Energy Transition in Oil and Gas Sector: A Dilemma

Photo by Aerial-motion/Shutterstock.com

27 October 2021 – by Ankush Kumar

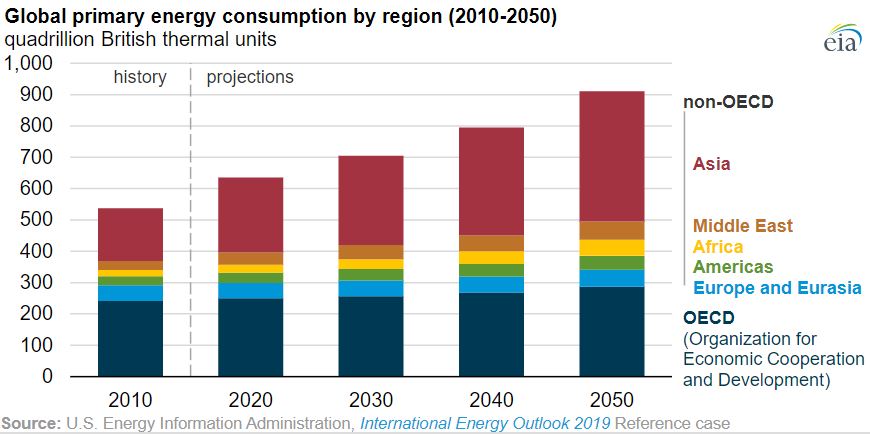

The energy transition towards renewables is happening, but a spotlight remains on Asia who will make up 43% of global energy demand by 2040. China and India will constitute for much of this demand. However, Asia is still inordinately reliant on fossil fuels; a lack of technological know-how, higher costs, ageing infrastructure and unfavourable policies contribute to this dependency. There’s much to do, when it comes to energy transition in oil and gas sector.

International Energy Agency Supports Clean Energy Transition in Oil and Gas Sector

In July 2020, International Energy Agency held it’s first Clean Energy Summit. Ministers from 80% of global economy took part in the summit. It shows the importance of clean energy transition in economy, especially in oil and gas sector.

Gloomy Energy Transition Future of Oil and Gas Sector

Climate change and global pledges aimed at achieving net-zero carbon emissions by 2050 are pressuring coal-related projects across the globe. In Asia, governments and financial institutions are now agreeing on their disbandment of supporting coal-fired power plants. However, what remains a miss is the lack of commitment aimed toward the oil and gas industry, where investments continue. This puts things at odds with the Paris Agreements targets.

While some Western oil and gas companies like Royal Dutch Shell, BP, Eni and Total accept a future of production declines, their Asian counterparts beg to differ. In China, China National Petroleum Co (CNPC) is aiming to increase production on existing oilfields. Elsewhere in the Philippines, the government sees new gas fields in the South China Sea, with the UK’s Forum Energy doing the drilling.

These continued explorations run contrary to the Paris Agreement and an increasing crowd of investors calling for companies to align themselves with the Paris climate accords.

Heavy Investment Risks for Oil and Gas Sector

The continued investments into oil and gas from companies exposes them and investors to risky stranded assets. The financial think-tank Carbon Tracker warned that over a USD 1 trillion was at risk if business continued as usual – including USD 480 in shale and USD 240 in deepwater oil projects.

Large companies risk becoming uncompetitive without adapting and adhering to new global trends such as decreasing oil demand. Projections show that conventional oil production will fall by 50% and shale oil by 80% by 2030.

Shrinking Oil Demand in Asia and Increase in Demand of Liquefied Natural Gas

Demand is already falling for oil in Asia as the clean energy transition makes headway. Covid-19’s impacts further accelerated this transition by shrinking demand for oil overall. But liquefied natural gas is on rise. Moreover, the growth in clean energy policies in transport, for example, in China, South Korea and Japan, will further add to oils demise on the continent. The East Asian nations make up around 20% of current global oil demand but have all pledged carbon neutrality goals.

