The IEA’s World Energy Outlook 2023: Global and Asian Gas Demand to Peak by 2030

22 November 2023 – by Viktor Tachev

The IEA’s World Energy Outlook 2023 highlights many positives regarding the energy transition – from clean energy deployment reaching “unstoppable levels” to a possible peaking in demand for all fossil fuels this decade. While the IEA expects Asian gas demand to drop significantly, industry organisations are more bullish and forecast massive consumption demand growth, especially in Southeast Asia.

World Energy Outlook 2023: Green Technologies Are Taking Over

The IEA’s World Energy Outlook 2023 report notes that the clean energy transition is underway, with investments rising by 40% since 2020. Over 500 GW of renewables will be added in 2023, and the total investment in solar deployment will exceed USD 1 billion daily.

EV adoption is also growing steadily. Today, one in five cars sold is electric, compared to one in 25 in 2020. With current policy settings, the agency estimates that by 2030, there will be almost 10 times as many electric cars on the road as today. By the decade’s end, solar PV will be generating more electricity than the US power system currently. The share of renewables in the global electricity mix is projected to be 50%, up from 30, and around three times more investment will go into new offshore wind power projects instead of new coal and gas infrastructure.

Under current policies, by 2030, renewables will contribute to 80% of new power generation capacity. Although solar will account for over half of that, much of its potential will still be untapped. By the decade’s end, the annual solar panel manufacturing capacity will reach 1,200 GW. Yet, the actual deployment in 2030 will be far lower, at 500 GW.

The IEA warns that more ambitious targets and faster action are needed to keep the 1.5°C goal alive.

“Governments, companies and investors need to get behind clean energy transitions rather than hindering them. There are immense benefits on offer, including new industrial opportunities and jobs, greater energy security, cleaner air, universal energy access and a safer climate for everyone,” notes IEA Executive Director Fatih Birol.

The Fossil Fuel Market to Remain Unstable

The IEA warns that while fossil fuel prices have dropped from their peak, the market remains highly volatile and tense. This is due to the ongoing war in Ukraine and the risk of protracted conflicts in the Middle East.

For the first time in history, the agency sees peaks in the global demand for coal, oil and gas being realised this decade based on today’s policy settings. Furthermore, it notes that global CO2 emissions will likely peak by 2025. However, despite this, the demand for fossil fuels and emissions levels will remain too high to keep within reach of the Paris Agreement goal.

The agency estimates that investment in oil and gas today is almost double the level required for its NZE Scenario in 2030.

As a result, the IEA sees a clear risk of protracted fossil fuel use that would put the 1.5°C goal out of reach, worsen climate impacts and significantly undermine energy security.

“Taking into account the ongoing strains and volatility in traditional energy markets today, claims that oil and gas represent safe or secure choices for the world’s energy and climate future look weaker than ever,” noted IEA Executive Director Fatih Birol.

Regional Insights: Developed and Developing Asia

The IEA states that emerging and developing economies have a range of options available to help them reach their national energy and climate targets. Among them are clean electrification, improvements in efficiency and a switch to lower-carbon and zero-carbon fuels.

China and India

China remains the world’s biggest coal consumer and a major consumer of oil and gas. The country accounts for a third of global CO2 emissions.

However, in 2022, China was also responsible for 60% of global EV sales. It contributed 50% of wind capacity additions, 45% of new global solar PV capacity and 30% of nuclear capacity additions. China is projected to surpass its 2030 NDC target of 1,200 GW in solar and wind capacity five years early.

The country remains the largest producer of solar PV, wind, batteries, heat pumps and electrolysers for hydrogen production. It even plans to scale up on this further.

China’s coal use is projected to peak around 2025 and will start a long-term decline to 50% below the peak by 2050. Natural gas use will grow strongly to 2030 before peaking in 2040. Meanwhile, oil consumption will peak before 2030.

Under current policies, India’s oil and gas demand will increase by nearly 70% between 2022 and 2050. Coal demand will grow by 10%. As a result, India’s annual CO2 emissions will rise almost 30% by 2050. This will mark one of the most significant increases in the world.

The IEA notes that regardless of the scenario, India will achieve its target of 50% non-fossil power generation capacity by 2030. By 2050, solar will account for between 45% and 50% of total generated power.

