Renewable Energy Financing: An Alternative to Financing Coal

Fossil fuel assets are likely to become strongly devalued. Credit: Monty Rakusen/ Getty Images

29 April 2021 – by Eric Koons

Acid rain, smog, reduced agricultural yields, respiratory diseases, mining accidents and other human health-related impacts. These are all disadvantages of coal energy and why financing renewable energy projects is the solution for the future. While coal appears to be a relatively cheap fuel, it is estimated to have caused €360 Billion in global damages in 2007 alone.

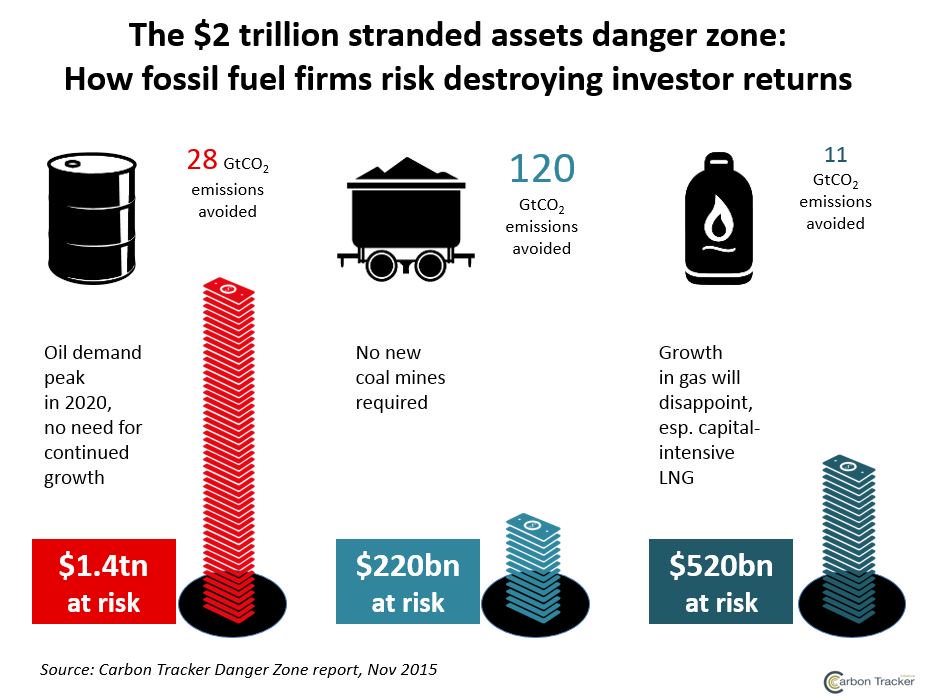

To avoid further significant climate change-related impacts, a 2019 IPCC report recommended that coal should be globally phased-out by 2037 in the energy industry. Coal is currently not being phased-out fast enough, despite a 75% reduction in new coal power (2015-2019) and market and policy changes making coal assets vulnerable. This all indicates that future coal-related investments will inevitably start to produce diminishing returns and will become increasingly risky. As coal projects become increasing investment risks, financing renewable energy projects becomes more secure.

Coal Trends in Asian countries

As Asia accounts for the majority of the world’s coal-fired power production and planned coal-fired power projects, it has the highest risk of stranded assets. The top 3 countries with the largest shares of total coal-fired power production (operating-MW) are China (49.1%), United States (12%) and India (11.2%). And countries accounting for the majority of planned coal-fired power projects are Asian: China (41.2%), India (13.2%), Indonesia (6.3%), Vietnam (6.2%), Bangladesh (4.6%) and Japan (2.4%).

Financial Institutions Moving Away from Coal

The funding for the majority of these Asian coal-fired power projects have historically been provided by various financing institutions in Japan, South Korea and China. However, multiple Japanese and South Korean financing institutions have recently added to coal’s risky future by announcing plans to significantly reduce and eliminate coal financing. As an alternative they will look towards renewable energy investment & financing.

Japanese Financiers Realizing the Disadvantages of Coal

In Japan, the Japan Bank of International Cooperation and Mizuho Financial Group are two examples of groups announcing reductions in coal-related underwriting and investing. The reasons behind these energy industry announcements mostly relates to the disadvantages of coal and future risks associated with coal-related projects and emerging trends. This will reduce coal use in the future, replacing it with renewable energy technologies. Moreover, civil society, investors, project developers and shareholders are increasingly voicing their concerns and voting against investments into coal-related projects as seen by the recent “No Coal Japan” campaign calling out to government and corporate leaders to end support for coal. By incorporating these factors into strategic and risk mitigation decision-making, these institutions are now reducing their overall financial, reputational and environmental risks.

Singaporean Investors Stop Coal Investments

Numerous other coal-financing groups throughout Asia are also taking similar steps to those previously discussed in Japan. In Singapore, DBS Group Holdings, Oversea-Chinese Banking Corp. and United Overseas Bank have announced they will cease financing new coal power-related projects.

Malaysia Banks Set Deadline to End Coal Funding

In Malaysia, the CIMB also announced it would end funding for new coal mines and coal-fired power stations as of 2021. These examples highlight how financial institutions and countries in Asia are also reducing their risks associated with coal-related investments (e.g.: stranded assets, financial, reputational, environmental, emerging technologies, social) and focusing on renewable energy investment..

Renewable Energy Financing is the Future

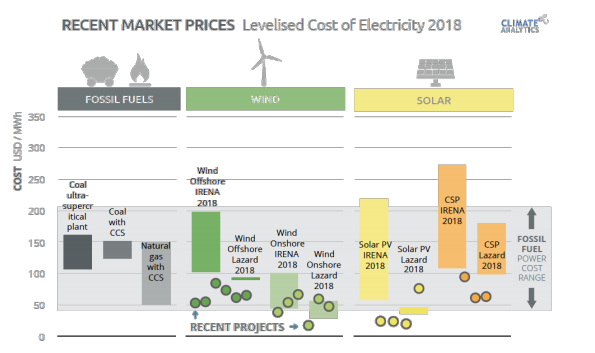

With the UN’s IPCC stating that global coal needs to be phased-out by 2040 at the latest, this creates poor future investment opportunities for coal. Especially in the context of the wide-spread environmental and social impacts associated with coal power and the rapidly decreasing costs of renewable energy technologies. Moreover, the recent actions taken by financial institutions in reducing coal-related financing also supports the notion that coal has a poor and risky investment future. Which will ultimately free up more capital to finance renewable energy projects. These opportunities represent more financially viable, environmentally-friendly and socially acceptable ways to produce energy.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more