LNG in Asia: A Threat to Financial Stability

07 January 2022 – by Viktor Tachev

LNG in Asia is already a huge market. Several countries aim to pursue fossil fuel for energy purposes well into the future. Yet, such a strategy will leave countries in the Asia Pacific region with a fleet of financially unviable LNG infrastructure. Asian countries need to rethink their strategy and chase more sustainable and economically wise pathways because of incompatibility of liquefied natural gas with a global net-zero transition.

Proposed LNG Projects in Asia: A Threat to Macroeconomic and Financial Stability

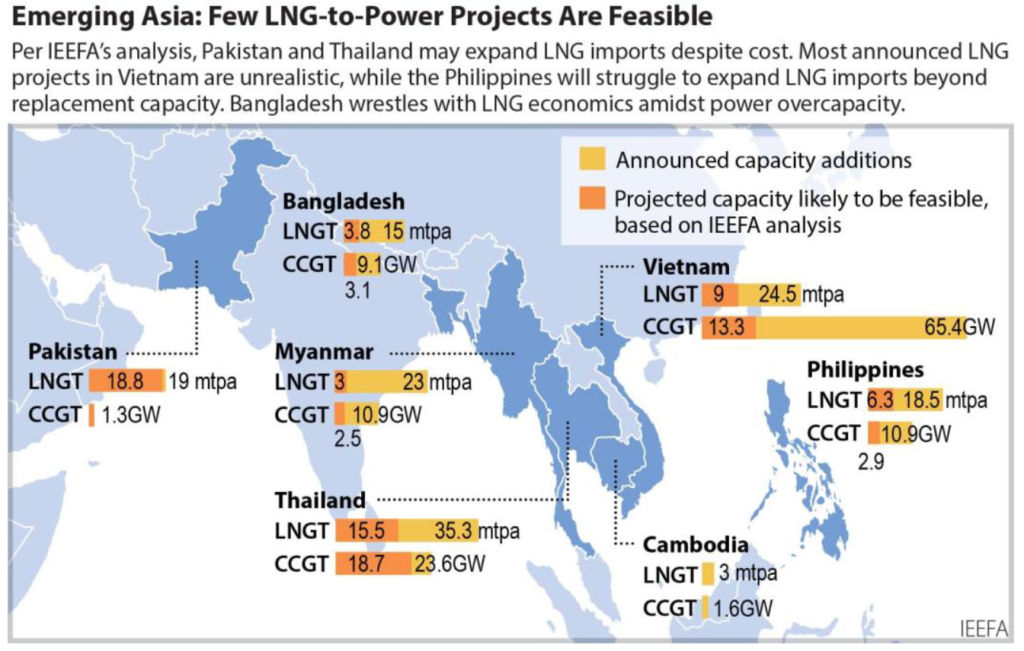

In December 2021, the Institute for Energy Economics and Financial Analysis (IEEFA) published an in-depth analysis of the proposed LNG pipeline in seven emerging markets in Asia. The report found that only a tiny fraction of LNG-related infrastructure in the observed countries would be viable, with 62% of proposed LNG import terminals and 66% of gas-fired power capacity being at risk of not being built.

In short, IEEFA suggested that fundamental project, country-level, and financial market constraints lead to such a scenario.

Consequently, even the LNG projects that stand a chance of being operational will also face challenges. They will still have to navigate each country’s unique markets and financial and regulatory risks.

