Investing in Coal Projects Bears Major Financial and Reputational Risks

28 April 2021 – by Viktor Tachev Comments (0)

A business environment held in the grasp of a global pandemic is anything but stable. Due to this, financiers are more cautious with capital allocation and increasingly look for secure, transparent, and sustainable investments. For years, fossil fuel projects have been the opposite of this. Economic theory, numbers, and recent examples that investing in coal projects bears financial and reputational risks are now further making a case for a renewable energy transition not only within Asia but all across the world.

Why Should Investors Reconsider Investing in Coal Projects?

The choice between investing in coal projects or renewables for energy sources is obvious, and many from the financial world are already taking the only viable path. The reason is based on three crucial concerns related to investing in coal projects, including:

Reputational risks of coal power plants

On the 17th of April, 2021, at least five demonstrating workers aged between 18 and 24 at the still under-construction coal-fired power plant of S Alam Group in Chattogram, Bangladesh, were killed after clashes with the police. Eleven others suffered bullet injuries. The reasons for the protest were issues on payment of dues and reducing working hours during the fasting month of Ramadan.

This wasn’t the first time the SS Power Plant took victims. Before its launch in 2016, four protesters against the project were killed. A few months later, another protest reignited as villagers near the construction site feared evictions and environmental harm. One was killed.

It is just another instance of a series of examples that coal plant projects are often controversial and associated with public unrest.

If we dig deeper, things get even grimmer.

Pollution from coal fired power plants

Taking the indirect casualties from the pollution caused by coal-based power projects and the death toll grows exponentially. According to End Coal, coal leads to over 800,000 premature deaths per year globally. On a broader scale, fossil fuels as a whole are estimated to cause over 8.7m premature deaths per year around the world.

In the case of coal projects, the effect of such controversies quickly translates through the supply chain. From the project’s developers through to the vendors and suppliers, to the project financiers – all sides involved in a controversial project may suffer from reputational risk.

In the age of ESG financing and sustainability, those investing in coal projects risk being left behind. Moreover, the public effect on their reputation often is devastating. Because markets have a long memory, and any step in the wrong direction that gets public exposure can negatively affect long-term growth opportunities and client retention. Lenders that back off or switch to renewable energy financing are in a way better positioned to safeguard their reputation.

