Renewable Energy Trends 2025: Capacity to Double by 2030

05 November 2025 – by Viktor Tachev

At the start of October, the IEA released its “Renewables 2025” report, the annual sectoral analysis that presents the latest renewable energy trends, forecasts, challenges and opportunities based on recent policies and renewable energy market developments. The report revealed that, despite headwinds, renewables, driven by solar PV, continue to grow globally — a much-needed trend if the world is to keep the Paris Agreement goal alive. Importantly, continuously declining technology and power costs, as well as the energy security benefits, will significantly accelerate renewable energy capacity deployment across most countries, with Asia on course to be the hottest market.

IEA’s Renewables 2025: Global Renewable Energy Trends Promise 4,600 GW in New Capacity by 2030

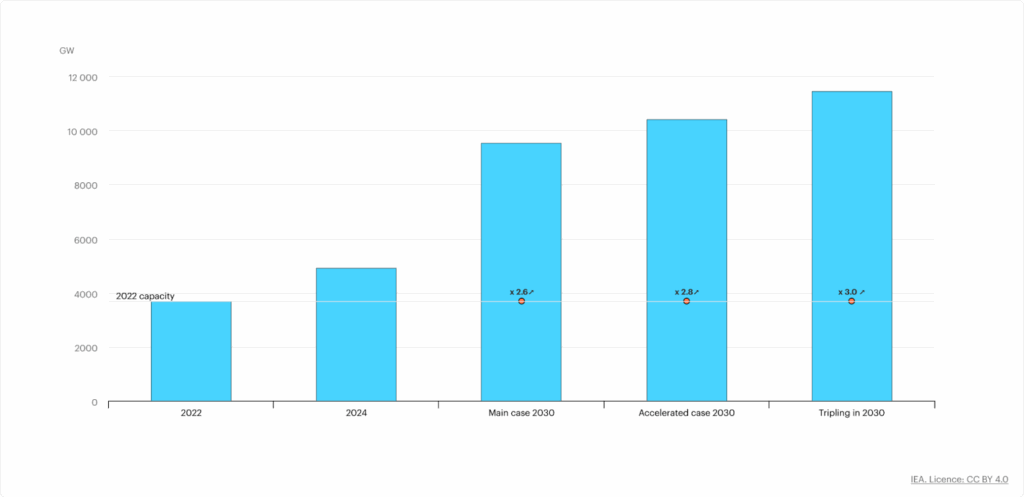

The main finding of the IEA’s report is that global renewable power capacity is on course to double by 2030, adding 4,600 GW. The agency notes that this is roughly equivalent to adding the power generation capacity of China, the EU and Japan combined to the global energy mix.

In total, the agency expects renewables to become the largest global energy source, used for almost 45% of electricity generation by 2030, increasing 60% — from 9,900 TWh in 2024 to 16,200 TWh in 2030.

