What COP30 Should Deliver to Advance the ASEAN Power Grid

17 November 2025 – by Viktor Tachev

The ASEAN Power Grid (APG) has been a long-envisioned goal for Southeast Asian nations to accelerate the deployment of clean energy, improve energy security and lower electricity prices for businesses and households. While it has failed to make substantial progress in recent years, it is again gaining renewed attention as a concrete way to turn climate pledges into action, connecting countries’ power systems, unlocking growth with renewables and improving the region’s competitiveness. By helping scale up the necessary financing, COP30 Brazil can set the stage for overcoming the challenges facing the Asian Power Grid and provide it with a much-needed boost to get on track with ASEAN’s energy transition goals.

The ASEAN Power Grid (APG) and Its Importance For the Region

The ASEAN Power Grid is a long-term regional initiative aimed at interconnecting the power systems of ASEAN countries and facilitating cross-border electricity trade. The idea was initially conceived in the late 1990s as a way for ASEAN nations to harness the clean energy resources across the region, such as the abundant hydropower capacity of Laos and Sarawak, solar power in Vietnam and Indonesia and wind in the Philippines. That way, neighbouring nations aimed to ensure uninterrupted power and its timely distribution to where it was most needed.

“ASEAN countries vary widely in their clean energy potential. Some countries have abundant capacity for solar, wind and others are blessed with hydro and geothermal resources,” explains Dr. Dinita Setyawati, a senior energy analyst for Asia at Ember. “By having an interconnected ASEAN grid, increased variability in hydro generation due to seasonal variations or solar and wind production necessitates the need to use these resources in combination. With the continued drop in solar panels and energy storage costs, and evolving technologies to grid-supportive functionality for these energy sources, interconnection can facilitate the use of these advancements and replace expensive fossil fuels with homegrown renewables.”

As of 2023, 13 cross-border interconnections stretching 3,631 km link six ASEAN countries. Today, ASEAN countries have a total of 7.7 GW of cross-border interconnection capacity, aiming to increase it to 17.6 GW by 2040.

The first successful project under the hat of the APG is the Laos-Thailand-Malaysia-Singapore Power Integration Project (LTMS-PIP). Between 2022 and 2024, it ensured the transfer of 100 MW of hydropower from Laos to Singapore via Thailand and Malaysia. The multilateral power trading project now aims to increase trade to 200 MW by 2026. However, it also remains the only operational multilateral arrangement of that sort in the region.

The Benefits of the ASEAN Power Grid For ASEAN Countries

Rystad Energy estimates that the APG can unlock up to 25 GW of renewable and energy storage projects, reducing power capacity needs in ASEAN by up to 37 GW by 2035.

In terms of cost savings, an analysis by Transition Zero finds that the ASEAN Power Grid can help economies in the region lessen the need for new storage and gas capacity worth at least USD 3 billion. In total, the experts estimate that advancing the regional grid interconnection could reduce the need for gas capacity in the Philippines and Vietnam, two of the countries with the biggest gas expansion plans in the region, by up to 44% and 21%, respectively.

“The regional interconnection directly boosts energy security and affordability by allowing countries to access the lowest-cost renewables, share reserves instead of building expensive backups, and better shield themselves from fuel-price volatility, resulting in a more resilient system delivering cleaner, cheaper electricity than isolated national grids could achieve,” explains Henry Eu, head of policy and development for Singapore and Malaysia at the Asia Clean Energy Coalition.

According to the Institute for Essential Services Reform, the APG could slash overall electricity supply costs by around 20% compared to reliance on individual power systems. Christopher Len, acting coordinator of the Climate Change in Southeast Asia Programme at the Yusof Ishak Institute, explains why.

“When we connect our power networks, we spread risk and reduce how much price spikes and outages hurt any one country. Shared trading and cooperation help cut waste and lower overall costs. The result is steadier, more predictable prices. Next, by teaming up to build cross-border infrastructure, we create a bigger, bankable market.”