A sealed faith

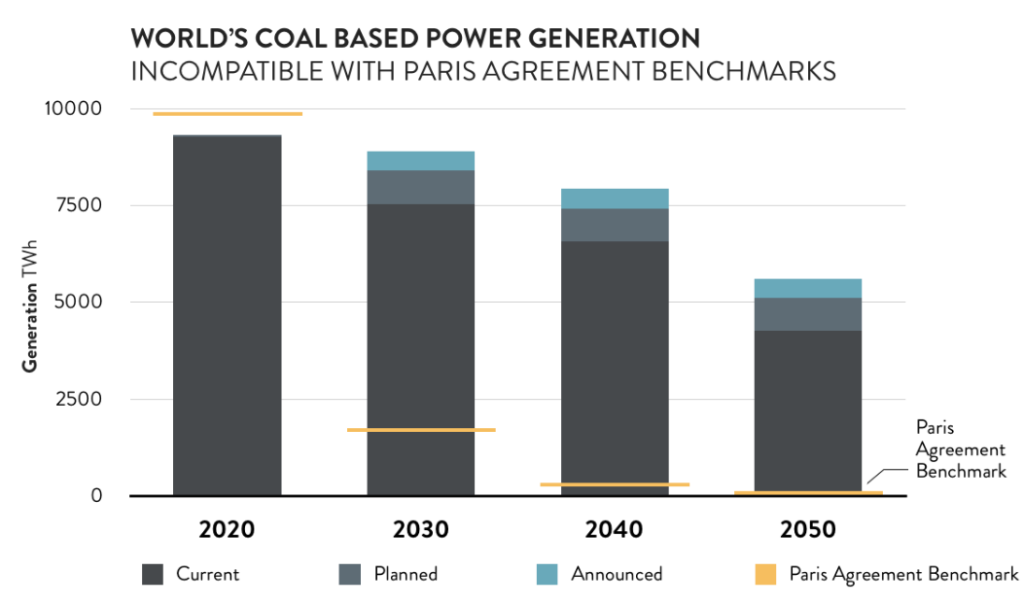

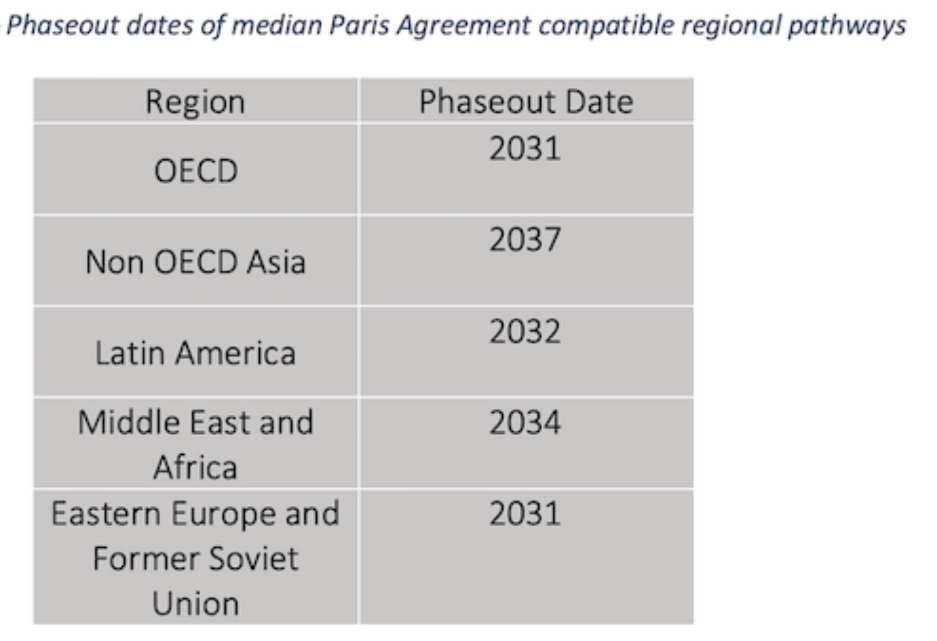

According to the Paris Agreement, the world should decarbonize the energy sector by 2050. To achieve that, OECD nations should end coal use entirely by 2030. All coal-fired power stations must shut down no later than 2040. The case is similar when it comes to Asian countries.

The world is marching towards carbon neutrality, and there is no way to turn that back. The coal power phasing out will inevitably take place. Funding and developing such short-lived projects isn’t viable from any perspective.

The only question is how long this process will take and whether countries will honor the pre-defined deadlines.

Considering the harsh implications of climate change on certain Asian countries, it is only natural to think carbon neutrality is the go-to priority of many national policies. Furthermore, public unrest will likely speed up the renewable energy transition even further.

With that said, investing in coal projects now becomes similar to launching a manufacturing plant for plastic straws. It might make money for a couple of years, but we all know how it will end.

