Japan’s EV Sales Boom: The Hunger for Electric Cars

12 May 2022 – by Viktor Tachev

The recent Japan EV sales boom has brought into question the viability of the country’s hydrogen strategy and the priorities of its auto industry. The market is showing its hunger for electric vehicles, and if the local industry does not manage to satisfy it, then the foreign EV makers and the imported electric vehicles will. This signals that hydrogen might not be the correct answer to its energy transition for the Japanese government.

Japan’s Auto Industry and Its Focus

Japan is the third-biggest car maker globally after China and the US. As such, one would expect it to lead the global EV market. And so did Elon Musk, who in 2010 said that Japan could become the second-biggest market for Tesla. However, we can see that things did not pan out exactly that way in hindsight. Today, electric vehicles in Japan account for just 1% of overall car sales in Japan.

There are several reasons for this. First, the market has leaned towards hybrid cars, as they are much cheaper than electric vehicles, with government subsidies being similar for both types of vehicles.

Electric Vehicles in Japan

Japan and its vehicle market have long been wary of electric vehicles. The government’s organised push for a hydrogen-based economy actively tolerates hybrid cars and hydrogen-powered cars. Speaking to Energy Tracker Asia, Daniel Read, Climate and Energy Campaigner at Greenpeace Japan, says that consumer perceptions around electric vehicles in Japan also play a significant role.

Read says that in Japan, hybrids and EVs are seen to be “an equal choice” for environmentally conscious motorists. He goes on to say that there is a strong narrative presented by the auto industry that suggests hybrids are a better choice for the Japanese energy grid, despite research demonstrating the opposite.

However, local automakers have failed to promote EVs as a viable option for the public. “In contrast to EV advertising in the EU, China and the US, there is very little promotion of EVs in Japan,” says Read. This is what keeps the low demand in the country even lower, which is not good if Japan wants to achieve carbon neutrality.

Japan’s Recent Electric Vehicle Sales Boom and What Is Behind It

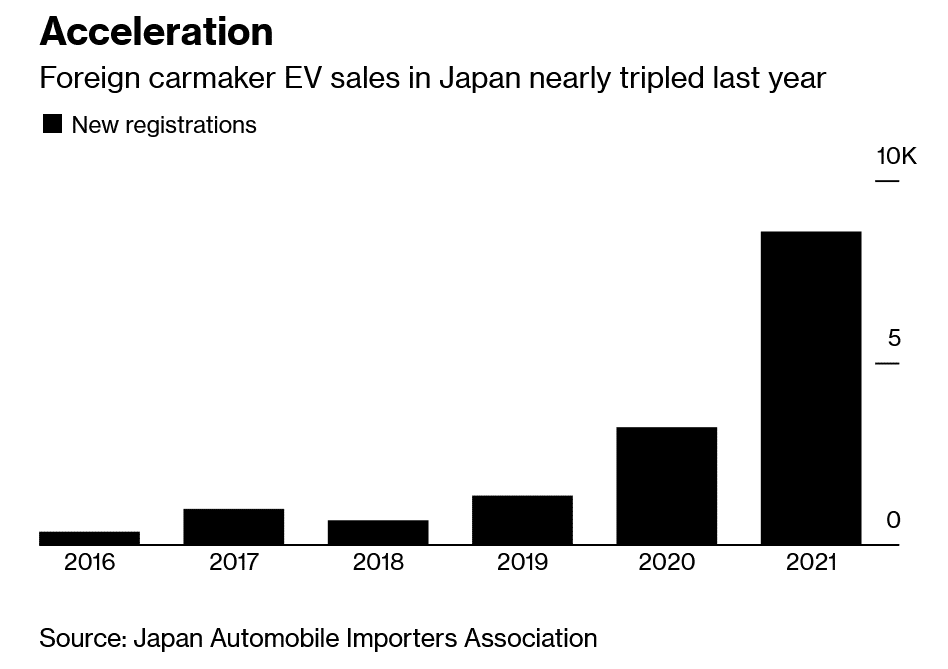

Out of the 20,000 new EVs sold in 2021, over 8,600 were imported electric vehicles. The result marked significant growth, nearly three times the number of foreign car registrations of newly imported EVs compared to the previous year.

The government’s decision to prioritise climate commitments instead of its auto industry’s interests is a major reason.

Japan pledged to become net-zero by 2050 and slash emissions by 46% by 2030. The government recognises the shift to EVs as being a way of supporting the country’s decarbonisation efforts. First, it plans to ban the sale of gas-fueled cars in the mid-2030s. It also plans to make EVs more affordable for consumers. Meanwhile, subsidies are now reaching a maximum of 800,000 yen (USD 7,000).

However, as long as hydrogen and hybrid vehicles remain the primary focus of Japan’s auto industry, the country will struggle to make real progress. And it will remain far behind China and the West.

The Implications of Japan EV Sales 2021 Boom for the Auto Industry and the Japanese Market

As the world shifts towards EVs, hybrids are slowly becoming a thing of the past. The auto industry should make a note of this movement. Otherwise, its hesitance to explore the EV market and actively address the growing local consumer interest might cost it dearly. This could result in the loss of its domestic market to foreign companies.

Tesla in Japan

According to Read, Tesla has shown rapid growth, and Hyundai has returned to the Japan’s market after exclusively selling battery electric vehicles and fuel-cell vehicles. He also suspects that Chinese EV makers are also looking to move into the Japanese market. “I suspect the Japanese makers will attempt to try and catch up but most likely won’t properly try until it is too late,” he says.

Interesting Case of Toyota

An interesting case is Toyota. The company has a history of actively advocating for the delay of electric vehicle policies in Japan and abroad. Furthermore, Greenpeace East Asia ranks its decarbonisation efforts as the worst among global carmakers.

Although it recently set a target for 100% CO2 reduction in all new vehicles sold in Western Europe by 2035, the company continues to actively promote ICE vehicles and hybrids.

“As battery prices drop, EVs will become more affordable, and hybrids will become obsolete,” says Read. He goes on to state that “foreign makers are already positioning themselves much better than Japanese automakers to catch that trend.”

However, Japanese automakers are starting to pivot under external pressure. Toyota, Nissan and Honda have all rolled out new EV strategies and plan to invest significantly in EV development. However, these developments still leave Japanese manufacturers far behind Western competitors in terms of decarbonisation efforts. Some of their counterparts have already committed to abandoning combustion engine cars in the near future.

Japanese Government Has a Critical Role in Promoting EV Sales

Countries are rushing to accelerate EV penetration rate in a global push for decarbonisation. However, Japan does not seem to be on the same page. To keep its status as a leader in innovation, Japan needs to do more to promote domestic EV manufacturing. Without more aggressive measures that incentivize the development of electric cars, instead of the hybrid and hydrogen vehicles, Japan will surrender its domestic market to foreign automakers.

However, Read suspects that the government will try to protect the auto industry’s interests. This may come in the form of allowances for hybrids and hydrogen vehicles. Despite this, Read predicts that hybrids and hydrogen vehicles will be “priced out” due to a drop in the cost of EVs within the next five to 10 years.

Japan has a choice. It can take meaningful action today by putting its hydrogen plans on hold. Or, the country can be forced into doing so by the market.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more