What Are Carbon Credits and How Do They Work?

Source: OFFSEL

02 May 2024 – by Eric Koons

“What are carbon credits?” is a question many business leaders are asking as the world aims to meet global and national emissions goals. As industries confront the challenge of reducing greenhouse gas emissions, they face numerous hurdles.

Reducing Greenhouse Gas Emissions

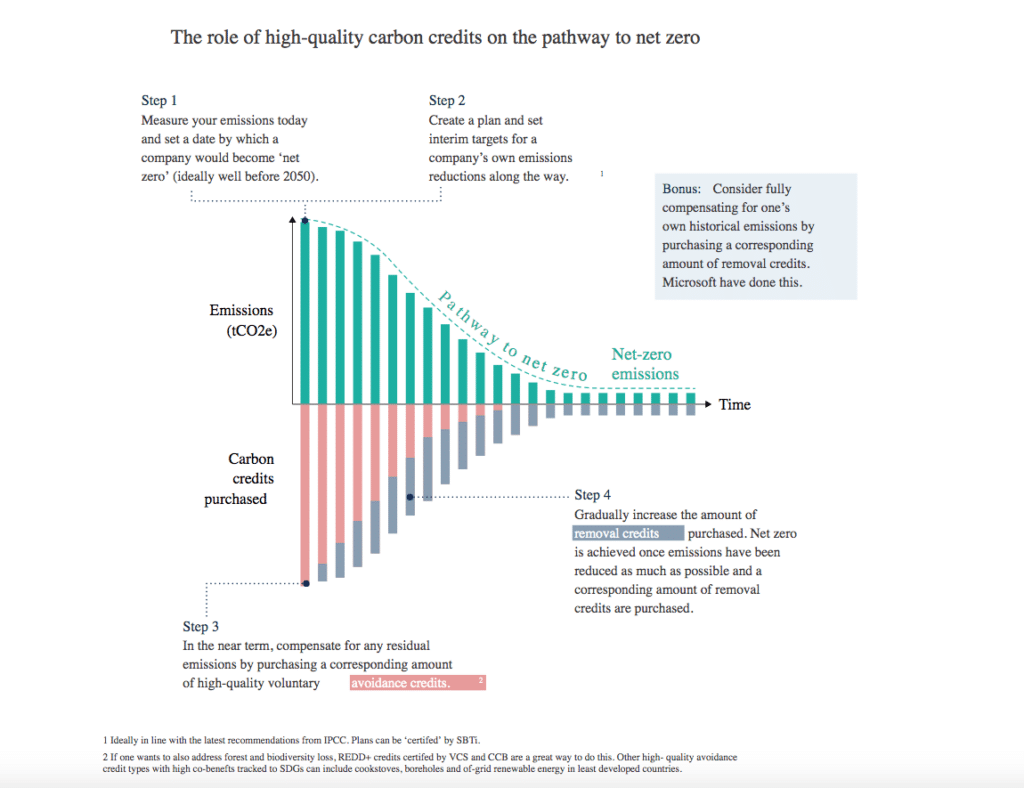

Rapid reduction efforts can be costly and complex. They are lengthy endeavours that are often beyond the immediate capabilities of a company. Carbon offset credits are a strategic tool in this scenario, facilitating the necessary emissions reductions in a manageable near-term way.

What Are Carbon Credits?

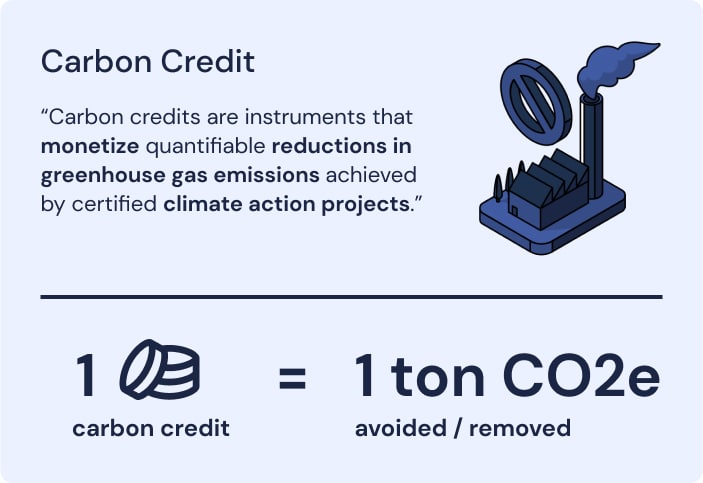

Carbon credits are tradable certificates or permits that represent the right to emit 1 tonne of carbon dioxide or the equivalent amount of a different greenhouse gas. They form the cornerstone of carbon markets, where such credits can be bought and sold, helping businesses reduce their total greenhouse emissions.

For example, a company that reduces its greenhouse gas emissions can sell the surplus credits to another that might be struggling to meet its emission targets. This system incentivises companies to invest in cleaner technologies and practices and reduce their carbon footprint.

