A New Supply Chain Crunch: Renewable Energy Commodities

24 May 2022 – by Viktor Tachev Comments (0)

The global net-zero journey is highly dependent on renewable energy commodities. Renewable energy, just like many things, is a blend of complex systems that should come together. However, in the fragile world of global trade, this comes with significant risks. COVID-19 exposed how vulnerable global supply chains are. While there is a rising demand for renewable energy commodities, there is insufficient supply in the energy markets.

The global net-zero journey isn’t as straightforward as expected because commodity trading wholesale markets are not as developed when it comes to renewables; energy companies should be prepared for it.

The Global Energy Transition Is Underway in the Energy Markets

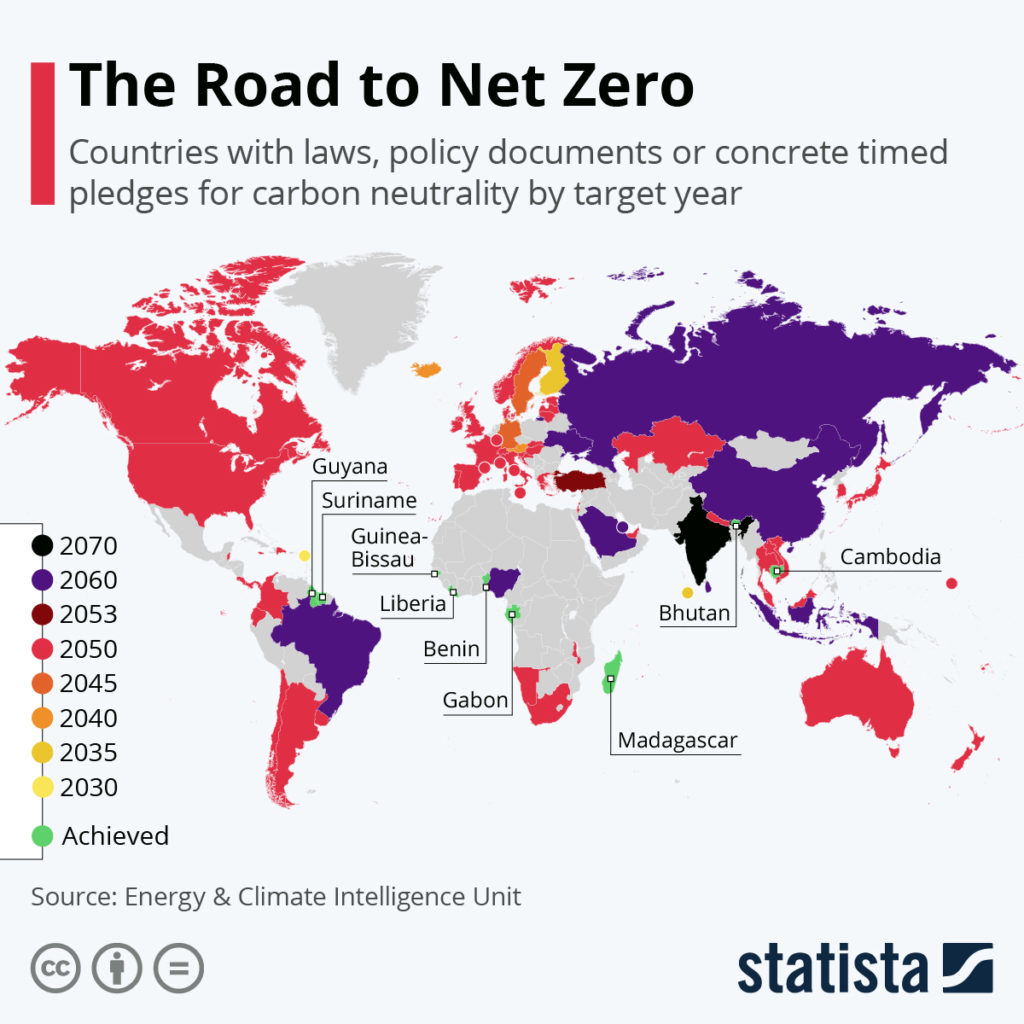

Despite the disparities in countries’ progress, the clean energy transition is underway worldwide. As a result, renewable energy is slowly but surely overtaking fossil fuels. Many of the countries with climate pledges have set 2050 as their goal. Top global polluters like China and India are aiming for net-zero by 2060 and 2070, respectively.

