Accelerating the Energy Transition Through Carbon Pricing Instruments

Carbon pricing plays an important role in driving corporate emission reductions. (Source: Medium)

01 July 2021 – by Eric Koons

The National Paris Agreement has set goals that take serious work to achieve. Carbon pricing is playing a key role in facilitating this transition. A Carbon pricing instrument can come in various forms and essentially require greenhouse gas (GHG) emitters to pay for their emissions. The tool incorporates both emission levels and the external costs associated with GHG emissions (e.g. crop damage).

The price set on emissions has incentivized companies to transform and reduce their GHG emitting activities. Furthermore, they are also trying to find ways to offset their carbon footprint.

Carbon Emissions: What Are Some Measures That Can Help?

Examples of carbon pricing instruments include emissions trading systems (ETS), carbon taxes, carbon offset mechanisms, results-based climate finance (RBCF), and internal carbon pricing.

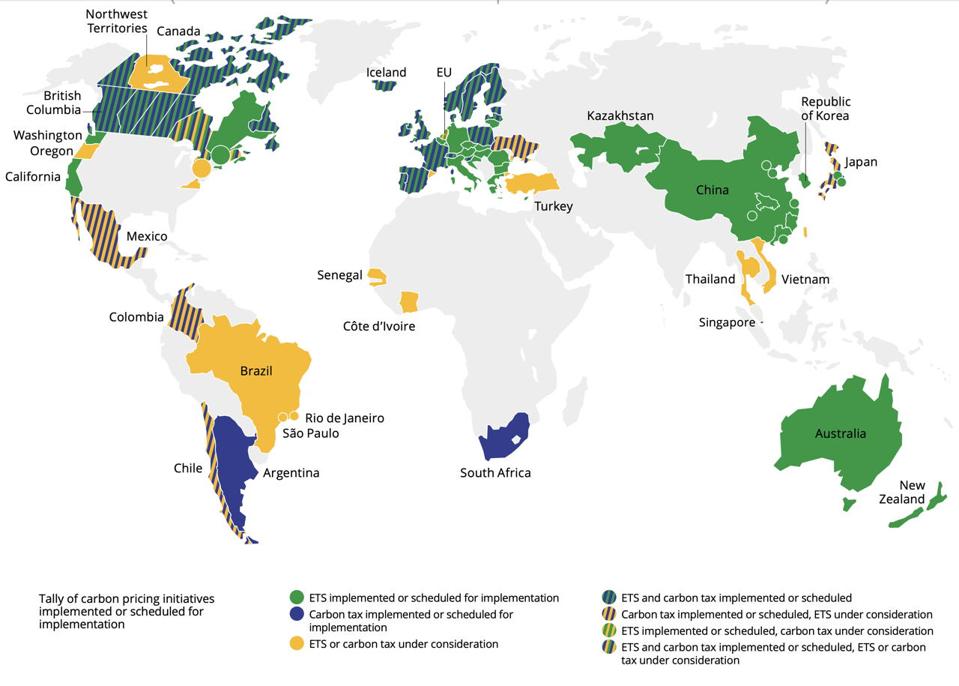

Globally, the adoption of carbon pricing has been increasing. This has caused a significant uptick in associated benefits such as emissions reductions and increased government revenues.

In 2020, 61 carbon pricing initiatives were implemented or scheduled for implementation. This is a large difference from the 19 in 2010. This covered 22% of global GHG emissions in 2020.

What is Internal Carbon Pricing?

Because carbon policies vary vastly country to country, many companies are taking carbon pricing into their own hands. Internal carbon pricing is a practice that allows companies to put a value per ton of carbon they emit, Internal carbon pricing is not compulsory nor bound to carbon emissions regulations. However, carbon pricing is an important component to think about for future investments and general competition in a lower-carbon future.

Carbon Pricing Instrument Towards Driving a Clean Energy Transition

In Europe, carbon pricing instruments have helped reduce the growth of the coal-fired power sector. Specifically, in 2019 it led to an 8.3% emissions reduction from the sector. That same year, government revenues from carbon pricing initiatives were over USD $45 billion, of which nearly half were dedicated towards environmental and development projects.

Some carbon pricing instruments have been developed to support specific outcomes. Specifically, these focus on health, biodiversity, resilience, water retention, and habitat protection.

Incentivising New Clean Energy Technologies

Carbon pricing instruments also have the benefit of promoting contributions made towards developing and adopting clean energy technologies. In the European Union, when the carbon price was approximately €30/ton, patents for renewable energy technologies and carbon sequestration increased by 30%. Similarly, the state of New York recently adopted a carbon price instrument that has shown similar renewable energy investment trends.

The Challenge Associated with Carbon Pricing

Even though carbon pricing has shown significant success, challenges do still remain.

These challenges mostly relate to carbon leakage, policy alignment issues, and how to effectively spend the revenues generated.

- Carbon leakage occurs when a GHG emitter relocates their carbon-intensive activities to a location which has relatively less, or no carbon pricing instruments in place.

- Political challenges include ensuring that the pricing of carbon is efficiently aligned with other existing policies.

- Revenues can face expenditure challenges related to preferential treatment of groups, lack of clear returns, and carbon price efficacy issues.

To address these challenges, guidance on carbon pricing has been published by the World Bank’s Partnership for Market Readiness for a wide variety of stakeholders.

The Perfect Storm for Clean Energy Investors

Overall, efficient carbon pricing creates benefits and opportunities for an array of stakeholders. Notably, these include governments, businesses, and clean energy investors.

Carbon Pricing and Policy

By incorporating carbon pricing into policy tools, governments can address their GHG-related external costs, increase revenues, and contribute towards their GHG emission reduction goals. Businesses benefit by becoming more competitive with carbon-intensive industries, effectively taking advantage of clean energy-related incentives in their regions. The combined public and private benefits create financing opportunities for clean energy investors, providing carbon offsets and clean energy solutions.

![]()

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more