Energy Crisis in Pakistan: New Policy Approach Is Crucial

12 August 2024 – by Viktor Tachev

The energy crisis in Pakistan has led to widespread power shortages, electricity shortfall, hindering economic growth and affecting daily life for millions. The summer of 2024 again brought Pakistanis scorching heat, with the mercury surpassing 50°C in some provinces, with Karachi breaking its nighttime temperature record. Pakistan is no stranger to extreme temperatures. Yet, when they are paired with excruciatingly long power shortages, the situation starts pushing the boundaries of human survivability. Since 2024 is proving to be yet another consecutive year when Pakistan finds itself in a severe energy crisis, the most pressing question is: what’s next? While solutions exist, the country’s energy policy approach and circumstances make the journey challenging.

Pakistan’s Energy Crisis in 2024

In 2024, Pakistan’s cities are again enduring up to 10 hours of severe load-shedding. In rural areas, power blackouts extend up to 18 hours.

The situation forced Pakistanis to the streets, blocking roads and protesting the electricity shortages and the scarce water supply. The lack of power prevented many from using appliances that offer some relief from the extreme heat, such as electric fans. Researchers described the outages as “catastrophic,” especially for pregnant women, infants and elderly people. The number of fatalities and people admitted to emergency units made some declare the situation “a humanitarian crisis”.

The ongoing woes aren’t a one-off event but the latest manifestation of the deepest energy and economic crisis in the country’s history. Over the past year, petrol prices also increased several times, while inflation hit a record 37.97%.

According to estimates, electricity bills, which usually cost an average Pakistani household between 15% and 20% of its income, have jumped by 100% to 200%.

Impacts of Energy Crisis in Pakistan on Economy

The energy crisis in Pakistan rippled through the entire economy, causing widespread turbulence. Many businesses participated in a nationwide shutdown strike and, alongside tens of thousands of protestors, expressed opposition to the high electricity tariffs and taxes. In some parts of the country, protests against the power generation sector and the energy department over soaring living costs even turned violent.

Human Rights Watch urged the IMF to intervene and help the struggling country deal with the situation.

While the government largely failed to address the problem, it made efforts to cover the cracks in the economy’s budget. For example, in 2024, it introduced a new tax collection target affecting local petroleum dealers. However, the move led to mass strikes and fuel station closures nationwide, leaving millions without fuel.

Fossil Fuel Import Dependence the Main Reason For Pakistan’s Power Crisis

Academics argue that the energy crisis is the main trigger for Pakistan’s prolonged economic crisis and severe fiscal challenges. According to Pakistani researchers, the energy and economic crises are a byproduct of poor administration, governance and inappropriate policies. At the same time, they point out that the efforts to overcome these crises with expensive capacity additions are inadequate. As a result, the country now faces a myriad of energy-related issues. Among them are high energy generating costs, subsidy burdens, large circular debt, heavy reliance on imported fossil fuels and mismanagement of power infrastructure.

In 2023, fossil fuels accounted for 59% of Pakistan’s electricity generation mix. Coal met 18% of the electricity demand, up from just 1% in 2016. The government plans to quadruple its coal-fired capacity by 2030 and is considering retrofitting furnace oil-based power plants to accommodate coal.

However, the main problem is that Pakistan relies on fossil fuel imports to meet over 40% of its energy needs. This has undermined the country’s energy security, exposing it to the increased volatility of coal and gas prices on global markets and leaving it competing with wealthier buyers and being at the mercy of suppliers. According to an investigation by Bloomberg, amid the 2022 energy crisis, Pakistan saw its deal for five tankers’ worth of LNG terminated as the deliveries were rerouted to wealthier buyers at three times the price.

On a microeconomic level, the aftermath was factory closures, elevated poverty and threatened food production.

On a macroeconomic level, this set the stage for Pakistan’s major debt crisis. Since the government tried salvaging the situation by sourcing replacement gas deliveries at prices at least 230% higher than normal, Pakistan’s modest foreign currency reserves were quickly drained. This pushed the country close to default, and it had to be bailed out by the International Monetary Fund. However, the intervention came at a price, with Pakistan bound by the terms of a USD 3 billion standby arrangement – including a requirement to slash fuel and electricity subsidies. This, in turn, put households and industry under even greater economic pressure.

According to experts, Pakistan’s current energy crisis stems from the 1990s with the decision to introduce independent power producers (IPPs). These operators produced electricity by burning imported fossil fuels, gradually becoming the most dominant source of electricity generation, substituting hydropower.