While some describe the net-zero targets as unrealistic due to the lack of significant progress, more and more governments are actively working towards reducing their fossil fuel dependency, especially for power generation. The sanctions and energy prices following Russia’s invasion of Ukraine have made Europe reconsider its crude oil and natural gas import policy. The continent is now actively working to replace Russian coal and gas with renewables. Change is also happening across Asia, where countries like China and Vietnam are fast-tracking their energy system transformation.

According to Carbon Tracker, the fossil fuel era is well and truly over. Solar, nuclear power and wind power could replace fossil fuels in the world’s electricity markets by the mid-2030s. Furthermore, renewables will push fossil fuels out of the world’s total energy supply by 2050.

The Lesser-known Obstacles to the Clean Energy Transition

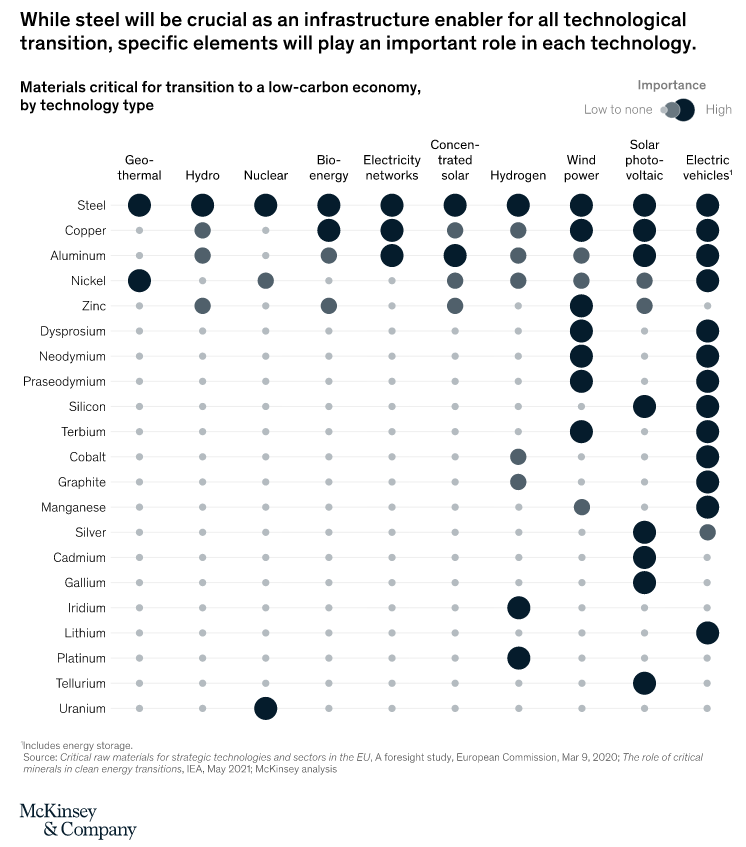

The spotlight for the energy transition often falls on crucial factors like political will, reforms, investments, incentives and more. However, they would all struggle to make a difference without the underlying core enabler: sourcing raw materials to produce renewable energy systems.

Clean energy infrastructure is highly dependent on the supply of copper, nickel, steel, aluminium, polysilicon and other raw materials. Renewable energy commodities play an integral part in the production of wind turbines, batteries, solar PV and other accompanying infrastructure.

The Supply Chain Risk

While the supply chain affects virtually all markets, its potential implications are even more devastating when it comes to the clean energy niche.

