Clean Energy Investment in 2024 Twice Amount for Fossil Fuels: IEA

16 July 2024 – by Viktor Tachev Comments (0)

Clean energy investment in 2024 will be twice the amount going to fossil fuels, according to IEA’s latest report. This marks a significant milestone, since clean energy spending managed to overtake the amount going to fossil fuels for the first time just a year ago. However, the agency also highlights major imbalances and shortfalls across markets, with clean energy investments in emerging and developing countries far behind those of developed nations and China. According to the IEA, ambitious policy support to stimulate clean energy deployment, de-risk project development and phase out fossil fuels can lure investors and help further scale the needed green financing for a 1.5°C-aligned world.

IEA: Clean Energy Investment to Reach USD 2 Trillion in 2024

The IEA’s World Energy Investment 2024 report concludes that clean energy investment is increasing at a record pace, despite higher financing costs hindering projects in emerging and developing markets. The agency estimates that spending on renewable energy technologies in 2024 is on course to reach USD 2 trillion. This is double what is going to coal, gas and oil.

“Clean energy investment is setting new records even in challenging economic conditions, highlighting the momentum behind the new global energy economy. For every dollar going to fossil fuels today, almost two dollars are invested in clean energy,” explains IEA’s Executive Director Fatih Birol.

The report notes that the clean energy investment will go to a range of technologies. Among them are renewables, electric vehicles, grids, storage, efficiency improvements and heat pumps, as well as nuclear power and low-emission fuels.

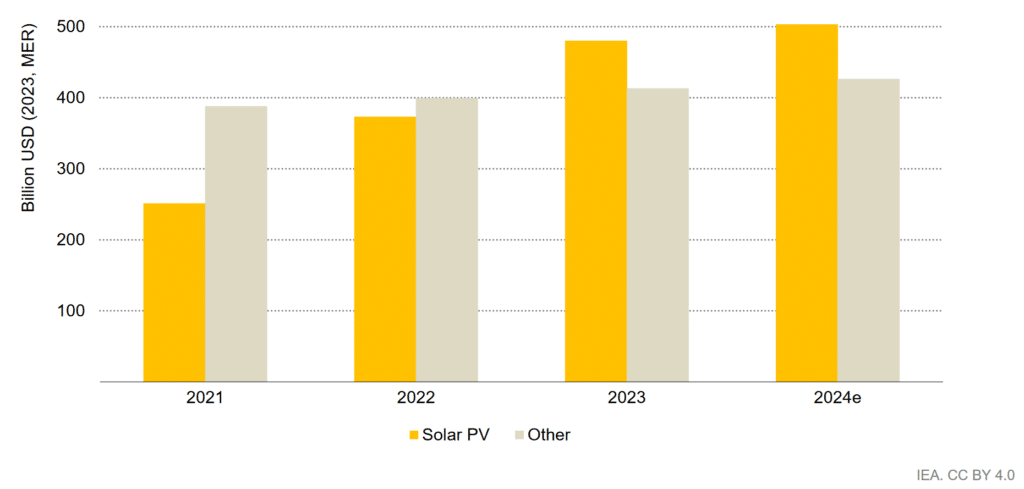

Remarkably, the report finds that more money is now going into solar PV than all other electricity generation technologies combined. In 2024, the investments in solar will potentially reach USD 500 billion. The main reason is the falling technology costs, the agency notes.

The momentum behind investments in grids and energy storage technologies will also accelerate. New policy initiatives across the leading markets will increase grid investments to USD 400 billion in 2024, up from the annual USD 300 billion spending seen since 2015. The falling costs of battery storage technology will also increase investments to over USD 50 billion in 2024. However, the spending will be highly concentrated in advanced economies and China.

A Big Spending Gap Between Markets

The IEA’s report warns that clean energy investment flows aren’t equally distributed, with major imbalances and shortfalls across markets evident. Emerging and developing countries besides China currently see the lowest level of clean energy financing. Although financing will top USD 300 billion for the first time, mainly due to India and Brazil, the figure represents just 15% of global clean energy investment. This is way below the levels needed to meet the rapidly increasing power demand across these markets. Furthermore, emerging and developing countries are struggling with higher capital costs, which hold new project development back, the agency warns.

“More must be done to ensure that investment reaches the places where it is needed most, in particular the developing economies where access to affordable, sustainable and secure energy is severely lacking today,” warns Executive Director Birol.

Battery storage spending perfectly exemplifies the issue. According to the IEA, for every dollar invested in battery storage in advanced economies and China, only one cent was invested in other emerging and developing economies.

Spotlight on Asia: China Leads, Southeast Asia Lags Behind

While Asia is making significant progress, no country besides China has reached the levels needed for clean energy spending in a net-zero-aligned world. In fact, Japan and Korea will need to double their clean energy spending by 2030 to meet COP28 targets. India must triple its green investments, while Southeast Asian nations must quadruple them.

