How To Buy Carbon Credits On Compliance And Voluntary Markets

16 May 2024 – by Eric Koons

In today’s world, understanding how to buy carbon credits is crucial for businesses. Carbon credits are becoming a cornerstone of voluntary corporate sustainability initiatives and government-mandated emissions reduction programs.

While government-mandated carbon trading systems – compliance markets – are heavily regulated, voluntary carbon markets lack a universal oversight body. In voluntary markets, oversight falls on private brokers and exchanges to create a market for buying and selling credits and private verifying companies to ensure credits are legitimate.

This creates a system with many providers and types of credits to navigate. Understanding how this system works is essential for companies and individuals.

What Does It Mean to Buy Carbon Credits?

A carbon credit represents one tonne of carbon emissions and is the currency used on the global carbon market.

In compliance carbon markets, the government overseeing the market releases a set number of carbon offset credits. Each credit allows the company that holds it to emit up to one tonne of carbon dioxide. Companies can sell carbon credits, which are in excess, to other companies within the market. Companies can only emit the quantity of carbon emissions they have credits for, or they receive a fine. It is strictly controlled by an overseeing government body.

Voluntary carbon markets have no cap on the number of credits produced. Instead, credits come from companies or projects that remove or prevent carbon from entering the atmosphere. For each tonne of carbon the project offsets, it gets one credit, which it can then sell through brokers and exchanges in the voluntary market. Companies can purchase these voluntary carbon credits to offset their emissions.

The Role of Carbon Offsets in Corporate Responsibility

Voluntary carbon credits are increasingly crucial in corporate social responsibility strategies. Companies like Microsoft have committed to being carbon negative by 2030, which will be very challenging to meet by directly reducing greenhouse gases in their supply chain and production.

Alternatively, companies can purchase carbon offsets on the voluntary market for emissions they have yet to eliminate directly through their operations. This approach helps offset their carbon footprint and supports projects that would not be financially viable without funding from carbon credit sales.

Carbon Credits Under Scrutiny from Critics

Carbon credits have faced backlash for several reasons, with critics claiming they don’t do enough to reduce carbon emissions.

- Real reductions: There’s potential for carbon offset projects to merely ‘offset’ climate impacts rather than truly reduce them at the source.

- Transparency: Issues with the accuracy and transparency of measuring and verifying its effectiveness lead to questions about the actual environmental impact of these projects.

- Enabling more pollution: Carbon credits can sometimes allow companies to continue polluting by purchasing credits rather than making genuine efforts to reduce their emissions.

- Complexity: The market for carbon credits can be complex and prone to manipulation, raising doubts about its effectiveness in reducing emissions sustainably.

Investors seeking to use carbon credits to reduce emissions and contribute to climate change mitigation should carefully review such mechanisms before investing.

How to Buy Carbon Credits for Businesses

Allocating Credits in Compliance Markets

In compliance markets, the government typically issues a set number of credits to each company or auctions them off to companies within the market. These credits can then be bought and sold through government-sanctioned secondary marketplaces.

Navigating Voluntary Market Purchases

Purchasing carbon credits in the voluntary market follows a different process. Because there is no cap on the total number of credits and credit options available, it requires more in-depth research on the possibilities.

First and foremost, because credit purchases are voluntary, there is the opportunity to strategise on how carbon offsetting will help the company beyond emissions. Many credits provide additional benefits that can help the company reach other sustainability goals beyond reducing emissions.