The IEEFA notes that for the fiscal year 2022-2023, the country has paid IPPs operating thermal plants on imported fuel USD 4.6 billion in capacity payments.

On top of this, the country spends up to 2.6% of its GDP on energy product subsidies, the highest in South Asia.

Fossil Fuel Infrastructure a Present and a Future Problem

Aside from the immediate pricing risk, Pakistan’s import-oriented plans bear long-term risks in the form of stranded assets. The IEEFA sees a real risk of unutilised LNG terminal capacity and idle supply infrastructure due to a supply-demand mismatch. The agency doesn’t expect gas to become more affordable in the future, even if prices come down or the country pushes through its virtual LNG projects to transport gas off-grid by trucks or rail. According to analysts, Pakistan will continue paying higher prices due to oil-indexed contracts and high credit risk, while investments in additional supply risk locking consumers in unaffordable power.

The case is similar when it comes to coal. IEEFA researchers warn that Pakistan’s policymakers’ actions to revive coal power plants and import coal lack evidence-based research. They note that due to the foreign exchange crisis, the country is unable to procure supplies and is already shutting down imported coal-based power plants. On the contrary, the agency finds that early coal plant retirement not only won’t affect Pakistan’s energy security, but it will also have a net positive effect on the economy. For example, retiring plants once they reach 15 years of age would cost USD 108 million. At the same time, it will ensure USD 210 million per plant in excess capacity payments.

The country is already struggling to complete fossil fuel projects due to geopolitical complications and huge costs. For example, last year, Pakistan suspended its participation in a USD 7.5 billion project for the construction of a 2,775-km-long natural gas pipeline with Iran. Although the country struck a 10-year extension agreement, its decision faces the risk of a USD 18 billion penalty.

To secure alternative gas delivery routes, Pakistan is exploring a potential USD 10 billion project alongside Turkmenistan, Afghanistan and India. However, it has already faced several delays. As a result, the project’s cost estimation, which is a decade old, will most likely be revised upwards, while local political instability and tension between participating countries can further distort the project’s outlook.

A Complicated Situation With No Short-term Solutions

Last year, the interim finance minister of Pakistan described the situation as “worse than anticipated,” admitting that the country had no fiscal space to provide subsidies and tame the energy crisis in Pakistan, Nikkei reports.

Experts from the State Bank of Pakistan showed that the electricity price pressure risks further damage to the economy, including increasing production costs, reducing export competitiveness, closing industries, worsening unemployment and causing hyperinflation.

IMF

Now that Pakistan’s standby agreement with the IMF has ended, the country has no relief for its foreign reserves. While it is looking to secure a long-term Extended Fund Facility (EFF) program with the IMF, such a deal would require significant additional structural reforms. Furthermore, in the meantime, it will have to find ways to deal with its economic instability, weak currency, limited foreign reserves and high energy import bill.

There are hardly any easy short-term solutions to Pakistan’s energy situation. Instead, the country should focus on helping its population navigate turbulent times while charting a more sustainable long-term energy system master plan that emphasizes energy independence.

Pakistani officials have recognised the need to diversify the national energy mix by focusing on alternatives to imported gas, such as scaling domestic coal production or moving toward renewables.

However, opting for the former risks exacerbating many of Pakistan’s current problems, including worsening the air quality problem, contradicting the country’s climate pledge and contributing to the climate crisis it is so vulnerable to. According to estimates, between 2000 and 2019, Pakistan was the eighth most affected country by climate disasters globally. Floods, droughts and heatwaves have been taking a massive toll on both nations’ ecosystems, livelihoods, infrastructure and food and water security. Furthermore, the country is facing an existential threat also due to the rapid melting of Himalayan glaciers. Continuing in the same direction will also have negative economic consequences. By 2050, climate change impacts, combined with environmental degradation and air pollution, are projected to slash Pakistan’s GDP, with the country incurring up to USD 3.8 billion in annual losses.

As a result, this leaves a shift toward renewables as the only viable long-term strategy.

Renewables to Offer Pakistan a Potential Shelter From the Acute Energy Crisis

During the peak of the energy crisis in 2022, Pakistan’s coal import reliance resulted in delivery costs as high as USD 419 per tonne. This resulted in power generation costs of up to USD 0.19 per KWh. For reference, the IEEFA notes that hybrid renewable energy systems consisting of solar, wind, and battery energy storage have a cost of power generation ranging between USD 0.05-0.07 per KWh.

