Best Renewable Energy Stocks in India for 2025: Top Picks to Consider

Source: Tickertape

21 November 2024 – by Eric Koons

Renewable energy stocks in India are making up a growing portion of the country’s energy sector, reflecting a transformative journey marked by rapid growth and robust investment opportunities. Over the past decade, India’s renewable energy capacity has witnessed a rapid increase – from just 52 GW in 2010 to over 175 GW by 2023.

In recent years, renewable energy stocks in India have been a great investment opportunity. For example, Adani Green Energy saw its stock prices rise between 2018 and 2024, going from around USD 0.80 per share to over USD 22. Similarly, Tata Power Renewable Energy experienced significant stock growth due to its diversified renewable portfolio and strong corporate backing.

The government’s ambitious targets – such as achieving 450 GW by 2030 – have been pivotal in attracting both domestic and foreign investments in the climate and energy sectors.

What Are Green Energy Stocks?

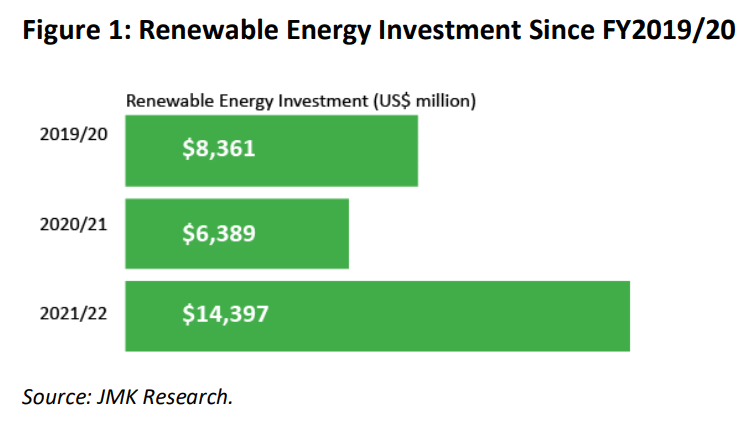

Green energy stocks represent shares of companies involved in producing, distributing and innovating renewable energy sources. Best green energy stocks investing allows stakeholders to participate in the rapidly expanding renewable energy market. With India’s renewable sector attracting over USD 29 billion in investment between just 2019 and 2022, the market potential for investors is immense.

Types of Renewable Energy Stocks

With India’s renewable energy sector becoming one of the largest in the world, understanding the different types of renewable energy stocks is essential for investors aiming to capitalise on this growth.

Solar Energy Stocks: Their Role in the Green Energy Sector

Solar energy companies involved in manufacturing solar panels, installing solar farms or providing solar energy solutions are at the forefront of India’s renewable energy push. The solar sector contributes over 90 GW to the country’s renewable capacity and the market is expected to grow at a compound annual growth rate (CAGR) of almost 20% until 2029.

Wind Energy Stocks: Contribution to the Renewable Energy Sector

Businesses focusing on wind turbine production, wind farm development and maintenance services are vital players. Wind energy accounts for over 40 GW of installed capacity with an anticipated CAGR of 8% until 2035.

