Renewable Energy Credits (RECs): How Do they Work?

Source: Morningstar

13 March 2025 – by Eric Koons

Renewable energy credits (RECs) are gaining traction as an instrument to encourage and validate green power generation. Corporations and governments alike see renewable energy certificates as a practical strategy for meeting climate targets, driving robust growth in REC trading across many regions.

Asia, in particular, is seeing increasing demand for energy and a stronger focus on sustainability, which have fueled a rapidly growing REC market. According to the International Energy Agency (IEA), Asia is at the forefront of global renewable capacity additions. This trend positions RECs as a powerful tool for corporations seeking to reduce their carbon footprints and capitalise on the region’s many opportunities to facilitate its energy transition.

For financial and decision-makers, investing in RECs presents a timely opportunity to address environmental impacts, respond to investor pressures and stay competitive in a marketplace that increasingly values green credentials.

What Are Renewable Energy Credits?

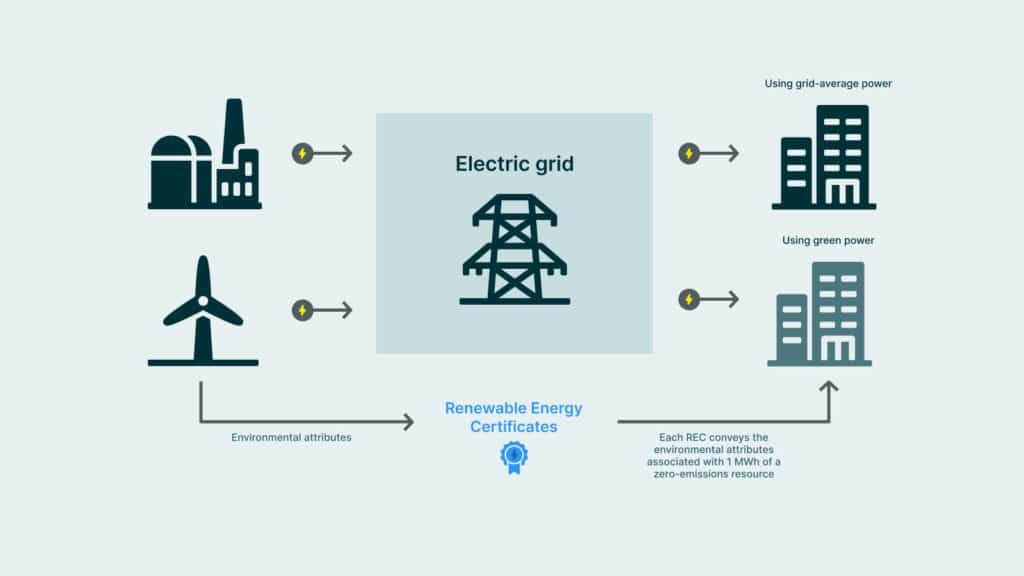

A renewable energy credit (REC), also known as a renewable energy certificate, is a tradeable instrument that verifies the production of 1 megawatt-hour (MWh) of electricity from renewable sources. Globally, these credits may have different names and regulatory frameworks, but they fundamentally serve to certify the origin of renewable electricity.

In Asia, numerous countries have developed or modified REC systems, each adhering to its own regulatory standards. For instance, Japan has more than four types of credits based on renewable energy sources, whereas India operates a renewable energy certificate mechanism that is regulated at the national level.

RECs help standardise the documentation and trading of clean energy worldwide. This standardisation facilitates organisations’ investment in greener energy portfolios across different countries and incentivises renewable energy production.

How Do Renewable Energy Credits Work?

RECs function by separating the environmental attributes of green electricity from the actual physical power. When a renewable energy facility generates 1 MWh of electricity, it creates one REC. That REC can be sold on a market or through a broker. The company purchasing the REC claims that quantity of renewable energy, offsetting any fossil fuel energy they already use. This allows companies anywhere to support renewable energy generation and enhance the efficiency of the renewable energy market and is particularly valuable in areas with limited on-site clean energy options.

