Are Carbon Offsets a Scam? A Deeper Look

Source: Medium

30 October 2024 – by Eric Koons

Carbon Offsets Legitimacy and Effectiveness In Question

Are carbon offsets a scam? This question has become increasingly relevant as the carbon credit market, both voluntary and compliance-based, has seen significant growth over the past decade.

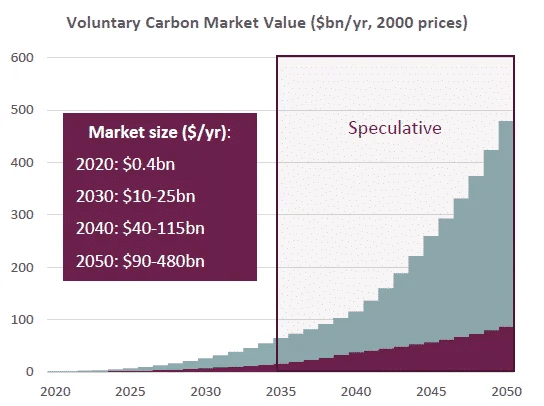

The voluntary market, where companies and individuals purchase credits to offset their own carbon emissions, was valued at USD 1 billion in 2021 and is expected to reach USD 50 billion by 2030. The compliance market, driven by regulatory requirements, is even larger, with estimates putting it around USD 850 billion in 2021.

However, as the market has expanded, so have concerns about fraud and scams, casting a shadow over its credibility and effectiveness.

Offsetting Carbon Emissions to Deal with Climate Crisis

Offsetting carbon emissions is a crucial strategy in combating the climate crisis. Carbon offsetting involves compensating for the emissions produced by various activities through carbon offset programs that reduce or capture an equivalent amount of carbon dioxide from the atmosphere. Key methods include reforestation, renewable energy projects, and carbon capture and storage technologies.

Is the Carbon Credit Market a Scam?

“Are carbon credits a scam?” is a question that arises from the growing instances of fraudulent activities within the market. Overall, the carbon credit market is not a scam. It plays a crucial role in global decarbonisation efforts by providing financial incentives for reducing greenhouse gas emissions. While not a standalone solution, carbon credits are critical for several hard-to-decarbonise sectors.

Well-known Carbon Credit Scams

While there are many instances of small-scale carbon credit scams, primarily individual projects or brokers selling fraudulent credits, there are also several cases of major scams that have rocked the carbon credit market as a whole.

