Japan’s ‘Green Transformation’ (GX) Is Stacked With Fossil Fuel-based Technology

19 April 2023 – by Tim Daiss Comments (0)

Japan, the world’s third-largest economy and one of its most carbon-intensive, is touting its green transformation (GX). However, Japan’s green transformation plan still includes a large dependence on fossil fuels.

On April 15-16, before the G7 summit in Hiroshima on May 19-21, Japan held a ministerial meeting on climate, energy and environment in Sapporo. This was slated to promote what it calls a “realistic energy transition”. However, hosting that event will not allow the country to skirt its climate change responsibilities.

Due to its coal usage, the Japanese government is reluctant to bring forward the G7 framework agreement from last year’s meeting to decarbonise the group’s respective power sectors by 2035.

The G7 will also focus on the seven developed countries’ decarbonisation efforts after each committed to achieving net-zero emissions by 2050. The G7 group includes Canada, France, Germany, Italy, Japan, the UK and the US.

Japan Still Favours Coal

Coal will account for around 19% of Japan’s power generation needs by at least 2030. The government is also trying to placate concerns over the fuel’s emissions. The country claims it will eventually reduce coal usage and pivot back to nuclear power.

Yet, it seems Tokyo is still waffling.

It has failed to formally set out a clear path for reducing and eliminating coal. The problem is heightened since most of the country’s nuclear plants remain offline due to the stricter safety regulations introduced after the 2011 Fukushima nuclear disaster and local opposition.

This prompts the question: Is Japan still suitable for nuclear energy? In 2022, nuclear power comprised only 8% of Japan’s electricity supply.

Moreover, according to the International Energy Agency (IEA), fossil fuels account for some 88% of Japan’s total power generation. This is the sixth-largest share among all IEA countries.

Japan’s Green Transformation Policy

Adding to the fray, Japan’s recently approved Green Transformation Strategy (GX) is largely based on fossil fuel technology. This includes LNG, ammonia co-firing, blue hydrogen development and carbon capture and storage (CCS).

Gas emits as much as 50% of the emissions as coal when used for power generation. Therefore, gas-fired power plants are anything but clean. Gas is also a major methane emitter. Meanwhile, methane is over 25 times more potent than even carbon dioxide at trapping heat in the environment, according to the US Environmental Protection Agency (EPA).

Fossil Fuel Technologies’ Shortcomings

Japan’s blue hydrogen development, often publicised by the government as a climate change breakthrough, is actually a cause for worry. Blue hydrogen is produced by burning natural gas while using CCS technology.

CCS remains an expensive technology that hasn’t been proven on a large scale. A CCS system is also incredibly energy intensive. There is growing evidence that trapped and stored emissions will pose significant environmental problems due to leakage.

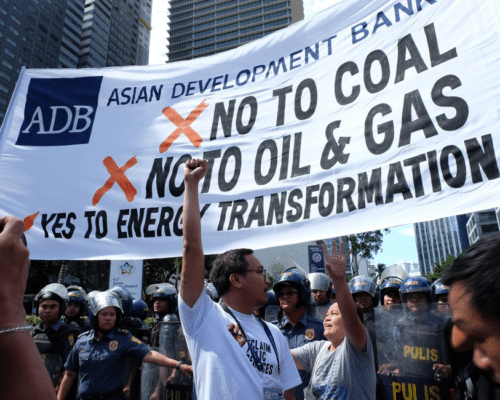

In response to fossil fuel usage, more than 140 groups from 18 countries have issued a letter calling on Japanese Prime Minister Fumio Kishida to stop promoting and expanding the use of fossil fuels and derailing the transition to renewable energy across Asia.

Japan’s climate moves are based on faulty assumptions of what fossil fuel-based technology can achieve and the harm it still poses to the environment. As such, it is merely another example of greenwashing.

Japan Presses Southeast Asia

To make matters worse, Japan’s GX is being used to press neighbouring Southeast Asia to adopt similar policies and fossil fuel-based technologies.

This includes over USD 1.1 trillion in public and private capital over the next 10 years to overhaul 22 industrial sectors in Japan. It will also provide partner countries in Southeast Asia with Japanese technology and finance.

This comes less than two years after the Japanese government set in motion a drive to fund “clean energy” across the Southeast Asia region. That USD 10 billion plan includes renewables but misses the mark since it advances LNG infrastructure development and gas-fired power plant funding.

Over the past two years, the global LNG drive has gained even more momentum and will peak at USD 42 billion in investment in 2024.

Energy Economics Favour Renewables

Renewable energy projects have largely reached cost parity with their fossil fuel-based power project counterparts. In many cases, they’re now less expensive. So, Japan doesn’t need to push its gas agenda onto Southeast Asia.

Furthermore, Japan’s coal usage is problematic. Coal burning releases carbon dioxide into the air, which mainly contributes to global warming and climate change. The nitrogen and sulfur oxides emitted from burning coal react with water in the air, producing acid rain.

Japan Must Act Now

As such, Tokyo must address its coal problem head-on, and it must do so now. It must set forth a concrete and verifiable plan to eliminate coal from its electricity sector before it convenes the G7 meeting next month.

Failure to do so will jeopardise the G7’s overall emissions reduction goals and the group’s framework established last year to decarbonise power by 2030.

by Tim Daiss

Tim has been working in energy markets in the Asia-Pacific region for more than ten years. He was trained as an LNG and oil markets analyst and writer then switched to working in sustainable energy, including solar and wind power project financing and due diligence. He’s performed regulatory, geopolitical and market due diligence for energy projects in Vietnam, Thailand and Indonesia. He’s also worked as a consultant/advisor for US, UK and Singapore-based energy consultancies including Wood Mackenzie, Enerdata, S&P Global, KBR, Critical Resource, and others. He is the Chief Marketing Officer (CMO) for US-based lithium-sulfur EV battery start-up Bemp Research Corp.

Read more