Hydro and Biomass Energy Stocks

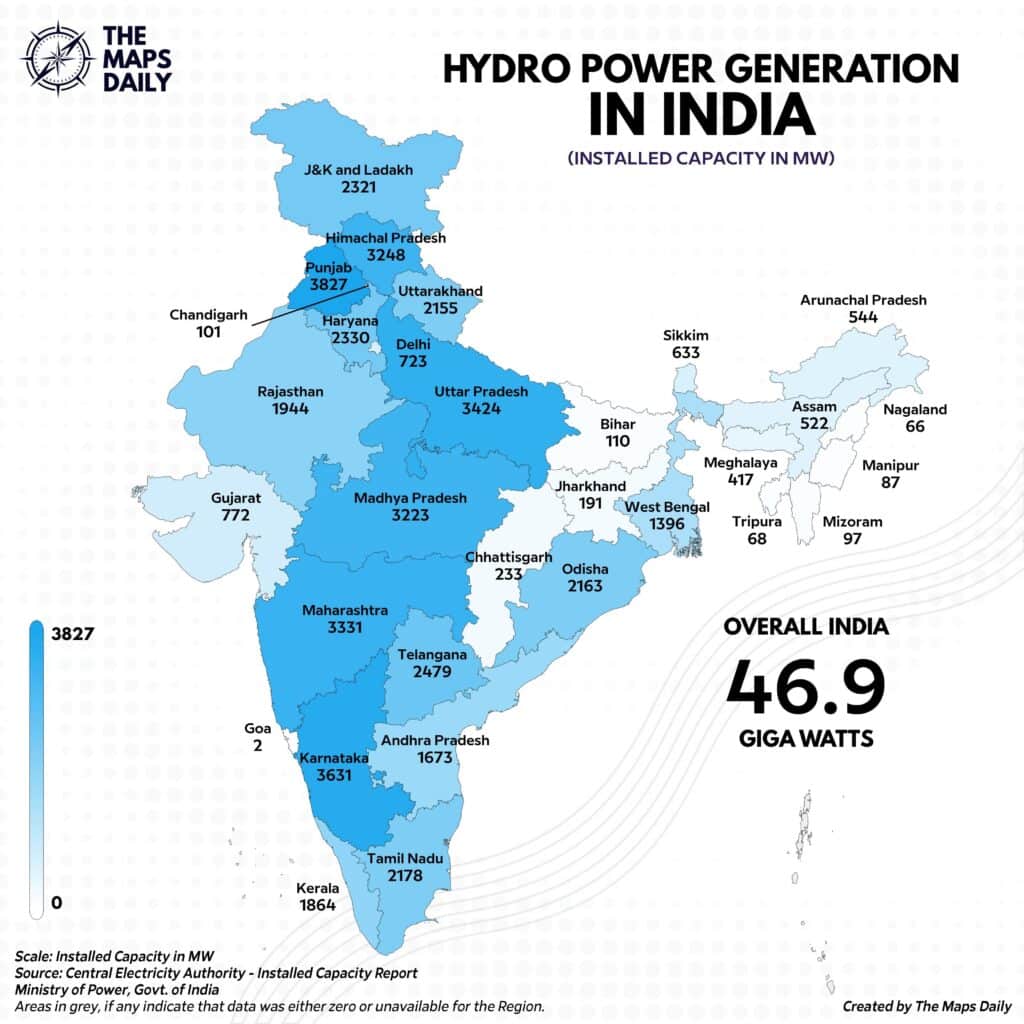

Entities engaged in hydroelectric power generation and biomass energy production are essential for diversifying the energy mix. India has a total hydro potential of about 145 GW with only around 29% currently developed.

Support and Service Providers – Green Energy Companies

Companies offering ancillary services like energy storage solutions, smart grid technology and renewable energy consulting are crucial for sectoral growth. These industries will grow in tandem with renewable energy infrastructure to support their deployment and improve energy efficiency.

Top 10 Green Energy Stocks in India for 2025

The following top green energy stocks in India for 2025 have been selected based on market performance, innovation and growth potential, making them promising candidates for investment leading up to 2025. They represent a mix of India’s key players in its growing renewable energy sector.

1. Adani Green Energy

Adani Green Energy is India’s largest renewable energy company, with quarterly profits of over USD 70 million and an operational capacity exceeding 11 GW. The company’s primary focus is solar energy, which accounts for nearly two-thirds of its total capacity. However, it does have smaller wind and solar-wind hybrid projects.

Aggressive expansion plans aim to achieve 50 GW by 2030. Significant investments in large-scale projects and a focus on improving its renewable energy system efficiency position it for substantial growth.

2. Tata Power Renewable Energy

Tata Power Renewable Energy is a subsidiary of Tata Power that focuses on solar and wind energy generation, managing around 5 GW of renewable capacity.

Strong backing from its parent company – India’s largest integrated power company – and a diversified renewable portfolio enhances its market standing. Another 5 GW of renewable energy capacity will come online in the next two years, and plans to scale up renewable capacity to 20 GW by 2030 will bolster its growth prospects.