Meeting Greenhouse Gas Emissions Targets

Consequently, many multinational corporations rely on RECs to meet greenhouse gas emission, renewable energy and ESG targets. RECs help organisations demonstrate to investors and stakeholders that a portion, or all, of their electricity usage stems from certified renewable sources from the electricity grid without installing solar panels or other renewable energy systems at their places.

How To Buy Renewable Energy Credits

Businesses typically buy renewable energy credits through brokers, dedicated exchanges or directly from renewable energy developers. In many countries, specialised platforms may cater to domestic markets, but international brokers often provide RECs from multiple regions for corporations with global footprints. This flexibility allows companies of all sizes to find solutions that align with their sustainability budgets and timelines.

Due Diligence & Quality

When purchasing renewable energy credits, due diligence is essential. Verifying the “vintage” (the year of issuance), location, and renewable source type (like solar, wind or biomass) ensures that a company’s REC strategy aligns with its ESG objectives. For instance, a firm striving to support wind power can specify wind RECs from a particular region. Quality certifications and tracking by reputable third parties minimise the risk of double-counting and protect the integrity of sustainability claims.

Renewable Energy Credit Price

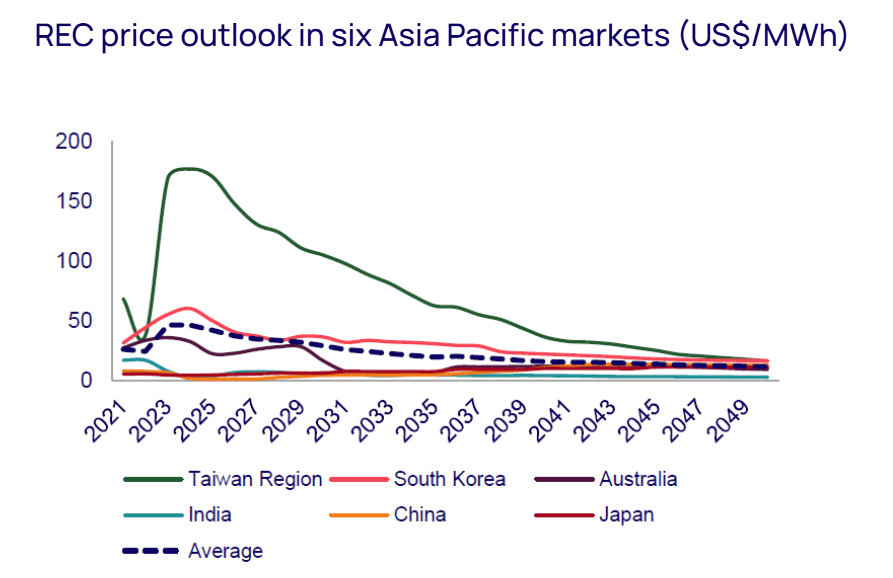

REC prices vary based on supply-demand dynamics, policy incentives and the maturity of a country’s renewable infrastructure. For instance, renewable energy credits prices may increase in markets with strict renewable portfolio standards or fewer renewable power installations. Looking at Asia, REC prices are at record highs, yet as more renewable energy comes online in the coming decades, prices will likely fall.

While rising costs can pose short-term challenges, many companies consider REC purchases a strategic investment. They help protect brand reputation and hedge against the risk of stricter climate regulations that could impose future penalties on carbon-intensive operations.

The Value of These Credits For Renewable Energy Market and Climate Change

Ultimately, renewable energy credits are a vital mechanism for scaling clean energy adoption, even for organisations not directly connected to renewable installations. RECs help companies meet their sustainability goals and align with emerging regulatory demands while providing additional cash flow for renewable energy developers. These incentives for both users and developers creates a feedback loop that drives up renewable energy supply and demand.

With Asia at the forefront of economic expansion and responsible for a large share of the world’s emissions, the region’s embrace of RECs can make a substantial difference in its energy transition. The Asian Development Bank (ADB) estimates that an additional USD 1.7 trillion in annual financing is needed in Asia to fully meet sustainable development objectives.

As interest in renewable energy credits continues to surge across Asia, organisations that seize this opportunity will be better positioned to thrive in a rapidly evolving global marketplace.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more