Green Transportation Trends in Asia – A Wave of Electric Charging Stations

Source: Chinadaily.com

21 October 2021 – by Eric Koons

The green transport wave in Asia is well underway, with big nations like China leading the electric vehicles (EVs) market. In 2020, China had over 4.5 million EVs, making it the largest market for EVs globally – Europe sits second at 3.2 million. China’s aggressive push for EVs and electric charging stations could be a blueprint for other Asian nations and their sustainable transport policies.

China’s electric vehicle journey began in 2001 when it pursued the first policies encouraging the development of EVs. In 20 years, it has doubled down on prior commitments to increase EVs adoption rates.

The first of these was launched around 2009 when it introduced a range of subsidies for buyers of EVs. Later on, China put forth a policy of EVs to make up 40% of vehicle sales by 2030. It now boasts 44% of the world’s EV fleet and 98% of the world’s electric buses.

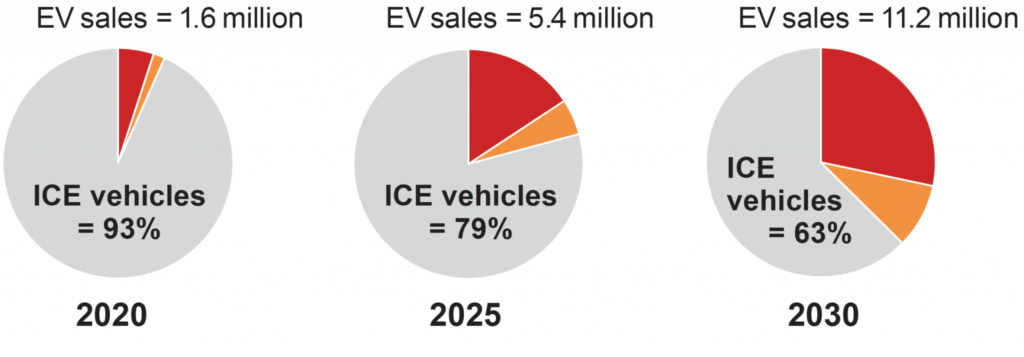

These pie charts show the split in projected sales among the three vehicle types in China: ICE vehicles (grey), hybrid EVs (orange), and pure battery EVs (red). The total number of EVs sold is indicated for each year. Source: MIT Energy Initiative

China’s Focus on Electric Charging Stations

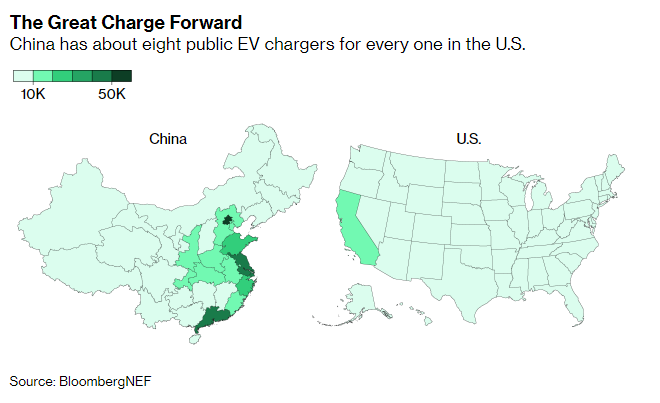

Beyond just developing policies, China also built the infrastructure to support EV growth. This vast network of electric charging stations – 1.2 million in 2019 – further cements the push for EVs in China. There are now installation plans for an additional 600,000 charging stations in 2021.

The explosion of these electric charging stations has reaped supportive benefits with over USD 1.4 billion in subsidies. On a grander scale, the Chinese government has already invested over USD 60 billion in EV-related subsidies since 2009.

The government subsidies that support this development total are over USD 1.4 billion for electric charging infrastructure alone. Moreover, on a larger scale, the Chinese government has invested over USD 60 billion in EV-related subsidies since 2009.

What Lessons Can the Rest of Asia Learn from China?

Emulating China’s success will not be easy. However, supporting policies that support EVs and its associated sectors like electric charging stations will be a good start.

Once appropriate policies are in place, then tackling energy generation is the next step. China’s renewable energy industry grew alongside its electric vehicle manufacturing. The two sectors go hand-in-hand, supporting the other’s adoption and growth.

