Why Are Carbon Credits Bad? The Hidden Dangers of Carbon Credits

Source: The Verge

28 October 2024 – by Eric Koons

Why are carbon credits bad? Carbon credits, also known as carbon offsets, are a mechanism to reduce greenhouse gas emissions. A carbon credit represents the reduction of one metric tonne of carbon dioxide or carbon dioxide equivalent in other greenhouse gases. Companies purchase these credits to compensate for their fossil fuel emissions, funding projects that reduce or sequester an equivalent amount of carbon emissions elsewhere.

Microsoft Will Buy 8 Million Credits

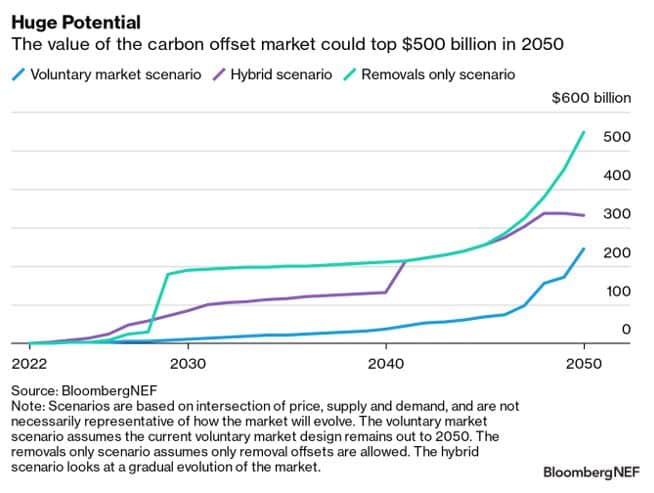

Carbon credits have become prevalent in today’s corporate world, with many companies integrating them into their decarbonisation strategies. For instance, major corporations like Microsoft have committed to being net-zero with heavy reliance on credits. Microsoft just signed a deal to buy 8 million credits through 2043. As a result, the global carbon offset market is growing rapidly, with projections suggesting it could reach USD 200 billion by 2050.

However, despite their apparent benefits, credits can have unintended negative consequences on the environment.

What Are the Disadvantages of Carbon Credits?

One of the most commonly cited disadvantages of carbon credits is their potential for greenwashing. Companies may use carbon offsets to create an image of being environmentally friendly without making substantial efforts to reduce their own emissions.

For example, an oil company might continue its polluting activities while purchasing credits to offset its emissions. This projects an image of sustainability without making significant operational changes, with the root problem not being addressed. This practice undermines the ultimate goal of reducing overall greenhouse gas emissions and can slow down the transition to a low-carbon economy.

Moreover, there is a lack of transparency and accountability in some carbon credit schemes. Not all credits represent real or additional emissions savings, as the effectiveness of offset projects can vary widely. In some cases, projects funded by credits might have happened even without the purchase of these credits, meaning the supposed emissions savings are not a result of the credit existing.

What Are the Risks of Carbon Credits?

Carbon Offsets are not without risks. Here are some of the top ones:

False Sense of Security

Carbon credits also pose specific risks. One major risk is creating a false sense of security among consumers and companies. Believing that their emissions are being effectively offset, there might be less urgency to make significant changes in behaviour or business practices. This complacency can hinder genuine efforts to combat climate change.

Market Manipulation

Market manipulation is another significant risk. Due to a lack of regulatory oversight, voluntary carbon markets can be susceptible to exploitation by intermediaries looking to profit rather than ensuring environmental benefits. For instance, there have been situations where credits were sold multiple times or the projects funded did not deliver the promised emissions reductions.

Environmental Inequality

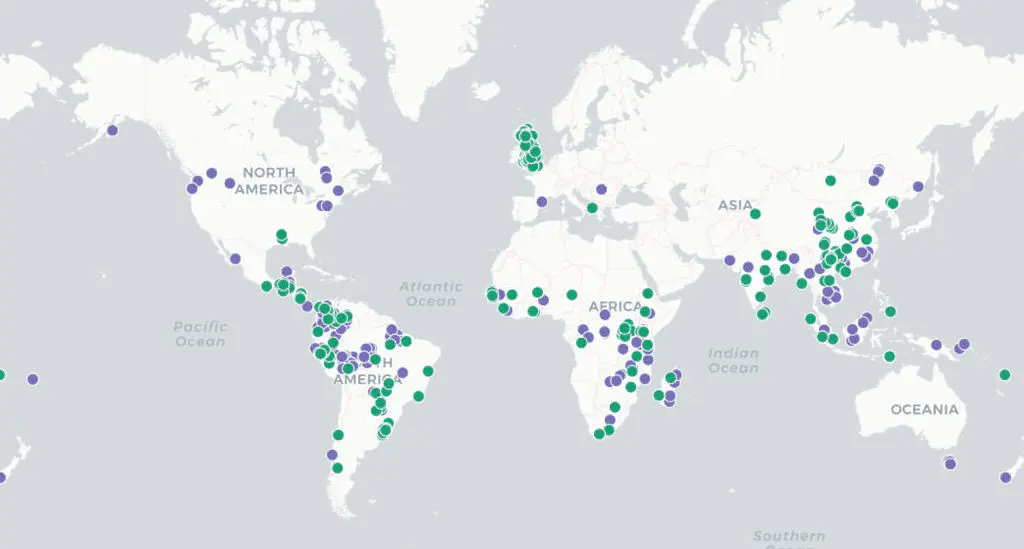

Furthermore, carbon offsets can perpetuate environmental inequality. Offset projects are often located in developing countries, where local communities may not see the benefits and can suffer other adverse effects.

For example, a project in Uganda subsidised local suppliers to produce more efficient stoves for local communities. In return, the project received carbon credits for the associated emissions reductions. However, after the credits were sold, there was no mechanism to sell and distribute the stoves to the communities, and it largely fell on the local businesses contracted to produce the stoves. This forced local companies to spend significant amounts of time selling the stoves, resulting in many being sold below market price due to a lack of demand within the communities.

Why Are Carbon Offsets Bad and Cannot Be Use As A Climate Finance Tool?

Considering the risks mentioned above, it can be safely said that carbon credits are a bad option to achieve darbonisation and they cannot be used as a climate finance tool.

The oil and gas industry uses carbon credits to continue the oil and gas extraction. It enables these companies to continue harmful emissions by purchasing offsets rather than making actual, long-term changes to reduce their carbon footprint, delaying the fossil fuel phaseout and damaging the efforts to tackle climate change at its core.

Evaluating the Role of Carbon Offsetting

While carbon offsetting has the potential to support global decarbonisation efforts, they come with significant drawbacks and risks. It is crucial to evaluate the use case of purchasing carbon credits rather than solely relying on them to achieve carbon reduction targets.

Stricter standards, regulatory oversight and multifaceted climate strategies that prioritise actual emissions reduction are essential to ensuring that carbon credits contribute positively to the fight against climate change.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more