CREA: Indonesia’s RUPTL Plan Puts Fossil Fuels First, Renewable Energy Later

15 October 2025 – by Viktor Tachev

Despite internationally backed climate commitments, pledges to transition to a 100% renewable-led energy system and claims of phasing out coal, Indonesia’s new 10-year power grid plan, Rencana Umum Perencanaan Tenaga Listrik (RUPTL), continues to prioritise fossil fuels, according to new research by the Centre for Research on Energy and Clean Air (CREA). As a result, Indonesia — the world’s largest thermal coal exporter, third-largest coal producer and sixth-biggest CO2 emitter— now risks derailing not only its own decarbonisation progress but also the world’s, in a year that marks the 10th anniversary of the Paris Agreement and the start of what proves to be the single most crucial period for climate action in history.

CREA: RUPTL Lowers Indonesia’s Clean Energy Target and Pursues a 40% Growth in Fossil Fuel Power Generation

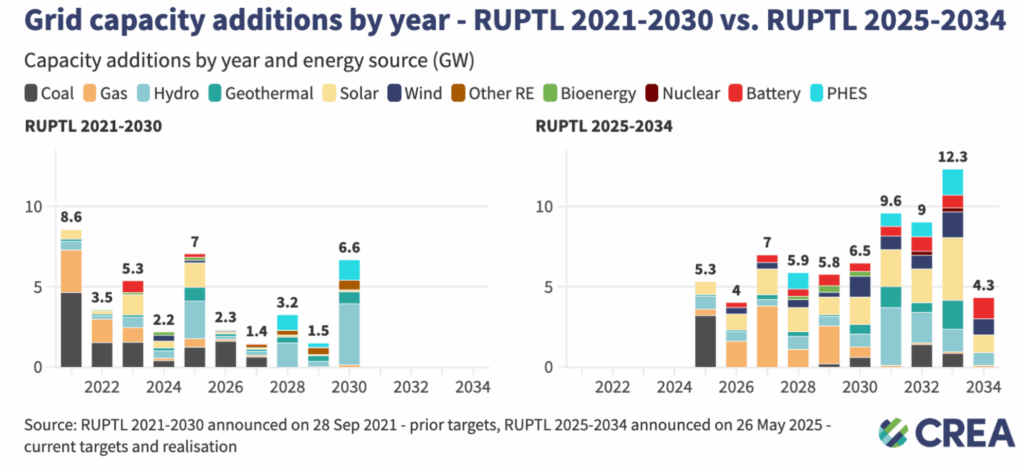

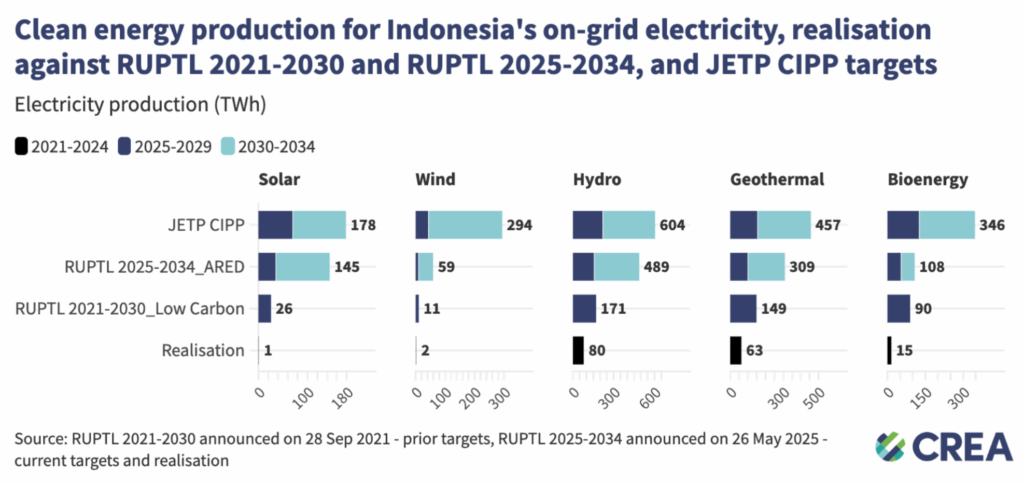

CREA’s in-depth analysis of Indonesia’s energy plan, “Indonesiaʼs RUPTL 2025-2034: Fossils first, renewables later,” reveals that while clean energy generation in the country will quadruple over the target period (from 44 TWh to 172 TWh), fossil fuel power generation is also poised to increase by a massive 40% (from 295 TWh to 407 TWh). Importantly, the experts find that not only does the RUPTL 2025-2034 continue the rapid expansion of fossil power generation, but it also lowers Indonesia’s targeted 2030 renewable power capacity.