South Pole Carbon Credit Scam

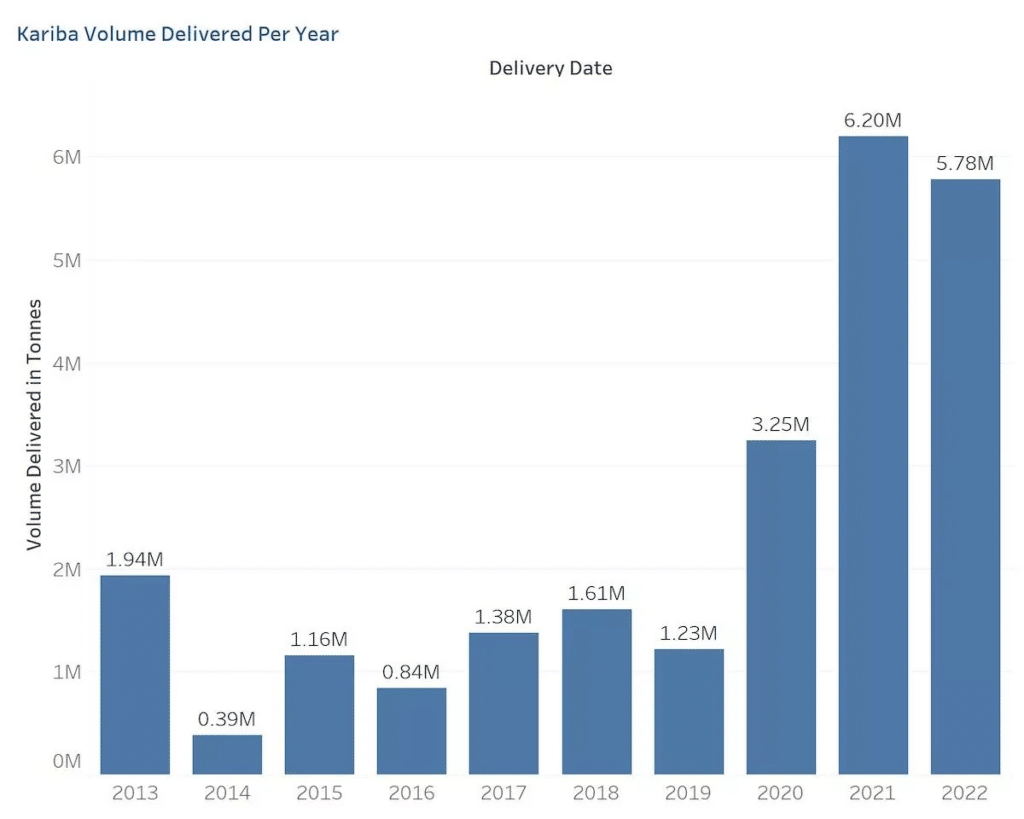

The South Pole carbon offsets scam involves significant overstatements of the environmental benefits and does not represent genuine carbon reductions claimed by South Pole, a prominent carbon credit provider. Its Kariba Forest project in Zimbabwe, which claimed to prevent deforestation equal to the size of Puerto Rico, produced far fewer carbon credits than claimed.

Estimates suggest discrepancies up to 30 times less than reported. This resulted in companies like Nestlé and Gucci inadvertently inflating their climate actions. Additionally, most of the EUR 100 million generated did not benefit local communities but went to South Pole and its partners.

In response, South Pole claims it has stopped working with the Kariba Forest project developer and has implemented more robust quality assurance protocols for its carbon offset projects.

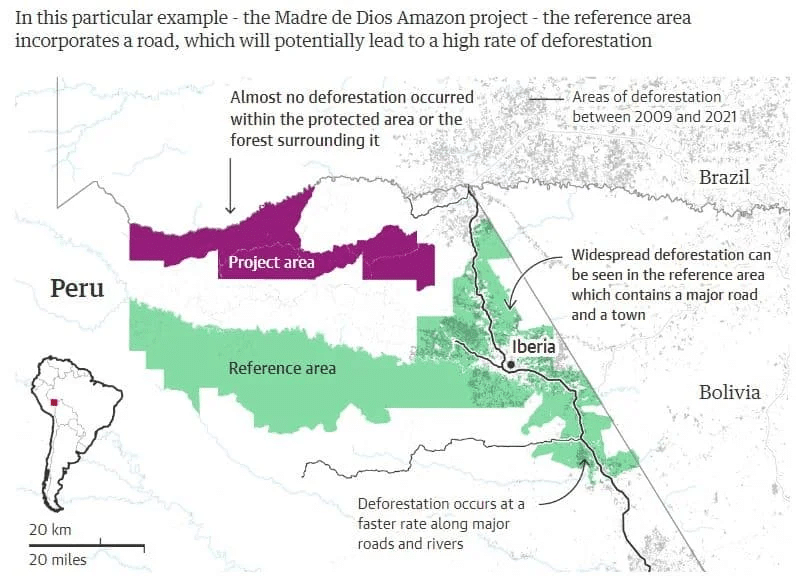

Verra Carbon Credit Scam

The Verra carbon credit scandal revolves around the credit issuer significantly overestimating the emissions reductions for its rainforest projects. Investigations revealed that only 6% of Verra’s “avoided deforestation” credits represented actual emissions reductions.

High-profile companies like Gucci, Shell and Disney were affected. This controversy led to a significant drop in carbon credit prices and resulted in the resignation of Verra’s CEO. The scandal raised serious questions about the credibility of carbon offset projects and whether deforestation projects effectively reduce carbon emissions.

Carbon Neutral Investments

The Carbon Neutral Investments (CNI) Brown scam involved the sale of nearly worthless carbon credits to the public at highly inflated prices. CNI facilitated sales through a network of brokers who cold-called public investors, leading to GBP 36 million in sales. In total, 19 companies were involved in the scam.

As a result, many investors lost substantial sums of money, and trust in the market was further damaged. Legal action resulted in several of the companies being shut down with fines and jail time for key figures.

The Impact of Carbon Offset Fraud on the Market

Fraud within the carbon offset market has far-reaching implications. It erodes trust among investors, who may become reluctant to invest in carbon offset projects. This hesitation can lead to reduced funding for legitimate projects, ultimately slowing progress in the fight against climate change.

Additionally, fraudulent activities can diminish the perceived effectiveness of carbon credits as a tool for reducing own emissions. When credits do not correspond to actual reductions, the overall impact on global emissions is weakened, undermining climate goals.

Ensuring Transparency and Regulation

While the carbon credit market is not inherently a scam, fraud and deceptive practices undermine its effectiveness and credibility. Transparency and robust regulation are essential to maintaining market integrity and public trust. Strengthening verification processes, enhancing oversight and imposing strict penalties for fraudulent activities can help protect the market’s legitimacy.

Despite these challenges, the carbon credit market remains a valuable tool for decarbonisation when appropriately managed, offering significant potential to reduce global emissions and combat climate change.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more