Another use case of carbon offsets is for companies whose sole business is reducing carbon emissions. They generate credits for the emissions they eliminate and then sell them for profit. For instance, carbon offset projects that restore forests, improve energy efficiency or use renewable energy can generate credits by demonstrating that they have reduced emissions or captured carbon and greenhouse gases from the atmosphere.

Who Issues Carbon Credits?

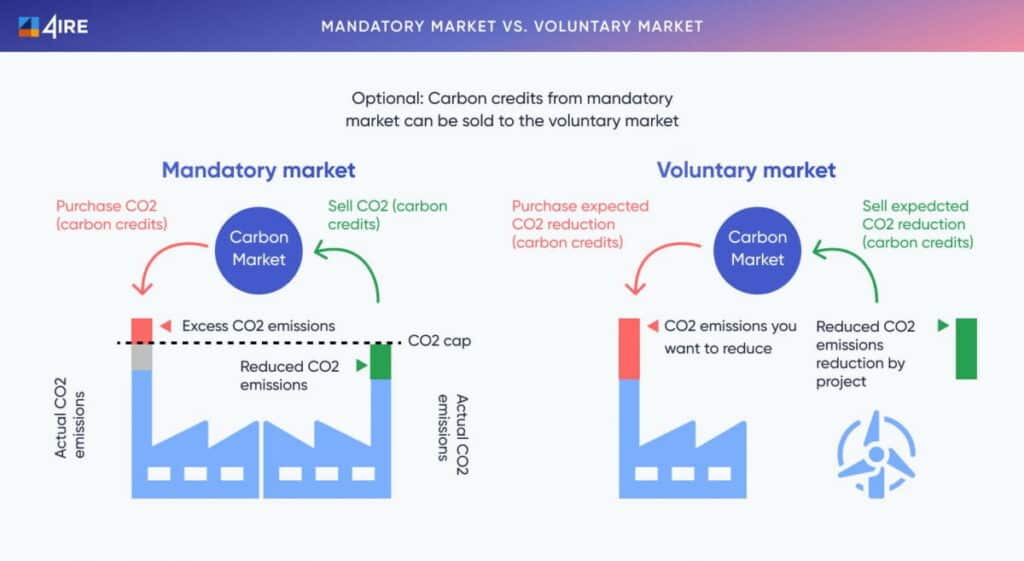

Carbon credits are issued based on the market they are for. There are two types of carbon credit markets: mandatory government-led markets and voluntary markets.

Mandatory carbon credit markets are usually part of national, regional or international regulations to achieve compliance, with caps on greenhouse gases. The overseeing government body issues credits and allocates or auctions them off.

On the other hand, voluntary markets operate outside the compliance markets, allowing companies to purchase carbon credits voluntarily for reasons related to corporate social responsibility or to achieve internal sustainability goals. These credits are often directly from projects that reduce or remove greenhouse gasses from the atmosphere and are sold through third-party exchanges.

Carbon Credit Verification

No government body oversees the voluntary credit market, so third-party agencies verify the emissions reduction claims before issuance. These agencies ensure the emissions reductions are real, quantifiable, measurable and permanent.

Entities like Verra or The Gold Standard are common verifiers in the carbon market. They provide assurance that the carbon credits are credible and that the carbon offsetting projects actually provide environmental benefits.

The Benefits of Carbon Credits

Carbon credits from mandatory and voluntary markets are important in decarbonisation efforts.

Benefits of the Mandatory Carbon Credit Market

Carbon credits on the mandatory market provide an immediate solution to compliance requirements for businesses under emissions regulations, avoiding potential fines. For governments, they allow national or sector-wide carbon dioxide emissions to be capped, controlled and reduced over time. This is crucial as governments pursue their net-zero emissions targets.

Benefits of the Voluntary Carbon Market

On the voluntary market, carbon credits enable companies to pursue emissions reduction programs much faster than directly decarbonising their operations. Credits work as a great stepping stone in the net-zero process. Furthermore, these programs help companies improve their market image, which can be crucial for customer trust and corporate partnerships.

From the perspective of issuers on the voluntary market, selling credits can generate significant revenue for reinvestment into further environmental projects or community development. For example, income from credits can be crucial for renewable energy developers by creating a sustainable cycle of investment and environmental benefits.

Carbon Offset Credits: Role in Reducing Carbon Dioxide and Greenhouse Gases and Global Decarbonisation

Leading global organisations like the International Energy Agency and the International Panel on Climate Change recognise the role of carbon credits in accelerating the transition to a low-carbon economy. These credits enable the scaling up of innovative clean technologies and support global decarbonisation efforts by making the deployment of new technologies and green initiatives more viable.

However, the role of carbon credits is not without controversy. Critics argue that they can allow companies to purchase a way out of actually reducing their emissions. This highlights the importance of ensuring that credit projects are additional, meaning they wouldn’t have happened without the funding from credits, and effectively verified.

Carbon credits play a critical role in the global strategy to reduce greenhouse gases. The careful application and management of these credits is essential in ensuring they contribute positively towards achieving global emissions reduction targets.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more