According to the plan, Indonesia will add 16.6 GW of new coal and gas power capacity, while the target for renewable power capacity in 2030 drops from 20.9 GW to 18.6 GW. The analysts note that in recent years, the sole state-owned power company, PLN, has actively pursued the expansion of fossil fuel-based capacity and has not been willing to implement earlier targets for renewable energy expansion or address coal phaseout.

Furthermore, the experts find that the RUPTL 2025-2034 plan targets expanding fossil fuel power (coal and gas) up to 2034, while it also delays significant renewable energy deployment post-2030. As a result, the new energy plan effectively takes a step back from the previous RUPTL 2021-2030 and contradicts climate commitments, such as the JETP, and President Prabowo Subianto’s declarations that Indonesia will transition to 100% renewable energy within 10 years.

Out of the planned renewable energy capacity, solar will account for the largest share (17.1 GW), followed by hydro (11.7 GW), wind (7.2 GW), geothermal (5.2 GW) and bioenergy (0.9 GW). The new RUPTL includes more geothermal, hydro, wind and bioenergy projects from the JETP Comprehensive Investment and Policy Plan (CIPP) compared to RUPTL 2021-2030, but fewer for solar power. According to the on-grid power generation targets in the JETP, Indonesia should achieve a ninefold increase in renewable energy by 2034 and a 16% decrease in fossil-based electricity. According to CREA, the full integration of all renewable energy projects outlined in JETP CIPP would increase Indonesia’s renewable energy target by an additional 22 GW, sending a clear signal to investors and affirming the country’s national energy transition commitments.

While the experts note that President Prabowo’s recently announced ambitious 100 GW solar plan does aim to reorient Indonesia’s energy transition by building 80 GW of decentralised solar and battery systems in 80,000 villages, the administration needs to address current national targets and modernise the grid outside of Java to support rapid renewable energy deployment.

Continued Fossil Fuel Buildup Raises Various Risks For Indonesia

According to CREA, the front-loading of fossil fuels in the first five years of the plan creates a real and significant infrastructure lock-in. If the ambitious growth targets for renewables in the second half of the plan (2030-2034) aren’t met, Indonesia will be left with a power grid dominated by fossil fuels for decades, making future integration more difficult and costly.

The continued expansion of fossil fuels is also a guaranteed way to exacerbate the severity of the climate disasters that have been tormenting the country in recent years. Without urgent decarbonisation along with the continuation of a high-emissions pathway, similar to the one that Indonesia’s current policies project, heatwaves in the country will last almost 8,000% longer by 2050, disrupting the workforce and devastating the agricultural sector. Increasing sea temperatures are set to significantly decrease fish stocks, causing up to IDR 66 trillion (over USD 4 billion) in losses. Meanwhile, rising sea levels and the associated coastal flooding risk are expected to cause IDR 632 trillion (over USD 40 billion) in damage to infrastructure.

In total, the Indonesian government estimates that the country is at risk of facing a potential 40% GDP loss by 2050 due to climate impacts. On the other hand, researchers note that by investing in a low-carbon economy now and protecting sectors such as agriculture, fisheries, infrastructure, tourism and others, Indonesia can limit those losses to 2% by 2050.

Furthermore, continued investments in fossil fuel infrastructure will further worsen the already poor air quality in the country. In IQAir’s 2024 World Air Quality report, Indonesia, the world’s fourth most populous country, was ranked as the worst performer in Southeast Asia and the 15th worst globally. Coal plants, as previously reported, are a major source of air pollution. In a dedicated analysis, CREA finds that an accelerated phaseout of Indonesia’s coal fleet could prevent 182,000 deaths and avoid USD 130 billion in health costs by 2040, while mandatory air pollution controls would unlock a net benefit of USD 70 billion. According to the experts, despite air quality being raised as a national issue, there has been a years-long standstill on national commitments specifying time-bound pollution reduction targets, highlighting a lack of political leadership and nationwide cooperation.

Capitalising on Indonesia’s Renewable Energy Potential: Ambitious Policy Measures Can Unlock Massive Economic Gains

While Indonesia has immense solar potential, estimated at around 3,295 GW, as of 2024, it had just 1.75 GW of operational grid-connected renewable power projects. About a third of that capacity came from solar (625 MW), but none from wind. In total, researchers find that Indonesia harnesses just 0.3% of an estimated 3.7 TW of potential renewable electricity.

Despite the weak clean energy targets in the new RUPTL, Indonesia has the means for a course correction. For example, CREA notes that the 290 ground-mounted solar projects already deployed are proving highly economically viable. While the island nation faces its own geographical challenges, capitalising on its potential isn’t impossible, as evidenced by the case of Japan, which has successfully built a decentralised energy system that leverages distributed renewable energy. As a result, Indonesia can effectively optimise local resource utilisation to ensure power continuity. Similar projects across the Philippines and Thailand have also proven successful, and, according to CREA, following the same path will enable Indonesia to assist the 1.3 million households that still lack access to electricity.

