The Economic Benefits of Renewable Energy For Asian Countries

Photo via ShutterStock

01 December 2022 – by Viktor Tachev Comments (0)

The fossil fuel price hikes hastening global inflation have again highlighted the economic benefits of renewable energy. At the same time, countries have many reasons to choose green growth – from low technology costs and cheaper electricity to price stability, reliable energy supplies and job creation.

The Continuously Decreasing Technology Costs

Scientists are clear: the more renewable energy infrastructure is installed, the lower the costs will get.

China is doubling its solar cell production capacity almost every year. Projections show it will continue doing so up until 2024, at least. These results and forecasts align with Swanson’s law, which states that the cost of PV cells falls by 20% with each doubling of global manufacturing capacity. As a result, the technology’s prices will continue decreasing, making clean energy infrastructure even more affordable. That is why renewables are expected to provide around 95% of the world’s new generating capacity.

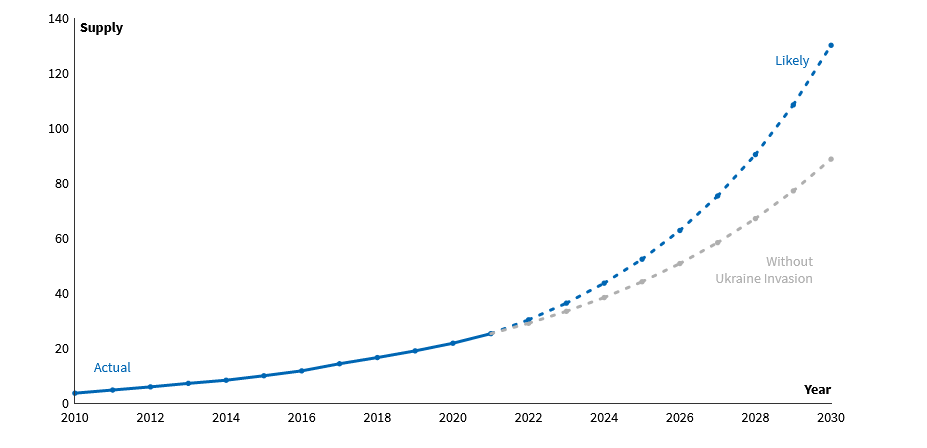

Russia’s invasion of Ukraine is another factor that will speed up renewables development and adoption. In fact, it has already sealed the fate of fossil fuels and accelerated clean energy investments. As a result, the solar and wind supply is now expected to grow even higher than the 15% to 20% average annual rates recorded throughout the last decade.

In many parts of Asia, including Japan, South Korea and Vietnam, new solar and onshore wind power units are either already or will become cheaper overall investments than new gas infrastructure by 2025. New solar power developments with battery storage capacity will be cost-competitive with existing gas plants in Japan and South Korea during the early 2030s.

Renewable Energy Electricity Prices Are Going Down

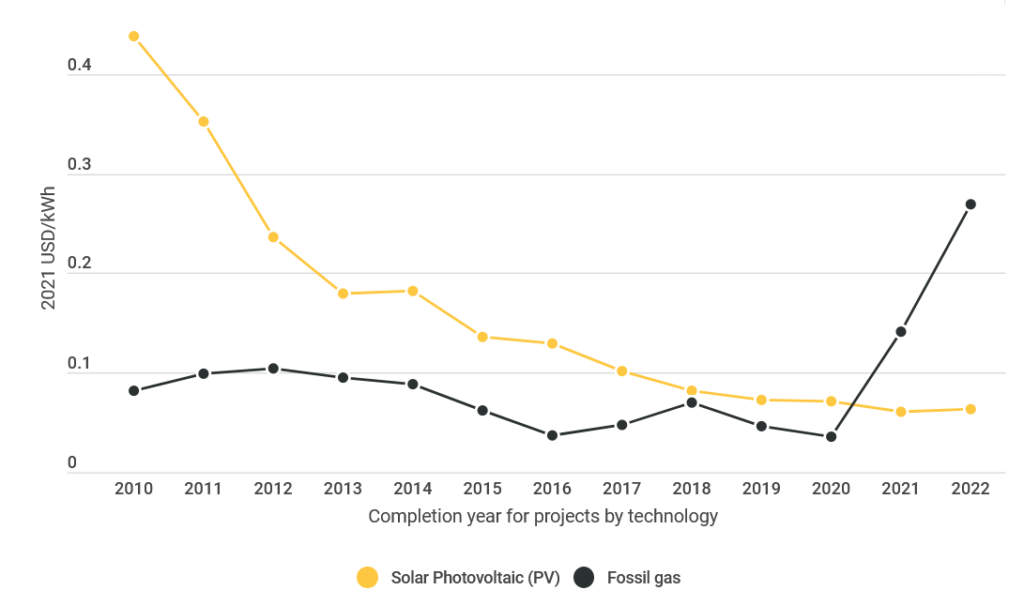

Even without subsidies, and before the recent fossil fuel price hike, renewable energy sources were cheaper than fossil fuels. Over the past decade, renewable electricity costs fell by up to 90%.

The trend continued in 2021 as well. According to IRENA, almost two-thirds of the renewable power added during the past year had lower costs than the cheapest coal-fired options in G20 countries. Furthermore, in 2020, the cost of electricity from onshore wind fell by 15%. Electricity from offshore wind and solar PV fell by 15% and 13%, respectively. In the wake of the recent fossil fuel price hike, the clean energy capacity added to the grid in 2021 is estimated to save around USD 55 billion from global energy generation costs in 2022.

