2026 Renewable Energy Outlook: A Potentially Quieter Year, But Steady Growth to Continue

13 January 2026 – by Viktor Tachev

Despite 2025 seeing unprecedented rollbacks in climate commitments, unambitious NDC submissions and a COP30 that failed to deliver tangible outcomes for global climate action, it proved to be yet another year of record growth in renewables capacity deployment, and experts remain hopeful that the outlook for 2026 will continue this trend, although at a slower pace. As in recent years, China, in particular, will lead the global surge, filling a vacuum left on the global clean energy stage by President Donald Trump’s administration in the US. This will open up immense opportunities for ASEAN nations to advance their climate goals and equip their economies with cleaner, more reliable and more affordable energy.

The 2026 Outlook For Renewable Energy: Renewables Now the World’s Top Power Source

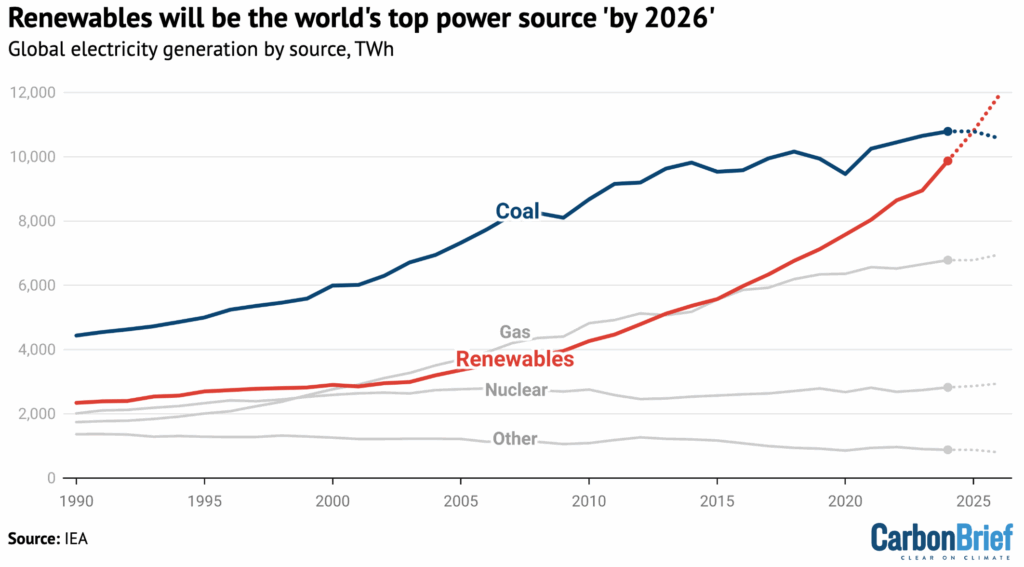

In July 2025, the International Energy Agency (IEA) projected that renewable energy would overtake coal to become the world’s top source of electricity by “2026 at the latest”. The forecast proved accurate as solar and wind met and exceeded all demand growth in the first half of 2025, leading to renewables overtaking coal for the first time and fossil generation falling slightly.

According to the IEA, in 2026, renewables will make up 36% of global power supplies, against just 32% from coal, the fuel’s lowest share in a century. Furthermore, the global share of electricity generation from wind and solar will rise to nearly 20%.

In total, the rapid solar expansion is on course to push the PV market value toward USD 333.7 billion by 2026.

