South African Coal Exports Decline for the Fourth Consecutive Year

Photo ShutterStock.com

23 May 2023 – by Hozefa Merchant

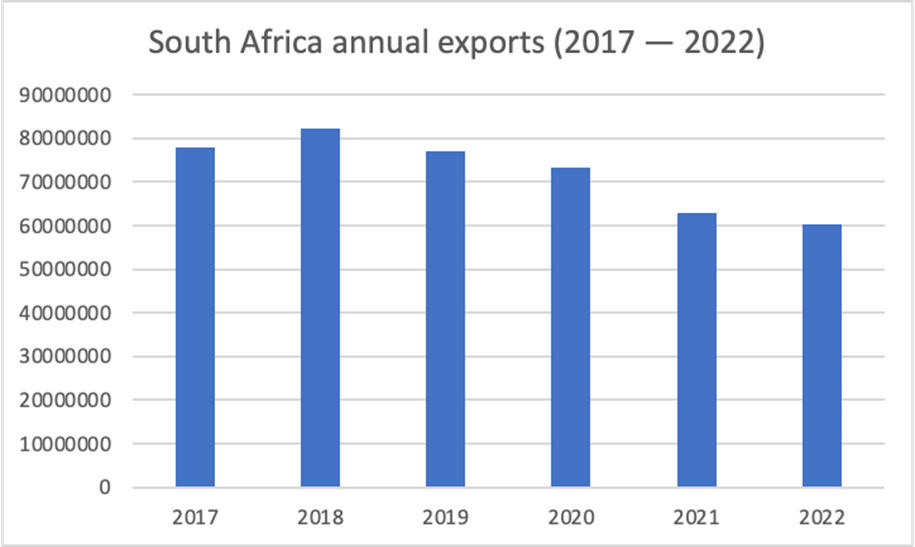

South African coal exports have declined for the fourth consecutive year in 2022. According to data from Kpler, an agency that tracks global commodities markets, South Africa exported 60.3 million tonnes of coal in 2022 via its Richards Bay terminal. The total seaborne coal trade volume has been the lowest in the last six years.

While the demand from European countries has increased, there has been a significant decline in demand from Asian countries. Compared to 2021, the demand from EU countries increased by 13mn tonnes, whereas the demand from Asia declined by 17mn tonnes. The increase in coal demand from the European Union could not offset the decline in demand from Asia, resulting in an average annual decline of 5 million tonnes between 2018 – 2022.

South African coal exporters, such as Thungela Resources and Exxaro Resources, made record profits last year despite declining export volumes. According to Exxaro’s financial reports, coal exports in 2022 were the lowest in the last 5 years. Meanwhile, Thungela Resources’ coal exports have been steadily declining since 2020. However, with prices cooling off, high production costs, and reduced coal demand again in 2023, South African coal exporters will see a steeper profit decline over the next several years. The outlook for South African coal exports this year is expected to remain negative.

For South African coal exporters, demand increases from European countries are short-term and not bankable. The Asian coal decline should be a wake-up call for exporters as it highlights the declining appetite for seaborne coal. Two of the largest coal importers in the world, India and China, are increasingly looking at domestic coal reserves and pivoting to renewables for power generation at a far greater speed than anticipated. This will have a lasting impact on South African coal exporters. It’s time South African coal producers think about an exit plan.

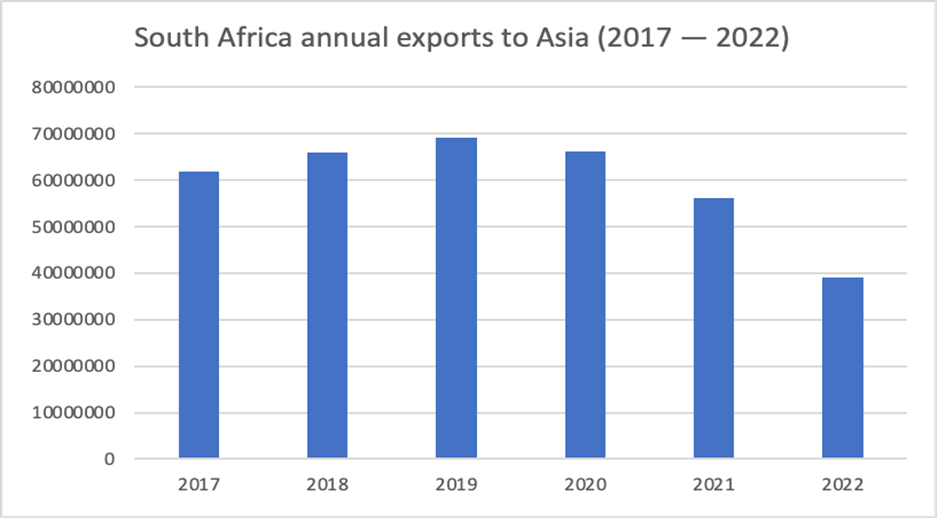

Demand from Asia

South African coal demand from Asia has declined since reaching its peak in 2019. South African coal exports to Asia in 2022 declined by more than 30 million tonnes compared to 2019 and more than 17 million tonnes compared to 2021.