According to CREA, unlocking the benefits of the clean energy transition requires realigning national planning with local potential and climate commitments, so that the RUPTL explicitly incorporates and prioritises the vast renewable energy potential identified in provincial planning. This would require revisiting near-term renewable energy capacity additions and aligning them with the JETP CIPP’s 2030 targets and a 1.5°C scenario pathway. For this measure to succeed, the government must accelerate the deployment of solar, wind and dispatchable renewables across all suitable regions, beyond just Java and Bali, the experts warn.

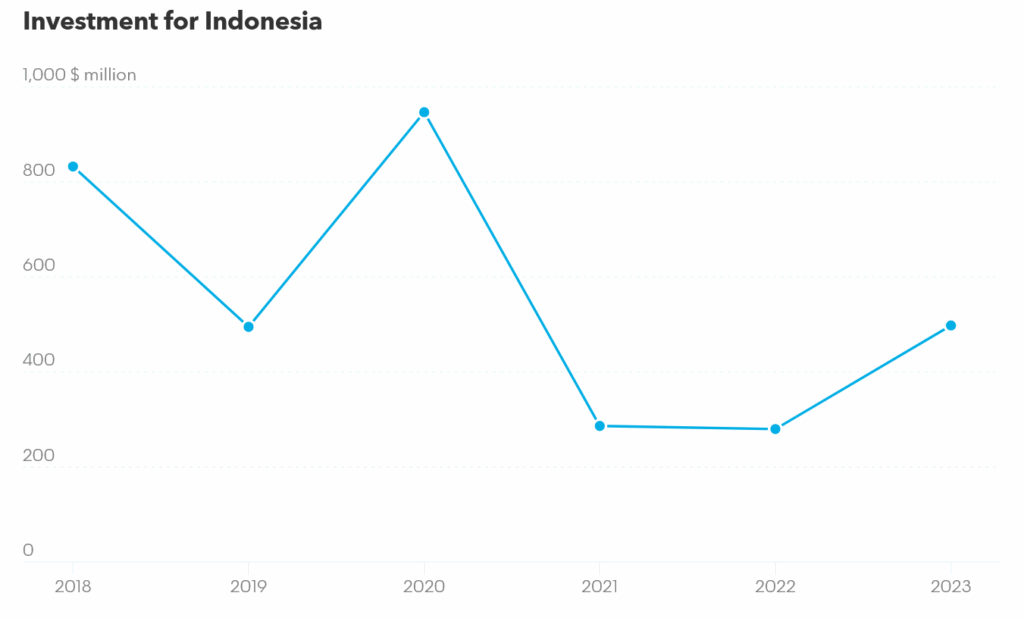

CREA also notes that creating a level playing field for renewable energy investment and grid decentralisation is of crucial importance, as renewables investment remains critically low at USD 565 million in the first half of 2024. For reference, this is less than a quarter of the USD 2.4 billion allocated to the mineral and coal sector and just a drop in the bucket compared to the USD 135 billion needed by 2030 to adequately accelerate a renewables-based power system that would facilitate Indonesia’s coal transition pathway.

To enhance Indonesia’s attractiveness to green capital investors, it is crucial to improve the clean energy market fundamentals. Currently, the country holds 45th place across all emerging markets in BloombergNEF’s Global Climatescope 2024 ranking.

According to CREA, improving on that front requires introducing fundamental policy reforms that streamline permitting processes and set attractive mechanisms to unlock private sector investment. It is also crucial for the central government to support the national electricity provider, PLN, and regional governments in their implementation of renewable energy through the issuance of facilitating regulations.

Another critical move, according to CREA’s analysis, is ensuring that the RUPTL no longer includes fossil power additions beyond absolute requirements for grid stability. The government also must display a firm commitment to phasing out coal power. Doing so would require revising Ministerial Regulation No. 10 of 2025 to provide a clearer, more obligatory framework with specific criteria and a transparent, independent assessment process for candidate power plants, the experts note. However, currently, the signals coming out of the PLN are that there will be no early retirement of coal power plants — just a “phase-down.”

Developing the Clean Energy Industry Can Create Millions of New Jobs

Recently, Indonesia’s new minister of finance announced plans to transfer approximately IDR 200 trillion (USD 12 billion) of the country’s cash reserves from the central bank to state-owned banks to accelerate the rollout of President Prabowo’s priority programs and to stimulate economic activity. While it remains to be seen how these funds will be allocated, renewables, as a potential target industry, can prove beneficial for Indonesia’s economy in the long run, ultimately helping the government to achieve the stated goals.

