Southeast Asia’s Slow Transition to Renewable Energy

Source: Middle East Institute

06 September 2021 – by Eric Koons

When it comes to news about the renewable energy transition, Europe and the United States are usually the two 800-pound gorillas in the room.

However, as we very well know, Asia will play just as important – if not more important – a role in the coming years. Taking this one step further, Southeast Asia (SEA) will be the critical piece for the coming decades.

Why Is Southeast Asia So Important for the Energy Transition?

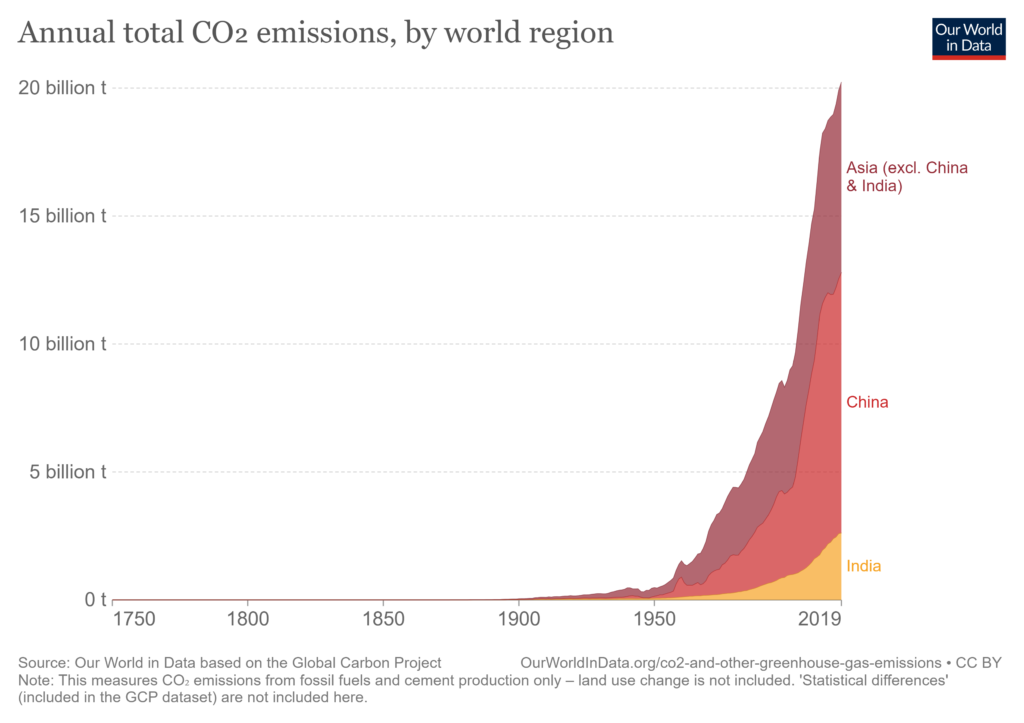

Simply put, SEA’s greenhouse gas emissions rates have been steadily increasing over the last decades. A report released by the Asian Development Bank (ADB) found that SEA was the fastest-growing region for greenhouse gas emissions between 1990 and 2010 – 5% per year.

Southeast Asia Can’t Meet Renewable Energy Demands

Increased demand for energy fuelled by rapid economic development (Average GDP growth of 5% from 2013-2017) has driven emissions.

In almost all ways, economic development is a positive metric, but along with development comes external factors, like:

- A growing urban population

- Increased electrification

- Growth in manufacturing

- Heightened demand for transportation

Why we Still use Fossil Fuels

All of these require energy, and a vast majority of the power is sourced from fossil fuels, mainly because the renewable energy capacity is not available to meet the growing energy demands.

In some ways, the gap in renewable energy infrastructure and energy demand is the fault of governments. However, this is a one-sided view, and the reality is that it is hard to keep up with rapid growth.

As Economic Growth Slows, it is Time to Catch Up

As economic growth begins to slow, there is the opportunity to swiftly develop renewable energy in the region to close the gap between supply and demand. The transition to renewable energy will need to accelerate in order to meet demands.