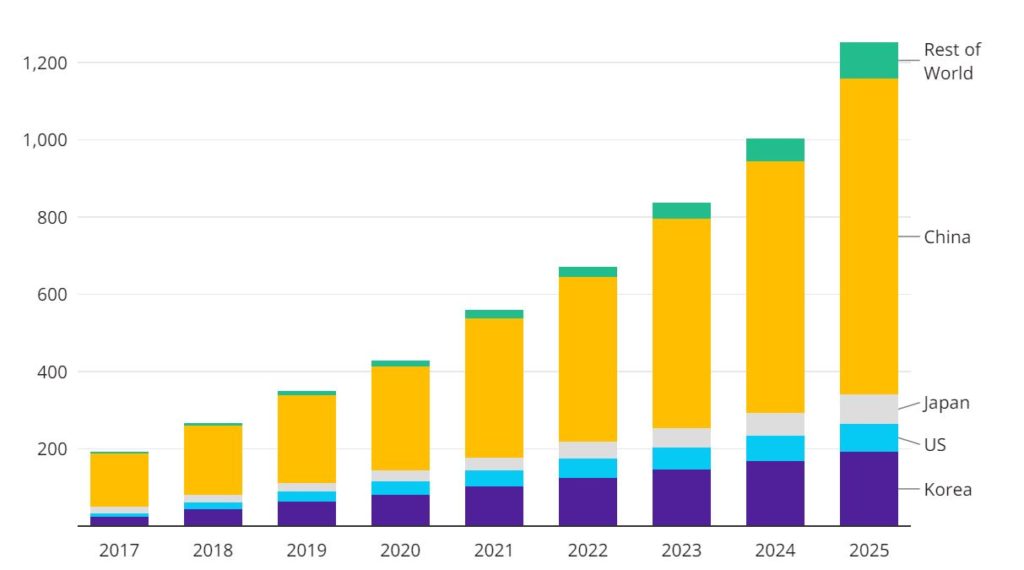

Asia’s EV market is a burgeoning example. In 2020, China was home to over 4.5 million EVs, making it the most significant electronic car market globally. Its support infrastructure for this surging market is just as impressive, with a record 1.2 million charging stations nationwide – the most globally. Similar policies on clean transportation are being pursued in South Korea and Japan.

Working in concert with the rise of EVs across Asia is its production of lithium-ion batteries powering the cars. China, South Korea and Japan also take up the bulk of global batter production.

Trends across Asia are at odds with the support and exploration of new oil and gas projects.

Energy Transition of Asia’s Industrial Sector

While transport across Asia is on a clean energy path, the industrial sector is the elephant in the room. Traditionally, fossil fuel industry pundits suggested that renewables would not be able to power the energy-demanding industrial industry. However, an International Renewable Energy Agency study showed that renewables and their increasing global capacities could do just that – power industrial activity.

Without looking toward the future with cleaner energy sources puts the industrial sector at risk. This risk is especially relevant in Asia, where manufacturing collectively makes up a significant portion of its economies.

Transitioning to Renewables is Lucrative

A shift to an entirely different business model is, of course, costly. Despite this, Daniel Stewart, an energy and climate programme manager, said it’s a story of reinvention and evolution in today’s world. “There are a lot of risks as the energy industry is being upended and reinvented. However, the transition also opened up highly lucrative markets.”

Stewart used the example of the Florida-based electric utility NextEra. Once a large oil and gas company is now a leader in solar and wind energy in the United States. Another example is one of the world’s largest offshore wind energy producers, Orstead – who was once one of Europe’s largest coal consumers. Orstead has now also sold off their entire oil and gas business.

“It is also clear that this clean transition and the risks it poses to the oil and gas industry is only going to get more aggressive as time goes on,” said Stewart. However, with energy demand in Asia set to rise significantly by 2050, governments, companies and investors alike need to focus on the boundless opportunities offered by renewables rather than the stranded assets of the past that oil and gas represent.

Go further with Energy Transition

This article is part of our global energy transition guide.

We will discuss more related topics in the following articles, such as the energy transition in India.