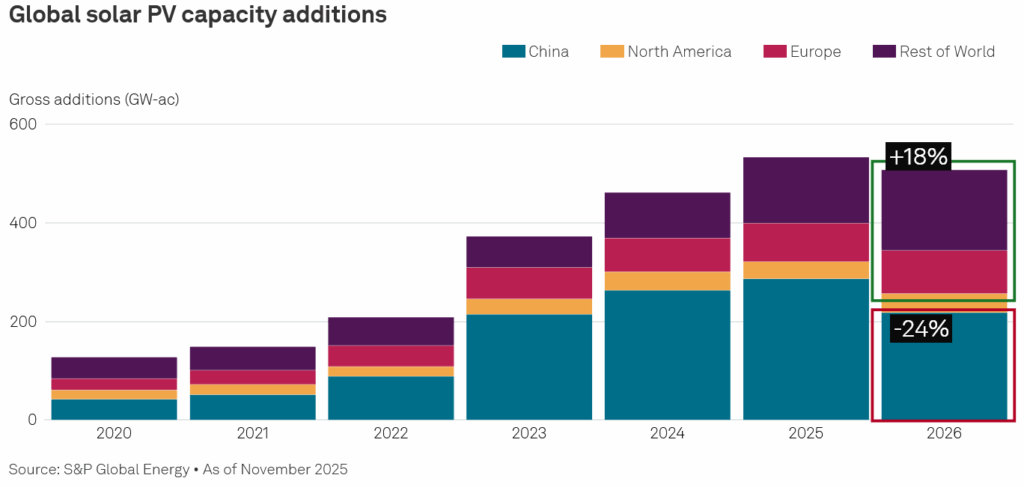

However, S&P Global expects solar to reach a temporary peak in 2026, marking the first annual slowdown in renewables additions after robust growth at the end of 2025, albeit by less than 10%. Still, the experts note that total installed capacity will continue to double through 2030, with emerging markets playing a significant role.

The analysts also see grid infrastructure modernisation and buildup moving into centre stage as a way to improve energy security and reliability throughout 2026. This segment, which has continuously lagged the pace needed to keep up with clean energy deployment across most markets, has often proved the energy transition’s weakest link, creating significant bottlenecks.

Energy Transition in Asia

In 2026, Asia will continue to drive the global clean energy transition, focusing on scaling up renewable energy capacity and increasingly reducing reliance on traditional sources. According to the Economist Intelligence Unit, the current year will mark the beginning of a long-term decline for coal, while renewables will expand at scale, led by China.

For example, Malaysia is one of the countries in the region that will actively pursue this path, with power demand to rise significantly in 2026 and 2027, driven by sectors such as data centres and high-demand industries. India’s energy demand outlook is also on a growth trajectory, with forecasts pointing to an up to 6.5% CAGR from FY 2026-2030.

However, others, like Japan, for example, are planning to push harder for alternative power sources, such as nuclear power, and aim at derailing recent progress in solar power in the country, including by cutting subsidies for large-scale projects. The moves are a part of the ruling party’s efforts to reduce the role of renewables in the energy mix. Considering Japan’s strong influence in the design of the energy system plans of many Asian nations and the increased push for adopting LNG and fossil fuel-based technologies, there are concerns that its fossil fuel lobby will push even harder to undermine the region’s energy transition and climate goals, especially when renewables are proving the more economically sound and secure choice.

As a result, Japan’s push has faced growing opposition across the region. In a joint statement from October 2025, 36 leading Asian civil society organisations warned that Japan’s technologies under the Asia Zero Emission Community (AZEC) won’t cut emissions at the scale or speed required, but will instead lock countries into long-term fossil fuel use, expensive infrastructure and debt, while delaying the renewable energy transition.

“Japan has the resources and the responsibility to support Asia’s renewable energy transition, and that begins with PM Takaichi’s political will,” said Makiko Arima from Oil Change International.

China to Remain in the Spotlight in and Beyond 2026

S&P Global warns that, in 2026, China’s annual additions will fall to 200 GW from approximately 300 GW in 2025, a decline so steep that no other region will be able to compensate. This is expected to be the result of a policy shift from guaranteed pricing to competitive bidding, which took place in mid-2025 and triggered a dramatic slowdown after an initial rush of installations, the experts note.

Still, the growth of the global clean energy industry in the upcoming years will be driven by China’s massive, cost-competitive manufacturing capacity for solar PV and wind.

