The Problem With Japan’s Carbon Neutrality Targets and Climate Strategy

04 December 2023 – by Viktor Tachev

Japan’s energy policies are damaging its own energy security. The country is suffering from weak carbon neutrality targets, questionable solutions in its GX strategy, continued fossil fuel project financing and its active opposition to a complete fossil-fuel phaseout. The country must change course to ensure its own future. With rapid developments in renewables, solutions are at arm’s reach.

Japan’s ‘Insufficient’ Climate Strategy

Climate Action Tracker (CAT) rates Japan’s climate policies and actions as “insufficient”. The organisation warns that the country needs substantial improvements to be consistent with the 1.5°C temperature limit.

Japan’s Basic Energy Plan aims for the collective share of gas (20%) and coal (19%) in total electricity generation to reach 39% by 2030. In comparison, renewables will account for just 36-38%. The Renewable Energy Institute notes that even if the clean energy deployment target is realised, it won’t reach the level of today’s major European countries.

The latest policy measure designed to speed up the country’s decarbonisation journey is the Green Transformation Strategy (GX). The investment roadmap, adopted in February 2023, aims to gather over USD 1.1 trillion in public and private financing. The funds are intended to transform industry, speed up the energy transition and promote carbon neutrality.

However, experts are divided on the strategy’s potential and its real motivation. While the government claims it will accelerate Japan’s carbon neutrality journey, analysts, society groups and even the country’s G7 peers argue that it will extend the life of fossil fuels. The reason is that the program doesn’t prioritise renewables. Instead, the plan focuses on technologies such as LNG, ammonia co-firing schemes, blue hydrogen and carbon capture and storage (CCS).

The Risks For Japan

Japan’s latest energy policy threatens to surface various risks at a domestic and regional level.

Undermining Energy Security With Costly and Untested Technologies

As a part of the G7, Japan should be on board with the group’s focus on energy security. Yet, its energy policy risks achieving precisely the opposite.

Japan meets 96% of its energy needs with imports and has an energy independence score of just 13.8%. The country is the world’s biggest LNG importer and plans to import gas for another 10 to 15 years. This is despite warnings that upstream and LNG infrastructure will become stranded around 2030.

Instead of pursuing a more self-sufficient and sustainable energy system, Japan is on course to worsen its problems. The technologies the country has chosen as part of its GX strategy risk being obsolete in the near future.

Japan is also a leading ammonia importer. While it plans to increase domestic ammonia production for its coal co-firing schemes, it will still rely on massive imports. Furthermore, Japan plans to invest in ammonia-producing projects abroad that will go live in 2026 and 2029.

The case with hydrogen is similar. By 2040, Japan plans to import 12 million tonnes of hydrogen. According to BloombergNEF, while the country’s 2050 target calls for an annual hydrogen demand of 20 million tonnes, the country would require only 7 million. Yet, Japan plans to spend USD 107 billion on hydrogen supply chains.

The plans for massive hydrogen and ammonia imports risk putting Japan at the mercy of suppliers in what could be tight markets in the medium term, similar to the current situation with gas.

High Fuel Costs

According to experts, aside from undermining Japan’s energy security, the country’s import plans will expose the country to price volatility. BloombergNEF notes that Japan spent over 3% (USD 1.8 trillion) of its GDP annually on fossil fuel imports between 2010 and 2022.

Even coal co-firing schemes with grey ammonia, the cheapest source, are four times more expensive than using thermal coal. With green ammonia, the margin jumps to 15 times. CCS also remains a costly technology that hasn’t been proven on a large scale. This is also the case with hydrogen, as previous analysis has shown.

When it comes to green hydrogen, BloombergNEF currently estimates the LCOE in Japan to be between two and over three times higher than that of China. However, if China decides to prioritise its hydrogen development, the gap could become even wider.

Various academics, politicians, market experts and environmental groups question the feasibility, affordability and commercial application of the technologies proposed in the GX.

Delayed Decarbonisation

Japan hasn’t updated its emission reduction targets since 2021. The current NDC targets a 42% emission reduction below 2013 levels by 2030. Yet, according to Climate Action Tracker, the currently implemented policies will take it to levels of just 31-37%. At the same time, estimates reveal that Japan must target at least a 60% emission reduction by 2030 to be 1.5°C-compatible.

The new GX strategy also provides no emissions reduction targets for 2030 or 2050. Moreover, it risks keeping Japan wedded to coal, as it emphasises the need to develop CCS, ammonia and hydrogen.

Another sign that Japan isn’t sincere in its decarbonisation efforts is the strong opposition to pledging a concrete coal phaseout date. It remains the only G7 country that plans to build new coal-fired power plants.

So far, the strong fossil fuel lobby in the country has succeeded in keeping the carbon tax rates in Japan among the lowest in the world. According to CAT, the GX’s carbon pricing scheme to be introduced in 2026 is not convincing. The organisation warns that the carbon levy, which will only be implemented in 2028, is expected to be set at a low level – unable to make much of an impact towards the clean energy transition.