Japan and South Korea

The IEA warns that the decarbonisation of both the Japanese and South Korean economies will be challenging due to their massive reliance on imported fossil fuels.

However, the agency notes that under the stated policies, the share of coal and natural gas in the power mixes of the two countries, which currently sits at around 65%, will fall sharply.

Gas demand will drop by 50%, while the share of low-emission power sources will jump from 30% today to 85% by 2050. Oil use will fall by two-thirds by the middle of the century.

While geography specifics will partially restrict renewable energy deployment, both countries are still expected to make significant progress.

Japan will prioritise nuclear power, which will account for 75% of the total electricity generation across both countries by 2050.

Under current policies, offshore wind in Japan and Korea will increase from 0.1% today to 15% by 2050.

However, the IEA also projects that both countries will import massive amounts of hydrogen. By 2050, South Korea and Japan will account for 40% of the global total hydrogen imports. In the short term, both will rely mostly on fossil fuel-based hydrogen.

Southeast Asia

In a stated policies scenario, by 2050, the Southeast Asian region will experience the second-highest energy demand growth globally after India. The countries will meet it primarily through fossil fuels. As a result, Southeast Asia will see the largest absolute growth of CO2 emissions of any region – 46% by 2050. Coal will be responsible for much of it.

However, Southeast Asia will also continue to be a leading global hub for clean energy technology manufacturing. Vietnam and Indonesia, for example, will join the ranks of the top exporters of solar PV modules.

Clean energy investments will double to USD 60 billion by 2030. However, this growth will be insufficient, and the IEA estimates that the region will need up to USD 120 billion by 2030. Such a development will ensure that solar power grows almost sixfold by 2030, while coal halves by 2050. As a result, CO2 emissions will drop by over 40%.

Differing Views on Gas: IEA Sees a Demand Drop, While Industry Organisations Expect Growth

Different organisations, analysis groups and industry associations have conflicting views over future gas demand.

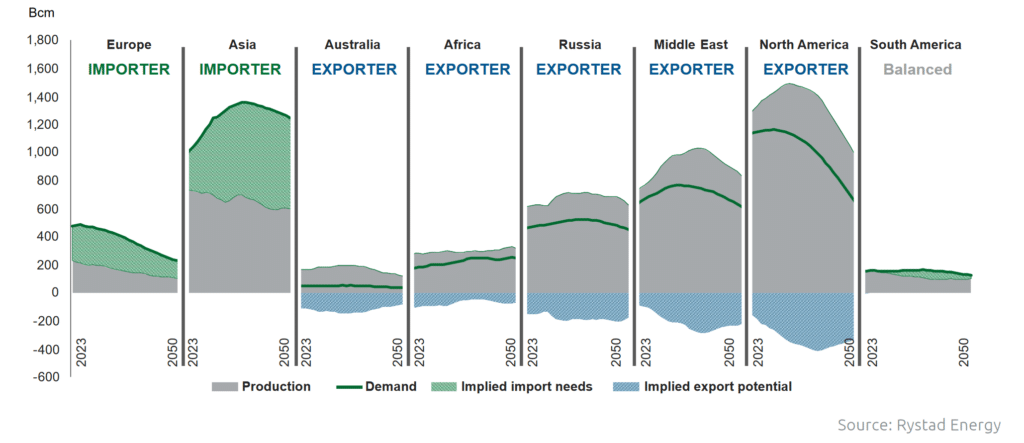

The IEA notes that from 2025, the world will see an unprecedented surge in new LNG projects. As a result, over 250 billion cubic metres per year of new capacity will come online by 2030. This is almost half of the total global LNG supply today.