Solar Energy

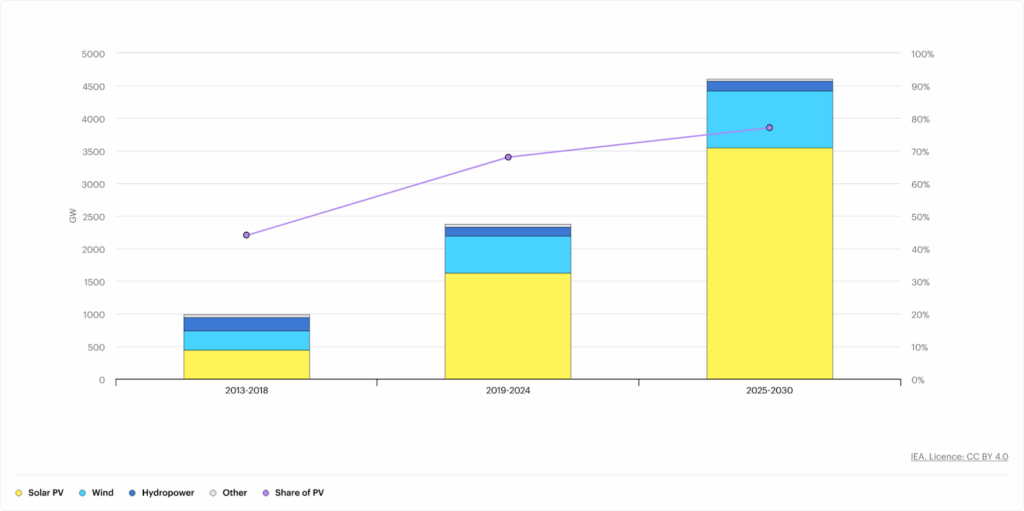

According to the IEA, solar PV, which will more than double over the next five years, accounts for almost 80% of the global increase, followed by wind, hydropower, bioenergy and geothermal. The agency notes that low costs, faster permitting and broad social acceptance will enable the growth. Higher retail electricity prices following the energy crisis have also contributed to the growing adoption of solar PV, encouraging individuals and businesses to install systems to reduce their electricity bills.

Wind Energy

The agency notes that global wind power capacity will nearly double to over 2,000 GW by 2030, driven mainly by China and the EU. Compared with the previous period (2019-2024), the IEA’s forecast expects cumulative onshore wind capacity additions to increase 45% over 2025-2030, reaching 732 GW. For offshore wind, capacity expansion is on course to top 140 GW, more than doubling the growth of the previous five-year period. The annual offshore wind market expands from 9.2 GW in 2024 to over 37 GW by 2030, with China accounting for almost 50% of this increase.

Hydropower

The IEA projects that hydropower will account for 3% of new renewable power additions by 2030.

Geothermal Energy

In 2030, annual geothermal capacity additions will reach a historic high, triple the 2024 increase, driven by growth in the United States, Indonesia, Japan, Turkey, Kenya and the Philippines.

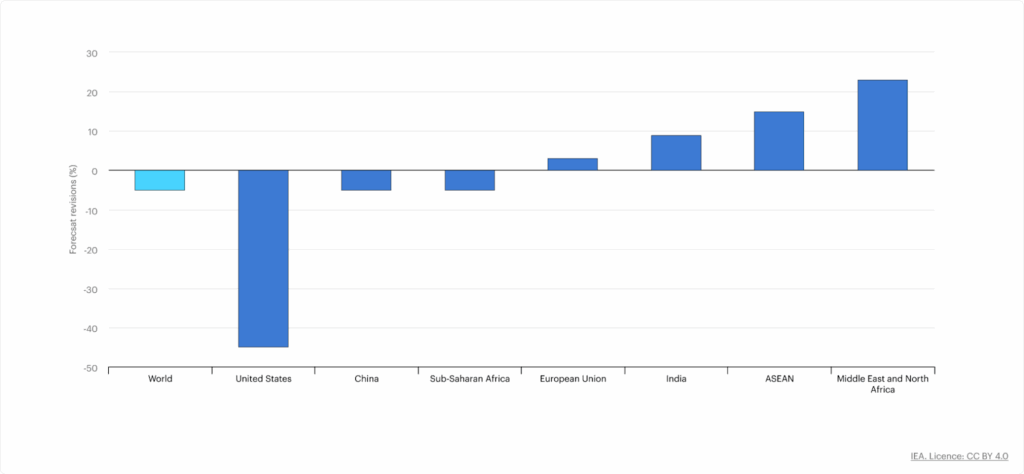

While the findings are encouraging, the IEA notes that its forecast for the period between 2025 and 2030 is 5% lower than its 2024 analysis, reflecting policy, regulatory and market changes. As a result, the agency now expects 248 GW less renewable capacity to go online over the upcoming five years.

Solar and Wind are Capable of Meeting Energy Demand

Regardless, according to Ember’s “Global Electricity Mid-Year Insights 2025” report, solar and wind power additions are already capable of meeting the rising global electricity demand. The analysts find that solar and wind met all electricity demand growth in the first half of this year, leading to a slight fall in fossil fuel generation compared to the same period in 2024. Importantly, Ember notes that renewables overtook coal for the first time in history, and record solar growth and steady wind expansion are now increasingly reshaping the global power mix.

“Solar and wind are now growing fast enough to meet the world’s growing appetite for electricity,” said Małgorzata Wiatros-Motyka, senior electricity analyst at Ember. “This marks the beginning of a shift where clean power is keeping pace with demand growth.”

