Charting the Path Of Solar Energy in Mexico

Source: The Jakarta Post

07 August 2025 – by Eric Koons

Solar energy in Mexico now sits at approximately 12 GW and supplies about 7.6% of the nation’s electricity. This growth of solar energy in Mexico underscores a quiet revolution transforming Mexico’s energy landscape. President Claudia Sheinbaum aims to continue this energy transition to achieve a 45% renewable power grid by 2030. However, despite these strides, significant challenges remain, raising critical questions about the achievability of this target. Investing in renewable energy sources is critical to maximising energy efficiency, curtailing greenhouse gas emissions, and encouraging sustainable development.

Solar Power in Mexico: Market Snapshot

Annual additions keep breaking records. Another 1.1 GW came online in 2024, lifting cumulative solar capacity (including utility and distributed generation) to the 11-12 GW range. Solar’s share of total energy consumption continues to rise with the third-highest absolute capacity in Latin America after Brazil and Chile.

Cheapest Source of Power Generation

Furthermore, utility-scale solar projects now deliver electricity at impressively low costs, under USD 0.049 per kWh, making solar Mexico’s cheapest source of power generation.

What Is Mexico’s Main Source of Energy?

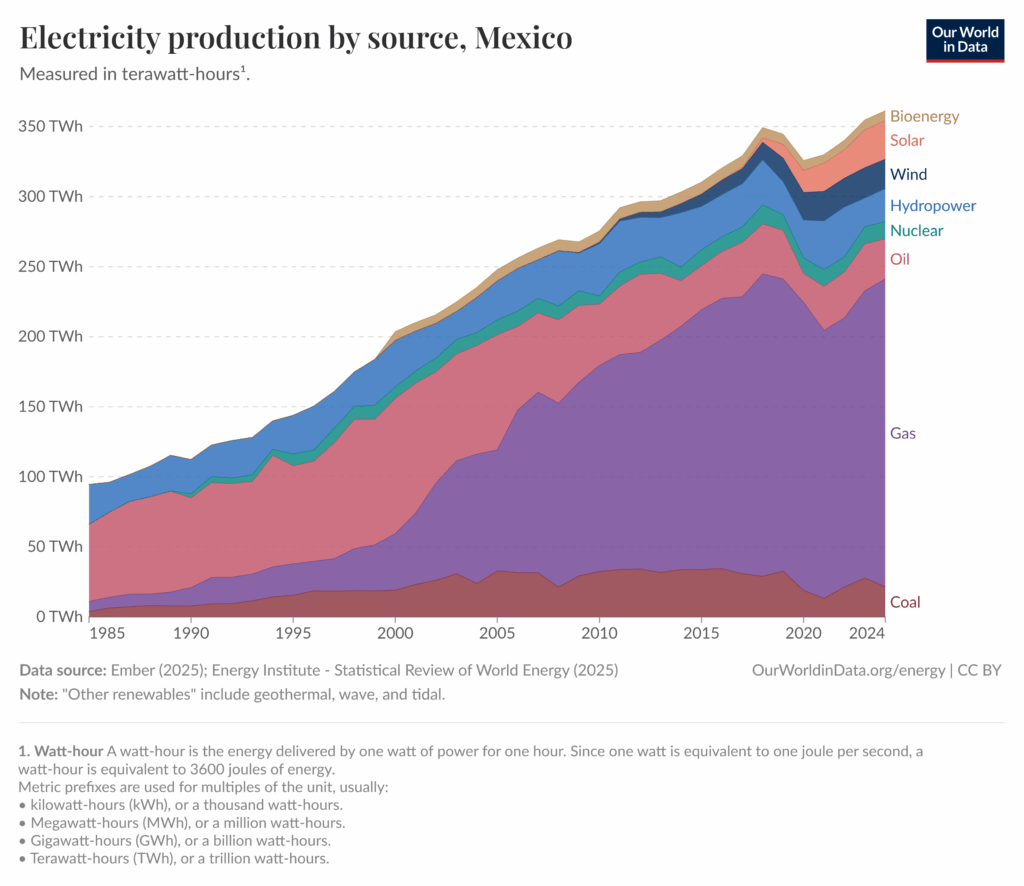

Mexico’s main source of energy is fossil fuels, particularly natural gas. Despite solar’s expansion and low costs, Mexico’s energy sector remains heavily reliant on fossil fuels. Fossil fuels account for over 90% of the country’s total energy consumption. Looking at just electricity, fossil fuels still account for over 70% of the country’s total electricity consumption, with 61% of that coming from natural gas. The vast majority of this is imported via US pipelines, making it open to volatile import pricing and uncertain trade relations.

