China’s 14th FYP – What could this mean for the Energy Sector?

David de las Haris

10 March 2021 – by Eric Koons

China is responsible for nearly one-third of all emissions globally, making it a primary candidate for renewable energy. This year on the 5th of March, the country will begin the week-long process of negotiating the local and national Five Year Plan (FYP). This plan will outline economic development and reform for the next five years. The FYP creates country-wide goals for economic growth, welfare, environmental protection, and energy consumption.

2021 will mark the official 14th FYP for China. This is a big deal globally, as China plays a primary role in renewable energy development. It is expected that this FYP will include a variety of renewable energy related initiatives and moves away from fossil fuels. Depending on how the 14th FYP is put together, there may be significant investment opportunities available for local and international businesses.

This is nothing new, as China has created a precedent of discussing renewable energy in their FYPs. The FYPs between 2001 and 2015 slowly increased the country’s level of accountability in the energy sector, particularly emissions. But the 13th FYP (2016-2021) was where the real shift to renewable energy began. China set the goal to reduce energy and carbon intensity by 15% and 18%, respectively. Both goals were met before the five-year stretch was over.

This year, there is a lot of talk around China’s potential regarding their energy consumption and distribution, especially since entering in the recent EU investment deal. The country has shown it can develop renewable resources readily, but how will their coal exports be addressed?

What to Expect From China’s 14th Five Year Plan (FYP)

In September 2020, President Xi pledged to announce (and did) larger climate change goals aimed for 2030. The plan includes cutting carbon emissions per unit of GDP by 65% from 2005 levels and increasing the country’s share of non-fossil fuel energy in primary energy consumption to 25%. This will put peak carbon emission rates before 2030 and play a crucial role in achieving carbon neutrality by 2060. The upcoming 14th FYP is a crucial opportunity for China to implement short term strategies to achieve these goals.

Renewable Energy vs. Coal Power

These 2030 goals will not be achieved by only focusing on renewable energy, but also with decreased coal use. We expect to see both of these touched on in the 14th FYP.

Renewable energy is a massive market with huge growth potential. It provides multiple incentives for China beyond just decreasing emissions. Increased renewable energy development provides jobs, reduces health costs, and increases economic stimulus. Particularly now, foreign investment is a way for China to increase their global share of renewable energy generation.

On the flip side, China will need to reduce its dependency on coal, which currently accounts for 58% of the country’s energy. China’s coal plants are the largest contributors to their CO2 emissions, which in 2019 totaled 10.3 billion tones.

This point is well established and has been discussed in the government. China’s Electricity Council has noted that they may potentially set the 14th FYP cap for coal sourced energy at 1300 GW annually. According to recent research, this is an improvement, but does not align with the 2030 goal of 680 GW of coal energy.

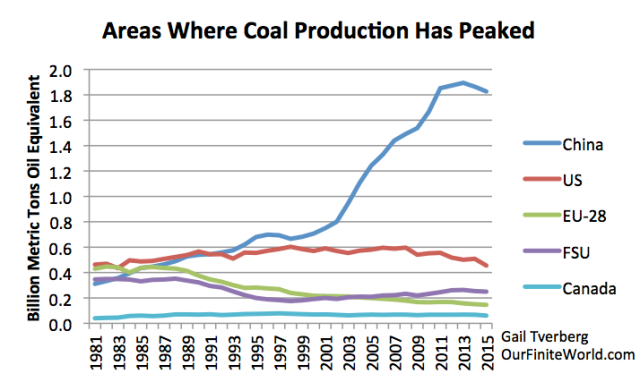

With the right investors and input, the 14th FYP can significantly improve China and its renewable energy reliance. Currently, the country is the leader in renewable energy sourcing, but this does not quite equate to a clean footprint when considering its immense population size and energy consumption. China is also still the world’s largest coal producer, producing as much coal as the rest of the world combined. This juxtaposition of a “clean energy” image at home with massive coal production may cause issues in the country’s future.

Renewable Energy Competition

Other Asian countries like Japan, South Korea, and Vietnam have begun to take on the market aggressively. Their endeavors have highlighted how valuable solar and wind power are when it comes to maintaining economics and sustaining a large, demanding population. Their progress this past year alone should help influence the Chinese officials and investors to further their renewable energy development.

China’s FYP – an Investment Opportunity

The 14th FYP is an opportunity for investing in renewable energy that China cannot pass up. Many analysts even believe China can do more than the targets outlined for 2030. Recent research suggests that by reducing carbon intensity by 70-75%, peak carbon emissions could be reached by 2025— five years sooner than projected. Such an accomplishment would cement China as both the leading country in renewable energy production and as an epicenter for investing in them.

The Chinese market already dominates so many facets of the global economy, and it would only make sense for it to take control of renewable energy. This is a prime opportunity for local and foreign investment to capitalize on the demand for more renewable energy infrastructure.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more