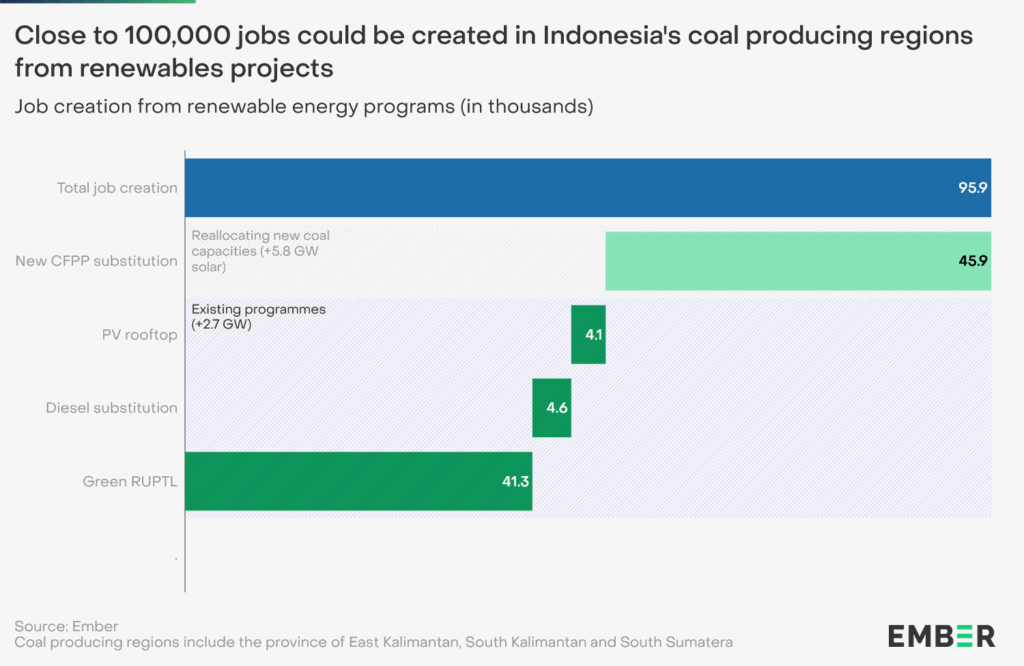

According to a study by Indonesia’s National Development Planning Agency, transitioning to a green economy could unlock an average GDP growth of 6.1-6.5% per year until 2050, creating up to 15.3 million jobs in 2045 across various sectors. Importantly, it would also increase the gross national income by around 25-34%, or the equivalent of USD 13,890-14,975 per capita by 2045. In a separate study, Ember finds that even coal-producing regions will benefit, estimating that implementing all existing programs and replacing all new coal-fired power plants with solar ones will create 96,000 high-skilled jobs.

Furthermore, the recent deadly protests, during which thousands have taken to the streets to express discontent about the worsening economic hardships faced by ordinary Indonesians, including stagnating wages and rising living costs, have put the government under pressure. In that sense, prioritising renewables as a way to unlock more affordable electricity and reduce the fiscal and healthcare costs associated with prolonged fossil fuel use and new infrastructure buildup, provides the government an opportunity to alleviate public pressure and demonstrate that it is taking the population’s demands to heart.

Furthermore, businesses also prefer a transition toward renewables. According to a survey by IEEFA, 88% of respondents stated that they want most of the country’s energy supply to come from renewables within the next 10 years. Notably, the majority also noted that they would consider relocating operations and contracting supply chains to other countries if Indonesia fails to deliver adequate renewable supplies.

Next Steps: 2025 as a ‘Make-or-break Year’ For Indonesia

CREA defines 2025 as “the make-or-break year” for Indonesia’s energy transition.

As the country passes the halfway mark of 2025, it has only achieved 8% of the targets set out in RUPTL 2021-2030, meaning it is running behind schedule. CREA also warns that the same financial and regulatory hurdles that caused the significant shortfalls in implementing RUPTL 2021-2030 remain unresolved.

Furthermore, the government is yet to submit its updated NDC for 2035. Indonesia remains among the worst performers in terms of climate action, with the country’s current policies aligning with a 4°C warming trajectory. According to the Climate Action Tracker, a 1.5°C compatible pathway requires Indonesia to commit to an emissions reduction target of 51% below 2019 levels by 2035 (including all sectors).

Despite commitments like the landmark JETP, which aims for a 44% renewable energy share by 2030, and President Prabowo’s vision to phase out all fossil power by 2040, concrete policy implementation paints a different picture — one that disregards the urgency of the climate crisis and the clear economic and environmental benefits of renewables.

Until Indonesia reforms its pro-coal policies, including the green taxonomy that categorises specific coal power projects as “transitional,” the path toward a cleaner and more sustainable future will remain blocked. Considering that companies and communities are ready and there is real demand for clean energy, if policy measures don’t catch up, it would mean that Indonesia is willingly embracing a future of ever-worsening climate, environmental, health and financial risks.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more