3 Top Carbon Capture Stocks in 2024

11 June 2024 – by Eric Koons

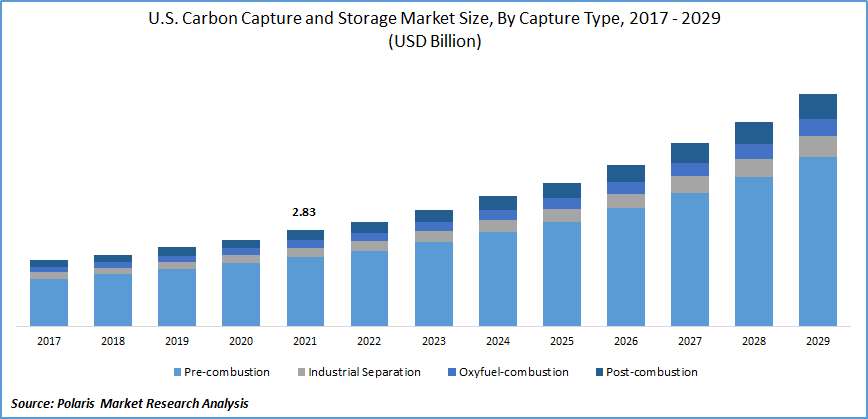

Investing in the top carbon capture stocks 2024 is a way to diversify your portfolio and invest in future technologies instead of investing in companies that are examples of greenwashing. Considering that many carbon capture companies are young, the pricing is affordable yet often volatile. With the emergence of Europe’s renewable energy efforts, the US’ renewable portfolio standard and global net-zero goals, carbon capture is a growing energy industry that will see increasing adoption worldwide. There should be more emphasis on renewable energy to fight global warming.

What is Carbon Capture?

Carbon capture is a technology that sequesters carbon from the atmosphere and either stores the captured carbon permanently underground or uses it in other industries. Agricultural, chemical and even architectural solutions use carbon dioxide as raw material and isolate it from the atmosphere.

Although it’s very young, the carbon capture market has seen the rise of 21 large-scale carbon capture projects and hundreds more in the pipeline. Top carbon capture and storage companies include:

3 Best Carbon Capture Stocks in 2024 to Invest In

The profitable business of capturing carbon will skyrocket in the upcoming decades with the technology development. Many applications, government subsidies and global demand for carbon credits are the driving forces for the industry. However, not every carbon capture company is publicly available. Here are some of the best carbon capture stocks 2024 to keep an eye on today:

Aker Carbon Capture (ACC.OL)

Aker, a Norwegian carbon capture company, is publicly available. This is one of the most promising companies that focuses on the entire process – from carbon capture and temporary storage to transportation, utilisation and permanent storage. The company has been in the business for over 20 years. Although the carbon capture stock is somewhat volatile, the efforts of the Norwegian government to limit climate change make the future of Aker Carbon Capture stabler.

EQUINOR (EQNR)

The second-largest European producer of natural gas has a lot of equity at its disposal. Equinor has entered the carbon capture market and has expanded to 30 countries so far. This stock can be seen as a better bet for value investors, especially in the long run. The stock also pays a dividend. However, at 1.46%, it is hardly the most attractive one. On the other hand, low dividend yield can mean the company is reinvesting more into growth.

Delta CleanTech (DELT)

Delta CleanTech is one of the oldest publicly traded carbon capture companies. Established in the 2000s, it deals with the source-capture of CO2, utilisation, hydrogen production and ethanol purification. This Canadian company is developing sales through international efforts. It is about to open offices in London, Beijing, Sydney and Houston. Its long time in the market, risk diversification through many means of utilising the captured CO2, and its experience with international CO2 capture projects over the last 15 years make it a mature option in a relatively new industry.

Other Carbon Capture Stocks

Besides these three, there are many more public carbon capture companies to invest in. Most have headquarters in Canada, the US and the UK. For example, some other publicly traded carbon capture companies include:

- Pond Technologies Holdings (POND)

- Advantage Energy (AAV)

- Schlumberger (SLB)

- Occidental (OXY)

The Future of Carbon Capture Technology Companies and Stocks

Currently, captured carbon is used in synthetic fuel generation, algae farms (for biofuel and kerosene production) and greenhouses. It is also used for enhanced oil recovery. Moreover, sand and gravel made from CO2 have the potential to decarbonise concrete production, one of the largest CO2 emitters. The market is lucrative and is expected to grow to USD 4 trillion by 2050.

As international pressure to reduce or offset CO2 emissions is growing, a new field of symbiotic cooperation among companies is being born. Source-capture or point-of-emissions capture is a particularly attractive field that allows the capturing of large quantities of CO2 from power plants and heating plants. As a result, this effectively reduces their emissions and offers readily available raw materials for carbon capture technology companies.

Final Considerations – What Carbon Capture Investors should do?

Although it is still in early development, the carbon capture and storage (CCS) or carbon capture and utilisation (CCU) market is quickly modernising. The entry of large players into the field (Exxon Mobil, Chevron and Shell) means that the interest in decarbonising carbon-heavy industries exists. As a result, carbon capture stocks are projected to grow, especially as the market matures towards the mid-century and energy transition becomes a reality.

This article is part of our detailed take on carbon capture.

We will discuss more related topics in the following articles, such as the top 10 carbon capture companies.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more