Is Oil a Good Investment in 2024?

Source: Investopedia

28 December 2023 – by Eric Koons

Is oil a good investment in 2024? Oil’s history is marked by dramatic fluctuations in price and return on investment (ROI). Over the last decade, the ROI on crude oil production has fluctuated between -45% and +55% per year. This reflects the complexities that drive the inherent volatility of all fossil fuel markets. Global oil markets rely on various factors, including market dynamics, global economic forecasts and geopolitical events – all of which are challenging to predict.

Is Now a Good Time to Invest in Oil in 2024?

With so many factors to consider, analysts and investors are divided on whether oil will be a good investment in 2024.

Brent Crude Oil Prices in 2024

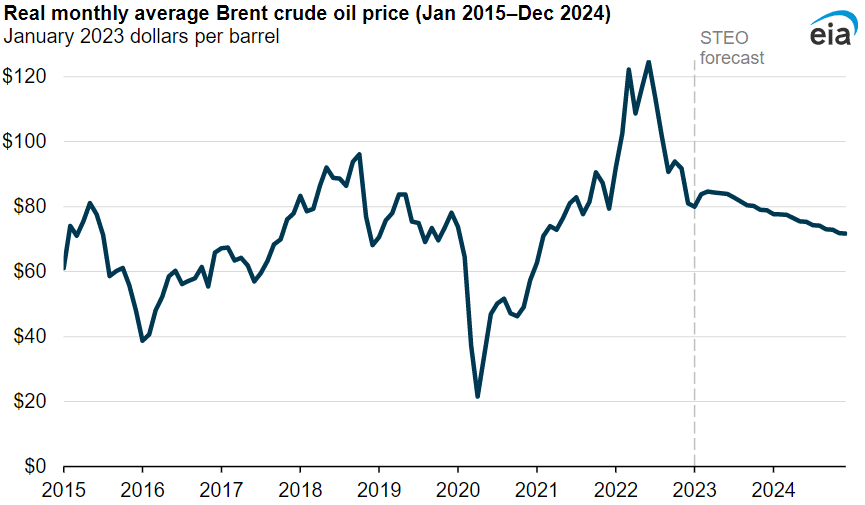

The average Brent crude oil price has been USD 82.70 during 2023, which is an 8% decline compared to 2022.

Goldman Sachs projects that oil prices could range between USD 70 and USD 100 a barrel in 2024, straddling the existing price. This oil price forecast suggests a potential window of profitability for investors and oil producers. However, it also highlights a potential further decline. While crude oil prices don’t directly reflect oil and natural gas sector stocks, they often correlate. This should raise some concerns for investors who want to buy oil stocks.

Is Oil Stock a Good Buy Right Now?

This may be why renowned investors like Warren Buffett are showing signs of scepticism. Buffett’s investment patterns indicate a cautious approach to oil stocks, possibly due to the uncertainties surrounding the industry.

All that being said, oil and gas sector investment has the potential to go either way in the short term into 2024.

Long-term Investment in Oil and Gas

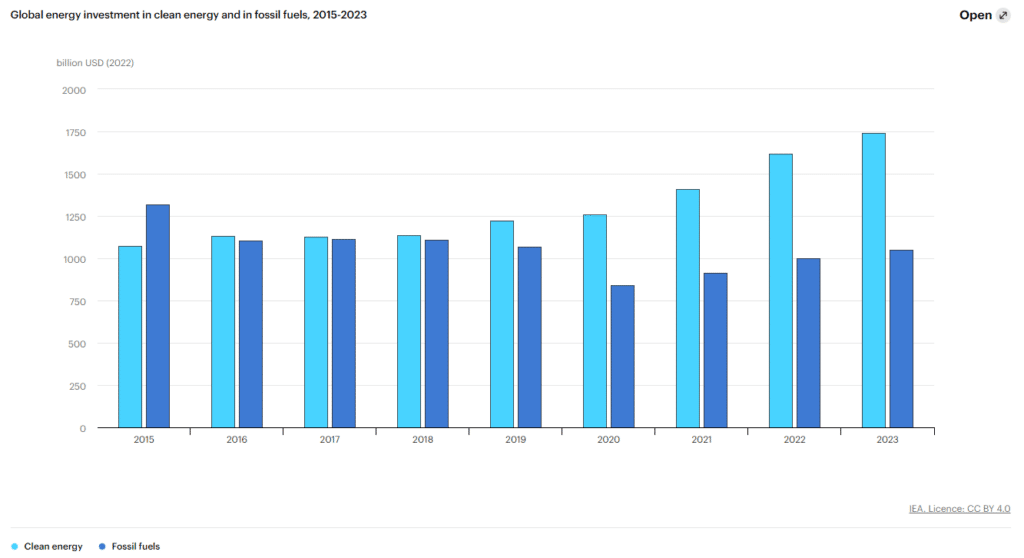

On a longer time scale, oil and gas investment returns will likely decline. Market analysis consistently shows that low-carbon technologies are outpacing oil and gas investment. Investment in renewables will rise 24% between 2021 and 2023 compared to 15% for fossil fuels. Additionally, of the USD 2.8 trillion in investment in the energy sector in 2023, USD 1.7 trillion is expected to go to clean energy technologies.

