Japan To Buy ‘Record Amounts’ of LNG From US After Trump and Ishiba Meet

25 February 2025 – by Viktor Tachev

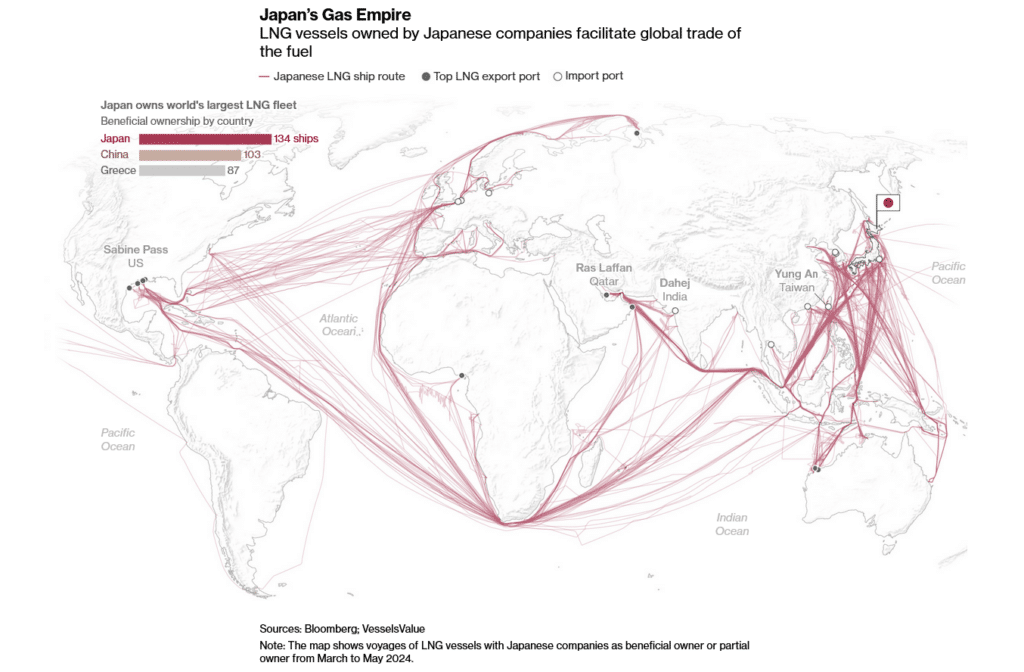

After getting into office, US President Donald Trump has been quick to start threatening or imposing tariffs on China and leading developed countries and trade partners, such as the EU, Canada, Taiwan and more. Japanese Prime Minister Shigeru Ishiba visited the United States earlier this month in a bid to strengthen the relationship between both countries and potentially avoid becoming subject to similar measures. During the meeting, Japan agreed to buy “record amounts” of natural gas from the US – a move that Ishida considers in his country’s national interest. At the same time, experts fear it will have far-reaching consequences on the domestic stage, but even more so for Southeast Asia, where Japan has profited from exporting excessive liquefied natural gas.

Japan Promises to Expand Liquefied Natural Gas Imports From the US to Record Levels

In a joint press conference after the meeting, Japanese Prime Minister Shigeru Ishida voiced optimism over averting tariffs. Key among the reasons was Japanese leadership agreeing to “soon” start importing “clean” US LNG in “record numbers”. Trump even said the two countries could resolve the existing trade deficit of USD 100 billion “very quickly” just “on oil and gas”, indicating the potential import-export volumes they could target.

Ishiba, who has previously emphasised the need to prioritise renewable energy and reduce reliance on nuclear power, and also criticised Japan’s wealth flowing overseas by importing fossil fuels, now says that expanding LNG imports from the United States is in his country’s “national interest”. The move followed JERA’s announcement ahead of the meeting that it planned to purchase more US LNG from export terminals under construction to diversify supplies. Currently, it handles the equivalent of about half of Japan’s domestic LNG demand annually.

During the meeting, Trump also reportedly requested a commitment to increasing Japanese investment in the US to USD 1 trillion. In response, alongside LNG, the Japanese prime minister also identified steel, AI and automobiles as areas of investment for recovering the trade deficit. He also indicated potential interest in importing bioethanol, ammonia and other resources from the US, if the price was “stable”. The idea is likely to originate from Japan’s strategy to actively promote co-firing ammonia with coal across Asia – a technology widely criticised for being too costly, polluting and untested.

According to Trump, Japan’s increased LNG deliveries will come from a USD 44 billion project in Alaska, for which both countries would form a joint venture. Bloomberg estimates that the project would be massive in scale, requiring the construction of over 1,200 km in pipelines, a separate carbon capture facility and import and export infrastructure. The Alaska LNG project has stalled for many years due to a lack of investment partners and significant cost hurdles, with major oil companies such as BP, ConocoPhillips and ExxonMobil withdrawing from it. While the project targets completion in 2031, any further delays would significantly threaten its viability, especially considering the looming new LNG supply capacity to come online from the end of 2026.

As of FY 2023, the US supplied 5.8 million tonnes of LNG to Japan, equal to around 9% of its imports. The top three suppliers included Australia with 26.6 million tonnes (41%), Malaysia with 10.2 million tonnes (15.8%) and Russia with 6.3 million tonnes (9.7%). According to Bloomberg data, roughly 10% of Japan’s LNG supplies came from the US in 2024. If realised, the Alaska LNG project will have an annual production capacity of about 20 million tonnes, equal to about 30% of Japan’s annual LNG import needs.

The Consequences of Increased US LNG Exports to Japan

As the world’s second-largest LNG buyer, Japan has ambitious plans to increase its LNG imports from the US, with several Japanese companies already considering investments in US export facilities. However, Japan’s moves raise various concerns – both on the domestic and regional stage.