Renewables are setting records for lower costs and new capacity development despite subsidy reductions. According to Bloomberg NEF, the inflation and rising materials costs didn’t impede the reduction of clean energy costs significantly. The levelised costs of electricity (LCOE) for utility-scale PV and onshore wind in the first half of 2022 were 86% and 46% than in 2010, respectively. Today, some countries produce renewable electricity at LCOEs of just USD 19/MWh for onshore wind and USD 21/MWh for solar.

Renewables paired with energy storage are now cheaper than coal. According to Bloomberg NEF, the gap between renewable energy and fossil fuels continues to widen. The cost for power from newly built onshore wind and solar projects is now around 40% lower than from new coal and gas-fired units.

Overall, renewables remain the cheapest source of new bulk power in countries comprising two-thirds of the world population and nine-tenths of electricity generation.

Reduced Volatility and Supply Stability

Russia’s invasion of Ukraine proved that fossil fuels are an effective weapon for creating economic hardship.

Due to the energy crisis and the unreliability of fossil fuel exporters, importing countries, many of which are in Asia, have been left starving for power and are forced to either pay exorbitant prices to ensure deliveries (Bangladesh is even considering increasing electricity rates by 58%, for example) or leave the market to avoid a bidding war.

Renewable energy sources allow countries to ensure their energy independency and guarantee continuous power supply at affordable prices.

Furthermore, a green energy transition will also help mitigate the effects of high-inflationary periods, often exacerbated by the constant volatility of the fossil fuel markets. According to research by the Roosevelt Institute, transitioning to electrified renewable energy can significantly increase price stability.

Job Creation

Today, there are more jobs in renewable energy than in fossil fuels. And while many have accused renewables of making fossil fuel workers redundant, this isn’t the case. The skills between both industries can be transferred relatively easily. Meanwhile, around seven out of 10 jobs in the oil and gas industry have partial overlaps with renewable energy jobs.

The International Labour Organisation finds that green energy projects can offset job losses from a decline in extractive industries and increase employment thanks to their diverse supply chains, higher labour intensity and increased net-profit margins.

According to studies, a transition to renewable energy would create 28.6 million more long-term jobs than we currently have.

Furthermore, this year, renewable energy-related jobs hit 12.7 million globally, with 700,000 new jobs added in just a single year. More importantly, these new jobs are resilient and reliable, ensuring a more stable economy and long-term employment.

Indirect Benefits in the Form of Averted Losses

Without the net-zero transition, the global economy will lose up to 18% of GDP or USD 23 trillion due to climate change by 2050. As a result of the climate crisis, the 20 most vulnerable countries alone have lost an estimated USD 525 billion in the past 20 years.

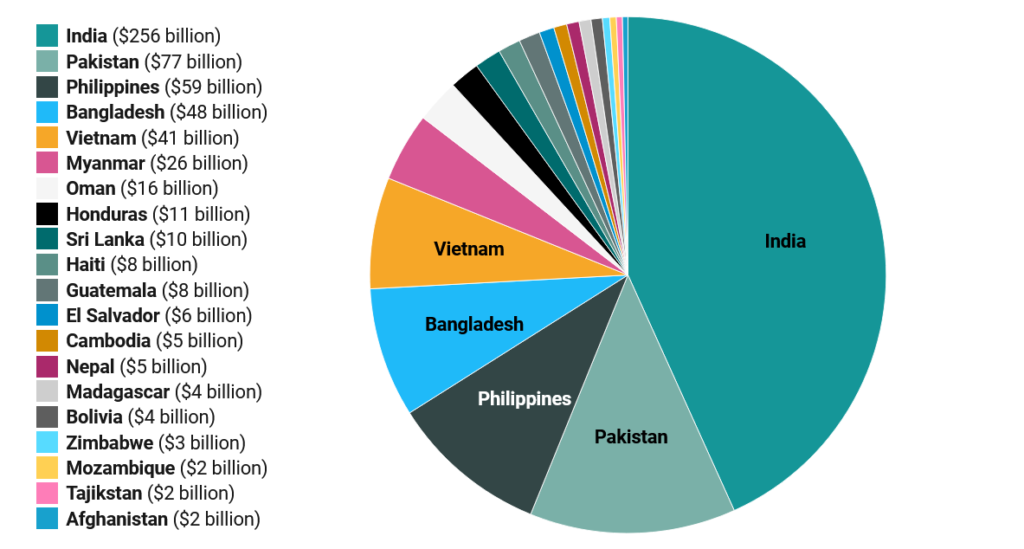

According to other studies, loss and damage from weather events between 1998 and 2017 cost USD 593 billion in developing countries. However, these figures are just conservative estimates, as they only measure the immediate damage and don’t include long-term economic impacts. Furthermore, 66% of those losses are in Southeast Asia.

Oxford scientists estimate loss and damage costs to be up to USD 580 billion a year by 2030. By 2050, they could amount to trillions annually.

Substituting fossil fuels with renewable energy is among the most effective ways to address this glaring problem. According to Stanford University academics, the investment needed to switch to 100% renewables would pay off within six years.

The Economic Benefits of Renewable Energy Motivate Countries to Move Away From Fossil Fuels

The world’s biggest economies are pushing hard to move away from fossil fuels. Even the biggest polluters are planning for substantial investments in new clean energy capacity and technologies.

Yet, many developing Asian economies continue to look towards gas. Forecasts predict the LNG demand in India, Indonesia, Bangladesh, Malaysia, Thailand, Vietnam and the Philippines to increase from 40 Mt in 2020 to 255 Mt in 2050. Furthermore, Southeast Asia has 117 GW of new gas capacity in pre-construction phases.

By materialising those plans, Asian nations will lock themselves into a future of uncertainty. They will be at the mercy of suppliers, with high power costs becoming the norm. The struggle to keep the lights on will be real. Fortunately, those countries still have the time and the means to change course.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more