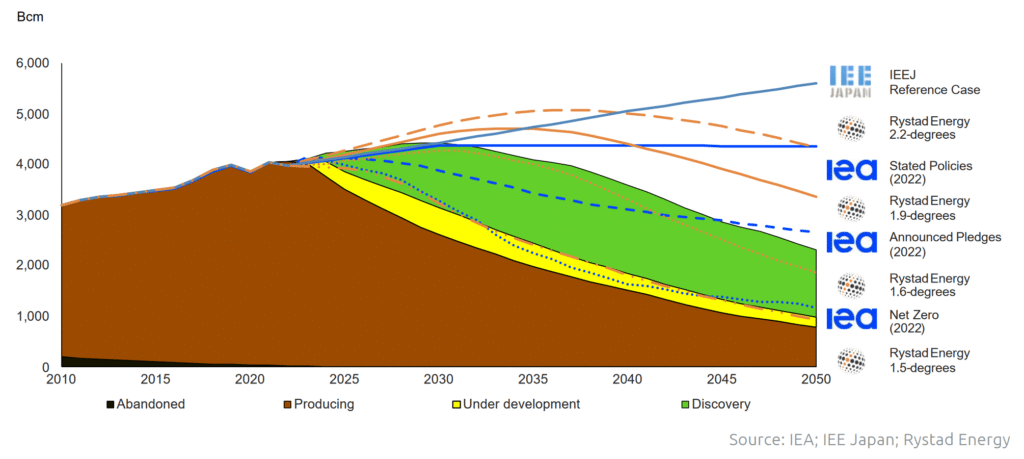

While this will lower gas prices, it will create an excessive supply and demand mismatch since global gas demand growth has slowed considerably in the past few years. Furthermore, the IEA expects gas demand to peak this decade in all scenarios. The main driver will be the shift to renewables from leading economies.

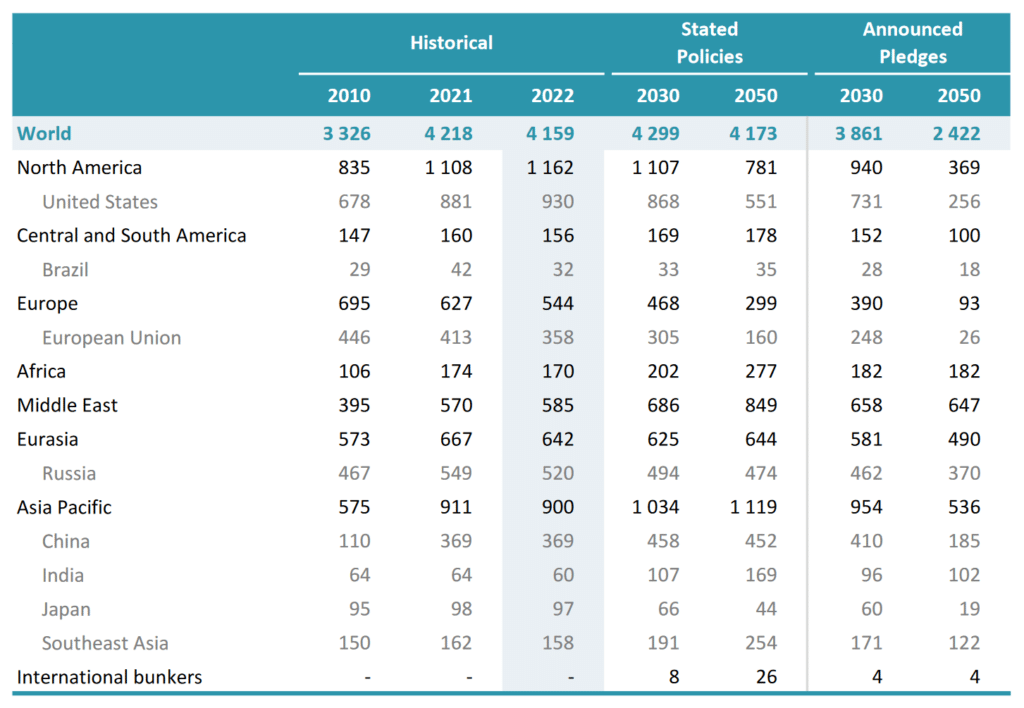

Based on the climate pledges of Asian governments, the IEA sees a 40% drop in the region’s gas consumption by 2050.

Industry Organisations Forecast Notable Growth in Asia’s Gas Demand

However, some Asian leaders are questioning the IEA’s forecast. At Singapore International Energy Week (SIEW), executives and policymakers reportedly highlighted that the region will need much more gas to switch from coal to renewables. Bloomberg writer Stephen Stapczynski notes that Asian energy importers and policymakers at the conference weren’t “as fussed about green policies”. Instead, they wanted more gas.