Pakistan should reduce its dependance on conventional energy sources. The good news is that Pakistan has a massive untapped clean energy potential with nearly 60 GW for hydropower, 40 GW for solar and 346 GW for wind. However, the bad news is that unlocking the economic gains of an accelerated clean energy-led scenario won’t be a straightforward task.

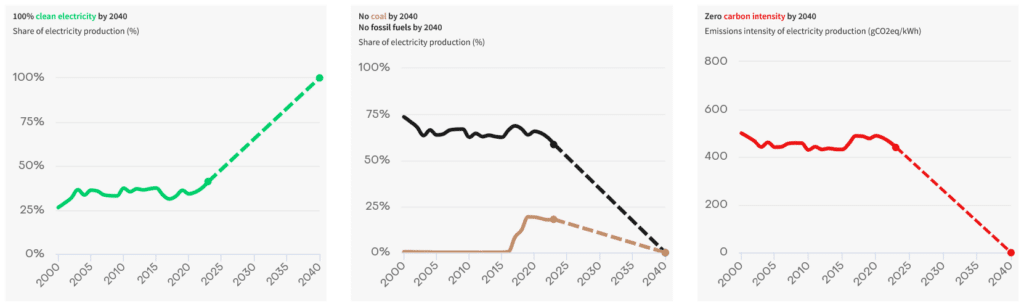

First, the country remains far off its target to have renewables account for 60% of its electricity generation mix by 2030. As of 2023, solar and wind comprised just 2.7%, while low-carbon electricity sources’ share stood at 24%.

Pakistan Will Need USD 101 Billion in Energy Sector Investments

Furthermore, Bloomberg’s analysis notes that moving forward with a large-scale renewables shift will take years and billions of dollars that Pakistan currently lacks. For example, to achieve a 50% emissions reduction by 2030, the country will need USD 101 billion in the Pakistan’s energy sector investments. It is worth noting that, aside from increasing the clean energy capacity, Pakistan should also concentrate on sufficient investments in battery storage, grid buildup and modernisation to overcome issues like transmission constraints and energy losses, which currently are 18-20%.

To gather the needed financing, the country will have to explore various financing options, including green bonds, private equity funds and financing from multilateral development banks. A recent successful measure is the Asian Development Bank’s USD 670 million funding for hydropower projects in the Punjab province. Other international financial institutions, including the European Investment Bank, alongside French and German banks, are also providing financing for the rehabilitation and updating of the Warsak Dam project. The EU has also granted funds to support community development around the project area and for a study of climate change resilience. However, such initiatives must also accelerate solar and wind power. International cooperation and support are crucial for succeeding in this aspect. As a result, the country should scale up partnerships for clean energy project development, such as those with China, as well as climate resilience and technology transfer.

Notably, Pakistan must address bureaucratic barriers to increase transparency and guarantee investment security for clean energy project developers. According to the IEEFA, decision-making in the country currently mostly happens in the highest echelons of power, without much public consultation or disclosure.

Power Supply from Solar Panels

Aside from some local government subsidies for solar panels, measures to support the clean energy transition are generally lacking. However, many Pakistanis who can afford to install solar panels and batteries, aren’t waiting for the state’s help. As a result, they are ensuring a stable power supply even during peak evening use and can sell the produced energy back to the power company. While this allows solar system investments to repay themselves, the Guardian notes that the government is considering regulating the tariff system to avoid losing revenue.

Pakistan’s Next Step Is Crucial

Since Pakistan’s oil and gas reserves are expected to last for another 15 years, the country has two options: either continue with imports or accelerate clean energy deployment. The first option is what brought it to the situation it is today.

Pakistan ranks 84th out of 99 countries in the World Energy Council’s rating on three factors, including energy security, energy equity and environmental sustainability.

Scorching temperatures, air pollution five to 10 times over the WHO’s guidelines, scarce water supply and lengthy power blackouts are further complicating the day-to-day lives of Pakistanis.

The country’s strategy of prioritising quick-fix solutions centred around imports instead of long-term, sustainable strategies for energy system diversification has brought it to a point where it not only continues paying high power costs and suffering energy cuts, but it also has an energy deficit of 6 GW and a USD 7 billion import bill. As a result, changing the situation today is more challenging, with little room for manoeuvring.

However, solutions exist. The strategy that is most likely to improve Pakistan’s course is reducing fossil fuel dependence and simultaneously accelerating investments in renewable energy and associated grid infrastructure while minimising impacts on affected communities.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more