What Is Behind the Japan Ammonia Greenwash Accusations?

travellight / Shutterstock.com

27 January 2022 – by Viktor Tachev

The sound of the Japan ammonia greenwash accusations over the weeks are still lingering. And they aren’t going away anytime soon. Japan should be at the forefront of the global clean energy transition, net-zero emissions, and efforts to curb carbon dioxide and greenhouse gases as a developed country. Yet it is looking everywhere for alternatives, bar the most sound option – renewables. Japan’s direction, most recently with its ammonia fuel push, is confusing at best.

Japan’s Ammonia Plans – Spending $242m on Mixing Hydrogen-Derived Ammonia with Coal

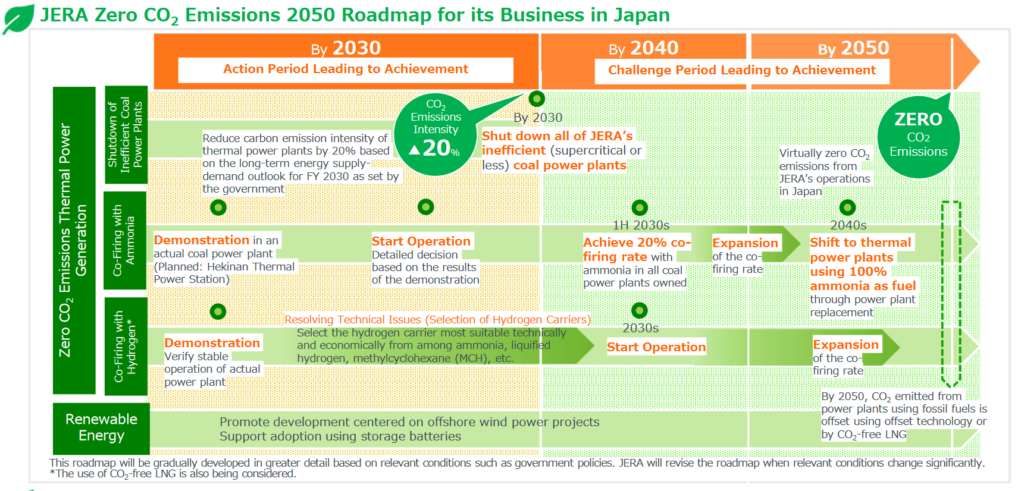

In January 2022, Japan’s Energy for New Era (JERA), a company responsible for over 10% of Japan’s emissions, announced plans to invest close to USD 600 million in ammonia technology development. Two of the three projects aim to use at least 50% of ammonia, along with coal, by March 2029. The third targets the development of new ammonia synthesis catalysts by March 2031.

The Japanese government’s green innovation fund will provide 70% of the investment needed to pay for this. The move is concerning. It signals that Japan is extending a lifeline to coal-fired power plants instead of supporting a future without fossil fuels. Moreover, this move also requires Japan to import significant amounts of ammonia as a part of its net-zero strategy.

Why is Japan Pursuing Ammonia?

The possible reasons for Japan’s ammonia push range from addressing the slow decarbonisation of the economy to a lack of alternatives. However, according to Paul Martin, co-founder of Hydrogen Science Coalition (HSC), Japan’s decision comes down to “Desperation”.

Ammonia, along with Japan’s pursuit of a hydrogen-led net-zero pathway, as discussed previously by Energy Tracker Asia, shows that the East Asian giant is looking everywhere, bar renewables.

“It appears more likely that Japan’s strategy with respect to these projects is delaying rather than focusing on real decarbonisation,” said Martin to Energy Tracker Asia.

What’s Behind the Japan Ammonia Greenwash Accusations?

With climate change’s impacts becoming more commonplace, Japan, as the fifth-largest greenhouse gas emitter globally, should be phasing out fossil fuels in a drastic way. Yet, discontinuing fossil fuel use seemingly isn’t a top priority for the world’s third-largest economy. Instead, Japan seems constantly distracted by exploring, at best, sideways moves.

“Such a move is saying: ‘Look, we are trying! We are blending hydrogen with natural gas and ammonia with coal, and we will reduce the CO2 emissions a tiny bit. We are making progress,” said Martin.

Green Ammonia and Renewable Energy: Green on the Surface, Grey Underneath it

In a similar vein to hydrogen, a “green” association attaches itself to the term when the public hears about ammonia. Yet, despite what green hydrogen and green ammonia can theoretically offer, it is far out-of-reach and often prohibitively expensive. For example, green ammonia is produced from hydrogen produced from renewable energy sources. However, since green hydrogen’s costs remain high and uncompetitive, green ammonia primarily exists only in labs and pilot projects.