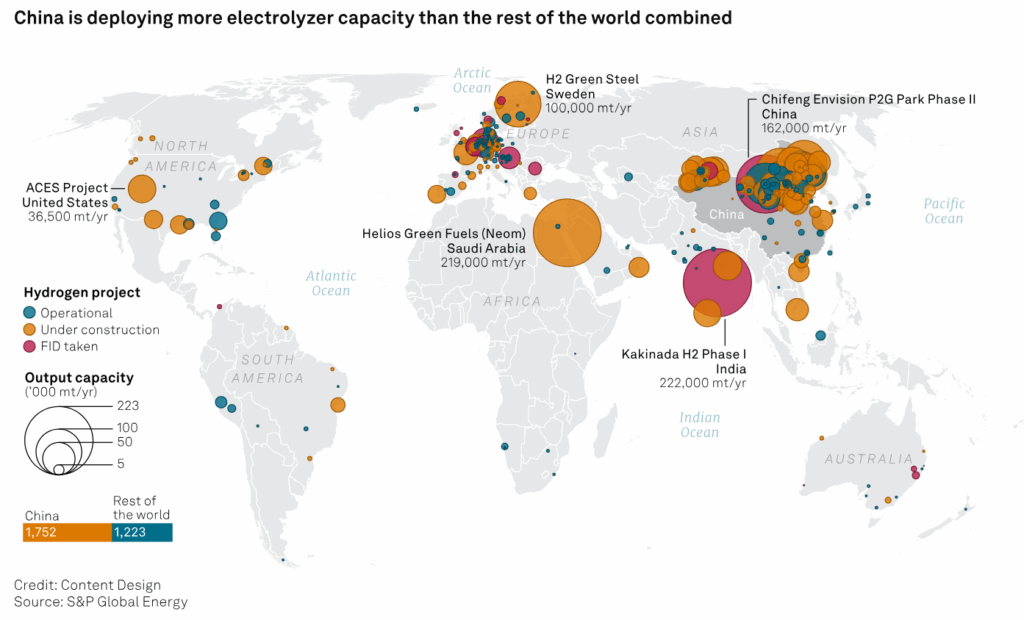

For example, S&P Global projects that as the rest of the world slows down, China will get serious about green hydrogen, with domestic deployment and exports set to grow exponentially in 2026. Furthermore, the country will continue to drive the exponential growth of the global EV industry, with electric vehicle sales set to climb further in 2026.

On a longer horizon, the IEA forecasts that China will continue to account for almost 60% of global renewable capacity growth and is on track to reach its recently announced 2035 wind and solar target five years ahead of schedule.

In total, Asia is poised to dominate the solar PV market with over 48.9% market share by 2026. This would result from surging energy demand in nations such as China and India. Furthermore, China’s data centre demand will more than double, growing from 20 GW in 2024 to potentially 63 GW by 2035.

Experts also note that cooperation between ASEAN and China will continue to expand, particularly in sectors such as technology, digitalisation and green energy, under the ASEAN-China Plan of Action (2026-2030).

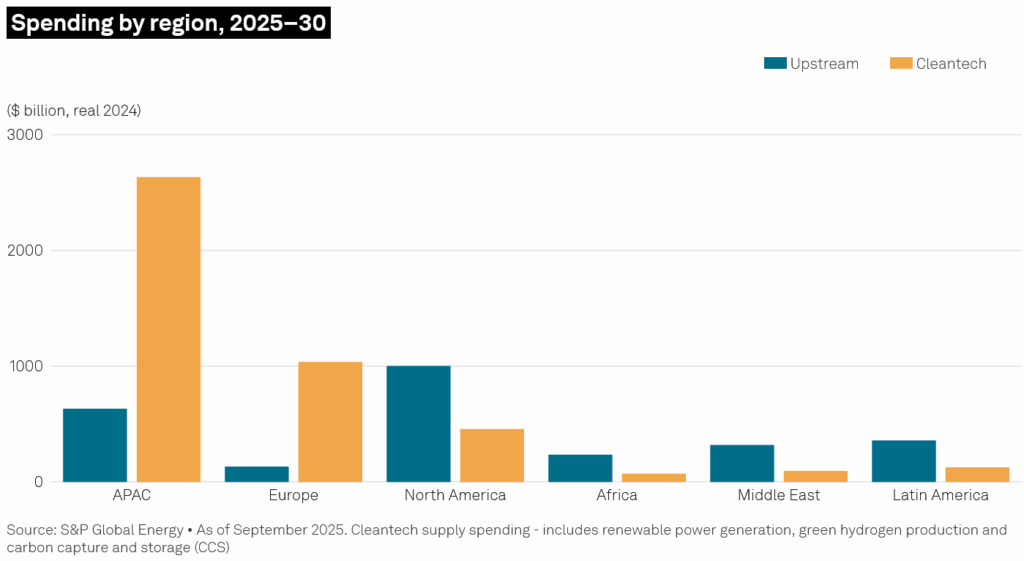

S&P Global projects that Asia will drive cleantech spending through 2030.

According to the World Economic Forum, as geopolitical tensions put energy security back at the top of the agenda, China will continue its efforts to bolster the resilience of its energy infrastructure and grow its dominance in new technologies. The nation will continue leading manufacturing across most clean and advanced energy supply chains, cementing its status as the world’s clean energy powerhouse.

China to Further Leverage Clean Energy Leadership in 2026 in the Absence of the US

In 2026, China’s role on the global clean energy stage will be further cemented as the US backtracks on its climate commitments and accelerates its pushback against renewables. In fact, Deloitte projects that the Trump administration will disrupt the country’s clean energy industry, including raising project costs, compressing timelines, tightening discipline among project investors, and disrupting technology imports. This is likely to ease supply chain capacity and any existing gluts, enabling other markets to accelerate planned projects, with China again shaping up as a key supplier and growth market.