Unlocking the needed capital requires backing the ambitious national targets and plans with supportive policies that will lure investors, assist project developers and accelerate the development of grids and clean energy supply chains.

China

China retains its crown as the undisputed leader in clean energy deployment and technology development.

Throughout 2023, China was responsible for a third of global clean energy investments. The country installed more solar panels in 2023 than any other nation has ever built in total. The wind power additions also marked significant growth of 66% year-over-year. In fact, there are reports that China is building more solar and wind power than its grid can accommodate.

Despite all the positives on the clean energy front, the IEA’s report notes that in 2023, China continued to approve new coal-fired plants due to energy security concerns.

China continued to demonstrate leadership in developing accompanying clean energy technologies, including solar cells, lithium batteries and EVs. The three industries saw a 30% increase in exports compared to the prior year, with the trend likely to extend to 2024.

China is set to account for the largest share of clean energy investment in 2024, topping USD 675 billion.

The IEA concludes that China’s energy investment levels are in line with the required amounts for meeting national energy and climate goals.

This year, the country announced a project for the world’s biggest solar farm. The 8 GW power plant will produce enough energy to meet the needs of 6 million households.

India

India continues to make substantial progress, with its clean energy investments growing notably due to ambitious policy support.

The IEA notes that energy demand growth in India is on track to outpace all other regions by 2050. As a result, the country can expect substantial stress on its energy system, which currently relies predominantly on fossil fuels.

In response to these expectations, the country has recently scaled up solar and wind power investments. The government also announced measures to promote domestic clean energy supply chains. It aims to make India a leader in producing solar modules, batteries and other clean energy technologies.

In 2023, clean energy investment in the country reached USD 68 billion, a 40% jump from the period between 2016 and 2020. For comparison, less than half of that, USD 33 billion, went to fossil fuels in 2023.

The IEA estimates that, under current policies, India’s clean energy investments will double by 2030. However, this won’t be sufficient to align with the national energy and climate goals, with the country needing 20% in additional growth. According to the IEA, achieving this target is possible. However, it would require addressing the factors leading to increased cost of capital for clean energy projects.

Japan and South Korea

The two most developed Asian countries have also made sufficient progress toward increasing their clean energy investments. The IEA finds that their current clean energy investment per dollar of fossil fuel spending is over five times the global average. The growth was increasingly evident between 2021 and 2023, when the average annual clean energy investment jumped 40% in Japan and 10% in South Korea compared to the 2016-2020 period.

Yet, the IEA warns that both countries must increase their clean energy investments by an additional 27% by 2030 to remain on course with their carbon neutrality targets by 2050.

Southeast Asia

Southeast Asia is about to undergo strong economic and population growth. As a result, it will experience a significant increase in energy demand in the years up to 2050. To meet this demand, the countries in the region have introduced ambitious clean energy and carbon neutrality targets. However, according to the IEA, the needed investments are currently lacking.

The agency estimates that Southeast Asia’s spending on clean energy accounts for just 2% of the global total. Throughout the past three years, the annual average investments were USD 72 billion. However, the region must increase this figure to over USD 130 billion by 2030 to achieve its long-term targets.

Crucial in scaling clean energy financing is introducing changes in power purchasing agreements to lure investors and address existing uncertainties around renewable energy generation remuneration to reduce risks and cost of capital. Furthermore, the agency stresses the importance of capitalising on international development financing mechanisms such as the Just Energy Transition Partnership programs of Indonesia and Vietnam for the mobilisation of capital for clean energy investments and supporting the phasing out of coal-fired power generation.

Huge Progress Since the Paris Agreement, But Not on Track with the COP28 Goals

The IEA’s report notes that when the Paris Agreement was signed in 2015, global investments in clean energy and nuclear power for electricity generation were twice the amount going to fossil fuel power generation. Fast forward to 2024, and the amount is now 10 times as much, with solar power the main focus.

However, investments in fossil fuels continue to increase. Over 50 GW of unabated coal-fired power was approved in 2023, the highest since the Paris Agreement. In 2023, oil and gas investments jumped 7%, with a similar figure expected for 2024 as well. According to the IEA, this increase is far higher than the trajectory required to meet national and global climate goals. More importantly, across 2023, oil and gas companies invested just 4% of their overall capital spending on clean energy.

According to the IEA, succeeding in the global net-zero journey requires a secure and affordable transition away from fossil fuels, underpinned by a major rebalancing of investments.

The agency notes that keeping 1.5 °C within reach requires a doubling of investments to triple renewables capacity, as well as a tripling of spending to double efficiency as per the COP28 targets.

While the IEA’s report reveals that today’s investment trends don’t align with the levels necessary for limiting global warming to 1.5°C and achieving the COP28 targets, it provides guidance on how to get there. It is now up to policy-makers and financiers to build on it.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more