Top 10 Solar Energy Stocks in India for 2025

Source: Fenice Energy

28 November 2024 – by Eric Koons Comments (0)

The top 10 solar energy stocks in India for 2025 are capturing the spotlight as the country’s solar industry experiences an unprecedented surge. With India already achieving 90 GW of installed solar capacity as of September 2024, the opportunities are immense.

Indian solar energy companies will need to continue to rapidly expand to meet this target and address the country’s existing energy supply-demand gap. As a result, these stocks represent lucrative investments and pivotal players driving innovation for the country’s energy transition.

What Are Solar Energy Stocks?

Solar energy stocks are shares of companies involved in the solar power industry. These companies operate across various segments, from manufacturing to installation, operation and maintenance. Investment opportunities in solar stocks range from established conglomerates with diversified energy portfolios to innovative startups pushing the boundaries of solar technology.

Why Invest in Solar Energy Stocks?

Rapid Market Growth and New Renewable Energy Projects

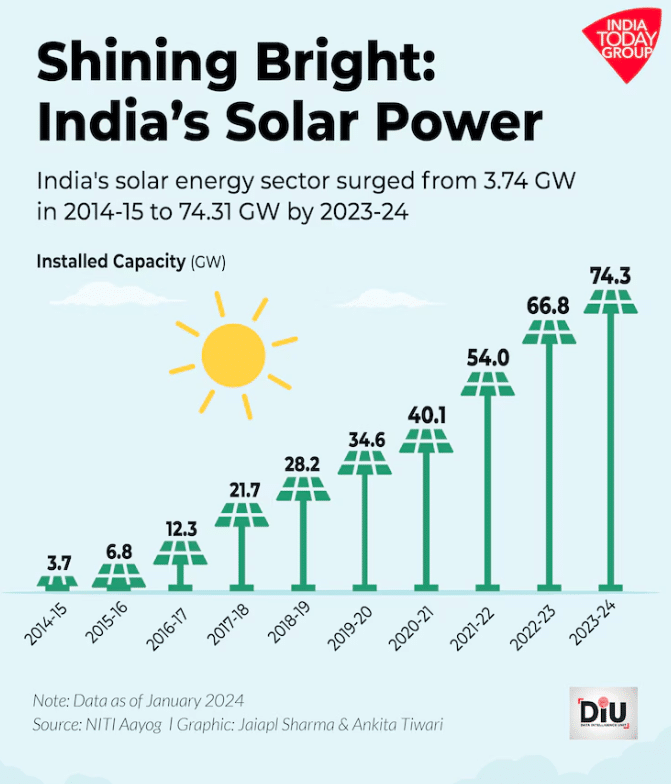

India’s solar energy capacity increased by 30 times over the last decade. The government’s supportive policies, like the National Solar Mission, have been instrumental in promoting this growth. The government will likely continue offering incentives such as tax breaks, subsidies and favourable tariffs to encourage ongoing progress in pursuing national renewable energy targets.

Technological Advancements

Innovations in solar technology have significantly reduced costs. The average price of solar power dropped by 85% between 2010 and 2020. Now, solar energy is the cheapest form of energy in the country. This provides significant growth prospects as costs will continue to fall as technology improves.

Economic Benefits

As renewable energy sector and solar energy capacity has grown, solar energy stocks have followed the same path. The market was valued at USD 39 billion in 2023 and jumped to USD 45 billion in 2024. The value is anticipated to increase to over USD 1 trillion by 2033. This exponential growth in the solar energy industry provides a significant market opportunity for India’s top 10 solar energy stocks during 2025.

Best Solar Energy Stocks in India 2025: An Overview

India’s solar energy market is filled with a growing number of companies serving the domestic and international markets. Below is our list of India’s top 10 best solar energy stocks for 2025.

