Why Asian Financiers Are Still Financing Coal

High carbon emission through coal power plants in Asia

12 April 2021 – by Ankush Kumar

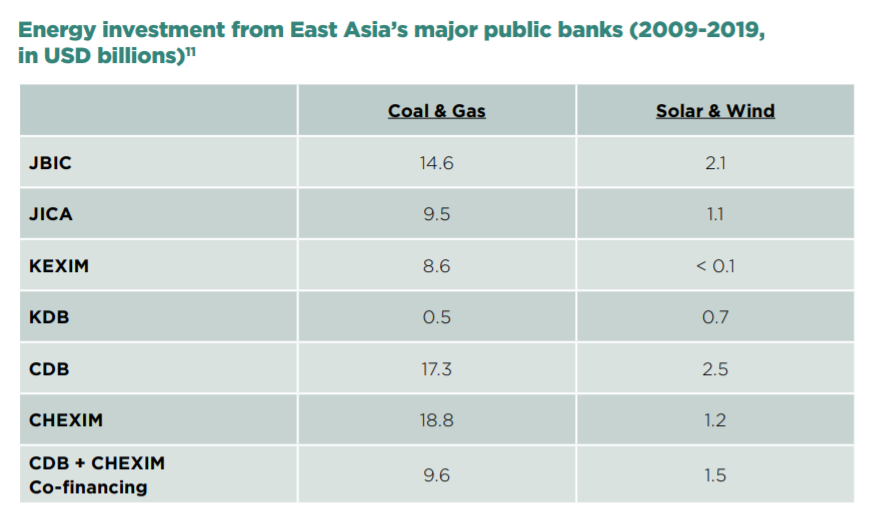

Global banks have funneled trillions of dollars in coal financing since the Paris Climate Agreement in December 2015. Though some of the leading financiers are from the US and Canada, Asian ones are not far behind. From 2009 to 2019, the major public banks from China, Japan, and South Korea committed USD $9.1 billion to renewable energy investments comprising solar and wind. However, coal and gas registered USD $78.9 billion of funding in the same period, a Greenpeace report found.

In 2018, all three Asian countries combined emitted one-third of all global carbon emissions. Although they have declared 100% carbon neutrality by 2050 (Japan and Korea) and 2060 (China), experts demand a concrete plan on how these nations will meet their targets.

The Greenpeace report states that due to political risk and rising trade protectionism, public banks’ risk mitigation for the private sector has become more and more crucial. Public banks, therefore, need to quickly develop comprehensive renewable energy finance processes for overseas investments.

Top financiers in Asia curtail fossil fuel funding

Following the net neutrality announcements, fossil fuel funding in Southeast and East Asia has tightened. In 2019, the three large Singaporean players – DBS Bank, OCBC Bank, and UOB – announced that they will stop financing new coal-fired power plants. Instead, they declared their interest in renewable energy investments. In Japan, major banks like Mizuho, Sumitomo Mitsui, and Mitsubishi UFJ Financial Group (MUFG) declared to stop financing coal-fired power plants and showed intent to support sustainability and climate change. Korea’s two biggest fossil fuel investors –Samsung Life and Samsung Fire & Marine – said they would no longer invest or underwrite insurance for coal-based power plants.

Asian banks make statements to stop coal financing

While many of these investors have declared not to finance coal, they have made exclusions in their statements. For instance, they declare to develop coal plants only for the betterment of the economy or to use low carbon technology.

Rising uncertainties in coal-based power projects

The COVID-19 pandemic has certainly had an adverse impact on most industries, including coal financing and coal fired power plants. However, experts suggest falling renewable energy prices, lower electricity demand, and lack of funds could be other reasons for project cancellations.