But that is not all. According to the expert, that scale attracts more investment, boosts efficiency from shared resources and makes financing for new projects easier.

“The grid also makes it easier to move surplus renewable energy across borders, cutting dependence on volatile fossil fuels and supporting cheaper, more secure energy. In short, cleaner power at lower cost, with a resilient supply. It’s about sustainable growth in a volatile global energy landscape.”

A study by the Net Zero World Initiative concludes that the regional interconnection could also increase GDP per country by up to 4.6%. Furthermore, electricity trade, enabled by the APG, can significantly contribute to the trade balance of exporting countries. For example, in 2023, electricity was Laos’ most exported product, contributing USD 2.15 billion or a quarter of the country’s total export of USD 8.7 billion.

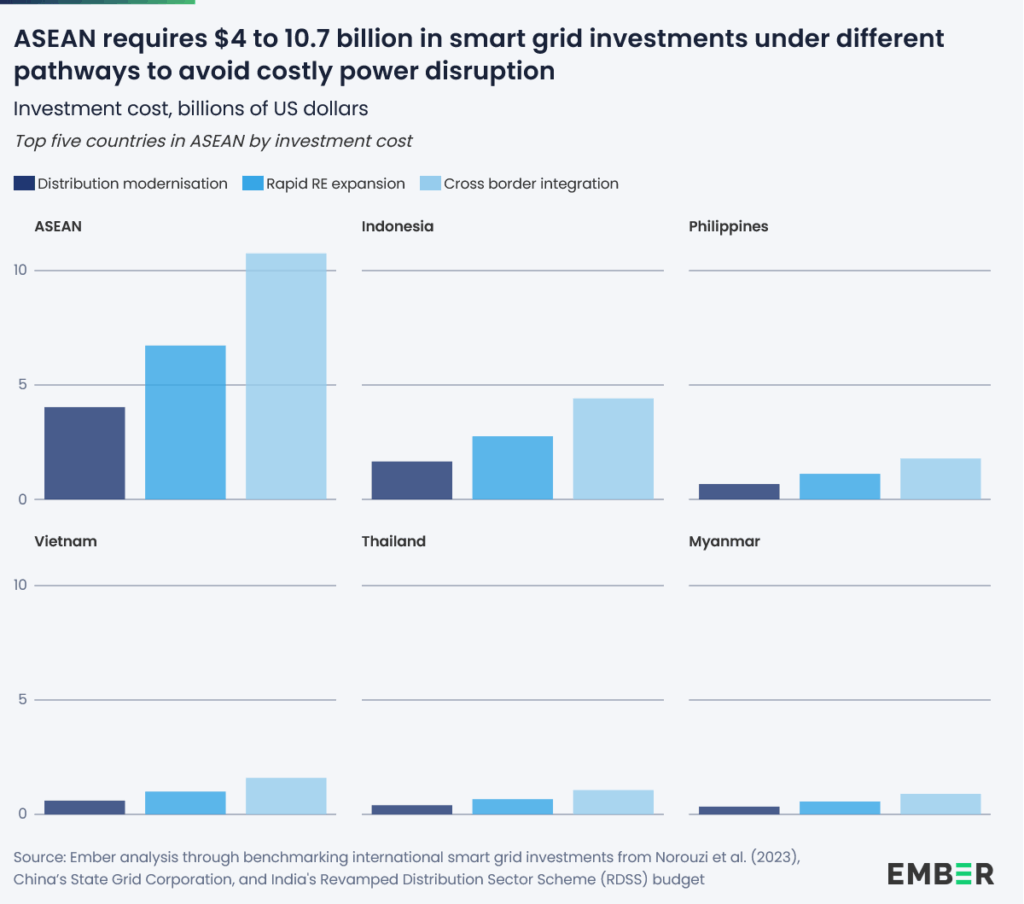

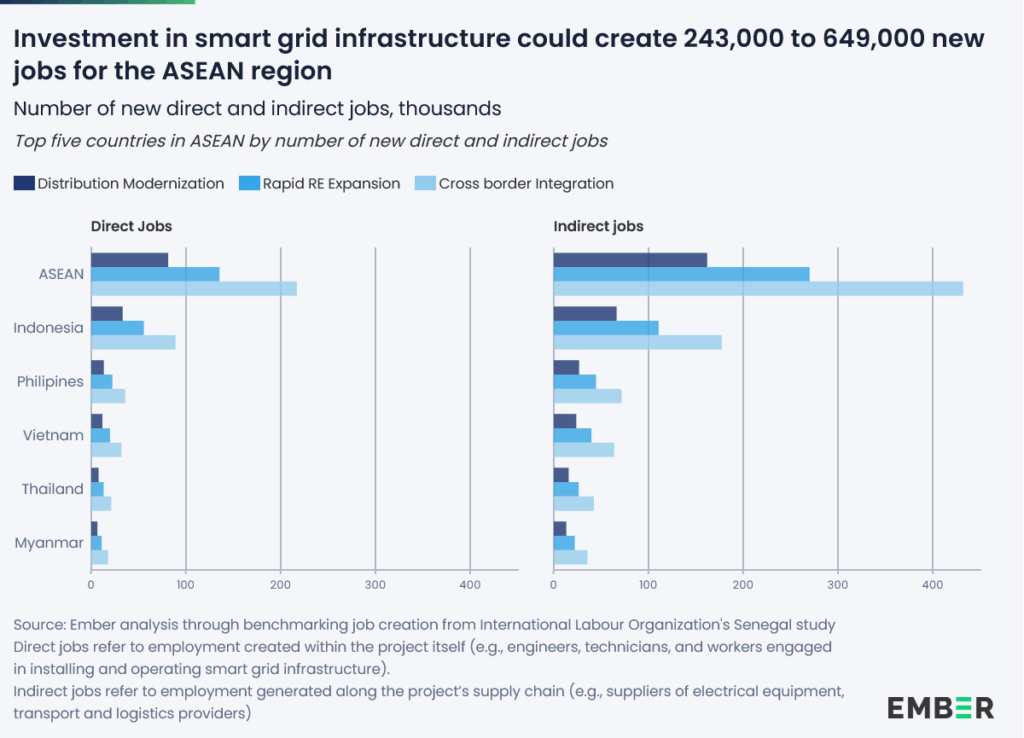

Ember’s team argues that smart grids are what will enable ASEAN’s low-carbon future. In a dedicated analysis, the experts estimate that if ASEAN nations prioritise investing between USD 4 and 10.7 billion in smart grids, they can avoid USD 2.3 billion in annual economic losses by 2040 and create up to 649,000 jobs.

Beyond strengthening reliability, smart grids can reduce renewable integration costs, unlock green industrial growth and facilitate regional power trade, ultimately positioning ASEAN to meet its climate goals while securing competitiveness in the global low-carbon economy.

However, unlocking these gains requires addressing several key barriers that countries have failed to address throughout the years.

The Financing and Technical Challenges Impeding the Progress of the ASEAN Power Grid Initiative

According to Ember, at a national level, transmission remains a key challenge. Since many of the most resource-rich solar and wind sites are located far from major demand centres, the experts identify limited transmission capacity as a reason for existing congestion and curtailment challenges. Furthermore, they note that grid expansion hasn’t always kept pace with renewable growth, in part due to permitting, financing and procurement processes, while ageing infrastructure and limited rural coverage impact overall reliability.