From Rooftops to Desert Megaprojects: How Solar Is Deployed

Taken together, distributed generation now accounts for roughly 4.42 GW, about 37% of Mexico’s 12 GW solar fleet, while utility-scale plants supply the remaining 7.6 GW.

Distributed Generation

Behind-the-meter solar is exploding. Distributed generation increased by 1.09 GW in 2024, representing a 35% rise compared to 2023. More than 518,000 net-billing contracts are active, with the vast majority in the 1-10 kW range. This suggests that small-scale residential installations are leading the charge.

Utility-scale Solar, Storage and the Electricity Sector

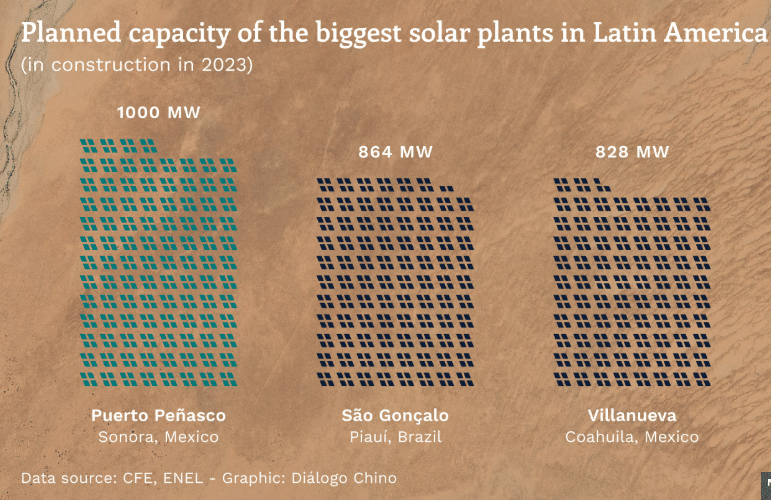

On the bigger front, the 828 MW Villanueva Solar Plant in Coahuila remains one of the world’s largest single PV projects. Furthermore, new, even larger projects are underway. The state utility CFE is currently constructing a 1 GW solar and 190 MW battery hybrid project in Sonora, with full operation scheduled for 2028. However, grid bottlenecks are already forcing curtailments, highlighting the need for grid infrastructure investment to meet the growing renewable capacity.

Policy and Renewable Energy Targets

Legislative initiatives drive Mexico’s renewable energy trajectory. This is primarily through the 2012 General Law on Climate Change, which initially set a goal of achieving 35% clean energy by 2024. Sheinbaum’s administration has since heightened ambitions, targeting 45% renewable electricity by 2030. To support this goal, Mexico introduced updated public-private partnership rules, allowing private sector entities to hold up to a 46% stake in new renewable energy development projects. Furthermore, Mexico will invest USD 23.4 billion in its energy infrastructure through 2030.

Energy Storage Mandate and Installed Solar Capacity

Another critical policy milestone is Mexico’s 2025 grid code update. It mandates that every new solar or wind installation integrates battery energy storage systems equating to at least 30% of their installed capacity. Furthermore, with declining battery storage costs, Mexico expects to add 2.2 GW of storage by 2030 to support grid stability and accommodate renewable energy growth.

