Top 10 Oil And Gas Companies In Singapore [2024]

04 April 2024 – by Eric Koons

Oil and gas companies in Singapore play a significant role in the economy. The oil and gas industry provides thousands of jobs and 2.3% of the country’s GDP. And they drive international investment. Most international and local oil and gas companies have a presence in Singapore, but this article will look at 10 of the most influential.

Singapore’s Energy Profile and Oil and Gas Industry

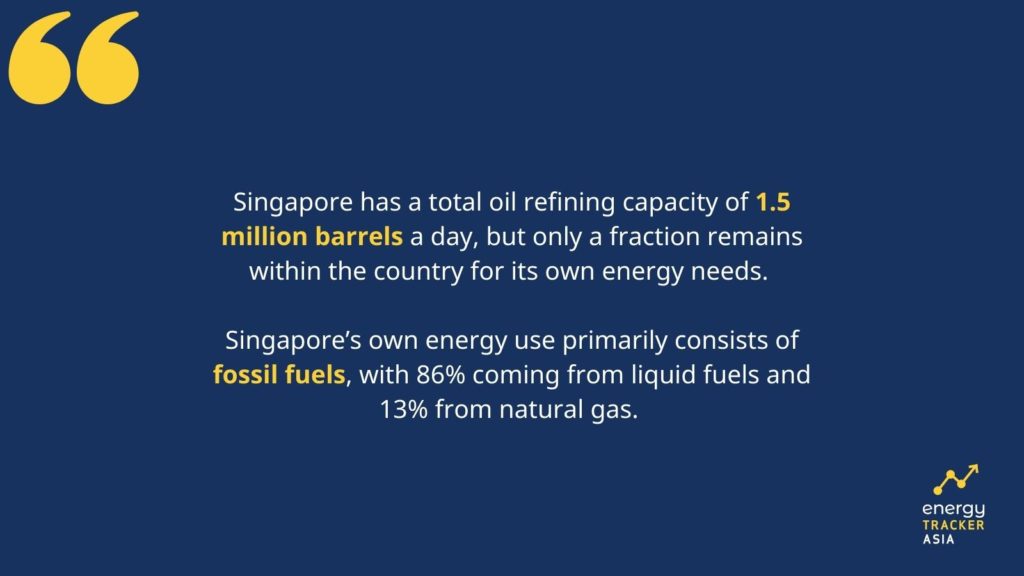

Singapore has a total oil refining capacity of 1.5 million barrels a day, but only a fraction remains within the country for its own energy needs. The rest represents a key energy export product for Asia and the world.

Singapore’s own energy use primarily consists of fossil fuels, with 86% coming from liquid fuels (oil, petroleum, kerosene, etc.) and 13% from natural gas. However, the remaining 1% consists of renewables and coal.

| Type of Fuel | Percentage in the Total Singapore Energy Mix |

| Oil Derivatives | 85.89% |

| Natural Gas | 13.28% |

| Coal | 0.58% |

| Solar PV Energy | 0.08% |

| Other Renewables | 0.18% |

Top 10 Oil and Gas Companies in Singapore

1. ExxonMobil – Jurong Island Refinery (Revenue = USD 9.4 Billion)

One of the largest refining facilities in the country is the Singapore Refinery, located on Jurong Island. Initially constructed in 1966, it is now owned and operated by leading oil and gas company ExxonMobil. The refinery has a capacity of 592,000 barrels per day, consisting of various fuels, oils and aromatics. In general, a majority of its product is sold throughout the Asia-Pacific region.

2. Singapore Petroleum Company (Revenue = USD 26 Million)

Singapore Petroleum Company is investing heavily in the oil and gas exploration, refining, storage and transportation of petroleum products. As a result, it owns a 50% share in a refinery with a capacity of 290,000 barrels per day. Additionally, its storage terminal on Pulau Sebarok has 220,000 m3 of total storage capacity with a deep-water jetty for tankers and barges.

3. Shell – Pulau Bukom Refinery (Revenue = USD 133 Billion)

The Pulau Bukom Refinery was constructed in 1961 as Singapore’s first petroleum refinery. Currently, it is owned by Royal Dutch Shell and is the company’s only major energy and chemical facility in Asia. Shell’s long-term plan for the site is to move away from fossil fuel production and focus on producing low-carbon products and renewable energy.

4. Puma Energy (Revenue = USD 67 Million)

Puma Energy was founded in 1997 and has facilities in over 40 countries, with its headquarters in Singapore and Geneva. Puma’s operations are based around storing and distributing petroleum products. However, this comes mainly in the form of retail gas stations and storage terminals.

5. Trafigura Pte Ltd (Revenue = USD 147 Billion)

Trafigura is a Singapore-based multinational commodity trading company. Overall, it facilitates the trade of petroleum products, from production companies to distribution networks.

6. PetroSeraya (Revenue = USD 5 Million)

PetroSeraya is an oil storage and sales company. It is a YRL Power Seraya Group subsidiary and was established in 2007. As a result, its primary role is to facilitate the sale and purchase of petroleum products for its parent company to use for energy generation within Singapore.

7. City Energy (Revenue = USD 10 to 100 Million)

City Energy provides several energy solutions for Singaporean residents – from natural gas for home heating to EV charging stations. For this reason, the company is focused on good energy. Furthermore, it explores low-carbon solutions and seeks ways to decarbonise the city.

8. Pacific Energy Corporation (Revenue = 83 Million)

Pacific Energy Corp’s primary focus is natural gas exploration, production and sale. Additionally, it owns three major combined cycle gas turbine (CCGT) power plants in China. Its markets are North America and Asia, specifically focusing on emerging Asian countries.

9. Repsol SEA Pte. Ltd. (Revenue = USD 42 Billion)

Repsol claims to be the first energy company with a net-zero by 2050 goal. This focus is leading the company down a path of sustainable development with an increasing emphasis on low-carbon energy sources. With that being said, it is still present in upstream and downstream crude oil and natural gas operations.

10. PetChem (Revenue = USD 8 Million)

PetChem is a Singapore-based trading company that deals heavily in fossil fuel transport and sale. Above all, they focus on the Asian market and have a presence in Vietnam, Cambodia, Thailand, Philippines, Indonesia and China.

Final Remarks

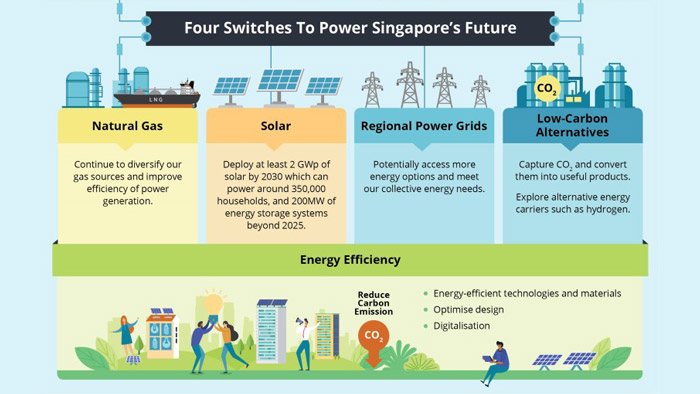

Singapore is the hub of the petroleum industry in southeast Asia and is a significant thoroughfare for fossil fuel products travelling across the world. Regardless, the island nation still has ambitious energy transition goals to push domestic energy generation towards renewables and a sustainable energy future.

This will undoubtedly affect Singaporean and international oil companies and the petroleum industry worldwide. However, many are still unsure as to what extent this will affect them. As a result, Singapore has the opportunity to put pressure on oil majors and help facilitate the global energy transition.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more