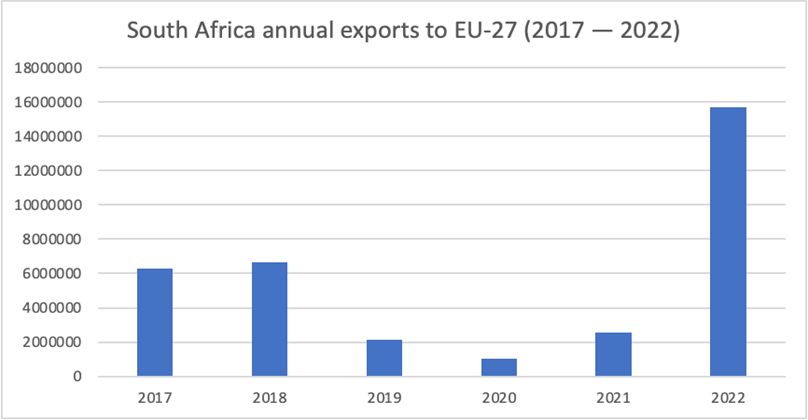

Demand from the EU+27

Meanwhile, demand for South African coal from the EU increased. Compared to the total coal exported to the EU+27 in 2021, coal exports in 2022 increased by more than 13 million tonnes. However, this increase was unable to cover the Asian deficit.

South African coal exports to the EU+27 had declined before reaching a new peak in 2022. The war in Ukraine and the EU reducing its dependence on Russian fossil fuels have been the key reasons for increasing South African coal imports to the EU. However, a recent analysis by the London-based power sector analyst Ember suggests that most of the coal imported by the EU remains unused.

The Ember analysis suggests coal power generation fell in 15 out of the remaining 18 coal-reliant EU countries over winter 2022 compared to the same period the year before. Only three countries – Italy, Finland, and Hungary – increased their coal generation. The coal units brought back into operation only ran at an average of 27% of their full capacity during the winter season.

Total South African Coal Exports

Data from Kpler suggests that South African coal exports peaked in 2018. Coal exports in 2022 declined by more than 21 million tonnes compared to 2018, resulting in an average yearly decline rate of more than 5 million tonnes.

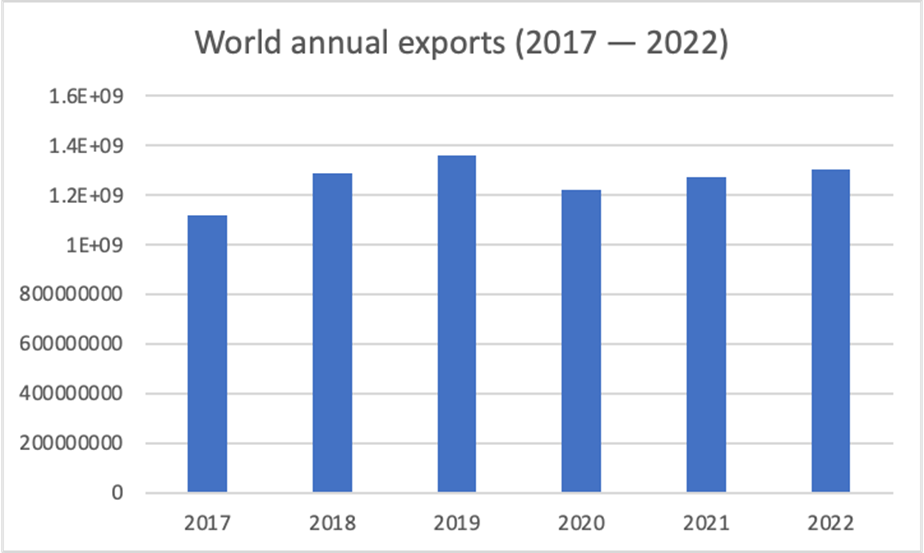

Despite the IEA’s report on global coal consumption breaking the 8 billion tonne mark for the first time, the seaborne coal trade remains depressed. According to Kpler’s data, although the total seaborne coal trade in 2022 increased by 35 million tonnes compared to 2021, the total volume traded remained significantly under pre-pandemic levels. Compared to 2019, when global seaborne coal trade peaked, the total volume traded in 2022 remained in deficit by more than 50 million tonnes.

One of the main reasons for the subdued performance of the seaborne coal trade in 2022 was China’s 30 million tonnes of demand deficit compared to 2021. Despite the deficit being covered by India’s 36 million tonnes year-over-year increase, the reduction in demand from other countries ensured that 2022 seaborne coal demand remained under the 2019 peak. Seaborne coal trade in 2023 is expected to remain subdued due to coal import and production trends in China and India. Both countries have ramped up domestic production and are increasingly restricting imports due to high import prices.

Demand from the EU will decline as steeply as it increases due to the warmer winter expected this year and due to gains made in renewable energy capacity addition and energy efficiency improvements. This further backs the negative outlook for South African coal exports in 2023.