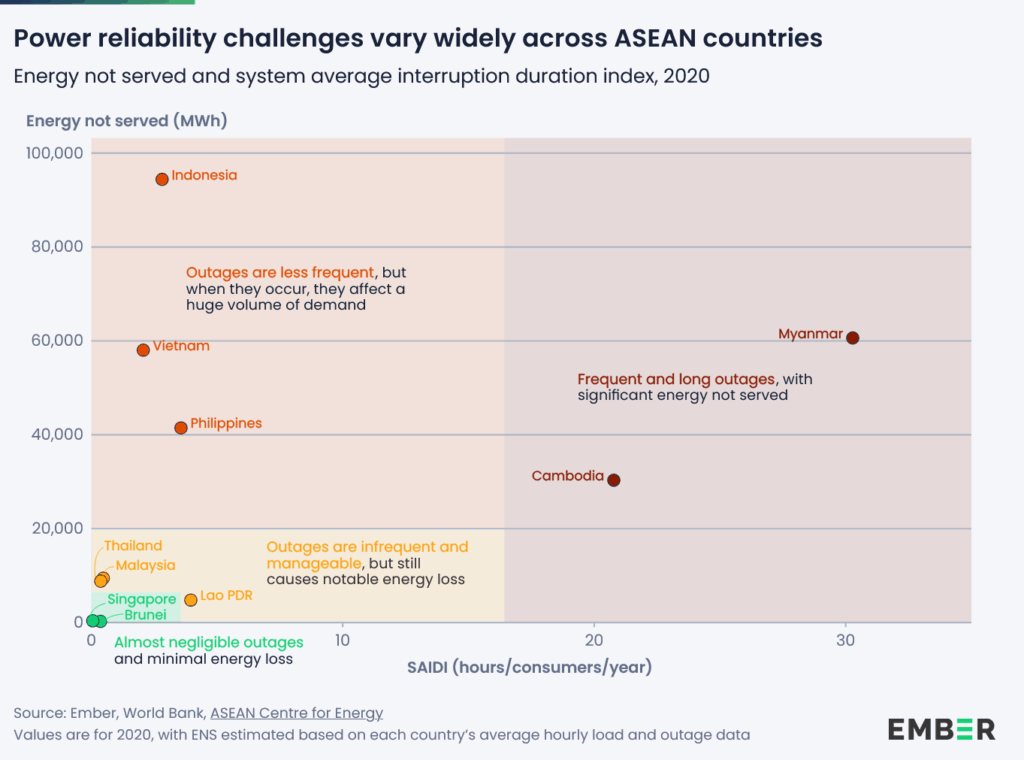

As a result, the experts note that grid reliability performance varies across ASEAN. For example, Singapore, Brunei, Malaysia and Thailand keep outages below one hour per customer annually, while the Philippines, Indonesia, and Vietnam have cut interruptions to just a few hours. Cambodia, Laos and Myanmar face the longest outages due to ongoing grid development.