This trend is expected to continue in the coming years – highlighting the global shift away from fossil fuels.

The Inherent Risks of Investing in Oil

One of the main challenges of investing in the oil and gas sector is its dependence on external factors that drive price volatility and ROI. These require careful consideration before investing. Key factors include the following.

Global Economic Conditions

The most direct influence is through supply and demand. When global economic conditions are strong, industries and consumers use more energy, increasing demand for oil and gas. This demand can drive up prices. Conversely, during economic downturns, demand for oil and gas typically decreases, leading to lower prices.

Additionally, considerations like inflation and interest rates directly affect the sector. Inflation leads to higher operational costs for oil and gas companies. Moreover, central banks often respond to inflation by adjusting interest rates, which can influence investment in the oil and gas sector. Higher interest rates can reduce investment in exploration and production, while lower rates can stimulate these activities.

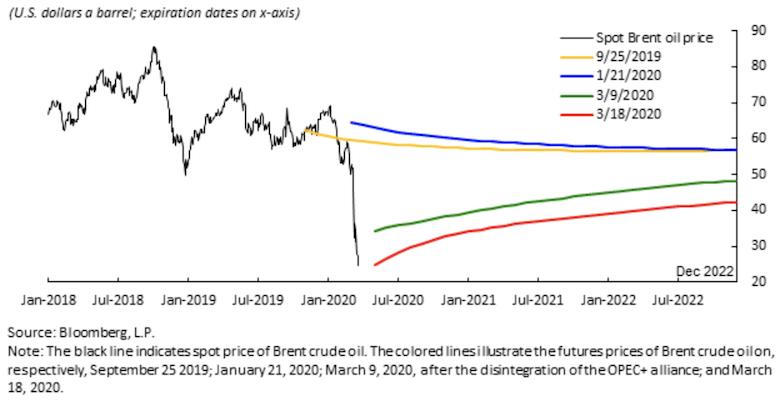

Global Disruptions and Oil Production

The oil market is extremely sensitive to global events, as evidenced by the impact of events like the Ukraine-Russia war and the COVID-19 pandemic. Such geopolitical tensions can lead to sudden and unpredictable shifts in oil prices, posing a risk to investors.

The Ukraine-Russia war immediately drove oil prices to a record eight-year high, whereas the COVID-19 pandemic pushed oil prices into freefall, ending with a Brent crude oil price of USD 9.12. These events are nearly impossible to predict.

Government Policies

National and international policies are increasingly favouring renewable energy sources over fossil fuels. This shift, driven by environmental considerations and the need for sustainable energy security, could further diminish the profitability and returns of oil as an investment.

For example, the European Union’s new carbon tax, the Carbon Border Adjustment Mechanism (CBAM), highlights government action on this issue. Products entering the EU will be subject to a carbon tax based on the emissions associated with production abroad. This will incentivise companies to move away from fossil fuels in their operations in favour of renewable energy – potentially driving down oil demand in the long term.

Stranded Asset Risk

In the long term, there is a serious risk of stranded assets for oil and gas companies. As regulation changes and the world shifts to renewables, fossil fuel infrastructure may become unusable or unprofitable.

These assets have significant construction times and are major investments that can drag down company profits and limit ROI for investors. For example, it takes 10 years from the time of exploration before a refinery produces oil and costs between USD 10 and USD 25 billion to build.

Balancing the Scales: Oil Versus Renewable Energy Investments

The inherent volatility of oil makes it a challenging investment choice in 2024. In contrast, renewable energy sources have shown steady growth over the last decade, emerging as a more stable and sustainable investment option.

The International Energy Agency underscores this trend, noting that clean energy investments are steadily outpacing fossil fuels. This shift is fueled by a combination of factors, including the increasing viability of renewable technologies, government policies promoting sustainable energy and declining technology costs.

As we move towards a future where energy security and sustainability are paramount, renewable energy investments offer a more promising and responsible alternative to the traditional oil sector.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more