How Much Are Carbon Credits Worth?

Source: EnergyElephant

10 May 2024 – by Eric Koons

Carbon credits represent greenhouse gas emissions, yet they also have a financial cost. So, how much are carbon credits worth? In simple terms, a carbon credit represents the reduction of 1 tonne of carbon dioxide or an equivalent amount in other greenhouse gases. These credits can be sold, providing financial returns for sustainability-focused projects and companies.

As a result, carbon credits are emerging as an important tool in private and public sector decarbonisation. Governments can implement carbon compliance markets that cap sector-level emissions and slowly reduce total carbon emissions over time. On the other hand, voluntary carbon markets help companies to offset their carbon emissions through investment in environmental projects.

These benefits give carbon credits financial value to businesses, similar to other services and investments.

Factors Affecting Carbon Credit Valuation

Supply and Demand Dynamics

The value of carbon credits is heavily influenced by market dynamics, particularly the interplay between supply and demand. As industries and nations strive to meet emission reductions targets, the demand for carbon offsets increases. Conversely, the supply of carbon credits depends on the quantity and scale of projects aimed at reducing emissions or the number of credits a government creates. As demand rises or quantity falls, carbon credit prices increase.

Regulatory Impact on Compliance Markets

Carbon credits operate within a complex regulatory framework that varies by region and type of credit. In compliance markets, a mix of supply and demand and government regulation governs the cost of credits.

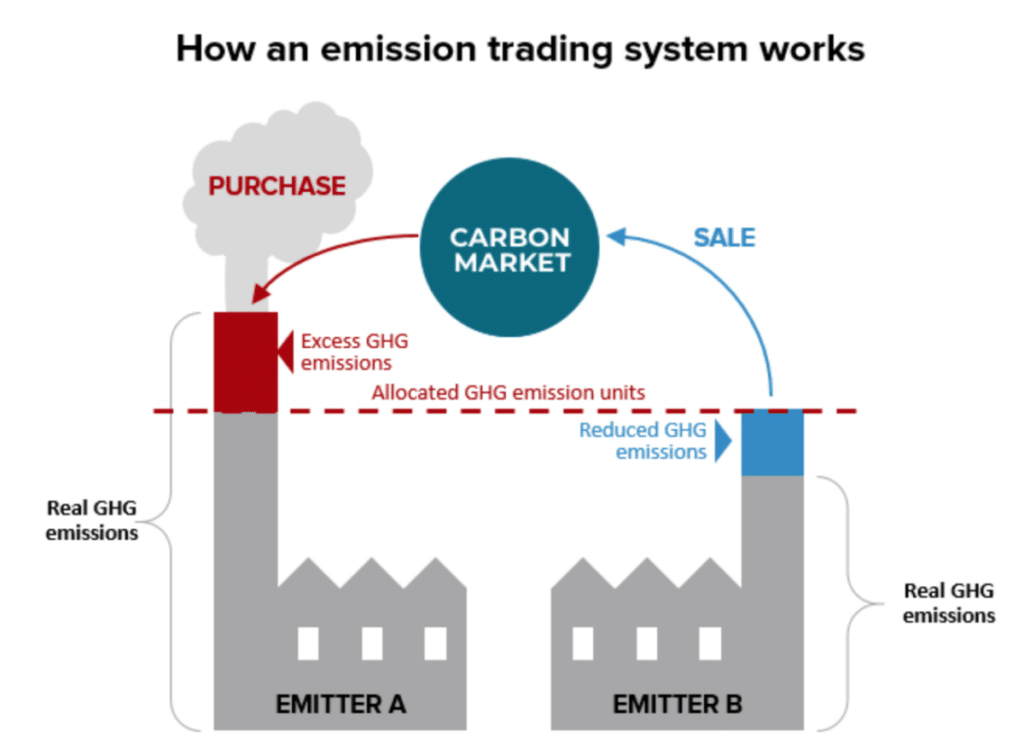

One primary type of compliance market is emissions trading systems (ETS) or cap-and-trade systems. In this system, the government’s implementation of the credit program dictates the baseline value of credits and the total supply of carbon credits. Credits are auctioned off or allocated to businesses across an industry, and the number of credits available typically decreases over time.

Businesses can then buy or sell carbon credits to other companies within the same compliance market, driving the demand side of the market. In theory, credits become more challenging and costly to acquire over time, pushing businesses to reduce emissions in other ways.