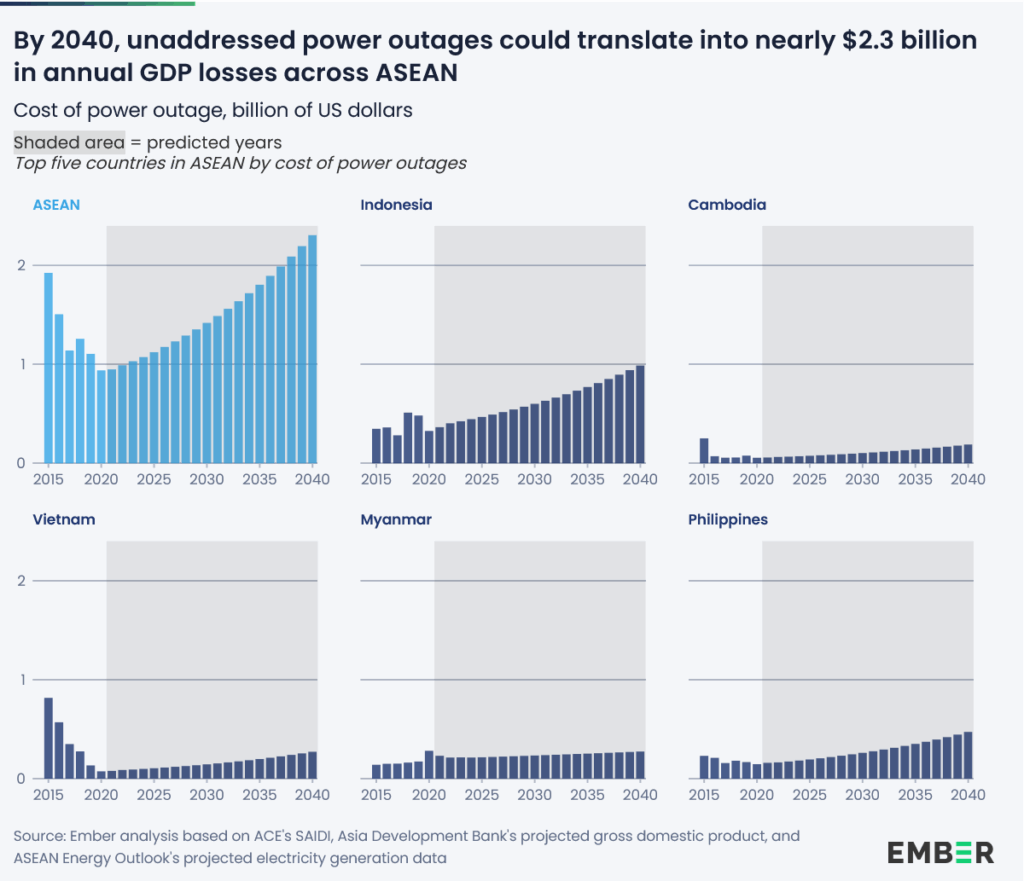

Ember’s analysis warns that these power outages are taking a significant toll on countries’ economic outputs, which can translate to USD 2.3 billion annually by 2040 if unaddressed.

According to Ember, while smart grids are critical to ASEAN’s clean energy transition, they require substantial upfront investment, meaning countries are facing both technical and financial challenges. According to the experts, in advanced economies, the latter can be addressed by strong regulation and utility creditworthiness that enable grid upgrades to be financed through capital markets and instruments like green bonds. Incentives from ASEAN governments to de-risk investments and scaling up market-driven models are also critical.

“Realising the goals of the ASEAN power grid requires considerable investment in both generation capacity and grid infrastructure. Well-connected electricity systems and the creation of larger markets create a more favourable investment climate, providing access to more customers with lower costs and making renewable energy projects bankable, thereby facilitating the entry of private investors into this growing industry,” explains Dr. Sung Jinseok, a research fellow at the Energy Studies Institute.

For developing countries, the biggest role falls on the provision of concessional and blended finance, including a combination of loans and guarantees from multilateral development banks (MDBs) and co-financing schemes where governments actively participate. According to Ember, India and Singapore have demonstrated how these mechanisms can be implemented to advance smart grid development.

Last month, the World Bank Group and the Asian Development Bank launched a new financing initiative of over USD 12 billion to support ASEAN’s collective effort to connect the region’s electricity network and address the critical need for domestic grid network upgrades. The ADB committed up to USD 10 billion for the next 10 years, supported by an initial USD 6 million of technical assistance, funded by the ADB, the United Kingdom, the EU and other partners. The World Bank is providing an initial contribution of USD 2.5 billion, including a USD 12.7 million seed grant to the ASEAN Centre for Energy to prepare bankable projects and define the next phase of support to the APG initiative.

Despite this, a huge financing gap remains, with the ADB noting that building the transmission lines to integrate the power grids of ASEAN by 2045 requires an investment of USD 100 billion. Furthermore, according to the ASEAN Interconnection Masterplan Study, a USD 764 billion investment is required “to build the transmission and power generation with high levels of variable renewable energy adoption”.

“High capital costs are a real barrier to clean energy investment in emerging and developing economies. The cost of capital is often so high that renewables become prohibitively expensive. Developed countries could and should address this through structural fixes: reducing currency and liquidity risks, correcting biased risk ratings, and reforming overly burdensome prudential regulations,” explains Lisa Sachs, director of the Colombia Center on Sustainable Investment and the Columbia Climate School’s Master of Science in Climate Finance. “These reforms, along with strategic use of guarantees and other risk-mitigation tools, are the only way for developed countries to meet their commitment to mobilise private capital at scale.”