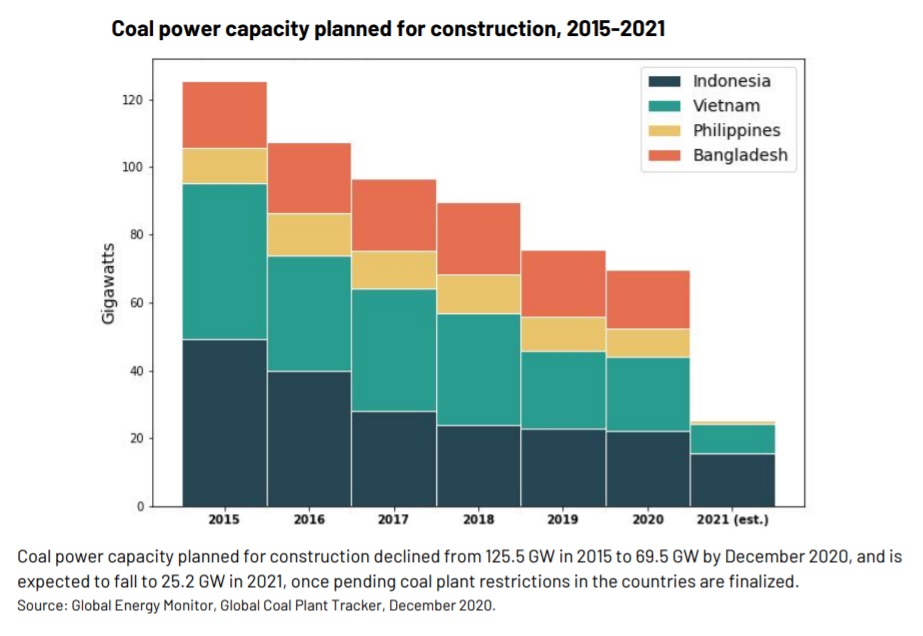

“South and Southeast Asia may be seeing their last new coal plant projects, as this year government officials in Bangladesh, Philippines, Vietnam, and Indonesia have announced plans to cut up to 62.0 gigawatts of planned coal power,” non-profit research organization Global Energy Monitor (GEM) 2020 report stated.

In such a scenario, China could be the last and biggest investor of fossil fuel in the next decade. Beijing’s net neutrality commitments are only about 40 years from now, while an average coal power plant runs for up to 45 years. Therefore, investments can remain profitable. According to the GEM, China has financed 30% (USD $15.5 billion) of the USD $51.8 billion in coal power capacity funding that has reached a financial close since 2015 in Bangladesh, Indonesia, the Philippines, and Vietnam.

A gradual shift in coal power plants financing

One troubling question may remain: Why do Asian financial institutions still want to finance coal despite the underlying risks? “Often projects don’t move forward as initially planned, like in the case of Bangladesh, where more coal-fired capacity was originally planned than what is now needed,” Katrin Ganswindt, energy campaigner with the German NGO Urgewald, told Energy Tracker Asia. “This is one reason why so many plants were canceled.”

Ganswindt added that another way of financing coal is to finance the company rather than the project itself. In recent years this has resulted in a gradual shift from fossil project to corporate financing. “Investing in coal power plants might still be lucrative in some jurisdictions, where capacity payments are still in place,” she explained.

To boost investment from private companies, power utility companies offer individual power producers security of future returns through Power Purchase Agreements (PPAs). Irrespective of the electricity demand, the power utility is required to pay the guaranteed amount as per the PPA for 25 to 30 years.

“This is one of the reasons why Bangladesh scrapped several projects because they were running the danger of bankrupting the government,” the energy campaigner said.

Potential of renewable energy investments in Asia

The dynamics in the South and Southeast Asian fossil-fuel business have changed drastically. These developments clearly suggest that renewable energy investments are the future. A report from Greenpeace identifies a USD $205 billion opportunity for renewable energy finance in Southeast Asia in the next ten years.

China, Japan, and South Korea can all enable low-cost energy transitions in the Asian region and make a profit from it, Greenpeace energy campaigner Daniel Read told Energy Tracker Asia. China is the world’s largest exporter of PV modules and a major exporter of wind energy technology components. Malaysia is number three in the production of solar cells. And the Association of Southeast Asian Nations (ASEAN) has made an ambitious target to achieve 23% of its primary energy from clean sources by 2025. The expertise and potential of these countries along with their strong presence in the Asian region gives them a formidable opportunity for future renewable energy development. “But we haven’t seen that at the scale and pace that we need”, Daniel Read from Greenpeace said. Instead, he observes a race to the bottom for fossil fuels.