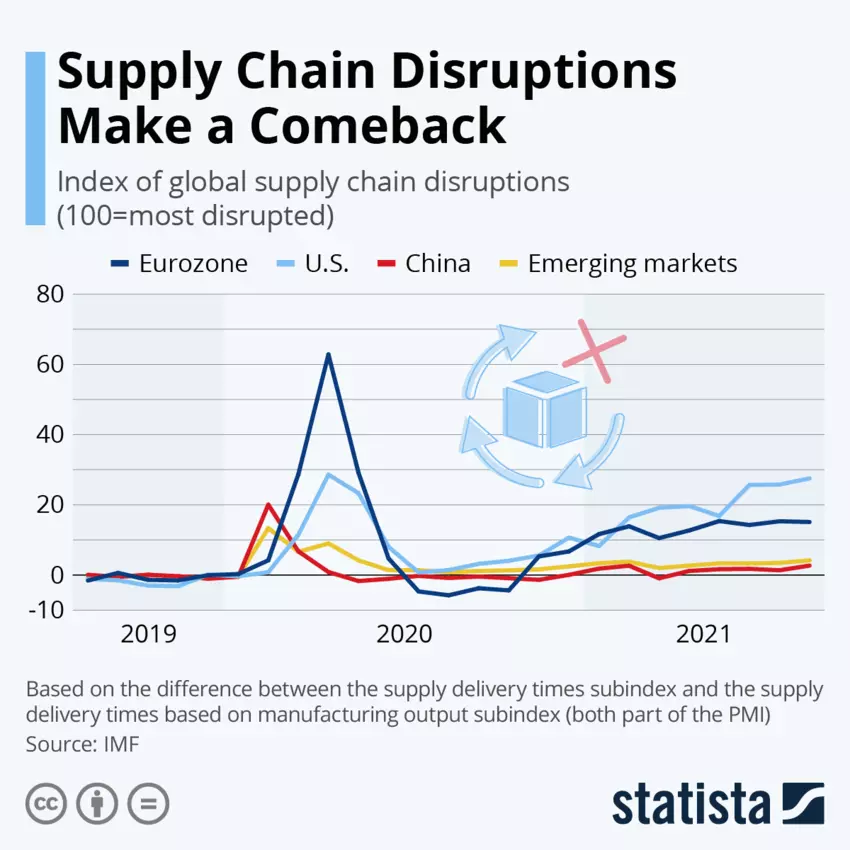

The Suez Canal blockage and the global pandemic have severely impacted international trade in the last two years. Events like these have shown that companies’ business continuity plans are seriously deficient. However, in the globalised world we live in today, such impacts don’t affect just particular business units. They have a ripple effect, which translates through the entire supply chain, affecting every node in it.

More importantly, supply chain disruptions aren’t just one-off events. They are becoming more and more common.

According to McKinsey, supply chain disruptions lasting for a month or longer now happen every 3.7 years. In the case of the COVID pandemic, the disruptions will have long-lasting implications on global supply chains, lasting months or even years.

While such delays might be bearable for other industries, when it comes to renewable energy and the global decarbonisation and carbon capture journey, the race against the clock leaves no room for experiments.

The Impact on Renewables

Considering that energy systems running on wind, solar, and battery resources are very mineral-intensive, they are highly affected by supply chain disruptions and soaring metal prices.

Tellurium and polysilicon are vital ingredients in most solar panels. Steel and resins are essential for the production of wind turbines. Lithium, aluminium and cobalt are critical raw materials for the electric vehicle (EV) industry. Copper is crucial to grid construction and electrification.

The common theme between these renewable energy commodities is that their prices and shipping costs have skyrocketed in the past two years. Among the reasons are supply chain crunches caused by events like the Suez Canal blockade and growing consumer demand. In 2021, solar companies also had to deal with shortages of semiconductor chips, which will continue this year.