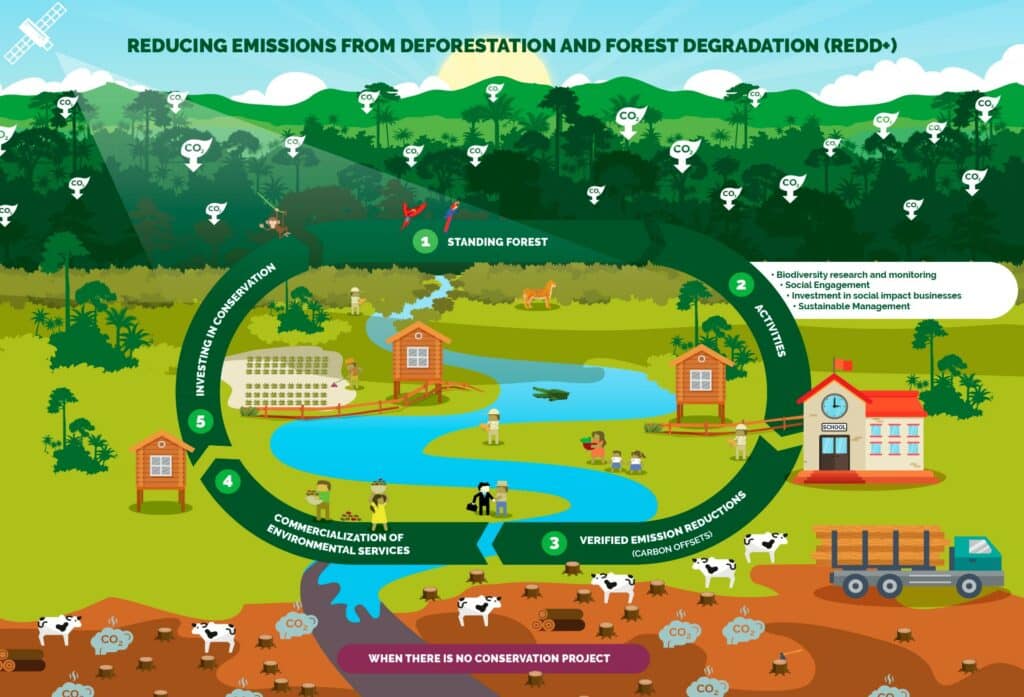

For example, the REDD+ program was established as part of the Paris Agreement and provides a framework for generating credits for activities that preserve forests and reduce forest-related emissions. These programs often involve local communities and organisations, a common theme in corporate sustainability.

The next step is to choose where to buy the carbon credits from.

- Project Developers: Buying carbon credits from a project developer provides the most direct contact with the project and lets you choose which developers you trust and want to support.

- Brokers: Brokers work between developers and credit purchasers to facilitate the process, making it easier yet more expensive.

- Retailers: Online retailers purchase and hold credits before reselling them. This is the fastest way to purchase credits, but there is often less information on their background.

- Exchanges: Exchanges work like the stock market, where credits are listed on a registry and sold based on the market price. They can be thought of as a virtual broker, but there is typically less background on the credit’s quality. Additionally, this is the easiest way to resell credits as an investment.

After credits are purchased, the purchasing company retires them. This claims the carbon reduction and removes the credit from the marketplace. It also ensures the credit is not resold or double-counted.

Can a Person Buy Carbon Credits?

Individuals can also purchase carbon credits through brokers or dedicated platforms offering smaller lots suitable for personal or small business use. It’s a great way to reduce your carbon footprint. It also provides the potential to use carbon credits as a personal investment vehicle, like stocks and bonds.

Buying Carbon Credits as an Investment

Investing in carbon credits has emerged as a significant opportunity for both environmental impact and potential financial gains.

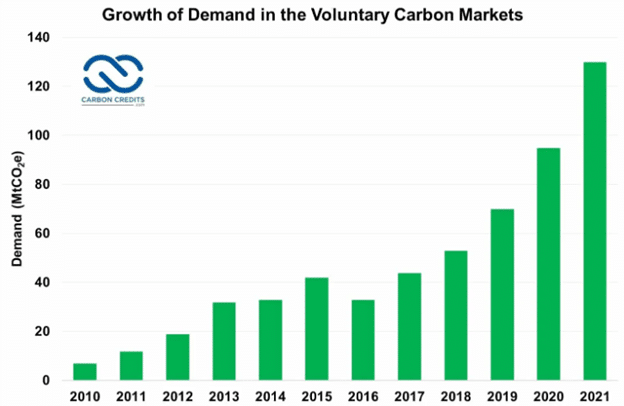

As companies and governments intensify their efforts to reduce carbon footprints, the demand for carbon credits grows. This surge is shaping a dynamic market with both opportunities and risks for investors.

Analysing the Voluntary Carbon Market

The voluntary carbon market is showing steady growth. In 2021, its value reached USD 2 billion in transactions, a significant rise from previous years. Projections suggest the market could expand up to USD 40 billion by 2030 due to heightened demand across industries, especially in hard-to-decarbonise sectors.

Key market trends include the increasing entry of institutional investors and the development of more sophisticated trading platforms that enhance transparency and verification processes.

The quality of carbon credits is also improving, with a greater emphasis on credits that offer additional benefits, like biodiversity conservation or community development, which tend to attract higher prices and greater investor interest.

Future Outlook: Reducing Carbon Emissions and Greenhouse Gas Emissions

As the carbon credit market matures, it offers environmental benefits and potential financial returns. Buyers should focus on selecting verified credits to ensure genuine impact and consider the strategic value of these purchases as part of broader sustainability and investment portfolios. Carbon credits represent not just a tool for compliance but an opportunity for leadership in sustainability.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more