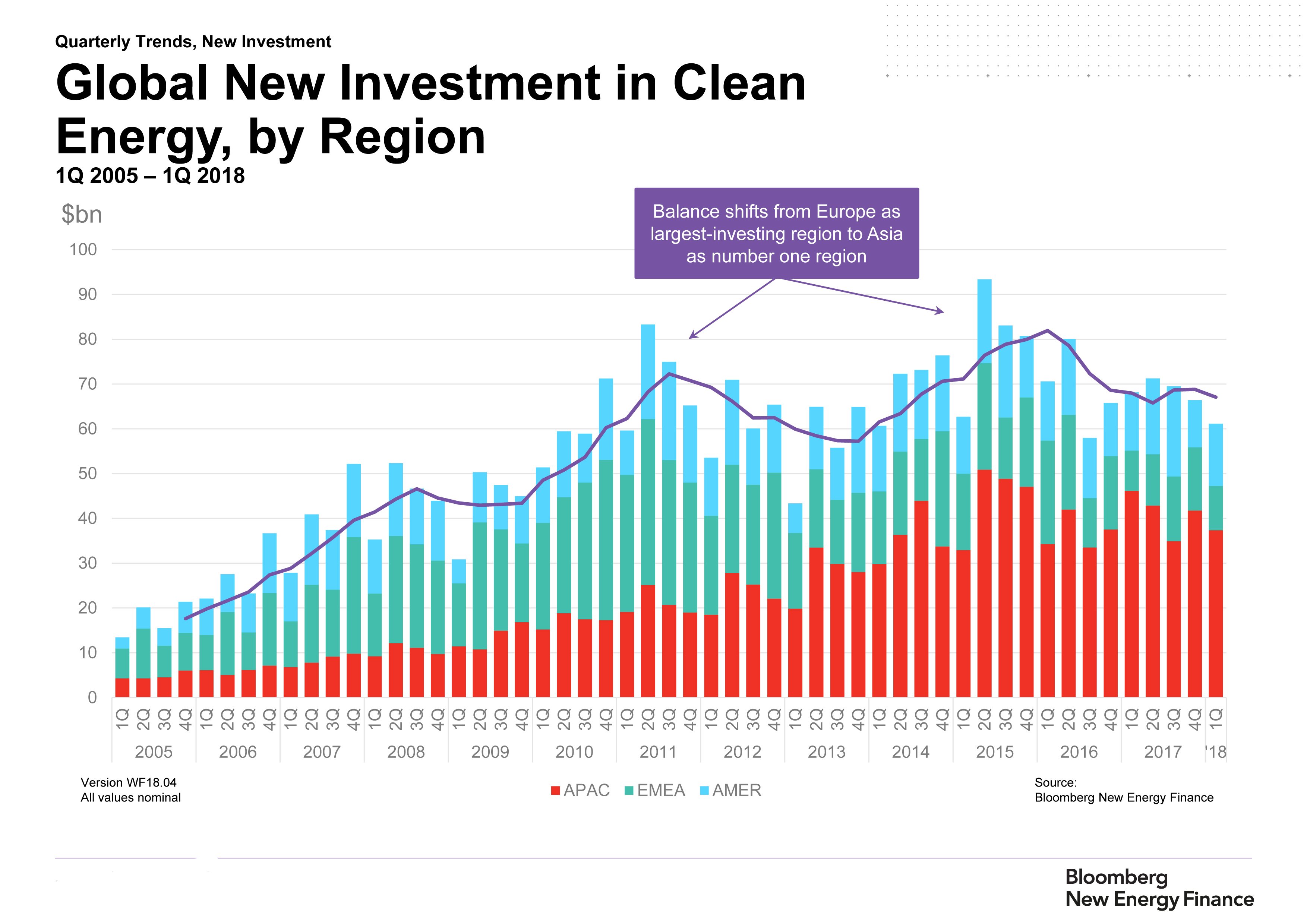

Two key areas that will drive this acceleration are government policy and investment.