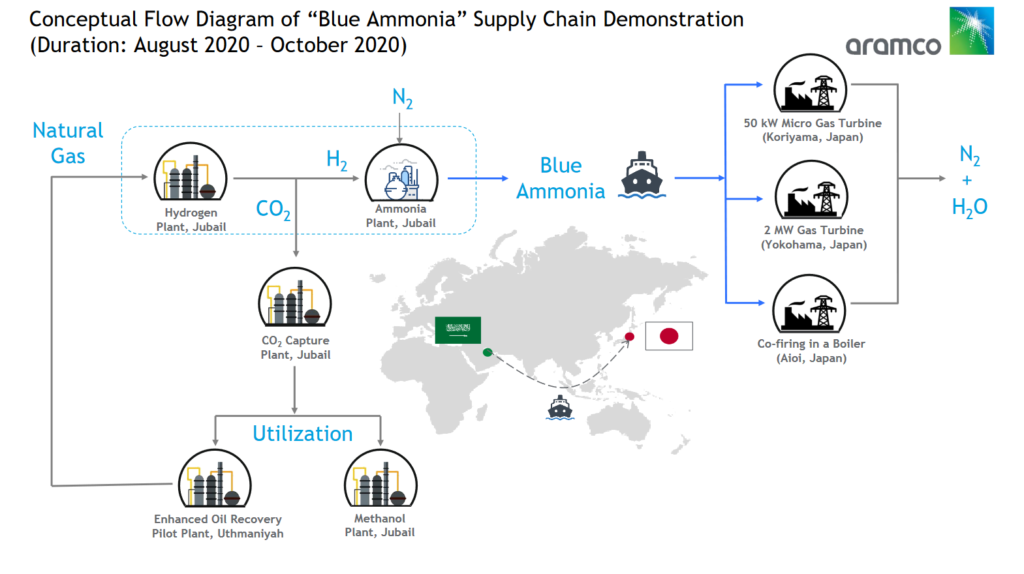

JERA’s plants will rely on blue ammonia, which company officials use to rebuff any greenwashing accusations. Yet, blue ammonia is produced from hydrogen sourced from fossil fuels. Nonetheless, JERA claims that it will capture the carbon emissions from the process. However, carbon capture from such projects remains questionable at best, due to concerns about methane leakage.

Moreover, the case of blue ammonia produced in one of Saudi Arabia’s project sites shows that the fuel can emit more carbon emissions than initially projected. This casts doubt over JERA’s claims. To make matters worse, Saudi Aramco, the oil giant responsible for some of Japan’s blue ammonia imports, plans to use two-thirds of the captured carbon for “Enhanced Oil Recovery”, producing yet more fossil fuels.

A Lack of Financial Reasoning for Burning Ammonia in Inefficient Coal Plants

“Wasteful greenwashing,” as Martin puts it in a LinkedIn post analysing the economic fundamentals of Japan’s decision.

“The whole process – taking ammonia, shipping it to Japan and burning it in a mixture with coal in a 35% efficient coal plant – you might as well start mixing dollars with coal and burn them, calling it a biofuel,” said Martin to Energy Tracker Asia. “The cost of the entire process is so high, relative to the cost of just using electricity directly, that it isn’t even close to what Japan is doing right now.”

In Martin’s LinkedIn post, he estimates that moving ahead with the plans would cost Japan “at least 5x the cost per joule” of the energy other countries use to fuel their economies. “It isn’t that Japan can’t afford such prices – it is a rich nation, in the end. The thing is, it will affect the competitiveness of its industry,” said Martin to Energy Tracker Asia.

And according to the IEA, low-carbon ammonia for power generation is likely to remain expensive up to 2030. They suggest that generation costs for co-firing 60% of low-carbon ammonia in a Japanese coal power plant would be 30% higher in 2030 than regular energy market values.

The next problem is ammonia’s high inefficiency for electricity production. According to Recharge, an energy transition publication, producing a single tonne of green ammonia would require a total of 14.38 MWh of power and generate 5.16 MWh when burned. Ammonia’s generated power plummets to 1.96 MWh when burned in a coal plant. According to a CSIRO study, the cycle efficiency of using ammonia as fuel (from electricity, back to electricity) is between 11 and 19%. The researchers found that relative to making ammonia, using renewable electricity directly “would clearly be far more efficient.”