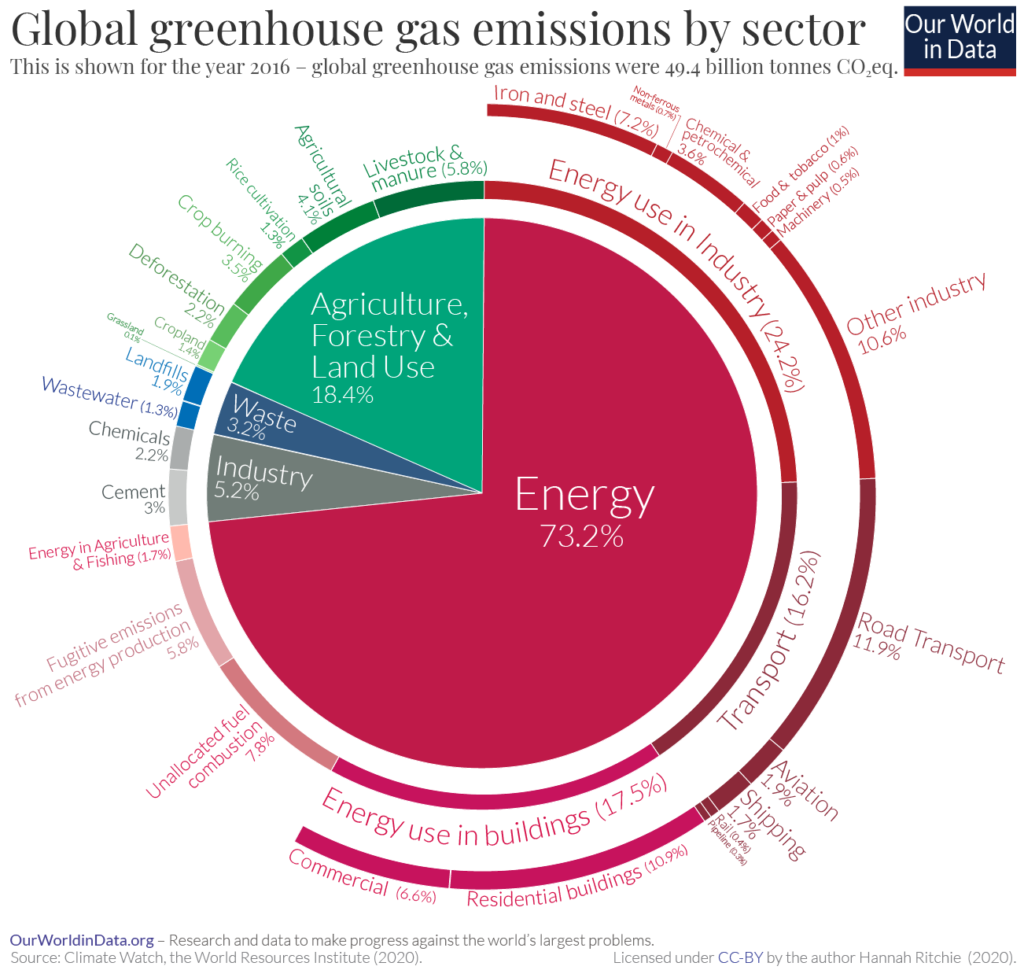

Harnessing renewable energy to generate electricity for EVs is critical to curbing CO2 emissions – especially in a growing Asia. In Europe, for example, cars alone represent 60% of its transport emissions, and globally transportation accounts for 14% of total CO2 emissions. An electrified vehicle fleet running off renewable energy will drastically reduce Asia’s emissions as a whole.

Oil and Gas Companies May Lead the Energy Transition

Ironically, the oil and gas industry is already pushing renewable energy and EVs. This is due to the expected decrease in demand for refined oil products like fuel and plastics.

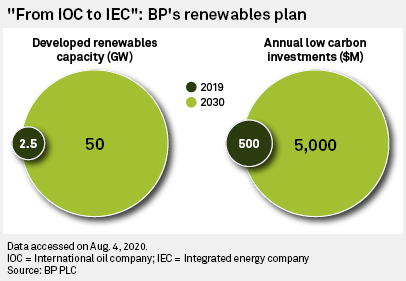

The revenue loss from EV fleets is causing oil companies to pivot their existing knowledge and tools into new areas. Oil and gas giants Shell, BP and Total have already invested or acquired several companies involved with EVs, electric charging stations, battery storage and renewable energy in general. BP has even signalled plans to decrease its fossil fuel products and increase its renewable energy generation by 20-fold from the 2.5GW its projects generated in 2019.

Big Automotive Investments are Pouring into China

While big oil looks at diversifying, back in China, major auto companies are partnering with the Chinese government for future development and manufacturing:

- Toyota and BYD have partnered to manufacture electric sedans and SUVs over the next five years. Toyota also has a deal with Contemporary Amperex Technology Co. Ltd. to purchase batteries.

- Renault SA is investing up to USD 145 million as part of a joint venture with JMEV – the EV charging arm of Jiangling Motors Corporation Group.

- Since 2017, Volkswagen has built relationships with FAW and JAC, along with Star Charge who manufactures the third-largest number of electric charging stations in China.

- BMW will partner with Great Wall Motors to produce electric Minis from 2021 onwards.

- Ford will be part of a USD 765 million joint venture with Zotye Auto to build EVs in China for the domestic market.

There is no doubt that China is now enjoying the success of its commitment to EVs. Can other Asian nations replicate this success?

Which Asian Market is Next for EV Adoption?

Being one of the largest markets in the world, India is now home to a rapidly growing middle-class and is already one of the globes major vehicle manufacturers. The nation is also looking to rein in its CO2 emissions and heavily investing in renewable energy.

In Southeast Asia, Vietnam and Thailand are prime candidates; both nations have pre-existing vehicle manufacturing facilities and sizeable motorcycle fleets. The region is also becoming a hot spot for renewable energy investments due to its rapid growth prospects and rising energy demands.

There is potential for other Asian nations to rival China’s successes in developing EVs and, in turn, reduce their emissions to further their goals to decarbonise their economies. China’s successes largely rest on the nation seeing EVs as an opportunity for growth and international investment and ensuring it supported the industry with subsidies for electric vehicle charging stations.

Over the years, China’s EV policies have culminated into rapid growth for several sectors of its economy. The rest of Asia can follow suit, provided it takes on the lessons learnt from China’s experience.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more