South Korea Scrapping Mega-scale LNG Terminal Projects Amid Weakening Demand and Overinvestment Risks

Photo: Shutterstock / Ievgenii Bakhvalov

12 August 2024 – by Michelle (Chaewon) Kim

Key Findings

- Since early 2024, at least four liquefied natural gas (LNG) terminal projects with a combined regasification capacity of 11 million tonnes per annum (MTPA) have been delayed or cancelled due to a lack of economic benefits and rising construction costs.

- There is a widening gap between LNG import infrastructure and demand, given the South Korean government’s climate targets projected that LNG-fired power generation would fall from 26.8% in 2023 to 11.1% by 2038.

- Over the next decade, natural gas demand in the country’s power generation is estimated to decrease from 22.89 MTPA in 2023 to 11.09 MTPA in 2036, at an average annual decline of 5.4%.

- The role of LNG in South Korea’s power mix is expected to diminish further with accelerated net-zero targets. At COP28, South Korea-backed pledges to triple global renewable energy capacity by 2030.

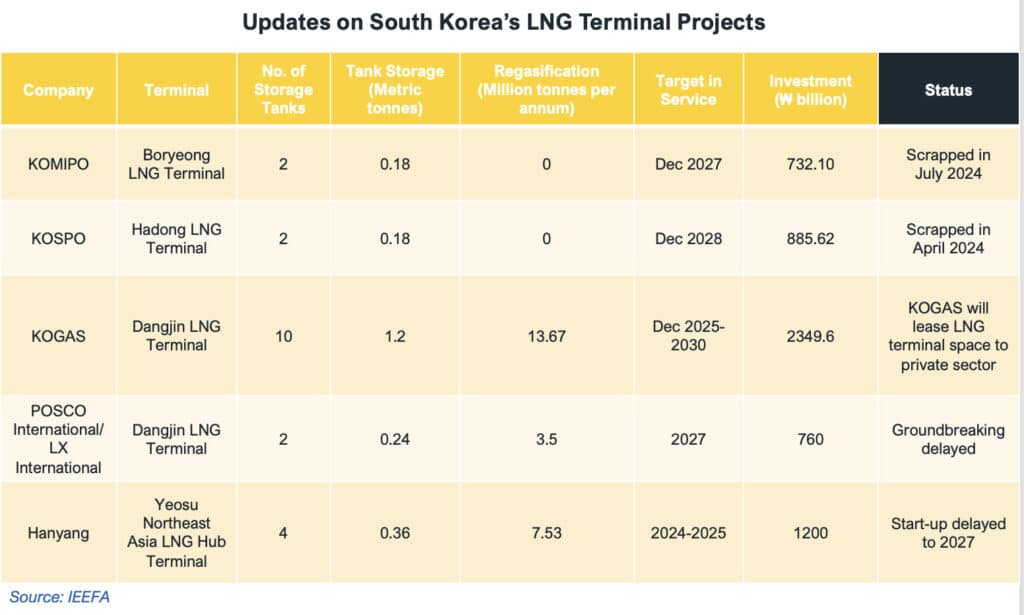

A growing number of South Korea’s mega-scale liquefied natural gas (LNG) receiving terminal projects have been scrapped amid weakening LNG demand and looming overinvestment risks. Since early 2024, at least four LNG terminal projects with a combined regasification capacity of 11 million tonnes per annum (MTPA) have been delayed or cancelled due to a lack of economic benefits and rising construction costs. These cancelled or delayed projects account for about 29% of the total proposed import capacity in the country.

In November 2023, a report published by the Institute for Energy Economics and Financial Analysis (IEEFA) highlighted that the rapid growth of proposed LNG import terminals by state-owned firms and the private sector presented a high risk of overinvestment.

IEEFA estimated that by 2031, South Korea’s 11 proposed LNG terminals could cost about ₩11.3 trillion (US$8.7 billion). These terminals would account for roughly 37 MTPA of regasification capacity, increasing national capacity from 153 MTPA to 190 MTPA.

IEEFA’s analysis showed a widening gap between LNG import infrastructure and demand, given the South Korean government’s climate targets projected that the share of LNG-fired power generation would fall to 11.1% by 2038, from 26.8% in 2023. Based on IEEFA’s calculations, the utilization of regasification facilities, already one of the lowest in the world, would fall to 19.78% in 2036 from 29.48% in 2023.

Several notable delays to LNG projects have occurred over the last nine months since the IEEFA report was published.

In January 2024, Korea Gas Corporation (KOGAS) announced that it would increase the utilization of KOGAS-owned facilities with the private sector to improve LNG infrastructure usage efficiency and reduce redundant investment. In April 2024, KOGAS announced it would lease the new Dangjin LNG terminal space to the private sector, receiving terminal user bidding from direct LNG importers.

In April 2024, Korea Southern Power (KOSPO) cancelled its Hadong 180,000 metric tonnes (mt) LNG terminal storage tank buildout project, which was due to start in 2028, because of a lack of economic benefits.

Most recently, in July 2024, Korea Midland Power (KOMIPO) scrapped its Boryeong LNG terminal buildout plan, scheduled for 2027, after reworking the feasibility study due to rising costs and declining demand.

IEEFA highlights that KOMIPO’s 180,000mt LNG terminal tank storage buildout plan in Boryeong by 2027, with investments worth ₩732.1 billion, is exposed to stranded asset risks due to overlapping with the existing Boryeong LNG Terminal jointly operated by GS Energy and SK E&S nearby.

Declining Demand Will Reduce the Need for LNG

South Korea’s LNG imports declined 4.9% in 2023, as high and volatile LNG prices placed downward pressure on power and city gas demand amid increased nuclear and renewable power generation. Over the next decade, South Korea’s Ministry of Trade, Industry, and Energy (MOTIE) estimates that natural gas demand in power generation will decrease from 22.89 MTPA in 2023 to 11.09 MTPA in 2036 at an average annual decline of 5.4%.

The role of LNG in South Korea’s power mix is expected to diminish further with accelerated net-zero targets. At COP28, South Korea-backed pledges to triple global renewable energy capacity by 2030.

Nevertheless, South Korea still believes fossil fuels are needed to bolster national energy security. The Yoon Suk Yeol administration recently announced exploratory drilling of potentially significant oil and gas reserves in the East Sea, estimated to hold up to 14 billion barrels of oil and gas.

The government will launch the project, which costs around ₩500 billion (US$363 million), by the end of the year, with initial drilling results expected in the first half of 2025. However, as South Korea’s natural gas demand declines and decarbonisation efforts accelerate, these East Sea oil and gas developments could become stranded assets. Simultaneously, additional domestic gas production could further reduce the need for new LNG import capacity.

In the long term, a transition to clean energy will support national energy security and sustainability rather than an overreliance on fossil fuels and overinvestment in fossil fuel-based infrastructure.

About IEEFA

IEEFA is an independent think tank that examines issues related to energy markets, trends and policies.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Energy Tracker Asia.