Spotlight on IEA’s Regional Insights and Renewable Energy Market Trends

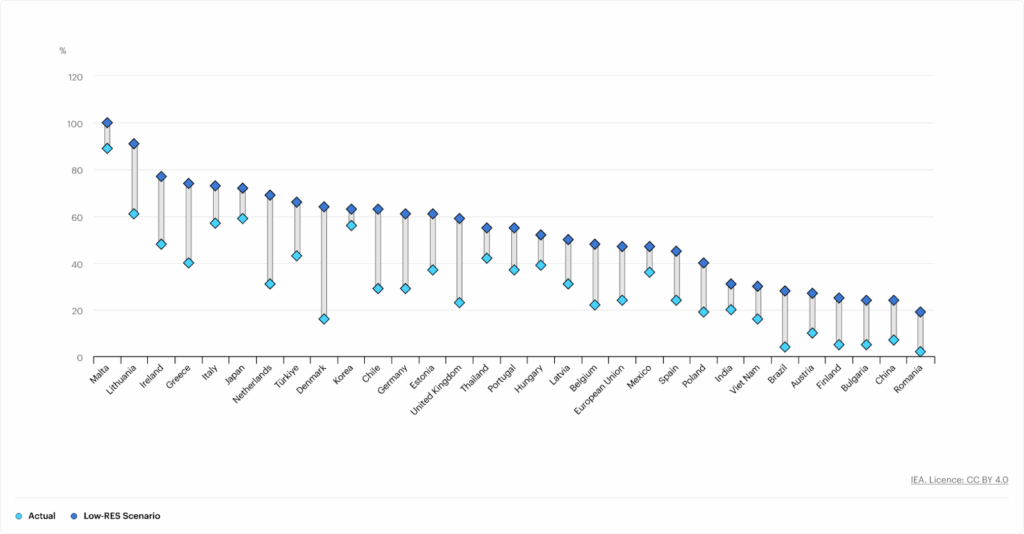

Overall, in more than 80% of countries worldwide, the IEA’s report finds that renewable power capacity will grow faster between 2025 and 2030 than it did over the previous five-year period.

The agency notes that policy changes in the US and China are the reason that the forecast for growth in global renewable power capacity is 5% lower than in last year’s report. The US, under President Trump, is the main outlier, with its forecast revised downward by nearly 50%. Despite the shift from fixed tariffs to auctions and its impact on project economics, China continues to account for almost 60% of global renewable capacity growth and is on track to reach its recently announced 2035 wind and solar target five years ahead of schedule.

For India, Europe and most emerging and developing markets, the IEA’s 2025 renewable market outlook is more positive than in the previous edition.

For example, in the case of India, the renewable expansion is driven by higher auction volumes, new support for rooftop solar projects and faster hydropower permitting. Notably, the IEA notes that the country is on track to meet its 2030 target and become the second-largest growth market for renewables, with capacity set to increase by 2.5 times over the next five years.

For the EU, the IEA has revised its growth forecast slightly upwards, driven by higher-than-expected utility-scale solar PV capacity installations and strong corporate power purchase agreement (PPA) activity across key markets. The growth is sufficient to offset a weaker outlook for offshore wind, the experts note.

The Middle East and North Africa (MENA) region remains the best performer, with its forecast revised up by 25%. This marks the most significant regional upgrade, driven by rapid solar PV growth in Saudi Arabia.

ASEAN ranks second after the MENA region, with a 15% higher forecast. In Southeast Asia, in particular, solar PV and wind deployment are accelerating, with more ambitious targets and new auctions.

The IEA’s report notes that the use of distributed solar PV applications with storage units is also growing in countries with unreliable electricity grids, such as Pakistan, where uptake of commercial and large-scale off-grid solar PV systems is rapidly improving electricity access.

Annual onshore wind capacity additions over the projected period are expected to rise in Africa, the Middle East, ASEAN countries, Latin America and Eurasia, in addition to Europe and India.

In China and India, this progress is already underway. Ember notes that both countries saw fossil generation fall in the first half of 2025 as clean power growth outpaced demand. China remained the leader in clean energy growth, adding more solar and wind than the rest of the world combined, helping to cut fossil generation by 2% (58.7 TWh) in the first half of 2025.

In the same period in India, growth in clean sources was more than three times bigger than demand growth. However, demand was exceptionally low at 1.3% (12 TWh), compared to the same period last year at 9% (75 TWh). India’s record solar and wind expansion, combined with lower demand, drove down fossil fuel consumption, with coal falling 3.1% (22 TWh) and gas 34% (7.1 TWh).