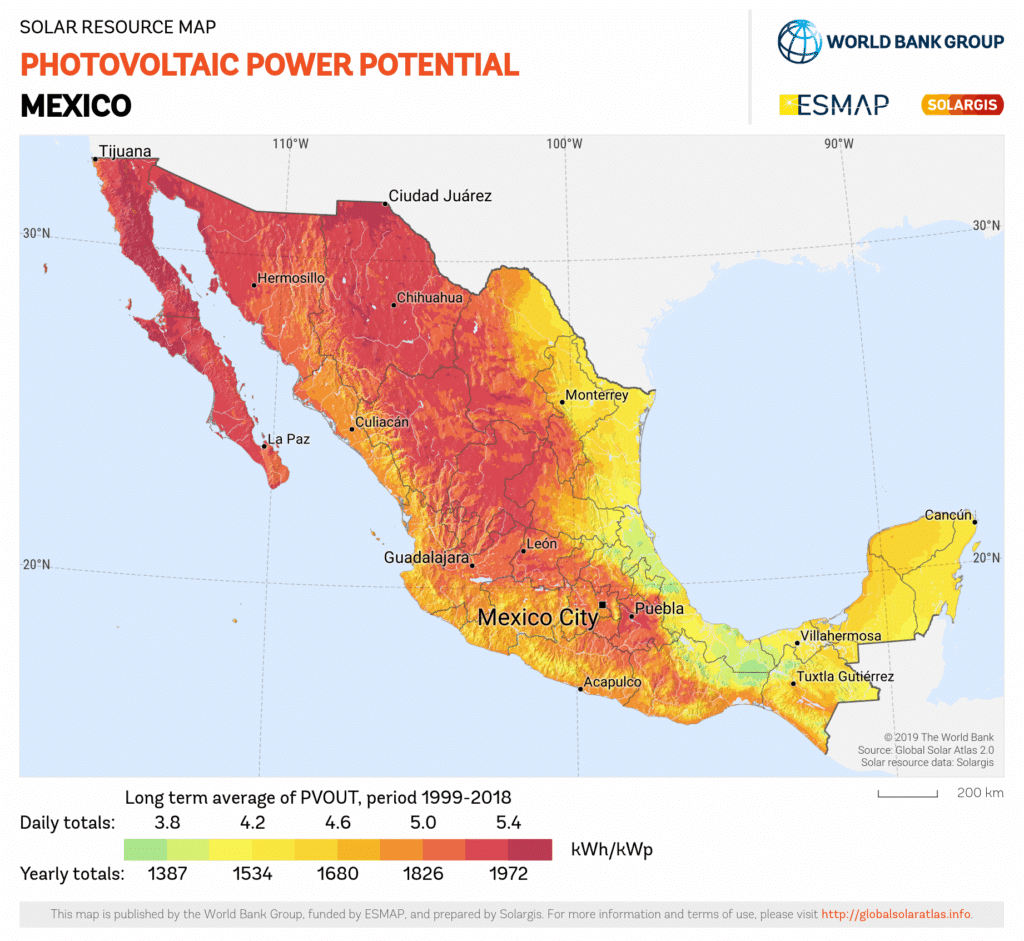

Resource Potential and Solar Panels in Mexico

Solar power in Mexico will be critical to reaching Mexico’s renewable energy goals. The country receives exceptional solar irradiation, with around 70% of its territory receiving more than 4.5 kWh/kWp a day. Areas like Chihuahua, the Sonora Desert and the high-altitude Central Plateau regularly yield above 2,200 kWh/kWp annually.

Complementing this resource advantage, Mexico’s domestic solar panel manufacturing capacity has surged to approximately 1.5 GW per year, positioning the country to ship its solar panels overseas.

Challenges and Enablers for Mexico’s Energy Transition

Regulation remains the wild card. A February 2025 reform that prioritises state-utility CFE and reserves at least 54% of dispatch for it has unnerved private players. Even though it keeps the door open to joint ventures, every permit still requires clearance from the energy regulator, CRE. The chill is visible: Iberdrola is selling nearly USD 4.7 billion in remaining Mexican wind and solar plants after a USD 6 billion divestiture last year, citing legal and tax uncertainty.

Grid stress is the second hurdle. During a May 2024 heatwave, the National Energy Control Center logged a record 51.6 GW of demand, warning that years of underinvestment in transmission had left the system prone to blackouts. Sheinbaum’s USD 23.4 billion energy program allocates USD 7.5 billion specifically for new transmission lines. However, industrial park developers in the north are already covering the cost of private spurs because federal funding can’t keep up with the growth.

Financing is the final piece. Even after multiple rate cuts, interest rates still remain at 8%, which raises project finance hurdles.

Solar Energy in Mexico’s Potential

Solar Energy in Mexico is scaling rapidly, from residential rooftops to gigawatt utility-scale hybrids. However, solar still contributes under 8% of the country’s electricity needs. Achieving the 45% renewable target by 2030 will require overcoming infrastructure bottlenecks, investing in solar energy technologies, rigorous enforcement of the new storage mandates and clear regulatory frameworks to sustain investor trust.

With its exceptional solar resource and declining technology costs, solar power is poised to lead Mexico’s broader transition toward a resilient, low-carbon energy future, provided that regulatory clarity and investment continue to align.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more