Ammonia Hardly Solves Japan’s Import Dependency

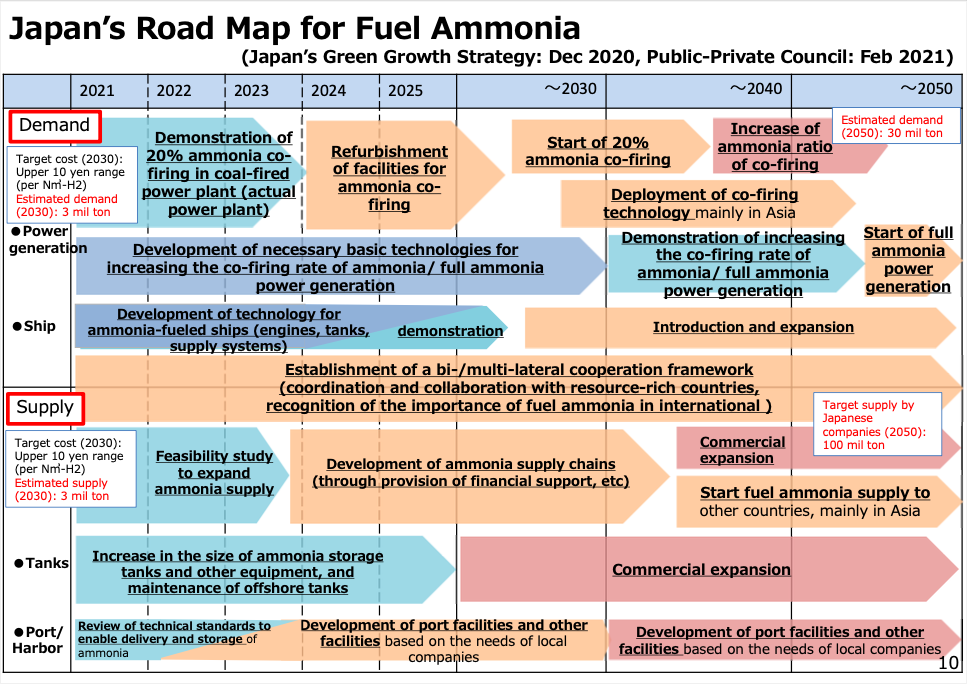

Currently, Japan imports around 20% of its fossil fuel-derived ammonia from Malaysia and Indonesia, with some coming from Saudi Arabia. However, imports would soar if Japan adopted ammonia more broadly. In total, the country would need 20 million tonnes of ammonia annually if coal power plants were to be co-fired with just 20% ammonia.

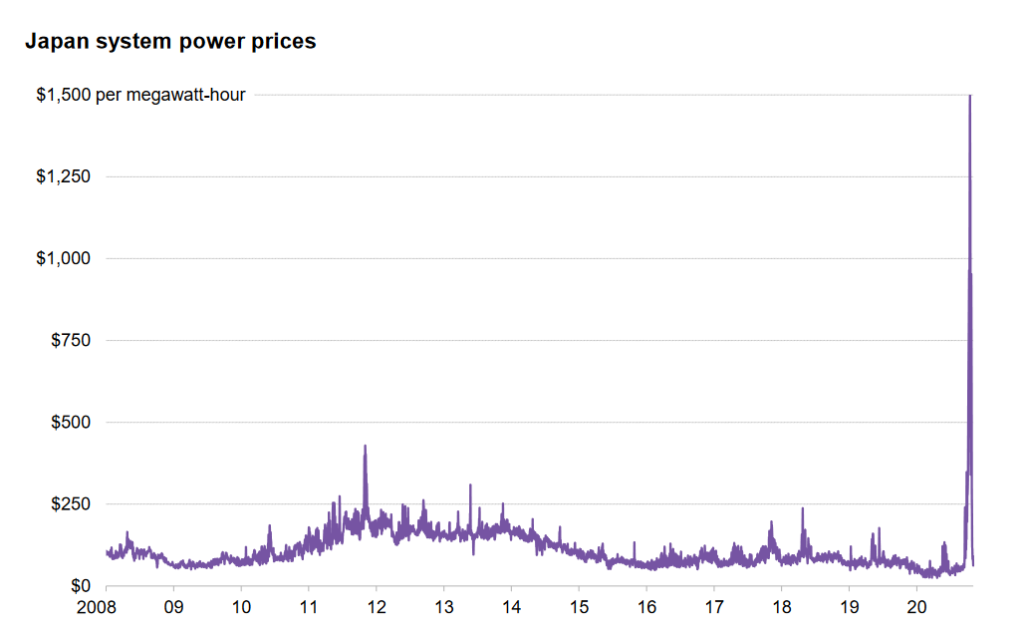

Adding to the problems, the ammonia export market isn’t highly diversified. This could lead to a scenario where Japan may face supply and pricing risks. The latter, however, isn’t unusual for the country based on its experience with gas imports. In January 2021, for example, Japan’s wholesale power price hit an all-time high of nearly $1,500 per megawatt-hour, more than three times the previous record price in 2011.

There isn’t an easy way out for Japan. According to Martin, while all options are worth considering, Japan is on the wrong track.

“I am not saying there is a simple solution that Japan can take and decarbonise its economy,” said Martin to Energy Tracker Asia. “I am saying that the path that’s being proposed doesn’t look honest. If they are sincere about this and are aware of the numbers, they would be building wind turbines like mad. Why aren’t they? Because, in my opinion, they are bargaining with the problem.”

Japan’s latest move signals a further distancing from the country truly achieving its net-zero goals. Goals that look more distant as time passes. “Ammonia is a distraction,” said Martin. “And we need to focus on real solutions, not on distractions.”

Paul Martin’s commentary for the article is made in a personal capacity and doesn’t necessarily reflect the views of the Hydrogen Science Coalition.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more