The Influence of Project Type, Quality and Location on Carbon Credit Pricing

Just like compliance markets, voluntary carbon markets heavily rely on supply and demand. However, unlike compliance markets, credits are generated from individual projects with unique characteristics. The type of project, project quality and its location can significantly affect the value of credits.

For example, carbon offset projects located in biodiversity hotspots or offering social benefits, such as improving local air quality or enhancing community health, may attract higher prices. This is because they provide additional benefits that buyers are willing to pay a premium for. Furthermore, well-established projects that show impactful long-term benefits and provide quality assurance often have a higher price.

Carbon Credits Under Scrutiny from Critics

Carbon credits have faced backlash for several reasons, with critics claiming they don’t do enough to reduce carbon emissions.

- Real reductions: There’s potential for carbon offset projects to merely ‘offset’ climate impacts rather than truly reduce them at the source.

- Transparency: Issues with the accuracy and transparency of measuring and verifying its effectiveness lead to questions about the actual environmental impact of these projects.

- Enabling more pollution: Carbon credits can sometimes allow companies to continue polluting by purchasing credits rather than making genuine efforts to reduce their emissions.

- Complexity: The market for carbon credits can be complex and prone to manipulation, raising doubts about its effectiveness in reducing emissions sustainably.

Investors seeking to use carbon credits to reduce emissions and contribute to climate change mitigation should carefully review such mechanisms before investing.

How Much Is 1 Carbon Credit Worth?

The value of one carbon credit varies significantly depending on the market, regulatory environment and the specifics of individual projects. There is no single price for one carbon credit.

Price Variance in Compliance Markets

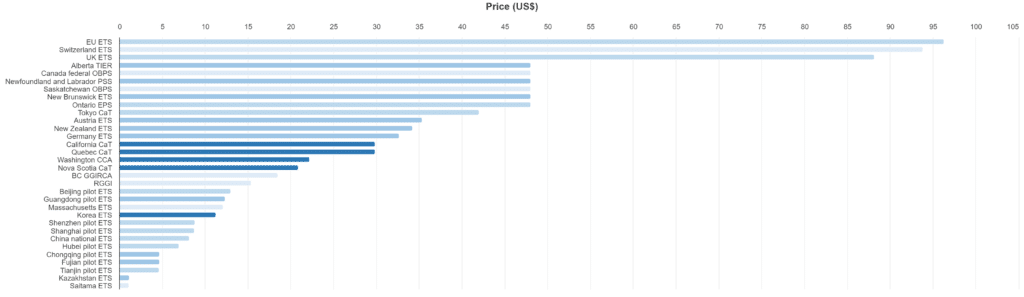

Even within the same type of market, the price varies greatly. In 2023, average national and sub-national ETS credit prices ranged from USD 1 to USD 96.

Several credits have seen significant price increases in recent years. This is the case with the European Union’s Emissions Trading Scheme (EU ETS), which briefly exceeded USD 100 per credit at the start of 2023 – up from less than USD 20 in 2020. This was the result of several factors, including stricter carbon pricing rules, social pressure for governments to reduce environmental pollution and increased use of higher-emitting coal due to the Russia-Ukraine War.

On the other hand, some credits have been declining, such as South Korea’s compliance market. At the start of 2023, the credit was trading closer to USD 10, down nearly 50% from the year before. This was the result of an oversupply of credits on the market that outstripped demand.

Price Volatility in the Voluntary Carbon Market

On average, prices of carbon credits in voluntary markets tend to be much lower and more volatile than in compliance markets. These markets are not regulated by compulsory carbon reduction mandates and, therefore, exhibit more price fluctuations based on voluntary demand and concerns over lack of credibility.

For example, average spot prices for voluntary credits reached USD 16 at the start of 2022 and fell over 80% by the beginning of 2023. This initial surge was driven by strong growth in demand as many of the world’s largest companies pledged net-zero commitments. However, the subsequent fall resulted from growing scepticism around the effectiveness and tangible climate benefits many of the associated projects have.

That said, the demand for voluntary credits is still growing, and many governments are starting to require transparency from companies that purchase carbon credits. This will help regulate the market and increase price stability.

Forward Outlook on Carbon Credit Markets

The carbon credit market is expected to grow at a compound annual growth rate of 14.8%. This will help markets mature and drive more regulation surrounding them. As a result, we can expect more price stabilisation. This stabilisation is essential for ensuring that carbon credits remain a viable and effective tool in reducing carbon footprint.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more