Fuelling the Climate Crisis

In 2023, Japan experienced the hottest summer on record by a significant margin. The temperature was 1.78°C above average, or 0.7°C above the previous record. The heatwaves, expected to become more common, are particularly dangerous for Japan, as it has the second oldest population in the world.

According to Climate Action Tracker, if all countries followed Japan’s approach, warming would reach over 2°C and up to 3°C.

To put this into perspective, a 2.4°C temperature increase would add to rising sea levels, cause coastal erosion and change storm patterns, exposing 4 million Japanese people to devastating floods by 2050. The fish catch potential would drop by as much as 10.6%. Precipitation patterns would also be affected. Some areas will suffer significant droughts, affecting crop productivity and causing water demand to increase by up to 4.9% by 2050.

Additionally, Japan ranks 50th in the Global Climate Change Performance Index, with a very low rating.

The use of untested fuels, like ammonia, won’t be harmless, despite what parties with vested interests argue. Research organisations have raised arguments about ammonia’s environmental and health impacts, most of which have been underreported. Among them are air and water contamination through the escape of unburnt ammonia, nitrogen oxide release and the significant PM2.5 pollution from ammonia co-firing schemes in coal plants.

Public Criticism

Much criticism has been laid against the technologies proposed in the GX strategy. Analysts are united in the view that there is an orchestrated effort from the fossil fuel lobby in the country to block climate progress and prolong the use of fossil fuels.

Market experts aside, Japan’s GX strategy and weak climate ambitions have received significant criticism also from local and regional coalitions of climate activists, societal groups and fellow G7 peers. G7 officials even referred to Japan as “an obstacle” in the group’s energy transition agenda. The group also challenged Japan’s GX strategy and the viability of its proposed technologies.

Renewable Energy as a Cheaper, More Secure and Proven Alternative

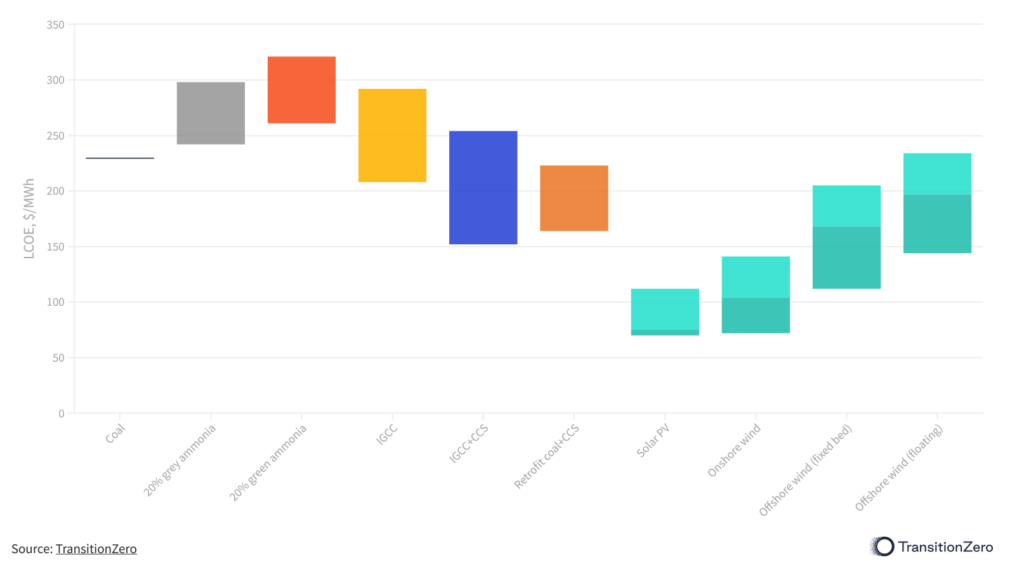

According to TransitionZero, by 2030, onshore wind will be cheaper than all coal options in Japan. Even floating offshore, the most complex and expensive wind power technology will be cheaper or level with the most competitive coal power alternatives.

As per 2022 prices, experts estimate that a 1 GW offshore wind farm would have saved Japan USD 928 million in imported gas costs.

The country has immense potential to turn these theoretical scenarios into actual gains. Experts note that it is feasible for the country to generate 90% clean power by 2035. Just an 18% share of offshore wind by 2035 would put Japan on track for a 90% decarbonised power sector.

Zero Carbon Analytics estimates Japan’s total technical potential for offshore wind generation at over 9,000 TWh/year. This is nine times the country’s projected electricity demand in 2050. Studies estimate that Japan has 14 times more solar and offshore wind resources than needed to supply 100% renewable electricity.

However, for all this to happen, Japanese leadership should move the proposed hydrogen, ammonia and CCS technology solutions from the top to the bottom of its list of priorities. Otherwise, Japan will end up sacrificing its energy security and carbon neutrality targets for very little gain.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more