The Financial Risks of the Unrealistic LNG Pipeline Plans

Limited Access to Capital for Project Development

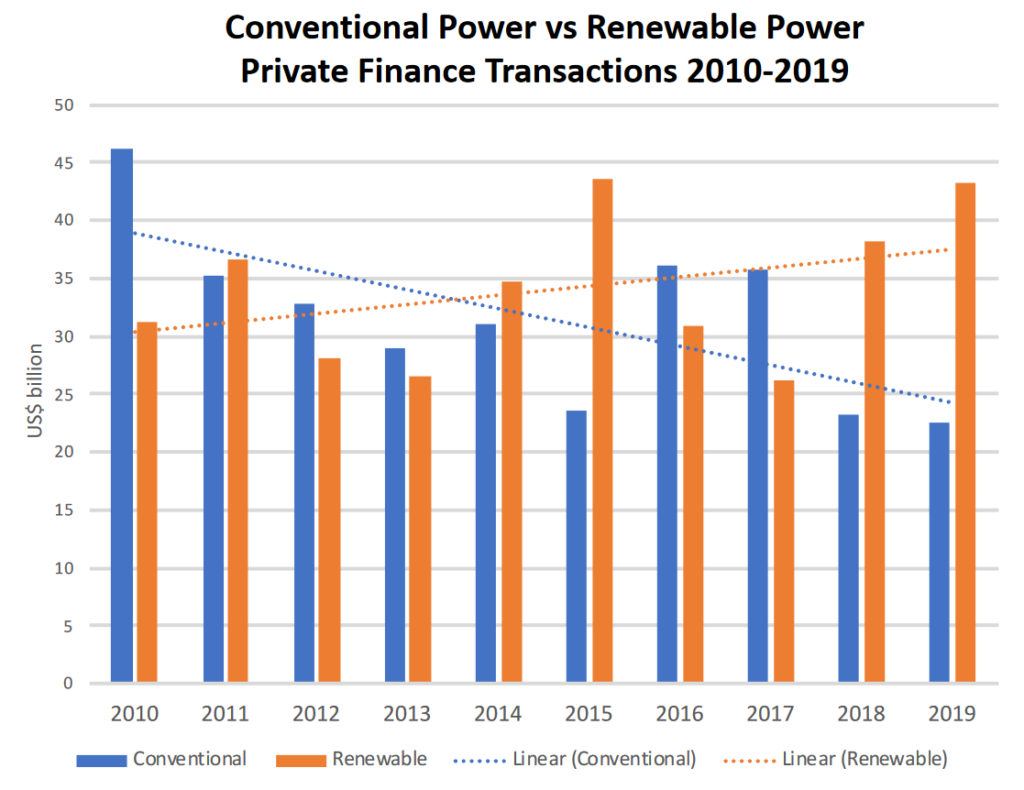

One of the biggest challenges for countries and LNG project developers is ensuring essential capital. Some key reasons include credit risks and the fundamental lending capacity of the project finance market. The IEEFA report clarifies that multilateral development banks (MDBs) and bilateral development institutions (BDIs) will not always come to the rescue. In other words, both are under pressure to stick to carbon emission reduction goals and are shunning fossil fuels.

As a result, BDIs will look to back their home country investors and industries when entering foreign markets. MDBs, on the other hand, might provide no more than 25% of the per-project lending requirements.

Importantly, the IEEFA report states that due to the absence of sovereign guarantees or risk insurance, commercial banks may hit lending limits in emerging Asian economies.