Energy Transition and Challenges for the Renewable Energy Sector

The IEA’s report identifies various challenges already threatening the growth of the renewables market, including overcapacity, low prices, trade barriers and regulatory shifts. These have slowed new investment in solar PV supply chains inside China, while manufacturing capacity outside of China is now expanding. The IEA also warns that challenges, such as grid integration, supply chain vulnerabilities and financing will also increase over the next five years.

The report projects that solar PV supply chains and rare earth elements for wind turbines will remain highly concentrated in a single country, highlighting supply chain security risks. Supply chain concentration for key production segments will remain above 90% in 2030, similar to today’s level, with China dominating the mining and refining of rare earth elements. Despite diversification efforts, mining and refining are expected to remain highly concentrated through 2030.

Wind power will face supply chain issues, rising costs and permitting delays, and not all regions will be able to adequately address these challenges to enable growth, the agency notes. The offshore wind industry, in particular, is expected to face multiple challenges over the next five years, with its forecast growth revised down by over 25%. According to the IEA, several developers have already weakened their 2030 deployment targets. The agency notes that the lower expectations are driven by the policy shift in the US and by project cancellations and delays in Europe, Japan and India due to higher costs and supply chain challenges.

The IEA also notes that growing shares of wind and solar PV are increasing integration challenges. By 2030, variable renewables are expected to generate nearly 30% of the global electricity supply, nearly double today’s level. According to the agency, this calls for a rapid increase in power system flexibility and grid investment in an increasing number of countries.

Furthermore, the IEA warns of headwinds for wind and solar manufacturers, which are already struggling financially and reporting significant losses despite surging global installations. According to the agency, the economic sustainability of equipment manufacturers remains an issue, citing China, where solar PV prices have decreased by over 60% since 2023 due to a module supply glut and intense competition for market share. This has brought the margins of the largest manufacturers to minus 10%, with cumulative losses reaching almost USD 5 billion since the beginning of 2024. The agency finds that wind manufacturers outside China have also been struggling, reporting cumulative losses of USD 1.2 billion in 2024.

Still, the IEA notes that the appetite for clean energy from developers and buyers remains strong over the projected period. The experts find that renewable developers have either increased or maintained their capacity deployment targets for 2030 since last year, with both developers and buyers benefiting from lower solar PV costs.

Bridging Gaps Between Ambition and Implementation Crucial To Triple Clean Energy Capacity

In total, the IEA estimates that global renewable power capacity will reach 2.6 times its 2022 level by 2030, but it will still fall short of the COP28 tripling pledge. However, the agency notes that the target can still be brought within reach if countries adopt enhanced policies to bridge gaps in both ambition and implementation.

For this purpose, the IEA presents an accelerated case, according to which global renewable capacity can reach 2.8 times its 2022 level by 2030.

To unlock this growth, countries need to minimise policy uncertainties, reduce permitting timelines and increase investment in grid infrastructure. Other crucial steps include expanding flexibility to facilitate the integration of variable renewables and derisking financing.

This will help countries accelerate their energy transition, unlocking huge economic, societal and environmental gains along the way. For example, the IEA notes that the deployment of renewables has already reduced fuel import needs significantly in many countries, enhancing energy diversification and security. The agency finds that, of the 2,500 GW of non-hydro renewable power capacity added globally since 2010, about 80% was installed in countries that rely on fossil fuel imports. Without these renewable additions, cumulative global imports of coal and natural gas in these countries would have been 45% higher in 2023.

As a result, countries have reduced coal imports by 700 million tonnes and natural gas imports by 400 billion cubic metres, saving an estimated USD 1.3 trillion since 2010. Japan, South Korea, Thailand, India, and Vietnam, for example, have been among the countries that have achieved the largest savings on fossil fuel imports through the adoption of renewables.

However, to lock in the progress achieved to date, Sonia Dunlop, CEO of Global Solar Council, notes that governments and industry must accelerate investment in solar, wind and battery storage. According to the expert, this will ensure that clean, affordable and reliable electricity reaches communities everywhere.

“We are seeing the first signs of a crucial turning point,” said Ember’s Wiatros-Motyka. “As costs of technologies continue to fall, now is the perfect moment to embrace the economic, social and health benefits that come with increased solar, wind and batteries.”

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more