S&P Global sees the strategic energy divide between China and the US widening further in 2026 as the former consolidates its leadership in clean energy technologies and supply chains and reinforces its influence through state-led industrial policy and active climate diplomacy. The experts also note that China’s cleantech overcapacity and weakening domestic demand are likely to make the export of cleantech products an economic imperative and a tool for geopolitical power projection.

United States Will Contnue Prioritising Fossil Fuels

The US, on the other hand, will continue prioritising fossil fuel exports and build on its efforts to undermine climate action, including quitting the Paris Agreement, skipping COP30, revoking environmental laws and challenging multilateral efforts such as the International Maritime Organisation (IMO) shipping emissions pricing. Furthermore, after the arrest of Venezuela’s President Nicolas Maduro, the Trump administration announced that US oil companies are about to invest “billions of dollars” to tap into Venezuela’s oil reserves. According to the US Energy Information Administration, Venezuela, a founding member of OPEC, holds the largest proven oil reserves in the world at 303 billion barrels or 17% of the global total. As a result, Trump’s leadership is likely not only to continue but significantly expand its bullish fossil fuel exploration plans, further distancing the US from the global climate goals and fuelling the climate crisis, which the president has previously branded as an “expensive hoax”.

This growing division between the US and China will allow emerging markets to evaluate the differences between the two approaches and choose their own energy transition pathways. According to S&P Global, China’s offering aligns more closely with long-term climate strategies, even as export controls on rare earths highlight supply chain vulnerabilities.

Furthermore, in 2026, China is likely to continue to position itself as an active participant in climate negotiations, building on its role since the Paris Agreement and having recently released new emissions targets. The country is likely to continue engaging in productive dialogues with partners, such as the talks with the EU in July 2025, which marked a new era in climate leadership.

Renewables Growth Still Insufficient to Offset Soaring Electricity Demand

The IEA projects global electricity demand to rise 3.7% in 2026, driven mainly by China and India. Demand in China is forecast to grow by 5.7% in 2026, while India’s is projected to grow by 6.6% this year.

Despite the steady growth trajectory for the clean energy industry, Wood Mackenzie’s Energy Transition Outlook 2025-2026 finds that it would be an insufficient countermeasure to the soaring global power demand, driven mainly by the surge in AI and data centres, which have received special attention at COP30. According to the experts, factors like these have made achieving net zero by 2050 goalunattainable, and are instead driving the world towards catastrophic 2.6°C warming. S&P Global even warns that, as AI uptake soars in 2026, energy supply and sustainability commitments will face a major breaking point.

However, tech giants can still slow down or reverse this trend. For example, at the start of 2026, Google announced it would acquire the clean power and storage developer Intersect for nearly USD 5 billion. The move will enable the company to ensure the clean energy needed to scale AI faster and gain a more competitive position in the global arms race.

However, for this to happen at the pace required by the climate crisis, grid modernisation and buildup would prove critical. As it has become clear that grid development is no longer just an enabler but a critical infrastructure, experts believe the market segment will attract increased investment, further enabling the rapid deployment of renewables. According to S&P Global, 2026 will send the clear message to policymakers, utilities and investors that the energy expansion required to satisfy AI-driven demand growth will only move as fast as the grid allows.

Still, despite the positive trends and the IEA’s expectations for a slight decline in carbon emissions in 2026, the magnitude of the climate crisis demands more urgent and ambitious action.

Looking Ahead

Despite the IEA’s forecasts that the global clean energy capacity will double by 2030, the COP28 goal to triple clean energy capacity is likely to remain out of reach.

However, predictions for the renewables market growth, and solar in particular, always come with caution, with analysts often underestimating its trajectory. For example, policy changes and geopolitics can quickly alter the outlook, as evident in the US and Japan. On the other hand, China’s growing investments in the clean energy market, as well as its consistent actions to crush national targets, can bring back balance in the market elasticity. While these forecasts are hard to nail down, experts are clear: the world is getting closer to the peak in fossil fuel use.

Renewables, led by solar, have been proving the cheapest power source for years already, and are becoming ever more reliable and capable of meeting the rising energy demand.

Moreover, the growing cumulative economic effects of climate hazards, including lost business revenue, physical damage to infrastructure and health impacts, would further accelerate this transition.

Furthermore, as governments increasingly realise the importance of energy security in an increasingly divided geopolitical environment, there is yet another critical reason to accelerate clean energy investments on top of the economic, environmental, and health advantages of renewables. And, with that, the market’s trajectory seems quite clear. The question is: at what pace will it unfold?

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more