Volatility in Asian Spot LNG Prices, Inflation and Stranded Asset Risks

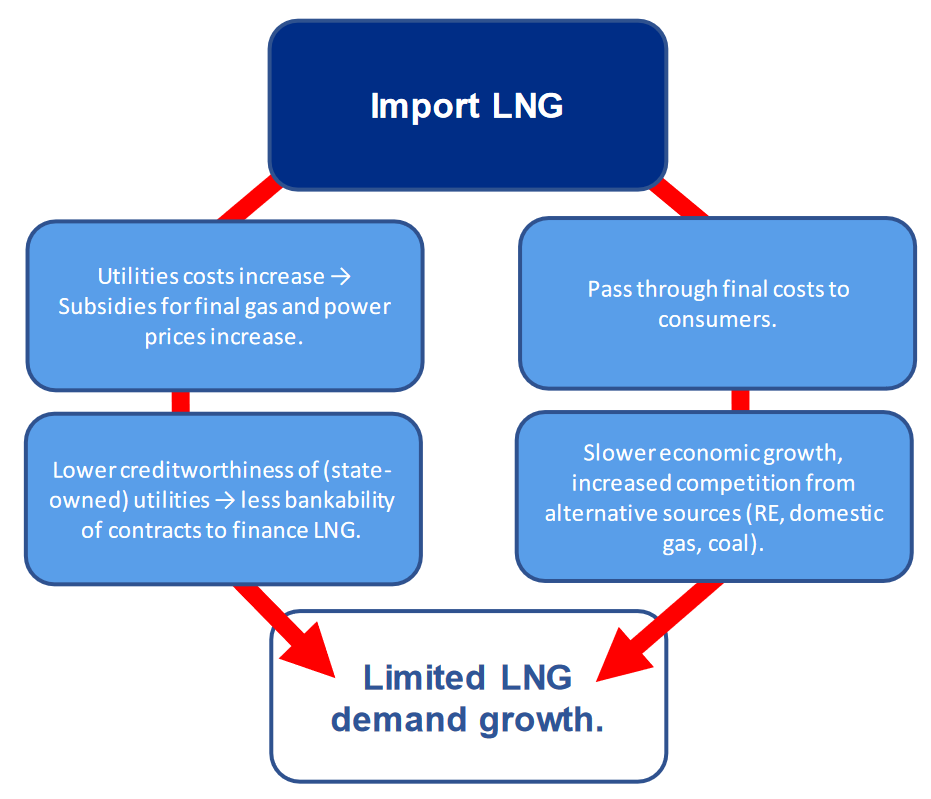

The growing dependence on US dollar-denominated LNG imports exposes consumer prices to macroeconomic impacts, mostly felt through inflation. For example, the last two years proved why LNG spot market prices in Asia and Northeast Asia are unpredictable. Prices hit all-time lows, immediately followed by record highs several times. This, in an earlier Energy Tracker Asia analysis, examined how the 1,000% leap in gas prices between April 2020 and January 2021 put USD 50 billion worth of projects in Bangladesh, Pakistan and Vietnam at risk.

Furthermore, emerging markets reliant on LNG imports face fuel supply insecurity and gas shortages. This is especially important for countries across Europe and Asia. Currently, both markets account for 94% of global natural gas imports and a third of global gas consumption.

But the inherent volatility of global gas markets isn’t the only issue. IEEFA singles out several other threats to the financial stability of energy industries in Asia’s emerging markets. These include higher power tariffs for end-users, higher government subsidy burdens and stranded asset risk for LNG-to-power investments.

Non-Financial Risks of Relying on LNG as a Bridge Fuel

Prices and market volatility aside, natural gas also brings environmental and health concerns. These include increased methane emissions and leaks and negative impacts on water, soil and wildlife.

“Energy sector planners in emerging Asia face an unenviable multitude of competing goals, including national energy security, affordability, self-sufficiency, and environmental sustainability. The reality is that LNG does not contribute to any of these goals, despite the LNG industry’s insistence that imported gas is a be-all-end-all solution.”

Sam Reynolds, Energy Finance Analyst, IEEFA

Why the Obsession with LNG in an Era of Renewables?

The gas industry has continuously spread the idea that the global coal-to-clean transition will fail without a “bridge fuel”. The industry argues that liquefied natural gas can serve as a backup to ensure renewable energy’s reliability. However, the LNG continuously failed to defend that much-proclaimed stability over the past two years.

The supply-demand disparities, price fluctuations, energy dependency risks and environmental concerns have reminded us that natural gas isn’t the future, especially in a net-zero world. Subsequently, as the IEEFA’s report makes clear, many proposed LNG plans may never materialise. This does not bode well for emerging economies betting on LNG in Asia, with the only clear way forward being that of renewables.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more