IEA Gives G7 a Pathway for Decarbonising Steel and Heavy Industry

15 June 2022 – by Viktor Tachev Comments (0)

Decarbonising steel and other heavy industries is crucial for reducing carbon dioxide emissions and limiting global warming to 1.5°C. However, countries have found the transition of hard-to-abate sectors challenging and complex, making little-to-no progress in the past decade. While targeted at G7 countries, the “Achieving Net-Zero Heavy Industries in G7 Members” report by the International Energy Agency (IEA) is equally valuable for Asian countries in providing an actionable plan to achieve meaningful progress in the transition to renewable energy. Carbon capture and storage (CSS) technology should also be used to reduce carbon emissions. There is a growing market for green steel.

Iron and Steel Production, Heavy Industry and their Importance for Net-Zero

Heavy industry sectors, such as the iron and steel sector, are among the world’s leading carbon emissions producers. In 2018, the sector’s carbon dioxide emissions amounted to 8% of the global total. Today, the share is 11%. According to estimates, the iron and steel industry emits 1.85 tonnes of carbon emissions for every tonne of steel produced. If the steel sector were a country, it would have ranked fifth in the world in terms of its carbon emissions.

The reason for the carbon intensity of the global steel industry is that the manufacturing process is still heavily reliant on fossil fuels and iron ore. Despite promising technological progress, especially in steel, the sector is not on track to reach net-zero by 2050.

Moreover, steel demand will grow by approximately 12% by 2050 under a 1.5°C scenario. Meeting it while reducing emissions is a significant challenge.

Not Only the G7 – Decarbonising Steel and Heavy Industry is Critical for Asian Countries

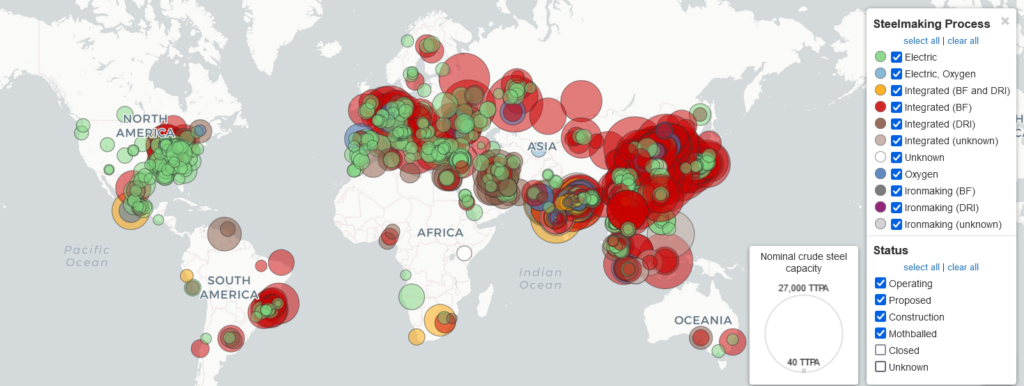

Global Energy Monitor’s Global Steel Plant Tracker, which tracks over 1,100 operating steel and iron plants, highlights Asia’s importance.