Government Policies for Renewable Energy Transition

Government policy is the foundation that makes it viable to develop large, costly renewable energy projects. Additionally, in many cases, policy forces the private industry to move away from fossil fuels and towards renewables.

Policies like net-zero carbon targets provide time frames for a country to become carbon neutral. Meeting these goals becomes mandatory and requires support from both the public and private sectors.

Carbon Pricing and its Effect on Renewable Energy Transition

Additionally, this creates a cascade of other government policies that facilitate reduced carbon use – this includes moving away from fossil fuels and transitioning to renewable energy.

An important trickledown policy from net-zero targets is the use of carbon pricing instruments.

Carbon pricing instruments make businesses pay for the carbon they generate, effectively creating an economic disincentive to produce carbon. Unless companies find ways to reduce their emission, their bottom line will suffer.

(If you would like to learn more about carbon pricing instruments, read our deep-dive article on this topic)

Increased Investment in Renewables

Carbon pricing ultimately increases demand for renewable energy, which drives up energy prices. Higher energy prices make it more viable for investors to develop new renewable energy projects. Thus, pushing the energy transition forward.

Investment in renewable energy is a tough sell due to long development and slow return-on-investments. But with government support, subsidies, and growing demand, the long-term profitability is very viable.

Singapore Is a Role Model For the Region in its Transition to Renewable Energy

One southeast Asian country that has started to embrace these policies is Singapore.

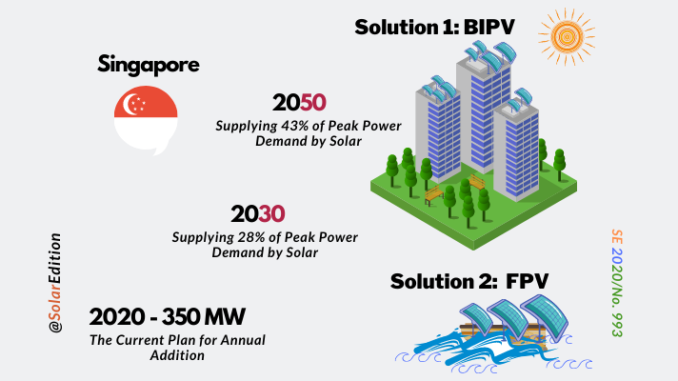

This focus is highlighted by their 2021 ranking in The World Economic Forum’s Energy Transition Index (ETI) – where they ranked first in Asia and 21st globally. Their success is the result of nearly 20 years of consistent energy policies that support renewable resource use.

There are Many Valuable Lessons From Singapore’s Approach to Transitioning to Renewable Energy

They have a well-planned system that looks 40-50 years in the future, reviewed every ten years. Additionally, the policy structure looks at sustainability across the board, from land use to clean air and public transport to nature conservation, waste, and energy generation.

Despite its success, Singapore is still a significant player in the global fossil fuel industry.

It is a large refining hub and home to a sizeable volume of the international LNG trade. Not to mention the country still sources 96% of its energy from natural gas.

Renewable Energy Options in Singapore

However, the nation-state is exploring alternative energy sources such as commercial solar, hydrogen and even ‘piping’ solar from a plant located in Northern Australia via undersea cable.

Solar is Singapore’s fastest-growing renewable energy sector, going from a 3.8-megawatt peak in 2010 to 400 megawatts in 2020. It aims to quadruple that capacity to 1.5 gigawatt-peak by 2025 and 2 gigawatt-peak by 2030

Southeast Asia – Time for Net-Zero Targets

Asia has already demonstrated that it can become a global renewable powerhouse, with over 80% of the world’s solar panels now being made in China. Furthermore, in 2020, the region’s largest polluters – China, South Korea and Japan made commitments to transition to net-zero carbon policies.

Commitment to Energy Efficiency

These commitments will inspire smaller countries (hopefully the SEA region) to develop their own policies and expand the role that renewable and energy efficiency will play in the energy transition of the SEA region.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more