A zero-opportunity investment

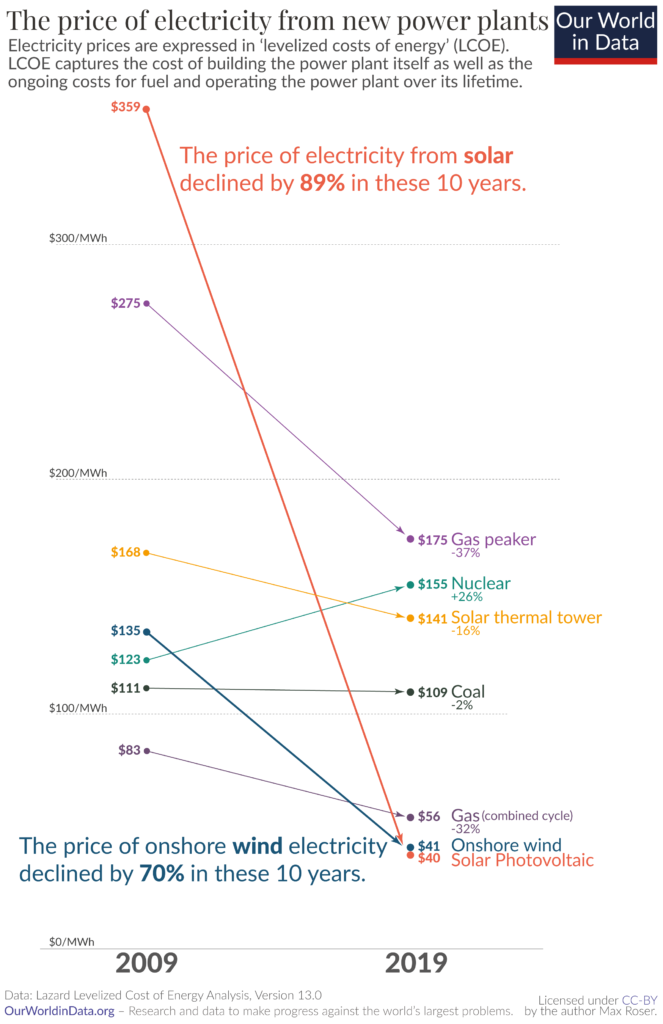

According to IRENA, renewable power is becoming increasingly cheaper than any new fossil fuels-based electricity. The “Renewable Energy Generation Costs in 2019” report estimates that replacing the costliest 500 GW of coal with solar PV and onshore wind can cut power system costs by up to US $23b per year. Furthermore, it can reduce annual emissions by around 1.8 gigatons (Gt) of CO2. This is equivalent to 5% of total global emissions in 2019.

Other reports also prove that cost of coal energy is significantly higher than solar and wind, for example. More importantly, for the last ten years, the cost of electricity from coal has dropped 2%. Solar energy prices, on the other hand, have fallen 89% for the same period.

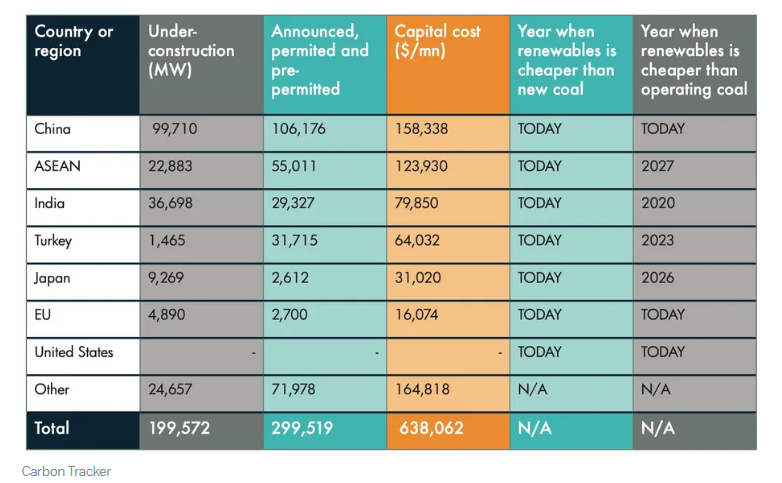

Due to the 15 to 20 years period needed for capital recovery, statistics reveal that investors can lose over USD $600b on doomed coal plants. Investing in such short-lived projects means filling up a portfolio of stranded assets. And USD $600b is a lot of stranded assets!

Leaving costs aside, coal plant development projects also are much harder to manage and plan. In the case of the tragically popular SS Power Plant, the project is behind schedule, for over a year and a half already. The plant was about to start supplying power to the national grid from November 2019. It still hasn’t done so in April 2021. And this isn’t an isolated case. Due to the development complexities, investors in such projects are often unable to make the right plans and end up with projects long overdue.

Renewables Are Here to Take Over

Investing in coal projects bears risks. No estimation or reasoning can justify the development of coal plants – not from an environmental, economic, or reputational point of view. The associated risks go as far as making it a negative investment for financiers.

The quicker financial institutions rethink their focus and get behind the inevitable renewable energy transition, the less controversial and more profitable projects they would be able to include in their portfolios.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more