According to Andy Elliot, president of ExxonMobil LNG Asia Pacific, China’s gas demand will double through to 2050. Meanwhile, the Global Gas Report 2023 by the International Gas Union also sees the country remaining a major driver of natural gas demand. The reason is China’s intention to use gas as a backup to renewables. On the other hand, the IEA sees China’s gas demand peaking in 2040 at levels 25% higher than today.

Tony Regan, the Asia-Pacific gas lead from NexantECA, an energy and refining advisory, expects Southeast Asian countries, particularly Vietnam, Thailand and Indonesia, to drive global gas demand. Additionally, S&P Global’s head of Emerging Asia’s gas and LNG markets, Zhi Xin Chong, predicts that by 2033, Southeast Asia’s LNG demand will quadruple, making up 12% of the global market. He expects Thailand, Malaysia, Indonesia and Singapore to be the leading markets.

At SIEW, India and Vietnam also revealed plans for LNG terminals and pipeline investments that would lock the countries in after 2050. Similarly, Singapore is committed to building new LNG import terminals to “boost energy security”. Indonesian power producers used the conference to call for more gas investments.

Bloomberg reports that the leaders are united in their view that the region will need over 300 million tonnes of new LNG export capacity by 2030 to meet its demand. This is a 75% jump from today’s levels.

Rystad Energy expects global demand for natural gas to remain on an upward trajectory in the power sector until 2030, driven mainly by the coal-to-gas transition in the Asian power sector and lower clean energy investments in the region.

Asia’s Gas Plans: Costly and Risky

The Institute of Energy Economics in Japan notes that to ensure sufficient gas supply through 2050, the world must invest USD 7 trillion in developing new developments and refurbishing existing infrastructure. However, these estimates are based on a 56% emission-reduction scenario by the middle of the century. If emissions remain at today’s levels, the needed investment will likely top USD 10 trillion.

The 2023 World LNG Report by the International Gas Union warns that LNG, gas project development and investment plans face various risks. Aside from the geopolitical conflicts and ongoing wars, the authors also highlight the ambitious decarbonisation policies of the EU, which intend to reduce gas demand significantly, as the main reason. The study warns that the issues will create supply and demand imbalances, bringing uncertainty to project developers. Regarding Asia, the report’s authors note that the high LNG prices discourage investment, specifically in power-starved nations like Bangladesh and Pakistan.

Despite the bullish projections of the gas lobby, according to the IGU, there is a real risk for future LNG demand in Asia to decline, given the price sensitivity of the region. Such fears are legitimate, considering that projects in Southeast Asia have faced notable delays in recent years due to a lack of incentives for investors.

In the Global Gas Report 2023, the IGU warns of “unprecedented uncertainty” regarding global gas demand. The organisation highlights the importance of developing gas supply ahead of the increasing gas demand. However, currently, this isn’t the case. The IEEFA says that the majority of the new gas supply will come online in 2025. In the short term, this will create supply/demand imbalances, significantly undermining the energy security of countries relying on the fuel, especially in Asia. The IGU expects Asia to be the leading net importer of natural gas by 2030.

If such a scenario materialises, Asia risks locking itself into the very same problems that have been tormenting it in the past two years. However, this time, it would be for the long term.

The IEA’s Five Pillars For Getting Back on Track

The IEA’s World Energy Outlook 2023 proposes a strategy, with a horizon of 2030, to get the world back on track. It states the necessary climate progress needed to ensure the success of COP28. Its five key pillars are

- Tripling global clean energy capacity

- Doubling the energy efficiency improvement rates

- A 75% reduction in methane emissions from fossil fuel operations

- Tripling clean energy investments in emerging and developing countries

- A significant reduction in fossil fuel use, including ending new unabated coal power plants

The IEA warns that current policies will push global average temperatures to around 2.4°C in 2100. Yet, the agency notes that the tools for bending the emissions curve downwards to 2030, including the five pillars mentioned above, are available and very cost-effective. COP28 is the perfect stage to put these initiatives into motion.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more