First, the country’s draft version of the 2035 NDC, which proved disappointing and targeted a 60% emissions reduction by 2035 instead of the 81% experts suggested, ended up being the official submission. According to reports in local media, the Ministry of the Environment even blocked a member of the governmental 2035 NDC formulation committee from expressing his opinion for a more ambitious target. Climate Action Tracker notes that this highlights the issues around the transparency and fairness of energy and climate policy processes in Japan. Now, the agreement for increased LNG deliveries further strengthens the notion that gas will play a leading role in the country’s energy plans, further distancing it from achieving its climate goals.

Japan’s scepticism toward renewable energy has long been evident on both the national and corporate fronts.

According to Oil Change International, Japan is the world’s largest provider of international public finance for LNG export capacity, with over 50% of global international public finance for completed projects since 2012 and projects under construction or to be built by 2026. Aside from being the largest coal user in the G7, it is also effectively exporting its slow transition across the region by promoting fossil fuel-based technologies.

According to InfluenceMap, the Japanese Business Federation has a history of lobbying “negatively on many strands of climate change regulation in Japan” and remains “oppositional towards regulated carbon taxes and the phaseout of thermal power”. It also actively advocates investing in LNG and fossil fuel-based technologies like hydrogen and ammonia co-firing.

The CEO of JERA has previously described the process of supporting the economic growth of the region with intermittent renewable sources as “hard” and urged the need to use gas as a transitional fuel. The CEO of Mitsubishi Heavy Industries branded a renewables-led transition in Asia as “unrealistic”.

The Alaska project’s substantial price tag and complexity raise questions about the fuel’s competitiveness in the international market at a time when renewables can reduce and stabilise power prices in the country, improve domestic energy security and unlock previously overlooked economic opportunities. According to Wood Mackenzie, the average levelised cost of electricity (LCOE) for new renewable energy projects across APAC is already competitive or lower than that of gas projects. Furthermore, the former is continuously dropping, while the latter have increased in recent years. Even traditionally costly projects like offshore wind will become cheaper than gas power in Japan by 2027. For reference, the earliest the Alaskan LNG project could come online, as per initial estimates, is 2031.

Susanne Wong, Asia program manager of Oil Change International, warned, “Financing U.S. LNG poses serious risks for Japanese investors.” The expert also expressed concerns that the deal wasn’t about energy security but “enriching fossil fuel billionaires at the expense of frontline communities and our climate”.

Sharon Wilson, founder of Oilfield Witness, who has been documenting the invisible pollution from the oil and gas facilities for many years, addressed the Japanese prime minister, saying that her analysis of Japanese LNG import facilities showed they emitted “alarming amounts of methane.” Wilson also said Ishida was lied to about LNG being a viable transition fuel.

Japan’s decision also risks influencing other Asian countries, such as South Korea, to follow suit. Local policymakers are already discussing increasing LNG imports from the US as a means to avoid tariffs, as Bloomberg notes.

Southeast Asia At Risk of Being a Dumping Ground For Japan’s Highly Priced LNG

According to the IEEFA, Japan’s LNG demand has continuously declined, falling over 20 million tonnes since 2014. The main reason was the gradual restarting of 12 nuclear reactors and the increasing deployment of renewable energy.

This has prompted Japan to increase the sales of LNG to third-party countries, mainly across Southeast Asia. In fact, the IEEFA says that in FY2023, 37% of the LNG volumes handled by Japanese companies were resold overseas rather than consumed domestically, up from 16% five years ago. Still, Japanese companies have continued to commit to additional LNG contracts despite declining domestic demand, with the apparent intent to profit from selling the gas to Southeast Asian countries. However, this hasn’t been the case for importing nations since renewables are already the cheapest source of new power in countries comprising two-thirds of the global population and responsible for 90% of electricity generation, including much of Southeast Asia.

According to Hiroki Osada, a campaigner at Friends of the Earth Japan, although Japan’s government says that LNG will strengthen energy security, in reality, the government is exporting it to other countries. “The volume of reselling is actually more than the biggest LNG exporter, Australia,” the expert notes.

After the Trump-Ishida meeting, Japanese companies may be willing to buy additional cargoes of US LNG, but their final destination is unlikely to be Japan. Under the Green Transformation Strategy (GX) and the Asia Zero Emissions Community (AZEC), the Japanese government and companies have been heavily developing the LNG market across Asia, investing in import terminals, power plants and pipelines. Research by Market Forces reveals that Japanese trading houses plan to build 8.6 times more gas power than solar and wind combined in South and Southeast Asia, undermining the region’s energy transition.

Furthermore, in some countries, including Bangladesh, the Philippines, Thailand and Vietnam, the Japanese government has heavily influenced domestic energy policies to ensure gas and LNG, and not renewables, remain the priority. As previously reported, these strategies risk worsening existing problems in Southeast Asian countries, including further slowing down economies’ decarbonisation, fueling the climate crisis, worsening the already bad air quality and associated adverse health impacts and elevating energy security and economic risks.

Reconsidering LNG Import Plans Crucial For Japan

While Japan’s decision to increase US LNG imports might help it avoid or at least delay falling under Trump’s tariff regime and shrink the trade deficit, it is neither backed by solid economic reasoning nor moves the needle on energy security.

First, the credibility of Japan’s claims that gas equals energy security already began eroding when former US President Joe Biden halted LNG exports from new projects last year, forcing Japan to explore alternatives.

Despite Japan’s attempt to resell LNG to Southeast Asia, countries in the region have already experienced the benefits of the continuously decreasing costs of renewables. Therefore, for these nations, the idea of LNG as a cheap, clean and secure energy source is quickly diminishing – a trend evident in their increasingly ambitious climate and energy plans.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more