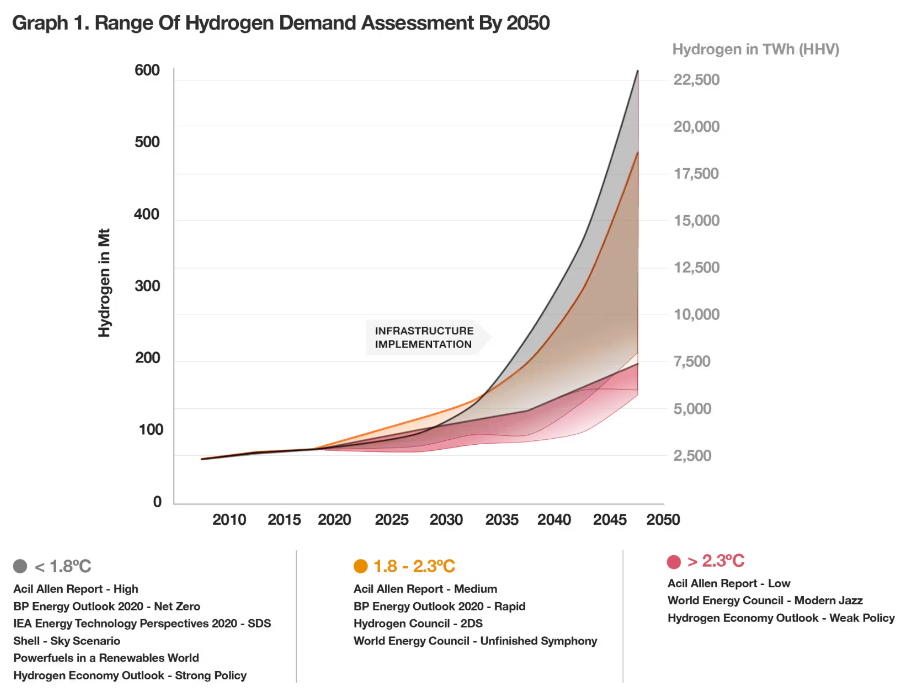

Experts predict that the cost of green hydrogen will decline significantly. However, this is highly contingent on government carbon emissions and green infrastructure policies. Stronger policies will spur higher demand, translating to more private sector investment in the industry.

As a result, it is challenging to predict how fast costs will fall, and estimates are variable. The International Energy Agency (IEA) predicts a 30% decline by 2030, whereas a study by consulting firm PWC estimates a 50% decline. Regardless, government policy is the driving factor in both predictions.

Government Policy Is Critical for Hydrogen

Governments are beginning to understand their role in developing the green hydrogen market, and the number of policies supporting the industry is rapidly expanding.

As of July 2021, 43 countries have developed roadmaps for the development of green hydrogen, and governments have pledged billions to support green hydrogen projects. As a result, the number of new green hydrogen projects has more than tripled in 2021.

However, these programs are not nearly enough to meet global requirements. Boston Consulting Group estimates governments will need to invest up to USD 12 trillion by 2050, with USD 700 billion of that by 2030, to fulfil the green hydrogen demand required to meet the Paris Climate Agreement goal of net-zero by 2050.

Government support, private sector investment, technological advancement and hydrogen cost are all connected. It will take an ongoing effort to facilitate these factors and develop a green hydrogen economy.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more