3. ReNew Power Ventures

ReNew Power is one of India’s largest independent renewable energy producers, operating over 150 utility-scale wind, solar and hydropower projects. This comes in at an installed renewable energy capacity of 10 GW and includes India’s largest wind energy portfolio at 4.7 GW.

Consistent capacity additions and strategic acquisitions drive its growth trajectory. Its recent IPO and international investments increase its capital for expansion. It plans to expand its capacity to 19 GW by the end of 2025.

4. Suzlon Energy

Suzlon Energy is a key player in wind turbine manufacturing and wind farm development, with a presence in 17 countries. It has installed over 13,000 wind turbine systems accounting for 20 GW of energy capacity for companies across the world.

The company’s international base of global customers and focus on technological innovation to increase turbine efficiency are promising for continued growth. This allows efficient wind energy generation in low-wind sites previously not financially viable.

5. NHPC

NHPC is a government-owned entity specialising in hydroelectric power generation, with an installed capacity of around 7 GW. The company plans to double its capacity to 14 GW by 2027 and reach 22 GW by 2032. It currently has 16 projects, totalling over 10 GW of capacity.

This expansion into solar will start to diversify its energy mix and give it higher growth potential.

6. Azure Power Global

Azure Power is an independent solar power producer with a strong presence across India. The company develops utility-scale solar projects and manages over 7 GW of assets. Long-term power purchase agreements ensure steady revenue streams. Plus, its focus on utility-scale projects positions it well for future growth.

7. JSW Energy

JSW Energy is a diversified energy company with hydro, solar and wind renewable energy projects operating in 10 Indian states. It has a total energy generation capacity of 6.7 GW, and around 3.5 GW of that is renewable. The company is working to expand its renewable energy portfolio to align with market trends, aiming to increase its share of renewable power in its total portfolio to 85% by 2030.

8. Inox Wind

Inox Wind manufactures wind turbine generators with a manufacturing capacity of 1,600 MW across India. Its wind turbines are used globally and account for 15 GW of capacity. It is well positioned for growth, as it provides a wind range of turbines from 1.65 MW to 10 MW. Additionally, the company offers turnkey solutions, including wind farm commissioning, operation and maintenance. This diversification reduces business risk and allows it to work with a large market of energy developers.

9. Greenko Group

Greenko Group is one of India’s leading renewable energy companies with a combination of energy generation and storage facilities across 15 Indian states. It operates a mix of hydro, solar and wind energy, providing a generation capacity of 7.5 GW. Its energy storage capacity sits at 6.16 GW, with another 10.96 GW under development.

Greenko is investing heavily in pumped storage projects (PSPs) and advanced battery storage solutions. Additionally, it is investing in a cloud energy platform to manage utility-scale generation projects and energy grid requirements. Both of these areas are critical for India’s renewable energy growth and provide significant growth opportunities for the company.

10. KPI Green Energy

KPI Green Energy is a fast-growing renewable energy company in India specialising in solar power generation. The company develops, owns and operates solar power projects, providing energy solutions both as an independent power producer (IPP) and through the captive power producer (CPP) model. With its solar power plants primarily located in the solar-rich state of Gujarat, KPI Green Energy serves a diverse clientele, including industrial and commercial customers seeking sustainable energy alternatives.

While smaller than other companies on this list, it is poised for growth in 2025 aiming to reach 1 GW by the end of the year. Its focus on long-term PPAs ensures stable and predictable revenue streams. Additionally, the company’s expertise in both IPP and CPP models allows it to cater to a broader market segment, enhancing its competitiveness.

Investing in India’s Renewable Energy Revolution

India’s renewable energy sector is on an upward trajectory as part of the country’s energy transition which emphasises on green energy sources and renewable energy production. Renewable energy stocks in India offer lucrative opportunities for investors in 2025 with the potential for substantial financial returns. By investing wisely in these promising stocks, stakeholders can play a pivotal role in shaping a sustainable future while reaping the benefits of a booming green energy sector.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more