The soaring raw-material costs alongside supply chain disruptions and supply shortages are putting a dampener on the renewable energy industry’s growth, causing project delays and cancellations.

These setbacks come at a time when solar power has become the cheapest electricity source, while EVs are just beginning to hit price parity with gas-powered cars.

To prevent further obstacles to the industry’s growth, diversifying and securing the supply of renewable energy commodities is of utmost importance.

Securing the Supply of Renewable Energy Commodities in the Commodity Markets: The Number One Priority

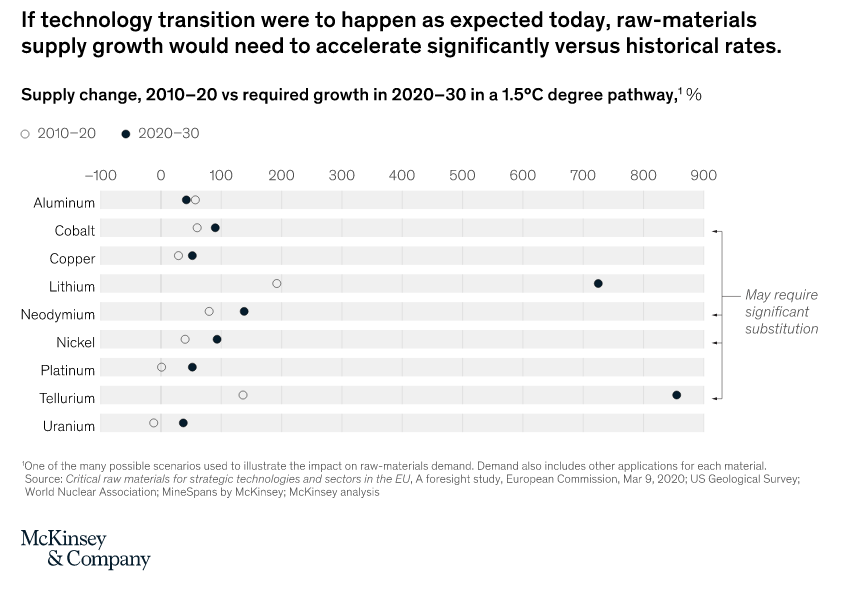

Securing the supply of renewable energy commodities is crucial to avoid damaging the prospects of net-zero by 2050. However, securing supply alone won’t be enough. Companies should be looking to scale it up. McKinsey finds that the optimal pace of transition requires that certain raw materials be available within a relatively short time period. In some instances, they should be available at volumes that are 10 times or more than the current market size to prevent shortages and keep new technology costs competitive.

According to Bloomberg NEF, by 2030, demand for cobalt will jump by about 70%. Lithium and nickel consumption in the battery sector will be 500% higher. The demand for manganese, iron, phosphorus, graphite, copper and other materials will also grow significantly.

To adequately address this trend, efforts should begin today, as sourcing supplies of key raw materials can take years of exploration and construction. Furthermore, any delay would further distance the world from decarbonisation, worsening climate change impacts.

However, initiatives are already underway. The International Renewable Energy Agency (IRENA) has launched the Collaborative Framework on Critical Materials for the Energy Transition. The platform promotes the exchange of knowledge and best practices and coordinates actions to ensure that the scarcity of minerals doesn’t threaten the accelerated deployment of renewable energy. Working groups under the new framework develop strategies to reduce the supply risks of critical materials and enhance the understanding of the market situation and outlook.

Preparing for a Future of Growing Demand for Renewable Energy Commodities

McKinsey projects that renewable energy commodities’ supply, demand and price reactions will lead to feedback loops. These loops will result in supply chain reactions, technology shifts and materials substitution. All nodes in the supply chain – from the producers to the suppliers and end-user sectors – should consider such prospective challenges by creating resilient business continuity plans in advance and being prepared to meet the demand growth to avoid further slowing down the decarbonisation progress. Without such efforts, we will be prolonging the future of fossil fuels.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more