ASEAN governments also have work to do. According to Ember, capitalising on the opportunities that a transition toward smart grids will unlock requires ASEAN countries to move from pilots to scale by focusing on accelerating policy and market reforms. The experts identify harmonising standards and grid codes as a key measure for enabling smoother renewable integration and regional power trading. They also advise governments to focus on mobilising finance and ensuring cost recovery to attract investment and sustain utilities, and leverage peer learning and frontr-unner models to replicate proven approaches and avoid costly trial-and-error.

“Host governments can and should ensure clear and credible regulatory frameworks that give investors confidence in long-term contracts and tariffs. But these internal and external reforms must go hand in hand; one will not be sufficient without the other,” adds Sachs.

According to Wai-Shin Chan, director of research at Asia Research and Engagement, the key to attracting investors is strong policies that favour renewable or lower-carbon power production, along with grid-level policy to support it.

“Strong national and regional policies in favour of renewable energy would force grids to evolve to better absorb the variability of renewable power, and give potential investors the comfort to deploy capital.”

What COP30 Brazil Should Deliver to Put the ASEAN Power Grid’s Wheels in Motion

During the 43rd ASEAN Ministers on Energy Meeting held from Oct. 14-17 in Malaysia, delegates endorsed several strategic frameworks that could drive APG’s next phase. Among them are an enhanced memorandum of understanding for the initiative and an endorsement of the ASEAN Plan of Action for Energy Cooperation 2026‑2030. Through the latter, governments aim to achieve a 30% share of renewables in total primary energy supply, 45% of installed power capacity from renewables by 2030 and a 40% reduction in energy intensity by 2030.

Bridging the financial gap remains critical for achieving these goals. While the financing from the World Bank and ADB-backed regional facility is a strong start, unlocking private capital is mandatory, and it will depend on credible policies that de-risk long-term infrastructure investment. COP30 provides the ideal platform for this.

“It is critical for ASEAN policymakers to maintain this momentum at COP30 in Belém by highlighting the APG’s role in accelerating the region’s clean energy transition. Exploring ways to present evidence on emission reductions, energy efficiency gains and renewable capacity mobilised can position the APG as an exemplary project for international stakeholders,” explains Melinda Martinus, lead researcher at the ASEAN Studies Centre and Climate Change in Southeast Asia Programme at ISEAS.

“If ASEAN policymakers collectively demonstrate political commitment to the APG at COP, it can help secure financial support from multilateral development banks, climate funds and private investors, as COP serves as a key platform to mobilise climate finance,” the expert adds.

Southeast Asian nations’ hopes that the ASEAN Power Grid becomes a key topic on the COP30 agenda have reasonable grounds. The initiative is a picture-perfect example of a project that requires world leaders to walk the talk on multilateralism, a significant point of focus during previous COPs. Furthermore, the initiative aligns with global efforts to triple renewable energy capacity and double energy efficiency by 2030, first championed at COP28, as well as the Global Energy Storage and Grids Pledge (GESGP) launched at COP29 for modernising power networks and scaling clean energy. Last but not least, the COP30 Presidency is prioritising the “Expansion and Resilience of Energy Grids” within the Action Agenda, as a core solution to driving progress on tripling renewable energy and doubling energy efficiency by 2030.

“COPs have too often focused on pledges and targets rather than supporting credible scenarios, roadmaps, and the practical mechanisms needed to address persistent institutional and financial barriers,” notes Sachs. “COPs should commit to strengthening regional energy planning and ensuring that these roadmaps are financed fully and affordably through strategic coordination of public and private finance.”

There is hardly any project that will better test whether regional and global leaders have learned their lesson on multilateralism and climate action. In that sense, if the APG doesn’t receive the necessary support during COP30, then governments will prove that global climate governance is still better at producing declarations than driving the transformations they demand.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more