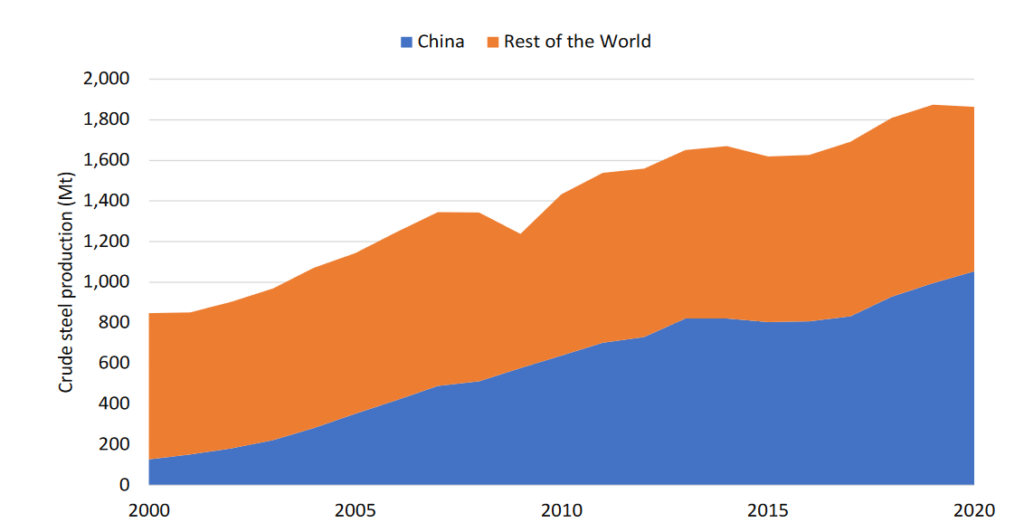

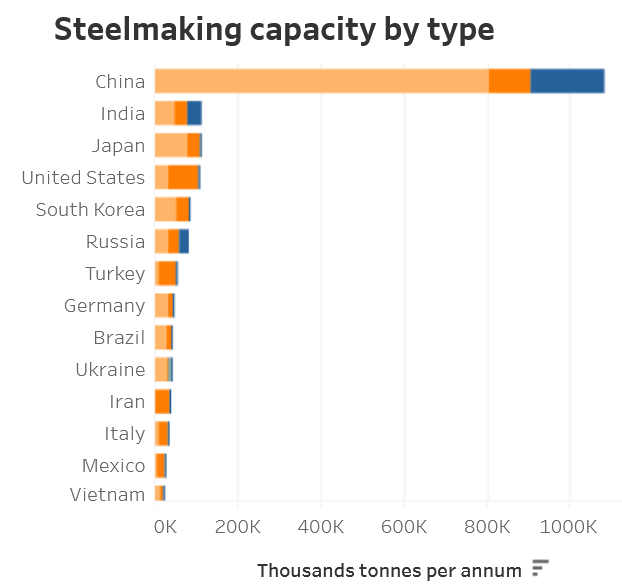

The majority of these plants are in China. The country is responsible for more than half of the steel consumed worldwide. On top of that, of the 14 steel companies with commitments to, or approved, science-based targets, only two are Chinese.

Furthermore, the country recently extended the target for its steel industry emissions to peak by 2030 instead of 2025.

The rest of the top 5 biggest steel producers include India, Japan, the US and South Korea. Asia’s journey towards decarbonising the steel industry is critical not only for the continent’s net-zero progress but also for the world.

Of the world’s biggest steel producers, Japan and South Korea have pledged carbon neutrality by 2050. China and India are targeting 2060 and 2070, respectively. These targets are doomed to fail without first decarbonising steel and hard-to-abate sectors.

The incentive for decarbonising steel isn’t only related to the climate. There is also a business and a steel supply chain case.

First, estimates reveal that approximately 14% of steel companies’ potential value is at risk if they fail to decrease their environmental impact.

Next, the war in Ukraine highlighted the risks facing heavy industries that rely on fossil fuel imports, bolstering the case for decarbonisation and energy independence.

While there are arguments stating that decarbonising steel is challenging and costly, it is critical. Furthermore, IEA’s latest report gives actionable steps to ease the process.

IEA’s 10 Recommendations for Decarbonising Steel Industry and Heavy Industry

IEA concludes that for the global iron and steel industry to get back on track with the “net-zero emissions by 2050” scenario, it needs substantial cuts in energy demand and CO2 emissions by 2030.

To progress towards these targets, the agency urges the G7 countries to lead the global transformation of the heavy industry sectors.

In its report, IEA lists 10 recommendations for success in decarbonising steel industry. The steps are:

- Develop ambitious long-term sustainable transition plans for the industry that are backed by policies before the mid-2020s.

- Finance a portfolio of demonstration projects for near-zero emission industrial production technologies within the next one to two years.

- Develop finance mechanisms to support the deployment of near-zero-emission industrial technologies and associated infrastructure over the next three years

- Create differentiated markets for near-zero-emission material production within the next three to four years.

- Explore a non-binding intergovernmental international industry decarbonisation alliance supporting the industry transition.

- Establish a cement sectoral breakthrough at COP27.

- Consolidate existing work on measurement standards, ensure their fitness for purpose, and avoid developing duplicate standards and protocols.

- Adopt stable, absolute and ambitious thresholds for near-zero emission material production that consider sector-specific nuances.

- Value the interim steps taken to substantially lower emissions intensity without compromising the stringency of the thresholds for near-zero emission production.

- Extend the reach of work on definitions down to existing supply chains and into new ones.

Caitlin Swalec, project manager for heavy industries at Global Energy Monitor, describes the call for specific definitions as “big progress”.

“This is something we called for repeatedly over the past two years, so good to see the IEA finally echoing,” said Swalec.

Asian Countries Should Also Take Note

IEA might have given its recommendations to the G7 nations, but the need for decarbonising steel and heavy industry is even greater in Asia. The leading steel producers should act urgently and focus on the steps that can bring immediate results.

From the list of recommendations, Asian countries can start by setting up an industrial decarbonisation alliance to make concrete carbon reduction targets. Such an initiative will show a commitment that the entire industry is determined to help global decarbonisation efforts. Furthermore, it will help steel producers cooperate, ensuring that all are held to the same standards. It will ensure that transforming the sector won’t cost them their competitive advantages.

Creating progressive national policies for decarbonising steel and heavy industry is another crucial and urgent step. That way, countries will be able to showcase the importance of the industry’s transition and ensure a level playing field where public and private entities will both be pursuing a common goal and adhering to unified standards. Implementing comprehensive mechanisms that tolerate collective and national commitments will accelerate the decarbonisation progress of the industry and the entire economy.

All Eyes on G7

With IEA’s latest report, G7 countries, alongside other heavy-industry countries like China, now have a blueprint for decarbonising steel and hard-to-abate sectors. Margaret Hansborough, a consultant, activist and senior policy advisor for the industry at COP26, sees the G7 summit as “the perfect opportunity for leaders to make what would ideally be binding commitments, among others, drawing a line in the sand and putting China on the spot”.

Asian countries are uniquely positioned to have the G7 nations pave the way for the decarbonisation of the steel sector. And having a well-trodden path to follow means leaders won’t have an excuse to continue their inaction.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more