1. Adani Green Energy

Adani Green Energy operates over 11 GW of renewable energy projects, mainly in solar energy. It aims to become a global leader with an ambitious plan to reach 50 GW by 2030. Its strong government ties and robust financials make it an attractive investment for those seeking an established company in the solar sector.

2. Tata Power Solar Systems

Tata Power Solar is a key player with over 3 GW of solar installations and a manufacturing capacity of 670 MW in modules. Leveraging the Tata brand and technological expertise, it offers stability and is expanding its capacity, making it a solid choice for investors.

3. Azure Power Global

Azure Power Global manages more than 4 GW of operational solar assets and was the first company to develop a utility-scale solar project in the country in 2009. Its strong project pipeline and recent partnerships with solar panel manufacturing companies present a compelling investment opportunity in the solar space.

4. Suzlon Energy

Suzlon is primarily a wind energy company, not a solar energy company, yet it began venturing into solar projects in 2016, with 340 MW in current capacity. While this makes up just 2% of its total renewable energy portfolio, the company plans to continue expanding in the solar market.

The company’s diverse offerings and robust, existing wind energy infrastructure offer the opportunity to capitalise on hybrid wind and solar facilities. This approach can increase total energy output at lower costs and yield significant investor returns.

5. Sterling and Wilson Solar

With a portfolio of over 19 GW and 268 solar facilities globally, Sterling and Wilson is an impactful global player for investors wanting international exposure that focuses primarily on the Indian market. Furthermore, the company has a robust presence in the operation and maintenance market, overseeing an additional 8.2 GW of facilities for other developers.

This scale and diversification, along with a robust order book of USD 118 million, provides confidence to investors seeking established market leaders.

6. Vikram Solar

Vikram Solar is one of India’s largest solar module manufacturers, having shipped 5.4 GW in modules. It has diversified across the utility, commercial and residential scales to provide products for the entire Indian market.

While its primary market is India, the company is slowly expanding internationally with plans to develop production facilities in countries like the United States. This expansion signifies the company is aiming to capitalise on the growing global solar market.

7. ReNew Energy Global

ReNew has a diversified portfolio spanning solar, wind and hydropower energy production, solar PV manufacturing and transmission infrastructure. With 8.9 GW of installed and committed solar projects, the company’s portfolio is one of the largest in the country. Furthermore, strong financial backing from Goldman Sachs and a NASDAQ listing offer global exposure, making it appealing for investors interested in a diversified renewable energy company.

8. Websol Energy Systems

Websol has been in the solar manufacturing market since 1994 and now has a PV cell annual production capacity of 600 MW and a module capacity of 550 MW. Its products meet the demands for utility, commercial and residential-scale projects, giving it access to any level of the Indian market. Its focus on high-efficiency panels for both domestic and export markets makes it a noteworthy investment.

9. Zodiac Energy

Zodiac is a fully integrated solar company that designs, manufactures, installs and operates solar systems. While it is a smaller company that only operates in Gujarat, it has had great success in this market. As a result, it has seen a five-year return of over 4,000% and a market cap of USD 95 million.

Zodiac may not be as large as many other companies on this list, but it represents a high-risk, high-reward opportunity for investors betting on the company’s future growth.

10. Borosil Renewables

Borosil is a solar glass manufacturer with a capacity of 1,350 tonnes per day. The company is expanding internationally with the recent acquisition of Europe’s largest solar glass manufacturer and plans to continue this growth.

The global solar glass market is still in its infancy but is projected to grow at a CAGR of around 13% until 2032. This provides a unique opportunity to capitalise on this niche yet growing market segment.

Investment Landscape in Solar Energy Sector in 2025

India’s solar energy sector presents immense growth potential and lucrative investment opportunities. India’s top 10 solar energy stocks for 2025 offer a mix of stability, innovation and aggressive expansion strategies.

As the country moves toward its ambitious renewable energy goals, these companies are poised to play significant roles. Investors should keep a close eye on these stocks leading up to 2025 and beyond.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more