Op-Ed: Implementing Indonesia’s JETP Plan Requires Prioritisation, Processes and Transparency

Photo: Shutterstock / Owlie Productions

05 December 2023 – by Grant Hauber Comments (0)

In November 2022, the Indonesian government and the multi-government International Partners Group (IPG) announced the US$20 billion Indonesia Just Energy Transition Partnership (JETP). Unprecedented in size and scope, it seeks to mobilise public and private sector funds to retire energy assets with high carbon dioxide (CO2) emissions and accelerate the adoption of clean technology while providing the country with sustainable economic development. But discussions seem to have become stuck on defining transition priorities.

In response, earlier this month, Indonesia released its Comprehensive Investment and Policy Plan (CIPP), which aims to codify its JETP-related green transition policy and investment needs in one place. The CIPP quantifies and qualifies the requirements to set the country on a path to net-zero CO2 emissions by 2050, identifying US$100s of billions in prospective investments.

Indonesia’s CIPP is a significant step in detailing the country’s decarbonisation goals and path to achievement. Yet, examining its contents objectively and identifying necessary actions to guarantee decarbonisation and economic prosperity is important.

Clarifying Foundational Assumptions

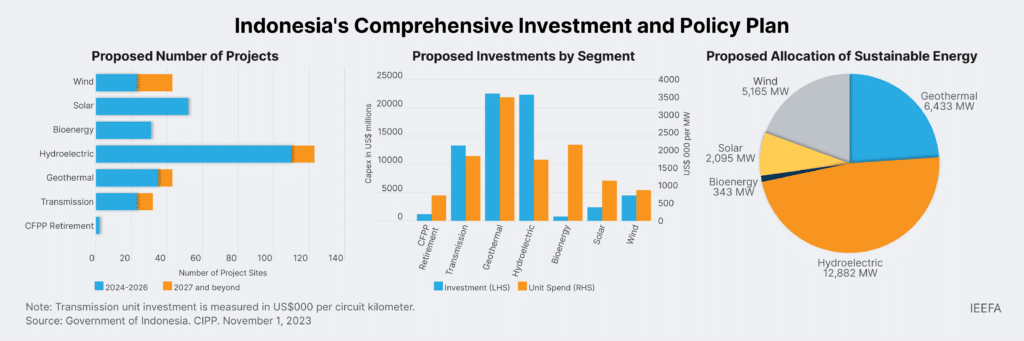

The CIPP offers unprecedented insights into power sector planning. The plan identifies over 400 near-term investments, totalling an estimated US$67 billion, encompassing transmission and distribution, hydroelectricity, geothermal, solar, and wind projects.

The money, time, and resources required to implement the CIPP leaves little room for unnecessary investments. Many CIPP projects seek to mobilise private investment capital supported with blended finance. Thus, the plan’s underlying economic and operating fundamentals need to be obvious.

The most fundamental CIPP assumption driving the number and size of proposed investments is a 5.8% energy demand growth rate. Globally, GDP growth has decoupled from energy consumption due to higher energy productivity and end-use efficiency. Thus, a 5.8% energy growth rate presupposes a far higher economic growth rate, warranting greater substantiation.

Excessive investments based on optimistic projections have happened before. In the past decade, the Java-Bail power grid added 20GW of mostly coal-fired power plants (CFPP). Many of these appear unnecessary as stand-by reserve capacity currently sits near 55%. The need to make minimum contractual payments on this underused plant has subjected national utility PLN to severe fiscal constraints. Over-optimistic coal-era demand growth projections now directly undermine PLN’s ability to consider new energy transition investments.

This situation is relevant since one of JETP’s primary goals is to shut down high-emitting CFPPs. However, CIPP architects have only been able to muster two early retirement prospects, totalling 1.6 megawatts (MW). Given the low rates of CFPP utilization, there may be room to consolidate capacity into more optimal operating bundles and raise ambition for retirement.

Going forward, more comprehensive data disclosure, including operating efficiencies, dispatch rates, emissions profiles, and marginal operating costs, would go a long way to provide transparency and objectivity to the CIPP’s retirement decision-making.

Examining the Proposed Transition Portfolio

While nearly 80% of CIPP projects are flagged for implementation between 2024 and 2026, 40% are not currently included in the country’s long-term Electricity Supply Business Plan and thus might need additional approvals before commencing.

Hydroelectricity has an outsized share of the CIPP at US$22 billion, while a nearly similar level of investment is earmarked for geothermal, despite its very high per-MW cost requirement. Large-scale hydro and geothermal projects are notoriously challenging to implement, suffering from long construction periods and cost escalations, thus, CIPP’s reliance on these long-gestation renewables is a gamble.

Solar energy has the least identified projects in the plan despite being the focus of domestic green manufacturing industry development and having globally proven ultra-low lifecycle costs. Meanwhile, despite potentially challenging wind resource speeds, identified wind energy projects total almost 2.5 times the capacity of solar.

There appears to be outsized concern about the impact of variable renewable energy (VRE) on the grid despite their total contribution being less than 1% of supply today. Evidence globally demonstrates that grids have been operating with a substantial proportion of VRE to no detriment, and Indonesia has a far path to travel before variability becomes a concern. Meanwhile, the CIPP’s ambitious and warranted transmission system build-outs should make excellent headway on VRE integration.

Supporting Implementation Through Prioritisation and Transparency

While many excellent transition projects have been identified, CIPP’s 400 projects cannot immediately commence. In addition to prioritising those with the greatest near-term benefit, certain key projects in each geographic region are likely prerequisites to enable others to follow.

Aggressive prioritisation would reduce risk and increase certainty for all public and private participants:

- Transmission improvements are needed to connect distributed sources of supply.

- Pricing policies are necessary to jumpstart the justification of renewables.

- Drilling campaigns are important to identify viable geothermal resources.

- Near-term renewable energy additions are required to demonstrate fossil plants can be retired and that the price of renewables can decrease.

Plans of such scope and scale require war room-like preparation for tendering and contracting. A veritable army of project designers, specifiers, procurers and negotiators is essential to seeing the CIPP become a reality. The government should systematically yet urgently put preparatory plans into action, as all actors involved, domestic or foreign, are subject to the pressures of short-cycle political calendars and even briefer news cycles.

Implementation efforts would benefit from drawing on the expertise and frameworks of the government’s “special mission vehicle”, PT Sarana Multi Infrastruktur, augmented by seconded staff from multiple government agencies. Judicious use of international technical assistance and grants to fund expertise and systems would constructively contribute.

The CIPP represents a vital step for Indonesia, taking control of the JETP process and focusing negotiations with the IPG on tangible destinations for grants and investments. Backing that with practical, speedy implementation will be crucial.

In Indonesia’s understandable goal of maximising IPG funding commitments, the CIPP, as it stands, could risk placing the country in a position of overpromising and underdelivering. Prioritisation, robust processes and transparency will increase the potential for the country to achieve sustainable, economic, and equitable outcomes.

Deliberate steps will help realise the CIPP’s ambitions, encourage the IPG and the private sector to commit to investments and provide the impetus for realising a just energy transition in Indonesia.

Grant Hauber is the Strategic Finance Advisor for Asia with IEEFA. He provides strategic advice on energy and financial markets for IEEFA’s Asia Pacific team. He emphasises the region’s emerging markets and provides insights to project finance, multilateral development institutions, and implementing the energy transition. Grant leverages his engineer and project developer background to objectively assess energy technologies, whether renewables, fossil fuels, or emerging sources such as hydrogen and ammonia.

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Energy Tracker Asia.